Global Wireless Temperature Sensors Market Forecast Highlights Impressive Growth Driven by Real-Time Data Demand and AI Integration Across Industries

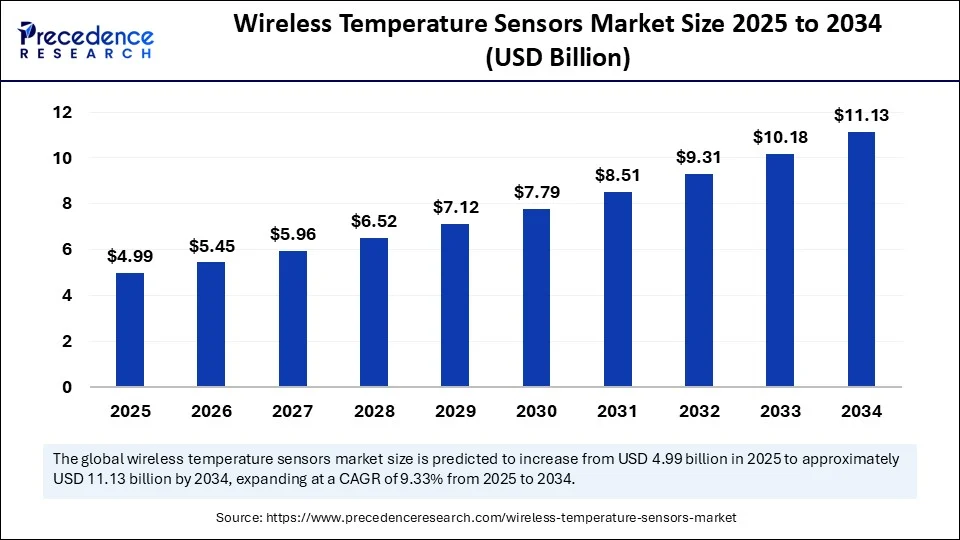

The wireless temperature sensors market is poised for substantial growth, with a market size projected to surge from USD 4.99 billion in 2025 to about USD 11.13 billion by 2034, exhibiting a CAGR of 9.33% over this period. This growth trajectory is primarily fueled by the increasing need for real-time temperature monitoring and automation in key sectors such as healthcare, manufacturing, smart homes, and cold chain logistics. Strategic advances in AI and IoT technologies are enhancing sensor intelligence, reliability, and scalability, which in turn accelerates adoption globally.

Wireless Temperature Sensors Market Quick Insights

-

The global wireless temperature sensors market size reached USD 4.56 billion in 2024 and is estimated to grow at a CAGR of 9.33% between 2025 and 2034.

-

North America dominates the market, with a valuation of USD 1.18 billion in 2024 and a forecast to reach USD 2.94 billion by 2034.

-

Asia Pacific is the fastest-growing region, propelled by expanding healthcare infrastructure, logistics, and government digitization efforts.

-

Leading companies shaping the market include key semiconductor sensor manufacturers and IoT solution providers.

-

The semiconductor IC temperature sensors segment holds a major market share due to versatility and IoT compatibility.

-

Wi-Fi (2.4/5 GHz) wireless connectivity dominates, complemented by rising adoption of long-range LPWAN technologies like LoRaWAN and Sigfox.

-

Integration of hardware with cloud-based SaaS platforms is the preferred solution offering driving operational efficiencies.

How Is AI Shaping the Wireless Temperature Sensors Market?

Artificial Intelligence is revolutionizing the wireless temperature sensor landscape by enabling smarter data processing and predictive analytics. AI algorithms improve sensor calibration, reduce measurement errors, and extend device longevity, which boosts sensor reliability and cost-effectiveness. In healthcare, AI-driven sensor data supports remote patient monitoring and vaccine storage safety, while in manufacturing and logistics, it enhances cold chain management and process automation. As a result, AI acts as a catalyst, significantly advancing sensor adoption and expanding application horizons.

Wireless Temperature Sensors Market Key Growth Factors

The rising demand for real-time monitoring coupled with Industry 4.0 automation is a critical growth driver. Expanding healthcare applications for patient monitoring and pharmaceutical cold chains further fuel market expansion. Additionally, the popularity of smart homes and energy-efficient building automation is driving sensor deployment. Growth in cold chain logistics and global trade in perishable goods mandates precise temperature tracking, reinforcing market prominence. Finally, government and private sector investments in IoT infrastructure and digitization accelerate adoption.

What Are the Major Current Opportunities and Emerging Trends?

-

How will rising government digitization initiatives in Asia Pacific unlock new market potential?

-

Will advancements in low-power long-range wireless technologies redefine scalability and deployment in rural and industrial areas?

-

How can SaaS-based integrated sensor solutions transform operational resilience in regulated industries such as pharma and food logistics?

-

What role will AI play in predictive maintenance and anomaly detection beyond traditional temperature monitoring?

-

Can the growing smart home market become a significant vertical for wireless temperature sensors?

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 11.13 Billion |

| Market Size in 2025 | USD 4.99 Billion |

| Market Size in 2024 | USD 4.56 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.33% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product / Sensor Type, Communication Protocol / Connectivity, Solution Type / Offering, Range & Deployment Class, Industry Vertical / End-User, Sales / Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Comprehensive Regional and Segment Analysis

North America continues to lead due to mature IoT infrastructure, strong healthcare systems, and regulatory emphasis on food and pharma safety. Asia Pacific’s rapid industrialization, healthcare expansion, and government digitization programs secure its spot as the fastest growing market. Europe, Latin America, and MEA also see steady adoption driven by regulatory frameworks and smart city projects.

The semiconductor IC temperature sensors segment dominates due to low cost, compact size, and seamless IoT integration, essential for connected devices and industrial automation. RTD sensors (e.g., PT100, PT1000) are the fastest growing segment given their high accuracy, especially in biotech and aerospace sectors.

Wi-Fi connectivity is the preferred choice for ease of deployment and cloud integration, especially in controlled environments like warehouses and labs. Meanwhile, LPWAN options such as LoRaWAN and Sigfox are expanding rapidly for wide-area, low-power needs in agriculture and logistics.

Integrated hardware with cloud SaaS offerings lead the solution segment, offering real-time monitoring, analytics, and compliance support. Managed services with subscription models are gaining traction for easing technical and regulatory complexities, particularly in healthcare and cold chain verticals.

Latest Breakthroughs and Leading Companies

Top players are innovating in sensor technology, AI analytics, and cloud platform integration to provide end-to-end temperature monitoring solutions. This includes development in low power consumption, higher sensor accuracy, and scalable IoT network compatibility. Featured companies shaping this market include major semiconductor manufacturers, IoT integrators, and SaaS providers.

Challenges and Cost Pressures

Despite benefits, high initial installation and integration costs deter SMEs and developing markets. Legacy system upgrades for wireless adoption add to expenditure. Data security and privacy concerns, especially in healthcare and pharmaceuticals, necessitate costly compliance with regulations such as HIPAA and GDPR, posing additional challenges.

Case Study

An advanced cold chain logistics company recently implemented AI-enhanced wireless temperature sensors with integrated SaaS platforms. This real-time system improved temperature anomaly detection by 40%, reduced product spoilage risks significantly, and ensured stringent compliance with international food safety standards.

Read Also: Quantum Cryptography Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344