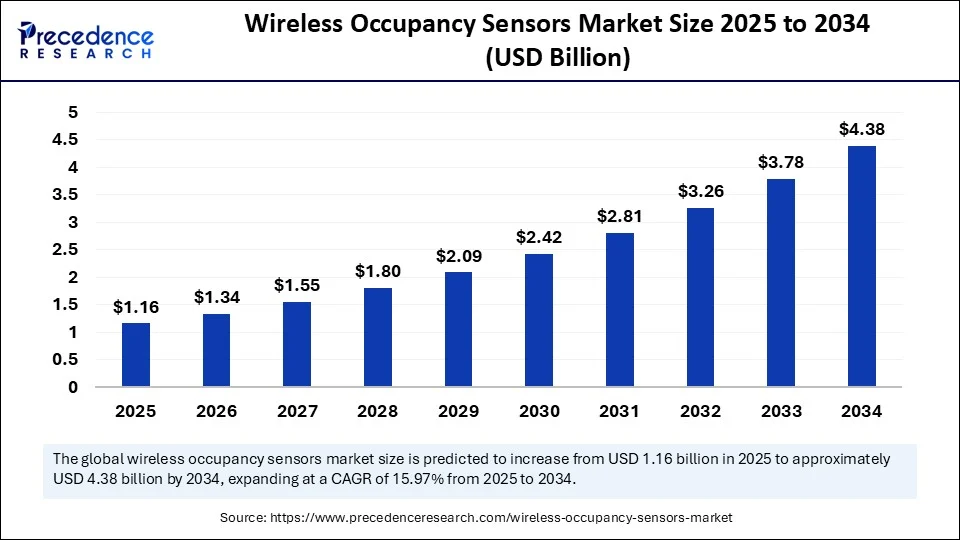

The global wireless occupancy sensors market is set for significant expansion, with projections soaring from USD 1.16 billion in 2025 to approximately USD 4.38 billion by 2034. This growth trajectory is driven by increasing energy efficiency demands, smart building trends, and AI/IoT technology integrations.

What’s Fueling the Surge in Wireless Occupancy Sensors?

The wireless occupancy sensors market is expanding at a Compound Annual Growth Rate (CAGR) of 15.97% between 2025 and 2034. Key drivers include the rising global emphasis on energy efficiency, regulatory support for sustainability, and the rapid digital transformation seen in smart homes and commercial buildings. Integration of AI and IoT has notably enhanced sensor functionalities, turning these devices into crucial components for optimizing lighting, HVAC, and security systems in both residential and commercial sectors.

Wireless Occupancy Sensors Market Key Takeaways

- The market size was valued at USD 1.00 billion in 2024 and is forecasted to grow to USD 4.38 billion by 2034.

-

North America dominates the market share, driven primarily by the U.S. market valued at USD 251.14 million in 2024.

-

Asia Pacific is the fastest-growing region, fueled by urbanization and smart city investments in countries like India, China, and Japan.

-

Top sensor technologies include Passive Infrared (PIR), Dual Technology, Ultrasonic, and Microwave.

-

The predominant product type in the market is wall-mounted sensors, with growing traction for ceiling-mounted variants.

-

Key applications revolve around lighting control and HVAC optimization.

-

Leading end-users are commercial buildings, followed by healthcare institutions.

-

Major companies innovating in this space include those focusing on AI-enabled, energy-efficient wireless sensor technology.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6685

Wireless Occupancy Sensors Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4.38 Billion |

| Market Size in 2025 | USD 1.16 Billion |

| Market Size in 2024 | USD 1.00 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.97% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Product Type, Application, End-User / Building Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Artificial Intelligence (AI) acts as a pivotal force enhancing wireless occupancy sensors beyond basic detection. AI-powered sensors efficiently analyze raw sensor data to identify intricate occupancy patterns and predict user behaviors. This enables building systems to dynamically adjust lighting, climate, and security settings in real-time, maximizing energy savings without compromising occupant comfort.

Moreover, AI-driven models leverage historical and real-time data collected from wireless sensor networks, allowing predictive analytics that optimize space utilization and resource allocation. This intelligence significantly enhances sensor accuracy and system responsiveness, propelling the market growth forward.

What Are the Principal Growth Factors?

-

Rising initiatives toward energy conservation and sustainability in residential and commercial architecture.

-

Increased adoption of smart building technologies integrating AI and IoT.

-

Supportive policies and government regulations encouraging green infrastructure development.

-

Expanding wireless network infrastructure facilitating sensor deployments.

-

Innovative sensor technologies improving accuracy and multifunctionality.

What Opportunities and Emerging Trends Will Shape the Market?

-

How will AI and machine learning redefine occupancy sensing to improve energy management?

-

Can expanding smart city projects in Asia Pacific accelerate market penetration?

-

What role will government incentives play in fostering widespread adoption?

-

How will integration with IoT devices create new connected building ecosystems?

-

What advancements in sensor material and design will enhance durability and efficiency?

Wireless Occupancy Sensors Market Regional Analysis

-

North America: Holds the largest market share, backed by government initiatives, consumer demand for smart buildings, and advanced infrastructure.

-

Asia Pacific: Fastest growth, driven by rapid urbanization, increasing electronics manufacturing, and strong governmental push for smart city development.

-

Europe, Latin America, Middle East & Africa: Emerging markets are increasingly focused on IoT adoption and energy-efficient building technologies.

Wireless Occupancy Sensors Market Segment Highlights

-

Technology: Passive Infrared (PIR) dominates due to cost-effectiveness and sufficient accuracy; dual technology sensors are gaining ground for better precision.

-

Product Type: Wall-mounted sensors are preferred in smaller spaces, whereas ceiling-mounted sensors are growing in usage for broader energy management.

-

Application: Lighting control leads due to immediate energy savings; HVAC control is gaining momentum alongside smart climate management demands.

-

End-User: Commercial buildings remain the primary users; healthcare sectors are rapidly adopting occupancy sensors for improved patient comfort and operational efficiency.

Read Also: Underwater LiDAR Market

Wireless Occupancy Sensors Market Companies

- Honeywell International Inc

- Schneider Electric

- Johnson Controls

- Legrand

- Eaton Corporation

- Acuity Brands

- Lutron Electronics

- Siemens AG

- Leviton Manufacturing

- Hubbell Inc.

- Texas Instruments

- Philips

- General Electric

- Butlr Technologies

- EnOcean (EnOcean GmbH)

- Carrier

Challenges and Cost Pressures

Despite promising growth, high initial investments and installation complexities pose barriers, particularly for small and medium enterprises. Interoperability issues among different sensor systems and network infrastructures can also slow adoption rates.

Case Study: Energy Efficiency in Smart Commercial Buildings

A recent implementation of AI-powered wireless occupancy sensors in a corporate office reduced lighting and HVAC energy consumption by 35%. The smart system dynamically adjusted based on real-time occupancy and environmental data, resulting in significant cost savings and improved occupant satisfaction.

Take Action: Unlock the Full Potential of Wireless Occupancy Sensors

Explore the comprehensive market report for detailed insights, segmentation analyses, and future outlooks. Download the full wireless occupancy sensors market report or schedule a meeting with our experts to understand how this technology can revolutionize energy management and smart building strategies.

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344