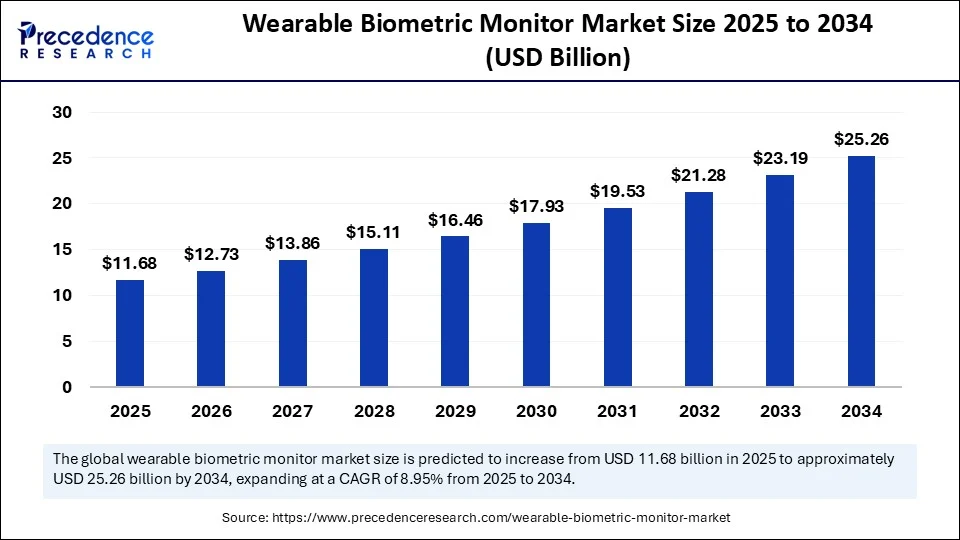

The global wearable biometric monitor market is expected to grow from USD 11.68 billion in 2025 to approximately USD 25.26 billion by 2034, expanding at a robust CAGR of 8.95%. Rising health consciousness, rapid AI integration, and expanded use in chronic disease management are key growth drivers fueling this surge.

What Propels the Wearable Biometric Monitor Market Forward?

The wearable biometric monitor market is witnessing rapid expansion fueled by heightened consumer focus on fitness and wellness, alongside advances in AI-driven biosensors. These devices transform physiological data into actionable health insights, transitioning them from lifestyle gadgets to essential health tools in remote patient monitoring and preventive medicine. The market’s trajectory reflects an increasing demand for precise health monitoring amidst growing chronic disease prevalence and digital health adoption globally.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6684

Wearable Biometric Monitor Market Key Insights

-

The market size was USD 10.72 billion in 2024 and is forecasted to hit USD 25.26 billion by 2034.

-

North America leads with a 37% revenue share, driven by high adoption in consumer and clinical segments.

-

The U.S. market alone is projected to grow from USD 2.78 billion in 2024 to USD 6.68 billion by 2034.

-

Asia Pacific is the fastest-growing region, benefitting from strong digital penetration and government support.

-

Smartwatches dominated in 2024, claiming about 44% market share through multi-sensor capabilities.

-

Heart rate monitoring leads biometric parameters with 30% market share, while glucose monitoring is fastest growing.

-

AI’s role intensifies with enhanced accuracy, battery efficiency, and personalized analytics driving adoption.

Wearable Biometric Monitor Market Revenue Breakdown and Market Size Overview

| Report Coverage | Details |

| Market Size by 2034 | USD 25.26 Billion |

| Market Size in 2025 | USD 11.68 Billion |

| Market Size in 2024 | USD 10.72 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.95% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Device Type, Biometric Parameter Monitored, Authentication Mode, Connectivity Technology, Application, End User, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

How Is AI Transforming the Wearable Biometric Monitor Market?

Artificial Intelligence is pivotal in revolutionizing wearable biometric monitors by transforming raw physiological signals into clinically meaningful data. AI-powered analytics enhance sensor accuracy under diverse conditions and optimize battery life through adaptive data collection. On the business front, AI drives product innovation by enabling personalized consumer insights, improving marketing strategies, and facilitating subscription-based health service models.

Moreover, continuous AI advancements are propelling wearable devices from mere fitness trackers to diagnostic-level health monitors capable of managing chronic diseases and supporting remote patient care. This transformation encourages deeper integration of wearables into electronic health records (EHR) and validated clinical pathways.

What Are the Key Market Growth Factors?

-

Increasing health awareness and fitness focus globally

-

Expanding adoption of AI-enabled, multi-sensor devices

-

Growth in chronic diseases such as diabetes and cardiovascular conditions

-

Advancements in sensor technology and miniaturization

-

Regulatory acceptance boosting medical-grade wearable adoption

-

Integration with telehealth and remote patient monitoring systems

-

Higher consumer demand for personalized wellness and preventive healthcare

What Opportunities and Trends Are Shaping the Market?

Could expanding AI-driven bioelectronics redefine continuous health monitoring? Emerging trends indicate that enhancements in AI and sensor technologies will push wearable devices toward real-time, near-clinical diagnostics. The combination of discreet form factors (such as smart rings) and advanced biochemical sensors offers new possibilities for seamless health management.

Are partnerships between device makers and healthcare institutions accelerating mainstream clinical adoption? Increasing collaborations aim to integrate wearable data into centralized medical records, driving broader acceptance in hospital and outpatient settings, particularly for chronic disease management and post-operative care.

How Does Regional and Segment Analysis Break Down?

North America spearheads the market with widespread consumer and clinical adoption, led by tech giants like Apple, Fitbit (Google), and Garmin investing heavily in AI-enabled health wearables. Asia Pacific’s rapid growth is fueled by mobile internet penetration, government initiatives, and rising healthcare demands in countries including China, India, Japan, and South Korea.

By Device Type: Smartwatches dominate (44% market share) due to multi-sensor capabilities, while smart rings and bands are gaining traction for their discrete, 24/7 comfort, particularly in sleep and recovery tracking.

By Biometric Parameter: Heart rate monitoring governs the market (30% share), with glucose monitoring poised as the fastest-growing segment, propelled by diabetes management needs and FDA approvals of over-the-counter continuous glucose monitors.

By Authentication Mode: ECG-based physiological authentication leads with 36% share, favored for its unique cardiac electrical patterns ensuring secure identity verification.

By Connectivity: Bluetooth remains most adopted (52% share) due to low power consumption and HIPAA/GDPR-compliant encrypted connections, while cellular (4G/5G) connectivity is rapidly rising with broader 5G deployment.

By Application: Health and wellness monitoring dominate with 33%, complemented by fast growth in chronic disease management driven by escalating non-communicable disease rates worldwide.

By End User: Consumers hold 40% market share, reflecting increasing health awareness; healthcare providers and hospitals are the fastest-growing segments, leveraging wearables for remote monitoring and care transition.

By Industry Vertical: Consumer electronics dominate, but healthcare and life sciences are emerging rapidly owing to medical-grade wearable integration and regulations like FDA approvals for over 200 digital health devices in 2024.

What Are the Latest Breakthroughs From Top Companies?

-

Nanowear received FDA 510(k) clearance for AI-enabled cuffless continuous blood pressure monitoring, supporting real-time hypertension diagnostics.

-

Happy Health launched the FDA-approved Happy Ring, blending comfort with clinical precision in sleep, oxygen, and brain activity tracking.

-

Stelo received FDA approval as the first over-the-counter continuous glucose monitor, expanding access for diabetes management.

-

Leading players include Apple, Fitbit (Google), Garmin, Samsung, Whoop, Oura, Polar, and Xiaomi, driving innovation, AI integration, and expanding market reach.

What Challenges and Cost Pressures Exist?

Despite impressive growth, concerns around data privacy and security remain significant barriers to adoption, especially in clinical environments. The high cost of advanced wearable devices restricts accessibility, while skepticism from consumers and medical practitioners regarding continuous biometric data recording impacts user retention. Furthermore, maintaining device accuracy and ensuring regulatory compliance add to ongoing cost pressures for manufacturers.

Case Study Highlight

Nanowear’s FDA-cleared AI-enabled cuffless blood pressure monitoring device exemplifies a successful blend of innovative AI technology and regulatory compliance, facilitating early hypertension diagnosis remotely. This case underlines how AI integration can enhance diagnostic accuracy and patient adherence, setting a precedent for future wearable devices in clinical care.

Read Also: Pharmaceutical Spray Drying Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344