Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/sample/6158

Veterinary Diagnostics Market Key Points

-

North America dominated the global market with the largest share of 40% in 2024.

-

Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

-

By testing category, the clinical chemistry segment held the largest market share of 24% in 2024.

-

The cytopathology segment is projected to grow at the highest rate during the forecast period.

-

By animal type, the companion animals segment accounted for the largest market share of 60% in 2024.

-

The production animals segment is anticipated to grow at the fastest CAGR in the coming years.

-

By product type, the consumables, reagents, and kits segment captured the major market share of 54% in 2024.

-

The equipment and instruments segment is projected to grow at the fastest rate during the forecast period.

-

By end-user, the veterinarians segment held the largest market share in 2024.

-

The animal owners/producers segment is anticipated to grow at a significant CAGR between 2025 and 2034.

Veterinary Diagnostics Overview

Veterinary diagnostics refers to the tools and techniques used to detect, monitor, and analyze diseases and health conditions in animals. This field covers both livestock and companion animals and includes diagnostic methods like immunodiagnostics (ELISA), molecular testing (PCR), clinical biochemistry, hematology, and imaging. These diagnostics help veterinarians identify infections, metabolic issues, and other conditions early, enabling timely and effective treatment.

The demand for veterinary diagnostics is rising due to increasing pet ownership, a surge in zoonotic disease awareness, and the growing importance of animal health in food safety and public health. Technological advancements—such as point-of-care testing, digital imaging, and AI-assisted diagnostics—are making veterinary testing faster, more accurate, and more accessible, especially in remote or underserved areas.

How is AI Transforming the Veterinary Diagnostics Market?

Artificial Intelligence (AI) is revolutionizing the veterinary diagnostics market by enabling faster, more accurate detection of diseases in animals. AI-powered tools analyze medical images, blood tests, and genetic data with high precision, helping veterinarians identify health issues like infections, cancers, and genetic disorders early. These systems reduce diagnostic errors and deliver quicker results, which is critical for timely treatment and improved animal care.

Additionally, AI enhances decision-making by integrating data from various sources—such as wearable devices, lab results, and clinical history—to offer personalized insights into animal health. Predictive analytics models can also forecast disease outbreaks or track herd health trends, making them especially valuable in livestock and pet healthcare. Overall, AI boosts efficiency, accuracy, and scalability in veterinary diagnostics, reshaping the future of animal healthcare.

Veterinary Diagnostics Market Growth Factors

The veterinary diagnostics market is expanding rapidly, driven primarily by rising pet ownership and increasing healthcare spending for companion animals. As more households around the world adopt pets and treat them like family, demand for diagnostic services—ranging from routine screenings to advanced molecular tests—continues to surge. Additionally, growing livestock populations and stricter food safety regulations are boosting demand for diagnostics in the agricultural sector, ensuring animal health and preventing zoonotic disease transmission.

Technological innovation is another powerful catalyst. The introduction of rapid point-of-care testing, automated analyzers, and molecular-based methods like PCR enables faster, more accurate detection of animal diseases. Moreover, supportive government policies and increased funding for disease surveillance and animal health research—especially in regions with emerging livestock sectors—are further fueling market expansion.

Market Scope

| Report Coverage | Details |

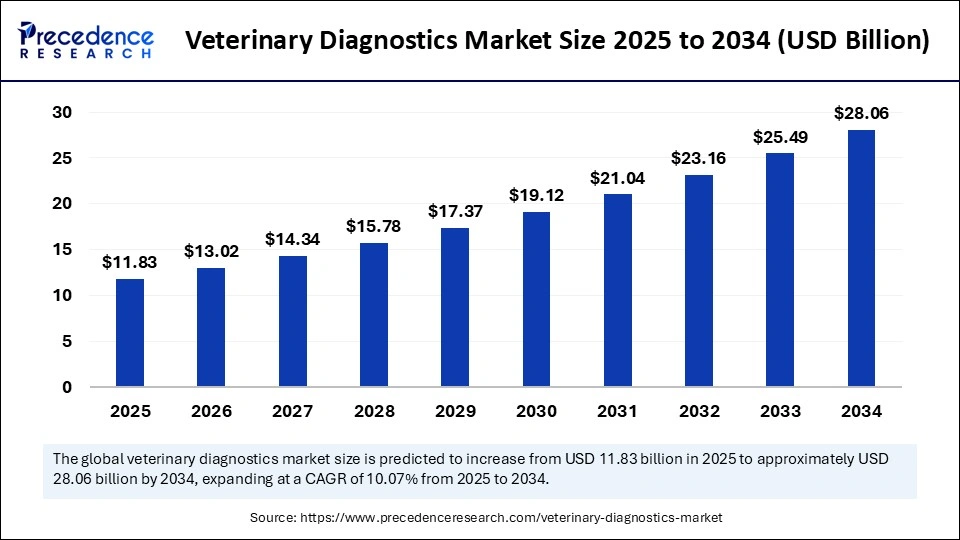

| Market Size by 2034 | USD 28.06 Billion |

| Market Size in 2025 | USD 11.83 Billion |

| Market Size in 2024 | USD 10.75 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.07% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Testing Category, Animal Type, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

The growth of the veterinary diagnostics market is significantly driven by the rising prevalence of zoonotic diseases and infectious animal disorders. Increasing pet ownership, especially in urban areas, is also contributing to a surge in demand for early disease detection and regular health checkups. Livestock farmers are increasingly adopting diagnostic solutions to ensure herd health and improve productivity, especially as the demand for high-quality animal protein and dairy products rises globally.

Moreover, awareness regarding animal welfare and the importance of timely medical intervention has grown considerably, promoting regular veterinary care. Technological advancements in diagnostic tools—such as point-of-care testing, molecular diagnostics, and digital imaging—have improved accuracy and reduced diagnosis time, which further supports market growth. The expansion of companion animal insurance policies and government support for animal healthcare also play a crucial role in fueling demand for diagnostic solutions.

Market Opportunities

The veterinary diagnostics market presents numerous opportunities, especially with the integration of advanced technologies such as AI, IoT, and machine learning into diagnostic platforms. These innovations offer real-time health monitoring, predictive diagnostics, and personalized treatment plans, transforming the veterinary healthcare landscape. Emerging markets in Asia, Africa, and Latin America are showing rapid growth in veterinary infrastructure, supported by rising disposable incomes and increasing pet adoption, offering untapped potential for diagnostics companies.

The growing trend of mobile and at-home veterinary diagnostics also opens doors for startups and existing players to innovate portable, user-friendly devices. Additionally, the increasing focus on preventive care and wellness in pets creates demand for routine screening tools. Collaborations between veterinary institutions, diagnostic companies, and research organizations to develop novel biomarkers and disease detection methods also present long-term growth prospects.

Market Challenges

Despite strong growth potential, the veterinary diagnostics market faces several challenges. High costs associated with advanced diagnostic procedures and equipment can be a significant barrier, particularly in cost-sensitive or rural regions. A lack of standardization in testing methods across different regions and institutions often results in variable diagnostic accuracy, impacting clinical decision-making. Moreover, the limited availability of trained veterinarians and skilled diagnostic personnel, particularly in emerging economies, restricts the effective adoption of advanced diagnostics.

Regulatory complexities related to the approval and distribution of veterinary diagnostic tools can slow market entry for new players. Another concern is the low awareness among pet and livestock owners in some regions about the importance of diagnostics, which affects market penetration. Additionally, competition from alternative therapies and home remedies in rural areas also poses a subtle challenge to formal veterinary diagnostics adoption.

Regional Outlook

Regionally, North America dominates the veterinary diagnostics market due to its well-developed veterinary infrastructure, high pet ownership, and strong awareness regarding animal health. The presence of leading diagnostic companies and extensive insurance coverage for pets in the U.S. and Canada supports sustained market growth. Europe follows closely, driven by increasing demand for companion animal care, stringent regulations promoting animal welfare, and the adoption of innovative diagnostics technologies.

Asia Pacific is emerging as the fastest-growing market, fueled by rising livestock populations, growing pet ownership in urban centers, and increasing government investment in veterinary healthcare, particularly in China, India, and Southeast Asia. Latin America and the Middle East & Africa present untapped opportunities due to expanding animal farming practices and improving veterinary service networks. However, these regions also require infrastructure and education initiatives to fully realize their potential. Overall, regional trends reflect a growing global commitment to animal health, creating a favorable environment for the expansion of veterinary diagnostics.

Veterinary Diagnostics Market Companies

- IDEXX Laboratories, Inc.

- Zoetis

- Antech Diagnostics, Inc. (Mars Inc.)

- Agrolabo S.p.A.

- Embark Veterinary, Inc.

- Esaote SPA

- Thermo Fisher Scientific, Inc.

- Innovative Diagnostics SAS

- Virbac

- FUJIFILM Corporation

Recent Developments

- In March 2025, Antech announced the launch of trūRapid FOUR, a comprehensive in-house canine vector-borne disease (CVBD) screening test. trūRapid FOUR is a lateral flow test used to detect canine antibodies to Anaplasma spp., Ehrlichia spp., and Lyme C6 (Borrelia burgdorferi), as well as heartworm (Dirofilaria immitis) antigen, using whole blood, serum, or plasma.

- In December 2024, Zoetis Inc. announced a plan to launch its new screenless point-of-care hematology analyzer, Vetscan OptiCell, to the global market at the Veterinary Meeting & Expo (VMX) in Orlando, Florida. It is the first cartridge-based, AI-powered diagnostic tool for veterinary hematology, providing complete blood count (CBC) analysis for accurate insights.

Segments Covered in the Report

By Product

- Consumables, Reagents & Kits

- Equipment & Instruments

By Testing Category

- Clinical Chemistry

- Microbiology

- Parasitology

- Histopathology

- Cytopathology

- Hematology

- Immunology & Serology

- Imaging

- Molecular Diagnostics

- Other Categories

By Animal Type

- Production Animals

- Cattle

- Poultry

- Swine

- Others

- Companion Animals

- Dogs

- Cats

- Horses

- Others

By End-use

- Reference Laboratories

- Veterinarians

- Animal Owners/ Producers

By Region

- North America

- APAC

- Latin America

- Europe

- MEA

Also Read: Recovery Footwear Market

Source: https://www.precedenceresearch.com/veterinary-diagnostics-market