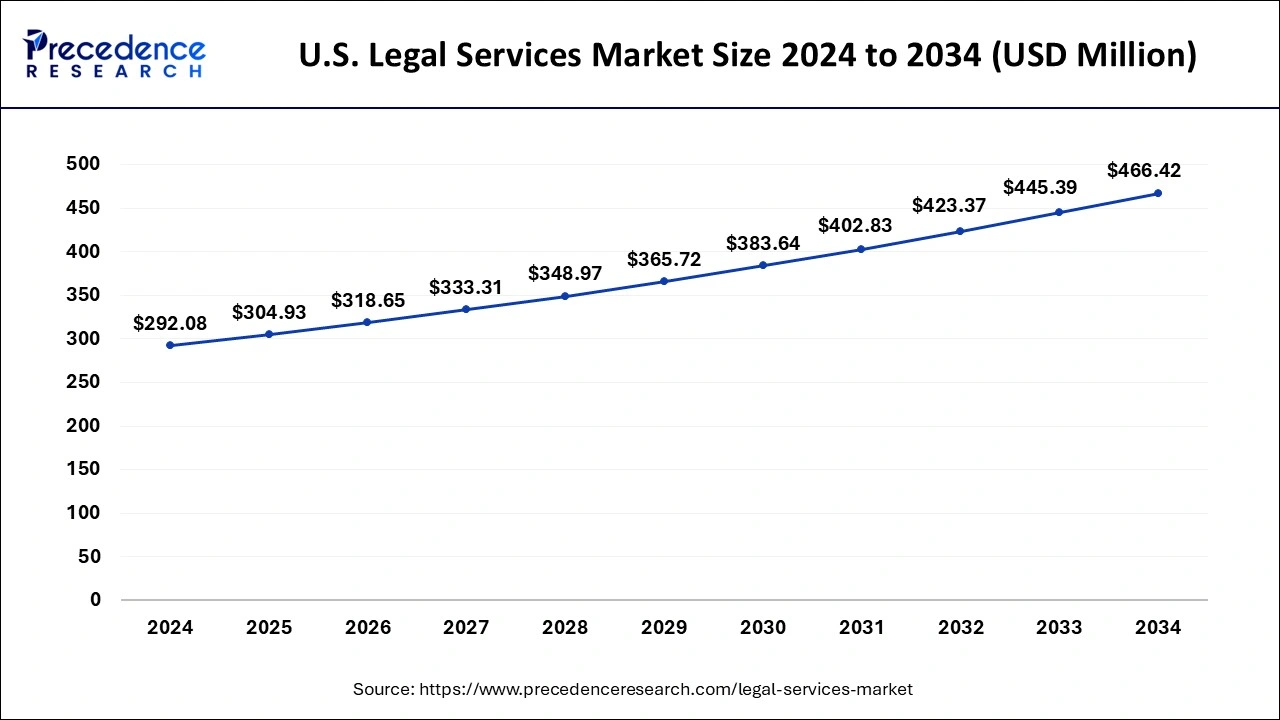

The U.S. legal services market size is estimated to attain around USD 466.42 billion by 2034 increasing from USD 292.08 billion in 2024, with a CAGR of 4.80%.

U.S. Legal Services Market Key Insights

- By fee type, the contingency segment held the major market share of 36.85% in 2024.

- By fee type, the corporate segment is projected to grow at a CAGR of 6.9% between 2025 and 2034.

- By size, the large firms segment contributed the largest market share of 38.30% in 2024.

- By size, the small firms segment is expected to expand at a notable CAGR of 6.1% between 2025 and 2034.

- By practice area, the civil litigation segment captured the largest market share of 32.68% in 2024.

- By practice area, the intellectual property segment is anticipated to grow at a significant CAGR of 7.8% over the projected period.

U.S. Legal Services Market Overview and Growth Outlook

The U.S. legal services industry remains the most mature and complex globally. It benefits from a robust demand base driven by regulatory compliance, high-stakes litigation, commercial contracts, and evolving business law needs. Despite increasing costs, including higher hourly rates charged by top-tier law firms, client demand for quality and specialized services remains strong. Midsize firms and boutique practices are emerging as competitive alternatives due to their cost-effectiveness and specialization.

Digital transformation, particularly through legal tech and AI, is beginning to redefine how firms deliver value. Flexible billing models such as flat-fee, contingency, and subscription services are gaining popularity over traditional hourly billing. In parallel, clients—especially corporate legal departments—are demanding improved transparency, outcome-based pricing, and technology-enabled efficiency.

Role of AI in the U.S. Legal Services Market

Artificial Intelligence is rapidly transforming the legal services sector. From AI-assisted legal research and predictive litigation analytics to automated contract review and document generation, AI is improving speed, consistency, and cost-efficiency across service types. Legal tech companies and law firms are leveraging generative AI to draft memos, summarize discovery materials, and assist in due diligence.

AI also enhances legal analytics, allowing firms to forecast case outcomes, optimize litigation strategy, and manage legal risks. In transactional law, AI is being used for contract lifecycle management, identifying non-compliant clauses, and suggesting revisions. As regulation around AI tools becomes more defined, law firms are taking steps to ensure compliance, data integrity, and transparency in AI-supported services.

U.S. Legal Services Market Growth Factors

The growth of the U.S. legal services market is fueled by several factors. The complexity of federal and state-level regulations in areas like healthcare, privacy, securities, and labor law continues to increase, creating demand for specialized legal counsel. Business globalization and the rise of cross-border disputes further drive legal advisory needs. Additionally, legal departments are under pressure to cut costs, encouraging the adoption of alternative legal service providers (ALSPs) and tech-driven models.

Increased litigation, particularly in intellectual property, environmental law, and corporate liability, is a major contributor. Furthermore, technological advancements, especially in e-discovery and compliance monitoring, are transforming traditional processes, reducing turnaround times and expanding capacity.

U.S. Legal Services Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 466.42 Billion |

| Market Size in 2025 | USD 304.93 Billion |

| Market Size in 2024 | USD 292.08 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.80% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Fee Type Insights, Size Insights, and Practice Area Insights |

Market Drivers

Demand in the U.S. legal services market is being driven by a complex and evolving legal framework. New regulatory requirements in cybersecurity, ESG compliance, and data protection are requiring companies to seek continual legal guidance. The rise of high-value litigation in technology and pharmaceuticals also drives significant billable hours and advisory services.

The growth of in-house legal teams within enterprises does not reduce the demand for external legal support; instead, it shifts the focus to more strategic and specialized legal services. Additionally, globalization and international trade disputes are encouraging law firms to expand their service portfolios and collaborate across jurisdictions.

Market Opportunities

There is significant opportunity in the legal tech space, especially platforms that integrate AI, blockchain, and cloud computing. Firms that offer automated tools for e-discovery, legal research, and contract analysis can scale efficiently and offer cost advantages to clients.

The rise of virtual law firms and subscription-based legal models opens doors for broader access to legal services among startups and SMEs. There’s also growing demand for services addressing environmental law, cryptocurrency regulation, and AI governance—creating new niches for legal professionals to capitalize on.

Market Challenges

The U.S. legal services market faces several challenges. Rising operational costs, talent shortages, and slow tech adoption—especially among traditional firms—can limit growth. Clients are increasingly cost-conscious, placing pressure on firms to demonstrate measurable value.

Adoption of AI tools also brings risks related to data privacy, security, and ethical use. Instances of AI-generated errors in legal filings have already resulted in publicized cases, emphasizing the need for robust governance and human oversight. Additionally, market saturation in general practice areas can lead to pricing pressure and reduced margins for smaller firms.

Competitive Landscape

- Cravath, Swaine & Moore LLP

- Gibson Dunn

- Kirkland & Ellis LLP

- Morgan Lewis

- Sidley Austin LLP

- Skadden, Arps, Slate, Meagher & Flom LLP

- Wachtell, Lipton, Rosen & Katz

- White & Case LLP

U.S. Legal Services Market Future Outlook and Trends

Looking ahead, the legal market will continue to evolve through digitization and specialization. Generative AI and predictive analytics will be embedded in routine legal work. Client preferences will shift towards fixed-fee and outcome-based billing structures. Firms that adapt to these changes will stand out in a competitive landscape.

Hybrid legal models combining human expertise and AI will become mainstream. Expect continued consolidation as firms look to offer integrated services across jurisdictions and technologies. New legal niches in ESG, AI ethics, and digital assets will open up high-growth opportunities for forward-thinking firms.

Segments covered in the report

By Fee Type Insights

- Contingency

- Non-Contingency

- Corporate

- Government

By Size Insights

- Solo Practitioners

- Small Firms

- Medium Firms

- Large Firms

- In-house Legal Departments

- Government Agencies

By Practice Area Insights

- Civil Litigation

- Corporate Law

- Employment Law

- Real Estate Law

- Criminal Law

- Intellectual Property

- Tax Law

- Immigration Law

- Government Law

- Family Law

- Environmental Law

Also Read: Sustainability Transformation Solutions Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6230

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344