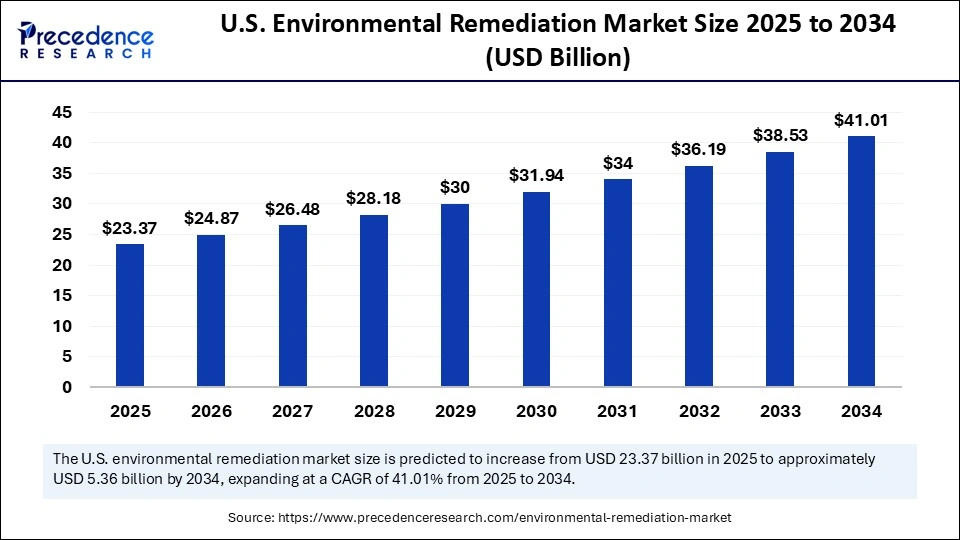

The U.S. environmental remediation market is projected to grow from USD 23.37 billion in 2025 to an estimated USD 41.01 billion by 2034, expanding at a compound annual growth rate (CAGR) of 6.45%.

This robust growth is fueled by increasingly stringent government regulations, particularly from the Environmental Protection Agency (EPA), heightened public awareness of environmental pollution, and ongoing contamination challenges resulting from decades of industrial, oil and gas, and manufacturing activities. Market demand is driven by the critical need to restore contaminated soil, water, and sediment to safeguard public health and ecosystems.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6733

U.S. Environmental Remediation Market Key Highlights

-

The market size was valued at USD 21.95 billion in 2024 and is forecasted to reach USD 41.01 billion by 2034.

-

The top region driving market growth is the United States, led by federal regulations such as CERCLA (Superfund).

-

The removal and disposal service segment dominated in 2024 due to the volume of legacy contamination.

-

Government and institutional buildings are the leading end-use sectors requiring remediation services.

-

Emergency response abatement is the fastest-growing segment fueled by increasing industrial accidents and spills.

-

Leading companies involved include players focused on advanced technology-driven remediation solutions.

U.S. Environmental Remediation Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 41.01 Billion |

| Market Size in 2025 | USD 23.37 Billion |

| Market Size in 2024 | USD 21.95 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.45% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, End-Use Sector, and Project Type |

Artificial Intelligence (AI) is rapidly transforming environmental remediation by enhancing operational efficiency, reducing costs, and enabling intelligent cleanup solutions. Using machine learning algorithms, AI forecasts contamination trends, optimizes cleanup methodologies, and facilitates real-time contaminant detection. This empowers stakeholders to make informed decisions quickly, speeding up response times during environmental incidents. The adaptability of AI systems allows remediation strategies to evolve dynamically based on ongoing environmental feedback, proving vital to handling complex, heterogeneous contamination scenarios.

Beyond predictive analytics, AI supports sustainable remediation by improving resource allocation and enabling precise monitoring of remediation progress. These innovations not only boost the effectiveness of treatments but also minimize environmental disturbance and operational overhead. AI integration represents a critical technological advancement, helping the U.S. maintain leadership in environmental protection technologies.

U.S. Environmental Remediation Market Growth Factors

Several key factors underpin the growth of the U.S. environmental remediation market. The foremost driver is the enforcement of stringent government regulations such as the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) and the Superfund program, mandating cleanup of hazardous waste sites. Rising public concern and media attention on pollution issues generate political and corporate pressure to adopt remediation solutions.

The historical legacy of industrial contamination in soils and groundwater, especially from the chemical, oil & gas, and manufacturing sectors, creates a persistent demand for remediation services. Simultaneously, advancements in remediation technologies, coupled with increasing investments from public and private sectors, enhance market capability and capacity.

What Are the Emerging Opportunities and Trends in Environmental Remediation?

How is increased public awareness influencing market dynamics?

Growing public awareness amplifies pressure on governments and industries to address pollution, leading to tighter regulations and greater demand for remediation services. Media coverage of contamination events often triggers urgent cleanup actions and sustained public scrutiny.

Why is soil and water contamination a prime opportunity in the market?

Addressing these contaminations not only complies with regulatory mandates but also enables economic benefits through brownfield redevelopment and ongoing prevention of pollution from sources like agricultural runoff and oil/gas operations.

What segmentation trends are shaping the market?

Removal and disposal services dominate due to the volume of hazardous legacy waste, whereas emergency response abatement is expanding quickly owing to increased industrial accidents and climate-related risks. Government and institutional buildings form the largest end-use sector, especially due to federal efforts targeting Superfund sites.

U.S. Environmental Remediation Market Regional and Segmentation Insights

The U.S. leads globally in environmental remediation due to its regulatory frameworks, historical contamination patterns, and technological investment.

Market segmentation highlights that the removal and disposal service type holds the largest share because of its direct impact on large-scale hazardous waste sites. The government and institutional buildings sector is the top end-user due to the extensive federal cleanup programs.

The renovation-related abatement segment dominates project types as aging industrial infrastructure undergoes compliance-driven remediation. Conversely, emergency/unplanned remediation projects are rising fast due to increased industrial spills and climate change-related environmental incidents.

U.S. Environmental Remediation Market Companies

- Clean Harbors

- AECOM

- Tetra Tech

- Jacobs Solutions Inc.

- WSP

Challenges and Cost Pressures

Despite favorable growth prospects, challenges persist in the U.S. remediation market. A critical restraint is the limited availability of skilled labor proficient in specialized techniques like advanced chemical treatments and environmental engineering.

This talent shortage increases project costs and delays timelines. Furthermore, complex contamination sites require sophisticated solutions, often escalating expenses. Regulatory compliance adds another layer of cost pressure, necessitating continuous investment in technology upgrades and process optimizations.

Case Study: Rapid Response to Industrial Spill

A recent emergency response to an oil spill in a major U.S. industrial corridor demonstrates the market’s urgency and capabilities. Using AI-enabled contaminant detection systems, the remediation team rapidly assessed spill extent, deployed containment measures, and optimized cleanup procedures in real time. This integrated approach minimized environmental damage and downtime, showing the effectiveness of emerging AI-driven remediation practices.

Read Also: Infrastructure For Business Analytics Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344