Empowering Next-Generation Cancer Treatments with AI and Allogeneic Therapies

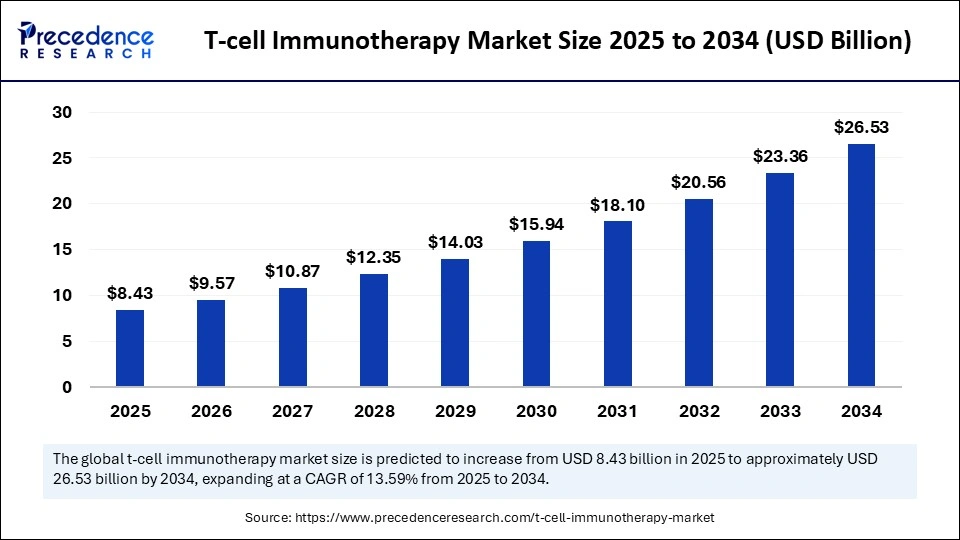

The global T-cell immunotherapy market is estimated to soar from $8.43 billion in 2025 to approximately $26.53 billion by 2034, driven by a robust CAGR of 13.59% over the forecast period. This growth is propelled by an escalating prevalence of cancer, rapid advances in cellular engineering, and an industry-wide pivot toward personalized and durable immunotherapies that are transforming treatment paradigms.

Key Insights

-

The market size reached $8.43 billion in 2025 and is projected to hit $26.53 billion by 2034.

-

North America leads the global market, while Asia Pacific is the fastest-growing region.

-

Kite Pharma (Gilead), Bristol Myers Squibb (including Celgene/Juno Therapeutics), and GSK rank among the top players, contributing up to 50% of total market share collectively.

-

The CAR-T segment commands the largest share, fueled by clinical adoption in treating hematologic malignancies.

-

Solid tumor indications are emerging as the highest growth opportunity, with recent clinical breakthroughs substantiating efficacy.

-

Viral vectors remain the dominant technology in engineered T-cell therapies, but non-viral approaches are gaining momentum for safety and scalability.

-

Hospitals account for the primary end-user share, while cell therapy centers are rising as cost-effective alternatives.

The Role of AI in T-Cell Immunotherapy

Artificial intelligence is rapidly accelerating the T-cell immunotherapy lifecycle from discovery to clinical deployment. AI platforms are optimizing target discovery, protein engineering, and gene-editing workflows, leading to improved T-cell production efficiency and enhanced cancer-cell killing performance. Through strategic alliances, major pharmaceutical companies are integrating AI-driven technologies, including CRISPR, to reduce R&D risks and decrease time to market for promising immunology programs.

Critical advances include AI-designed proteins that boost T-cell manufacturing and minibinders that increase the potency and specificity of immunotherapeutic agents. These innovations are reshaping candidate selection, safety profiling, and scalability, positioning AI as an indispensable pillar in next-generation T-cell therapies.

What Factors Are Driving T-Cell Immunotherapy Market Growth?

-

The surging global cancer burden, especially the rise in hematologic and solid tumor cases, is fueling demand for targeted immunotherapies that offer durable and precise clinical responses.

-

Breakthroughs in cellular engineering, notably CRISPR and allogeneic platforms (“off-the-shelf” therapies), are making T-cell immunotherapies more accessible and affordable by overcoming manufacturing and supply constraints.

-

Strong regulatory support, including recent FDA relaxations, is enabling broader access and faster commercialization in key markets like the U.S..

-

Expanding academic-industry collaborations, incentives, and clinical trial capacities, especially in Asia Pacific, are catalyzing innovation and adoption worldwide.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.43 Billion |

| Market Size in 2026 | USD 9.57 Billion |

| Market Size by 2034 | USD 26.53 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.59% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

What Key Opportunities and Trends Are Emerging?

Can “Off-the-Shelf” Universal T-cell therapy Transform Immunotherapy?

Universal allogeneic T-cell products, produced from healthy donors using advanced gene editing, are poised to disrupt market paradigms by eliminating wait times and lowering costs. Innovations like Cellistic’s Echo-NK platform enable scalable, rapid deployment of therapies across multiple indications, signaling a major leap toward accessible and democratized cell therapy.

How is Solid Tumor Penetration Reshaping the Market Outlook?

Ongoing research is overcoming barriers in solid tumor therapy—such as poor T-cell infiltration and immunosuppressive microenvironments—through engineered dual-antigen CARs, logic-gated constructs, and combination strategies. Notably, the first China-based clinical trial in gastric cancer demonstrated a 40% survival benefit, marking the next frontier for immune-oncology.

Regional and Segment Analysis

North America

Robust trial ecosystems, advanced clinical infrastructure, and proactive regulatory amendments (including relaxed REMS for CAR-T therapies) have secured North America’s dominance in the T-cell immunotherapy space. The U.S., in particular, benefits from accelerated approvals and extensive hospital infusion capabilities, drawing significant venture capital and biopharma partnerships.

Asia Pacific

China, Japan, and South Korea are fast-tracking regulatory processes and fostering clinical innovation, making the region a hotbed for next-generation T-cell therapy development.

India Rising: Recent launches of NexCAR19—India’s first home-grown CAR-T gene therapy—along with key approvals for B-cell lymphoma treatments are transforming access to advanced cellular therapies in emerging markets.

Segmentation Highlights

Therapy Type: CAR-T leads, followed by engineered TCR and regulatory T-cell approaches.

Technology: Viral vectors are dominant, with non-viral techniques rapidly advancing for safety and scalability.

Indications: Hematologic malignancies command the largest share, but solid tumors are growing at the fastest rate.

End-User: Hospitals remain the primary delivery centers; specialty infusion centers offer more decentralized options.

Targeting Strategy: Movement from single-antigen to dual/multi-antigen targeting enhances therapy durability and tackles tumor heterogeneity.

Breakthroughs & Company List

Recent FDA approvals for CAR-T and TCR therapies (e.g., Tecelra for synovial sarcoma) and clinical trials in Asia highlight unprecedented progress in solid tumor applications. Companies driving these breakthroughs include:

-

Kite Pharma (Gilead)

-

Bristol Myers Squibb (includes Celgene, Juno Therapeutics)

-

GSK

-

Cellistic

-

ImmunoACT (India)

-

Numerous Tier II and III biotech firms focused on regional and niche innovation

What Challenges and Cost Pressures Persist?

-

The tumor microenvironment (TME) in solid tumors creates immune-suppressive barriers, hindering T-cell efficacy and infiltration.

-

Scarcity of skilled professionals and high investment costs slow market adoption, particularly in developing regions.

-

T-cell exhaustion (due to persistent tumor antigen exposure) remains a hurdle for long-term efficacy.

-

Manufacturing and logistical issues tied to personalized autologous therapies impact scalability and price.

Also Read: Preeclampsia Diagnostics Market Size to Reach USD 1.70 Billion by 2034

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6994

Download a Sample Report/Book a Consultation

Take the first step towards breakthrough insights and robust market intelligence.

Download a sample report or schedule a meeting with our experts: sales@precedenceresearch.com