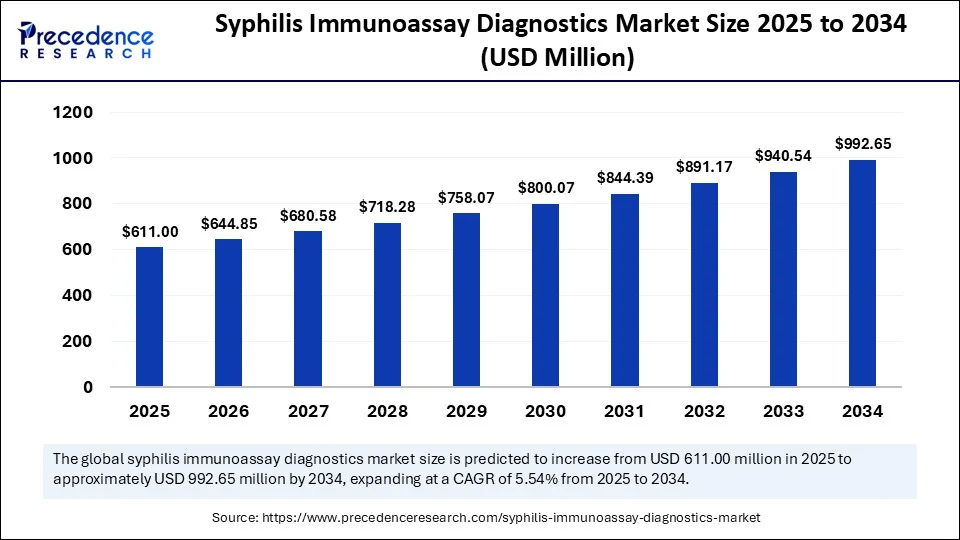

According to Precedence Research, the global syphilis immunoassay diagnostics market size was valued at USD 578.93 million in 2024 and is expected to rise to USD 611 million in 2025. The market is projected to grow at a compound annual growth rate (CAGR) of 5.54% from 2025 to 2034, reaching a valuation of USD 992.65 million by 2034.

This expansion is driven by rising syphilis incidence globally, growing public health mandates for prenatal and blood screening, and rapid advancements in immunoassay technologies such as lateral flow assays and enzyme-linked immunosorbent assays (ELISA). Additionally, artificial intelligence (AI) and smart diagnostics are making notable inroads into laboratory and point-of-care workflows, enhancing accuracy and accessibility.

Syphilis Immunoassay Diagnostics Market Overview and Growth Drivers

The growing disease burden of syphilis, especially among reproductive-age adults and newborns, has prompted many countries to strengthen their testing infrastructure. National and global screening initiatives have spurred a surge in demand for accurate, fast, and scalable immunoassay diagnostics.

As a result, manufacturers are focusing on enhancing assay sensitivity and turnaround time, leading to greater adoption of automated chemiluminescence immunoassays (CLIA) and AI-assisted rapid tests. With syphilis often remaining undetected in early stages, timely diagnostics are critical to reducing complications and transmission. This has positioned immunoassay platforms as an essential component of modern sexually transmitted infection (STI) control strategies.

Syphilis Immunoassay Diagnostics Market Regional Highlights

In 2024, North America dominated the syphilis immunoassay diagnostics market, accounting for nearly 58% of the global revenue share. The region’s leadership stems from its robust diagnostic infrastructure, well-established laboratory testing protocols, and heightened awareness of congenital syphilis screening.

The Asia Pacific region is projected to register the fastest growth rate during the forecast period, owing to improving healthcare access, rising STI awareness, and governmental focus on antenatal care screening in countries like India and China.

Technology and Segment Analysis

By technology, ELISA remained the dominant platform in 2024, offering reliable quantitative results suitable for centralized laboratory settings. However, lateral flow assays (LFAs) are witnessing the fastest growth due to their portability, affordability, and suitability for remote or low-resource settings.

On the test type front, treponemal tests held over 60% market share in 2024, as these assays are preferred for initial diagnosis and often integrated into rapid diagnostic formats. Meanwhile, non-treponemal tests are expected to see increased demand in follow-up testing and monitoring due to their correlation with disease activity.

The blood/serum segment was the most commonly used sample type in 2024, owing to its diagnostic accuracy and compatibility with various platforms. However, the industry is seeing rising innovation in oral swab and self-testing methods. Among end users, hospitals and specialty clinics accounted for approximately 40% of the global share, driven by their capacity to perform confirmatory testing and manage follow-up treatment.

Interestingly, blood banks are emerging as the fastest-growing end-user segment, supported by mandatory screening policies and the need for high-throughput diagnostic solutions.

Read Also: Biotech IP Monetization Platforms Market Size, Report by 2034

Artificial Intelligence and Technological Advancements

Artificial intelligence is playing a transformative role in syphilis diagnostics. In one notable 2025 clinical study, an AI-powered smartphone app analyzed 669 RPR card tests and achieved 94.85% sensitivity, 91.56% specificity, and a negative predictive value (NPV) of 98.59%. Such tools are being increasingly deployed to standardize visual interpretation, minimize human error, and improve diagnostic outcomes—especially in point-of-care and rural applications.

Concurrently, public sector initiatives such as the NIH and CDC’s grant funding for AI-enhanced STI diagnostics (e.g., RFA-AI-23-039) are fueling rapid innovation in the space.

Innovation and Competitive Landscape

The rise in syphilis incidence is being matched by innovation in diagnostic modalities. Several top manufacturers, including Abbott, Bio-Rad, Siemens Healthineers, Chembio Diagnostics, Danaher, and DiaSorin, are focused on expanding their immunoassay portfolios. These companies are launching rapid tests with dual or multiplex capabilities—such as tests that can simultaneously detect syphilis and HIV making them ideal for integrated screening programs. Such innovations not only reduce testing costs and time but also support broader infectious disease control strategies.

Challenges in the Syphilis Immunoassay Diagnostics Market

Despite these promising developments, the market faces significant challenges. High equipment costs, particularly for automated platforms, often limit adoption in low-income settings. Moreover, variability in assay performance across different formats necessitates confirmatory testing, which can delay diagnosis and treatment.

Sociocultural stigma surrounding STI testing also presents a barrier to uptake, especially in certain regions. Regulatory hurdles and lack of harmonized diagnostic protocols continue to complicate the commercialization of newer testing technologies.

Real-World Case Study

In one real-world case, a network of blood banks across Southeast Asia implemented a standardized CLIA-based testing protocol supported by automated analyzers and reagent kits. The program resulted in a 30% increase in syphilis detection rates, a 20% decrease in false positives, and an overall doubling of testing throughput within 12 months—demonstrating the clear benefits of technology-driven improvements in diagnostic accuracy and efficiency.

Syphilis Immunoassay Diagnostics Market Conclusion and Strategic Outlook

With robust growth projected through 2034, the syphilis immunoassay diagnostics market is poised to become a central pillar of global STI control efforts. Stakeholders across the healthcare spectrum—from public health agencies to diagnostics manufacturers—are actively investing in innovation, access, and awareness.

As AI technologies and rapid testing capabilities continue to advance, the future of syphilis diagnostics is expected to be more accurate, responsive, and equitable than ever before.

Download the Full Report or Connect with Our Experts

To explore detailed market forecasts, competitive analysis, and segment-wise insights, download a sample report or schedule a meeting with our expert analysts at Precedence Research. https://www.precedenceresearch.com/sample/6453

About Precedence Research

Precedence Research is a global market research and consulting organization that provides industry intelligence, growth strategy insights, and forecast analysis across the healthcare, biotechnology, diagnostics, and life sciences sectors. We empower organizations to make data-driven decisions in complex and evolving markets.

Media Contact:

Precedence Research – Communications Team

📧 Email: sales@precedenceresearch.com

🌐 Website: www.precedenceresearch.com