Sterile Injectables CDMO Market Key Highlights

-

In 2024, North America emerged as the leading regional market, accounting for 41% of the total revenue.

-

The Asia Pacific region is anticipated to witness the fastest growth, with a projected CAGR of 10.7% from 2025 to 2034.

-

Large molecules dominated the market by molecule type, contributing 67% of the total revenue in 2024.

-

The small molecules segment is expected to register substantial growth over the forecast period.

-

Among products, pre-filled syringes held the largest market share at 42% in 2024.

-

Specialty injectables are forecasted to expand at the fastest CAGR between 2025 and 2034.

-

Formulation development led the service segment with a 40% revenue share in 2024.

-

The manufacturing service segment is projected to grow at a notable CAGR of 10% through the forecast timeline.

-

Oncology was the top therapeutic area, capturing 31% of the revenue share in 2024.

-

Central nervous system diseases are experiencing a robust CAGR of 10.31%.

-

Intravenous (IV) administration accounted for the highest share of 31% in 2024 among all routes.

-

Subcutaneous (SC) administration is projected to grow rapidly, with a CAGR of 10.42% from 2025 to 2034.

-

Biopharmaceutical companies represented the dominant end-use segment with a 44% share in 2024.

-

Pharmaceutical companies are expected to expand steadily with a significant CAGR during the forecast period.

What are Sterile Injectables CDMOs and Why Are They Important?

Sterile Injectables CDMOs (Contract Development and Manufacturing Organizations) offer specialized services for the development and aseptic manufacturing of injectable drugs, including biologics, vaccines, and complex generics. These CDMOs handle critical processes such as formulation, fill-finish, analytical testing, and packaging under strict sterile conditions. With the growing demand for injectable therapies to treat chronic diseases, cancer, and infectious diseases, pharmaceutical companies increasingly outsource to CDMOs to leverage their expertise, reduce costs, and accelerate time-to-market.

How is AI Revolutionizing the Sterile Injectables CDMO Market?

AI is significantly enhancing the efficiency and precision of operations in the sterile injectables CDMO market. From drug formulation and process optimization to quality control, AI algorithms analyze vast datasets to identify trends, minimize errors, and predict outcomes. This accelerates development timelines and reduces costs by enabling real-time monitoring and adjustments during aseptic manufacturing, ensuring regulatory compliance and maintaining the highest sterility standards.

Moreover, AI supports predictive maintenance of manufacturing equipment, reducing downtime and enhancing production scalability. It also plays a vital role in supply chain management by forecasting demand, optimizing inventory, and ensuring timely delivery of injectables. As a result, CDMOs can offer more agile, cost-effective, and high-quality sterile injectable solutions to pharmaceutical companies, meeting the growing global demand for injectable therapeutics.

Sterile Injectables CDMO Market Growth Factors

monoclonal antibodies, and complex therapies such as gene and cell therapies. A growing number of chronic and acute conditions, including cancer and diabetes, require injectable treatments, leading to increased outsourcing of sterile manufacturing. Pharmaceutical and biotech companies are turning to CDMOs to avoid high capital investments in sterile infrastructure, focus on R&D, and ensure faster time-to-market. Additionally, the growth of biosimilars and generic sterile injectables is further accelerating demand for contract development and manufacturing services.

Technological advancements in aseptic processing—such as single-use systems, automation, isolator technology, and modular cleanrooms—are enhancing manufacturing flexibility, quality, and efficiency. CDMOs are increasingly investing in capacity expansion, digital tools, and compliance with global regulatory standards to meet rising client expectations. Strategic mergers, acquisitions, and global facility expansions are also helping CDMOs scale up capabilities and extend their geographic reach.

Market Scope

| Report Coverage | Details |

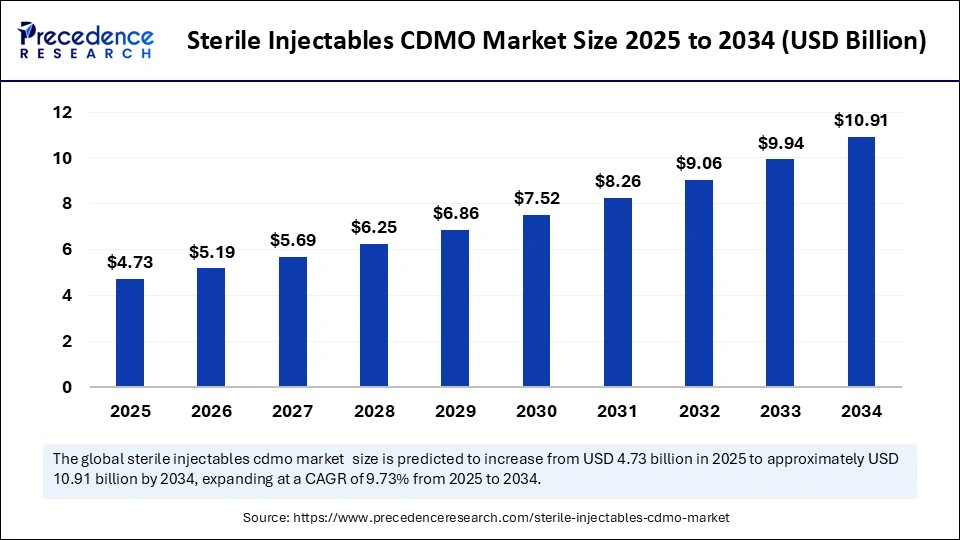

| Market Size by 2034 | USD 10.91 Billion |

| Market Size in 2025 | USD 4.73 Billion |

| Market Size in 2024 | USD 4.31 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.73% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Molecule Type, Product, Service, Therapeutic Area, Route of Administration, End-use and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

The sterile injectables CDMO (Contract Development and Manufacturing Organization) market is experiencing strong growth due to a variety of interconnected drivers. A significant factor is the rising demand for sterile injectable drugs across therapeutic areas such as oncology, cardiovascular diseases, autoimmune disorders, and infectious diseases.

This surge is partly due to the increasing global prevalence of chronic illnesses that require immediate and targeted drug delivery. Additionally, the growing number of biologics and complex formulations that require sterile environments is pushing pharmaceutical companies to partner with specialized CDMOs. The high cost of building and maintaining sterile manufacturing facilities, coupled with regulatory complexities, makes outsourcing a more efficient and cost-effective option for both large pharma companies and emerging biotech firms.

Moreover, the ongoing trend of pharmaceutical companies focusing on core competencies—such as R&D and marketing—further boosts reliance on CDMOs for sterile injectable production.

Market Opportunities

The market presents significant opportunities for growth, particularly with the rise of biosimilars and biologics, which require sterile injectable formats. CDMOs that specialize in high-potency active pharmaceutical ingredients (HPAPIs) and lyophilized injectables are well-positioned to capture increasing demand. Additionally, the expansion of personalized medicine and the growth of advanced therapies, including cell and gene therapies, create a fertile environment for specialized sterile manufacturing services.

CDMOs that can offer end-to-end services—from formulation development to commercial-scale production—are in high demand. Another area of opportunity is the integration of advanced technologies such as automation, robotics, and single-use systems, which enhance efficiency, flexibility, and compliance in sterile production environments. With emerging markets upgrading their healthcare infrastructure and regulatory frameworks, CDMOs also have the opportunity to expand geographically and serve local and regional pharmaceutical needs more effectively.

Market Challenges

Despite the promising outlook, the sterile injectables CDMO market faces several critical challenges. First, the high capital investment and technical expertise required to establish and operate sterile facilities are significant barriers to entry. Compliance with stringent global regulatory requirements, including FDA, EMA, and WHO guidelines, adds complexity and cost to operations. Any lapse in quality can lead to regulatory penalties, product recalls, or reputational damage.

Additionally, the growing competition in the CDMO landscape is exerting pricing pressure, especially among small and mid-sized players. Capacity constraints are also a challenge, particularly when sudden spikes in demand occur, such as during public health emergencies like the COVID-19 pandemic. Furthermore, talent shortages in skilled manufacturing and quality control personnel can hinder scalability and operational consistency.

Regional Outlook

From a regional perspective, North America leads the sterile injectables CDMO market due to its mature pharmaceutical industry, robust regulatory environment, and the presence of several leading CDMO companies. The U.S., in particular, is a major hub for biologics and biosimilar production, driving the need for sterile injectable manufacturing services.

Europe follows closely, with countries like Germany, Switzerland, and Ireland being key players in pharmaceutical outsourcing. The region benefits from strong government support, skilled labor, and a tradition of high manufacturing standards. Asia Pacific is emerging as the fastest-growing region, fueled by cost-effective manufacturing, increasing R&D investments, and growing demand from local pharmaceutical markets. Countries such as India, China, and South Korea are expanding their sterile injectable capabilities and attracting global clients with their competitive pricing and improving regulatory compliance.

Latin America and the Middle East & Africa are relatively nascent markets but show potential for growth, particularly as multinational pharmaceutical companies expand their global footprint and local demand for sterile therapies increases.

Sterile Injectables CDMO Market Companies

- Aenova Group

- Ajinomoto Bio-Pharma

- Alcami Corporation

- Baxter (Simtra BioPharma Solutions)

- Boehringer Ingelheim International GmbH

- Eurofins Scientific

- FAMAR Health Care Services

- Fareva Group

- Fresenius Kabi Contract Manufacturing (Fresenius Kabi AG)

- IDT Biologika GmbH

- PCI Pharma Services

- Pfizer CentreOne (Pfizer Inc)

- Recipharm AB

- Siegfried AG

- Torbay Pharmaceuticals

- Unither Pharmaceuticals

- Vetter Pharma International GmbH

Segments Covered in the Report

By Molecule Type

- Small Molecules

- Large Molecules

By Product

- Pre-filled Syringes

- Vials and Ampoules

- Specialty Injectables

- Others

By Service

- Formulation Development

- Analytical and Testing Services

- Method Development and Validation

- Stability Testing

- Drug Substance

- Stability Indicating Method Validation

- Accelerated Stability Testing

- Photostability Testing

- Other Stability Testing Methods

- Extractable & Leachable Testing

- Others

- Manufacturing

- Clinical Trial Manufacturing

- Commercial Manufacturing

- Aseptic Fill-Finish Services

- Packaging

- Storage

- Cold

- Non-cold

- Others

By Therapeutic Area

- Oncology

- Cardiovascular Diseases

- Central Nervous System Diseases

- Infectious Disorders

- Musculoskeletal Diseases

- Hormonal Diseases

- Others

By Route of Administration

- Subcutaneous (SC)

- Intravenous (IV)

- Intramuscular (IM)

- Others

By End-use

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Also Read: Veterinary Point of Care Diagnostics Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6188

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344