Starter Culture Market Key Takeaways

-

North America dominated the starter culture market in 2024.

-

Asia Pacific is projected to register the fastest CAGR between 2025 and 2034.

-

By product type, the yeast segment accounted for the largest market share in 2024.

-

The lactobacillus segment is expected to grow at a significant CAGR in the coming years.

-

By application, the dairy products segment held the largest market share in 2024.

-

The alcoholic beverages segment is projected to grow at a notable CAGR during the forecast period.

What is Driving the Growth of the Starter Culture Market?

The starter culture market is expanding rapidly due to its essential role in the food and beverage industry, especially in fermented products like yogurt, cheese, bread, beer, and sausages. Starter cultures consist of microorganisms such as bacteria, yeasts, or molds that initiate and control the fermentation process, improving texture, flavor, and shelf life. The growing demand for natural, clean-label, and probiotic-rich foods has significantly boosted the use of starter cultures, especially in dairy and plant-based alternatives.

Increased health consciousness among consumers, along with technological advancements in microbial strains and fermentation processes, are further propelling the market. Additionally, the expanding processed food industry and rising global consumption of traditional and artisanal fermented foods are creating new growth opportunities. Regions like Asia-Pacific and North America are witnessing robust growth due to strong dairy consumption and growing demand for functional foods.

How is AI Enhancing Innovation in the Starter Culture Market?

AI is playing a crucial role in transforming the starter culture market by enabling faster and more precise strain development. Using machine learning and predictive analytics, researchers can analyze vast genetic and microbial datasets to identify optimal microbial combinations for fermentation. This reduces the trial-and-error process traditionally required in culture development, resulting in more efficient production of consistent, high-quality starter cultures tailored for specific dairy, meat, or plant-based applications.

What Benefits Does AI Bring to Quality Control and Customization?

AI-powered systems are streamlining quality control by monitoring microbial performance in real-time and detecting deviations during fermentation processes. This leads to enhanced product safety, improved shelf life, and reduced waste. Additionally, AI enables the customization of starter cultures based on consumer trends such as veganism or probiotic enrichment. By leveraging AI insights, manufacturers can respond more quickly to market demands and ensure consistency in flavor, texture, and health benefits across product lines.

Market Scope

| Report Coverage | Details |

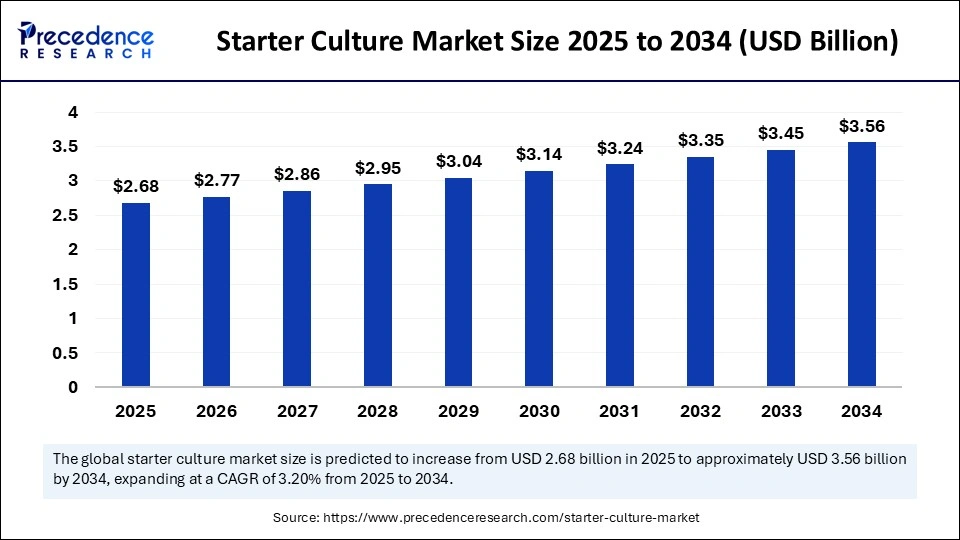

| Market Size by 2034 | USD 3.56 Billion |

| Market Size in 2025 | USD 2.6 Billion |

| Market Size in 2024 | USD 2.68 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.20% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers:

The starter culture market is primarily driven by the growing demand for fermented food and beverages such as yogurt, cheese, kefir, sausages, and alcoholic beverages. Consumers are increasingly gravitating toward functional foods that promote gut health and boost immunity, thereby fueling the use of microbial starter cultures in food processing. The rising popularity of clean-label and natural food products has also enhanced demand, as starter cultures help achieve fermentation without synthetic additives or preservatives. Additionally, the expansion of the dairy and meat processing industries, especially in developing economies, supports market growth. Technological advancements in microbiology and food biotechnology have enabled the development of more robust and efficient strains of starter cultures, leading to improved consistency, flavor, and shelf-life of fermented products. Regulatory support for probiotic and functional food claims further reinforces market momentum.

Market Opportunities:

The market presents considerable opportunities in both product development and geographic expansion. One major area of potential is the customization of starter cultures for specific health benefits, such as lactose reduction, improved digestion, or enhanced nutritional profiles. The rising vegan and plant-based movement also opens up avenues for the development of starter cultures suited for non-dairy and alternative protein fermentation, such as soy, almond, or pea-based products. Moreover, innovations in freeze-dried and encapsulated cultures offer manufacturers better control over shelf-life and microbial activity, creating scope for use in a wider range of applications and geographies. There is also untapped potential in emerging markets, where increasing urbanization and exposure to global food trends are driving interest in fermented products, thereby expanding the demand for starter cultures.

Market Challenges:

Despite its promising outlook, the starter culture market faces several key challenges. One of the major hurdles is the stringent regulatory environment concerning the use of microbial strains in food production. Gaining approvals for new strains and ensuring compliance with food safety standards across different regions can be time-consuming and costly. Moreover, the high cost of advanced starter cultures, particularly those with customized functionalities or probiotic properties, can limit adoption among small and medium-scale food processors. Another challenge lies in the complexity of maintaining the stability and viability of microbial cultures during storage and transport, especially in regions lacking cold chain infrastructure. Additionally, there is limited consumer awareness in some markets regarding the benefits of fermented products, which can slow down demand growth.

Regional Outlook:

Europe leads the global starter culture market due to its deep-rooted tradition of consuming fermented foods and well-established food processing industry. Countries such as Germany, France, and Italy have strong demand for cheese, cured meats, and fermented dairy products, all of which rely heavily on starter cultures. North America follows closely, driven by increasing health consciousness, demand for probiotics, and a growing artisanal and craft food movement. The Asia Pacific region is expected to witness the highest growth rate during the forecast period, as rising incomes, urbanization, and Western dietary influences fuel demand for packaged and processed fermented foods. In particular, China, India, Japan, and South Korea are key markets, supported by expanding food industries and increasing awareness of the health benefits of fermentation. Latin America and the Middle East & Africa also offer emerging opportunities, especially as food manufacturers seek to introduce value-added products in these regions. However, infrastructure and economic limitations may pose short-term constraints in these areas.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/sample/6156

Recent Developments

- In April 2024, Nordmann entered into a partnership with Sacco System to supply meat starter cultures. These starters enable the production of cured and fermented meat products.

- In September 2023, dsm-firmenich announced the launch of Delvo Fresh Pioneer, a new generation of starter cultures for very mild yogurts. This launch addresses yogurt manufacturers’ need for high quality ingredients, stable production processes, and consistent mildness throughout shelf life by enabling exceptional pH stability during processing.

Key Players Operating in the Market

- Dohler Group

- Lesaffre Group

- Danisco A/S

- Angel Yeast CO. Limited

- CSK Food Enrichment B.V

- Wyeast Laboratories Inc.

- Lallemand Inc

- Lactina Limited.

Segments Covered in the Report

By Type

- Bacteria

- Yeast

- Molds

By Application

- Dairy Products

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Also Read: Recovery Footwear Market

Source: https://www.precedenceresearch.com/starter-culture-market