Spintronics Market Quick Insights

-

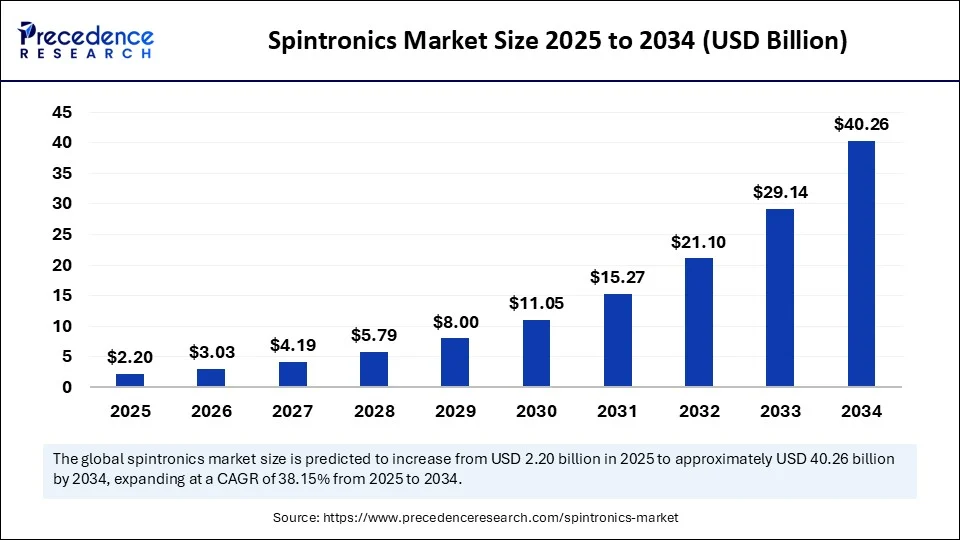

2024 Market Size: USD 1.59 billion

-

2025 Forecast: USD 2.20 billion

-

2034 Projection: USD 40.26 billion

-

Growth Rate (2025–2034): CAGR 38.15%

-

Leading Region (2024): Asia Pacific with ~46% share

-

Fastest-growing Region: North America via R&D and early adoption

-

Top Device Type (2024): Metal‑based devices, with TMR holding ~38% share

-

Fastest-growing Device Type: Semiconductor‑based devices, led by Spin‑FETs

-

Application Leader (2024): Memory Devices (MRAM ~42%)

-

Fastest-growing Application: Logic devices (especially spin logic gates)

-

Material Leader (2024): Ferromagnetic materials (~35%)

-

Material with Highest Growth: Graphene & 2D materials

-

End-user Share (2024): Consumer Electronics (~33%)

-

Fastest-growing End-user: Automotive segment

How Is AI Revolutionizing Spintronics?

AI and machine learning tools are optimizing spintronic material discovery, accelerating design of devices with ideal spin polarization and low power consumption. By training models on large datasets, new materials—with optimal magnetic and electronic properties—are identified faster, reducing prototyping cycles and costs.

In manufacturing, AI also improves yield through precision process control, real‑time defect detection, and adaptive testing—especially critical in scaling MRAM and advanced sensor fabrication. Integration with AI promises to unlock neuromorphic and quantum‑compatible spintronics platforms.

What Opportunities and Trends Are Shaping Growth?

-

Can MRAM fully displace flash and DRAM for next‑generation non‑volatile memory?

-

Will spin logic devices enable ultra‑low‑power computing architectures in IoT and edge applications?

Rapid advances in spin‑transfer torque and tunneling magnetoresistance (TMR) technologies, combined with new materials like graphene and 2D magnets, are opening new use cases across quantum computing, ADAS sensors, and neuromorphic systems.

Spintronics Market Regional Analysis

Asia Pacific dominated the global spintronics market in 2024, accounting for approximately 46% of total revenue. This leadership position can be attributed to the region’s well-established semiconductor manufacturing infrastructure, particularly in countries like China, Japan, South Korea, and Taiwan. The presence of major fabrication plants and continuous investments in spintronics R&D further bolster its dominance.

North America is emerging as the fastest-growing region during the forecast period. The market here is being driven by strong government initiatives supporting AI and quantum computing, as well as a growing ecosystem of semiconductor startups. This combination of innovation and investment is accelerating the adoption of spintronics-based technologies across computing and defense applications.

Europe, Latin America, and the Middle East & Africa (MEA) are also witnessing steady growth. Europe’s focus on automotive sensing and industrial automation, along with rising demand for energy-efficient devices in Latin America and MEA, is contributing to a broader global expansion of the spintronics market.

Spintronics Market Segmental Insights

Segmentation by Device Type

In terms of device type, metal-based spintronic devices held the largest share of the market in 2024. Within this category, Tunneling Magnetoresistance (TMR) devices played a significant role due to their use in magnetic sensors and memory components. However, semiconductor-based devices, especially Spin Field-Effect Transistors (Spin-FETs), are expected to grow at the fastest pace, driven by advances in semiconductor integration and miniaturization.

Segmentation by Application

Memory devices, particularly Magnetoresistive Random-Access Memory (MRAM), remained the largest application segment in 2024, contributing approximately 42% of total revenue. These devices are widely adopted in data storage due to their non-volatility, speed, and energy efficiency. Looking ahead, logic devices—especially spin logic gates—are anticipated to witness the most rapid growth as demand rises for low-power computing in edge and IoT applications.

Segmentation by Material

Ferromagnetic materials led the market in 2024, holding around 35% share due to their reliable magnetic properties and availability. However, the landscape is evolving as graphene and other two-dimensional (2D) materials gain traction. These advanced materials offer superior spin transport characteristics, which could revolutionize spintronic device performance in the coming years.

Segmentation by End-User

Among end-user industries, consumer electronics emerged as the top segment in 2024, accounting for roughly 33% of the global market share. The demand for faster, energy-efficient components in smartphones, wearables, and smart devices continues to fuel growth. Meanwhile, the automotive industry is projected to be the fastest-growing end-user segment, driven by the increasing integration of spintronic sensors and MRAM in advanced driver-assistance systems (ADAS), infotainment, and EV battery management.

Also Read: Syphilis Immunoassay Diagnostics Market

Latest Breakthroughs from Leading Players

Though Precedence’s public press‑release does not list company names, major players in this space typically include NVE Corporation, Everspin Technologies, IBM, Intel, Spin Memory, Crocus Technology, and others—pioneering in MRAM deployment, TMR sensors, and spin logic devices.

Challenges & Cost Pressures

-

Extremely tight tolerances in nanofabrication and materials synthesis elevate production costs.

-

Integration with conventional CMOS logic remains technically complex.

-

Talent shortages—especially in advanced spin materials and fab skills—hinder rapid scale‑up.

-

Supply‑chain volatility for rare magnetic materials and clean‑room equipment adds pricing pressure.

Case Study Highlight

An automotive OEM partnered with a leading spintronics firm to integrate embedded STT‑MRAM within ADAS system controllers. The outcome: low‑power real‑time caching, superior reliability under thermal stress, and faster system startup compared to flash‑based memory.

Ready for In‑Depth Insights?

Dive deeper with the full spintronics market report, including:

-

Detailed segmentation forecasts

-

Company benchmarking and M&A updates

-

Strategic implications for OEMs, semiconductor suppliers, and fab operators

➡️ Download Sample / Schedule a Meeting https://www.precedenceresearch.com/sample/6460

About Precedence Research

Precedence Research provides strategic market intelligence and forecast models to support evidence‑based decisions across emerging technology sectors.

Contact Us

Precedence Research Pvt. Ltd.

Email: sales@precedenceresearch.com