Special Mission Aircraft Market Key Insights

-

North America led the special mission aircraft market in 2024, holding the largest share.

-

Asia Pacific is projected to register the fastest CAGR during the forecast period.

-

By platform, the military aviation segment accounted for a significant market share in 2024.

-

The unmanned aerial vehicle segment, by platform, is expected to grow at a rapid pace in the coming years.

-

By application, the intelligence, surveillance, and reconnaissance segment dominated the market with the largest share in 2024.

-

The air/rocket launch segment, by application, is projected to grow at the fastest CAGR during the forecast period.

-

By component, the communication suite segment held the largest market share in 2024.

-

The sensors segment, by component, is anticipated to register the highest CAGR between 2025 and 2034.

-

By end-user, the defense segment contributed the largest share of the market in 2024.

-

The commercial & civil segment, by end-user, is forecasted to expand at the fastest CAGR during the projection period.

-

By point of sale, the OEM segment captured the highest market share in 2024.

-

The aftermarket segment, by point of sale, is projected to grow at the fastest CAGR in the coming years.

Special Mission Aircraft Market Overview

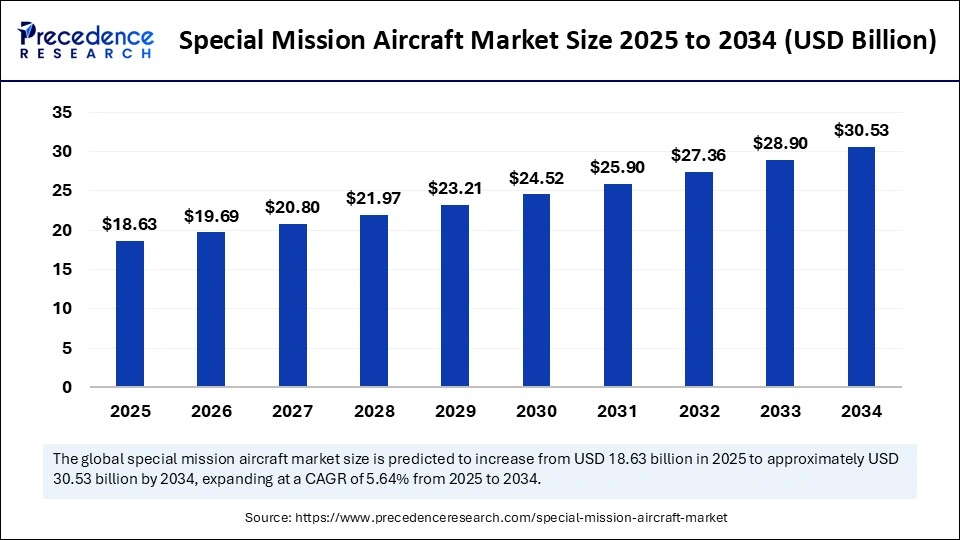

The special mission aircraft market is a highly specialized segment within the aerospace and defense industry, focused on aircraft configured for specific missions beyond conventional passenger or cargo transport. These missions include intelligence, surveillance, and reconnaissance (ISR), maritime patrol, airborne early warning and control (AEW&C), electronic warfare, search and rescue (SAR), medical evacuation (MEDEVAC), and border security. These aircraft are either designed from scratch or adapted from commercial or military platforms such as business jets, turboprops, or military transports. The global security environment has intensified demand for such capabilities, driven by rising geopolitical tensions, transnational threats, natural disaster response needs, and counter-terrorism operations. Governments, military forces, and defense agencies around the world are increasingly investing in multi-role and technologically advanced aircraft to fulfill their expanding mission profiles. The market is poised for substantial growth over the next decade as both developed and developing nations enhance their aerial capabilities with modular and multi-functional mission aircraft.

Special Mission Aircraft Market Growth Factors

Several significant factors are propelling the growth of the special mission aircraft market. The escalation of regional conflicts and asymmetric warfare has spurred demand for advanced ISR and electronic warfare capabilities. With nations prioritizing national defense and border surveillance, there is growing investment in aircraft equipped for maritime patrol, electronic intelligence, and coastal surveillance. Another critical factor is the global increase in disaster response and humanitarian missions, which require rapid deployment of search and rescue or MEDEVAC aircraft in regions hit by natural calamities or health crises. Additionally, technological advancements such as modular mission systems and open-architecture avionics are enabling the development of aircraft that can switch roles rapidly, enhancing operational flexibility and mission efficiency.

The growth of dual-use aircraft platforms is another contributor—platforms that can perform both civilian and military roles, such as medical transport during peacetime and battlefield evacuation in conflict zones. Furthermore, the rise in defense budgets across Asia Pacific, the Middle East, and Eastern Europe, along with increased NATO spending, has unlocked new procurement projects for special mission aircraft.

Impact of AI on the Special Mission Aircraft Market

Artificial Intelligence (AI) is having a transformative impact on the special mission aircraft market, enabling smarter, faster, and more autonomous mission execution. AI-powered analytics are revolutionizing ISR operations by processing vast volumes of surveillance data in real-time, allowing operators to detect, classify, and track threats with greater speed and precision. AI also plays a crucial role in predictive maintenance, reducing downtime and increasing aircraft readiness by analyzing sensor data to forecast mechanical issues before they occur.

In electronic warfare and signal intelligence (SIGINT) roles, AI is enhancing signal processing and jamming capabilities, improving responsiveness against enemy communication and radar systems. AI is also at the core of autonomous decision support systems, which assist pilots and mission commanders by recommending optimal routes, threat avoidance strategies, or target prioritization. The integration of AI with onboard sensors, radar systems, and communications suites is creating semi-autonomous aircraft capable of operating in GPS-denied or contested environments. Furthermore, AI is aiding in mission simulation and pilot training, enhancing situational awareness and preparedness for complex operations. As the defense industry continues to embrace digital transformation, AI will become indispensable to the functionality and efficiency of next-generation special mission aircraft.

Market Drivers

The special mission aircraft market is being driven by several strong forces. Firstly, rising global security concerns and border threats are prompting governments to invest in enhanced surveillance and reconnaissance capabilities. Maritime nations are particularly focused on acquiring aircraft for anti-submarine warfare (ASW), illegal fishing deterrence, and maritime domain awareness. Secondly, the modernization of air forces and the replacement of aging fleets are key drivers, as many countries are upgrading to more capable and multi-role platforms. Additionally, the proliferation of unmanned aerial systems (UAS) is complementing manned special mission aircraft, offering coordinated operations that increase mission reach and effectiveness.

The integration of network-centric warfare capabilities, where real-time data sharing between platforms is critical, is another major driver. Governments are increasingly prioritizing aircraft that can operate in joint-force environments with seamless data interoperability. Furthermore, the commercialization of surveillance services, such as border monitoring and environmental patrol by private contractors or defense companies, is expanding the market beyond traditional military procurement.

Opportunities

The market presents numerous growth opportunities, especially in regions with emerging defense capabilities. One such opportunity lies in the modularization and customization of platforms. Aircraft that can be rapidly configured for different missions—whether ISR, MEDEVAC, or electronic warfare—offer immense value to nations with limited budgets. The increasing use of commercial aircraft platforms for military conversions, such as business jets or regional turboprops being adapted for ISR or AEW&C, is also opening cost-effective solutions for smaller air forces.

There is also considerable potential in space-air-ground integrated surveillance networks, where special mission aircraft act as the central node between satellite data and ground operations. Moreover, cross-border security collaborations and joint operations, particularly in regions like the European Union, ASEAN, and the Middle East, are spurring demand for interoperable special mission platforms. The development of electric-powered or hybrid special mission drones and aircraft offers another frontier for innovation, providing lower-cost, low-signature alternatives for tactical operations. Additionally, increased demand for medical evacuation and disaster relief aircraft—as climate-related emergencies rise—creates a growing humanitarian and civilian market segment.

Challenges

Despite the growth momentum, the special mission aircraft market faces several challenges. A primary concern is the high cost of procurement, integration, and maintenance. These aircraft require extensive customization and advanced sensor payloads, which elevate acquisition costs significantly, particularly for ISR and AEW&C variants. For many emerging nations, limited defense budgets restrict the scope of deployment. Moreover, technical integration of multiple subsystems—such as radar, communication, and SIGINT suites—onto a single airframe poses significant engineering complexity and operational risk.

Another persistent challenge is interoperability with legacy systems and allied forces, which is vital in coalition operations. Cybersecurity is also a growing concern, as special mission aircraft become more connected and reliant on digital systems. Geopolitical export restrictions and ITAR regulations can hinder international sales, especially of U.S.-origin technology. Furthermore, supply chain vulnerabilities, especially for microelectronics, semiconductors, and mission-critical avionics, can delay production and fleet readiness. These challenges necessitate strong vendor support, resilient logistics, and long-term maintenance frameworks.

Regional Outlook

Geographically, North America dominates the special mission aircraft market, largely due to the United States’ extensive investment in ISR, AEW&C, and EW capabilities. The U.S. Air Force and Navy operate some of the world’s most advanced special mission aircraft, such as the E-3 Sentry, P-8 Poseidon, and RC-135 Rivet Joint. The region also benefits from a strong industrial base, with companies like Boeing, Northrop Grumman, and L3Harris leading in technology development and export.

Europe follows closely, driven by NATO modernization efforts and regional defense initiatives. Countries such as the UK, France, and Germany are upgrading their ISR and maritime patrol fleets, while EU-wide defense collaboration is fostering interoperability. The Asia-Pacific region is poised for the fastest growth, fueled by escalating tensions in the South China Sea, Indo-Pacific militarization, and modernization programs in countries like India, China, Japan, South Korea, and Australia.

The Middle East and Africa are increasingly investing in surveillance and border protection platforms due to geopolitical instability and counter-terrorism efforts. The UAE, Saudi Arabia, and Israel are prominent adopters of ISR and electronic warfare aircraft. Latin America is emerging gradually, with demand centered on drug interdiction, environmental surveillance, and disaster relief missions. Overall, global demand is being reshaped by evolving threats, strategic realignments, and increased emphasis on intelligence and readiness, making the special mission aircraft market a vital pillar of 21st-century defense.

Special Mission Aircraft Market Companies

- The Boeing Company (US)

- Lockheed Martin (US)

- Dassault Aviation SA (France)

- Textron Aviation (US)

- Northrop Grumman Corporation (US)

Segments Covered in the Report

By Platform

- Military Aviation

- Commercial Aviation

- Unmanned Aerial Vehicle

By Application

- Intelligence, Surveillance, & Reconnaissance

- Command and Control

- Combat Support

- Emergency Services

- Transportation

- Air/Rocket Launch

- Scientific Research and Geological Surveys

- Other Applications

By Component

- Sensors

- Communication Suite

- Protection Suite

- Others

By End-User

- Defense

- Commercial & Civil

- Space

By Point of Sale

- OEM

- Aftermarket

By Region

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- Latin America

Read Also: Airflow and Zone Control Equipment Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6127

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344