Selective Laser Sintering Market Key Points

-

North America held the dominant position in the market with over 39% share in 2024.

-

Asia Pacific is forecasted to grow at a strong double-digit CAGR of 25% during the forecast period.

-

By process parameter, the laser power segment captured a significant market share in 2024.

-

The build bed temperature segment is expected to witness substantial growth between 2025 and 2034.

-

By material type, the polymers segment accounted for a notable share of the market in 2024.

-

The biomaterials segment is projected to register a significant CAGR throughout the forecast period.

-

By application, the prototyping segment led the global market in 2024.

-

The tooling segment is expected to expand rapidly in the coming years.

-

By industry, the automotive segment emerged as the dominant sector in 2024.

-

The aerospace segment is anticipated to grow at the fastest CAGR of 23.4% during the forecast period.

Selective Laser Sintering Market Overview

The Selective Laser Sintering (SLS) market is experiencing dynamic growth, driven by its pivotal role in the rapidly expanding additive manufacturing (AM) sector. SLS is an advanced 3D printing technology that uses a high-powered laser to fuse powdered materials—typically polymers like nylon—layer by layer into solid, durable structures. Its ability to create complex geometries without the need for support structures gives it a significant advantage over traditional manufacturing methods and other 3D printing technologies.

SLS is gaining traction across industries such as aerospace, automotive, healthcare, consumer electronics, and defense due to its high resolution, strength of final parts, and material versatility. As companies increasingly embrace digital manufacturing for prototyping and small-batch production, SLS has transitioned from a niche technology to a mainstream manufacturing solution. With increasing R&D investment, material innovations, and falling equipment costs, SLS is positioned for long-term adoption across industrial and commercial segments.

The market is also being shaped by broader technological trends, including the push for lightweight components, mass customization, and decentralized production. As a result, SLS is not only disrupting traditional manufacturing workflows but also enabling entirely new business models and design approaches.

Selective Laser Sintering Market Growth Factors

The growth of the SLS market is fueled by several converging factors. One of the most significant is the rising demand for rapid prototyping and agile product development. SLS offers unmatched speed and design flexibility, allowing engineers to iterate designs quickly without expensive tooling or molds. This capability is particularly valuable in high-innovation sectors like aerospace, automotive, and medical devices, where time-to-market and performance optimization are critical.

Another major growth factor is the increasing need for lightweight, high-performance parts, especially in transportation sectors seeking to improve fuel efficiency and sustainability. SLS-printed components are often lighter than metal equivalents and can be precisely engineered for strength-to-weight optimization, making them attractive for aircraft interiors, electric vehicle components, and satellite parts.

Material advancements are also playing a pivotal role. While early SLS systems primarily used polyamide (nylon), new developments now include reinforced composites, flame-retardant materials, biocompatible powders, and even metal-infused polymers. This broadens the scope of applications and allows SLS to meet the demands of regulated industries like healthcare and aviation.

The shift toward decentralized and on-demand manufacturing is further propelling the market. SLS systems are ideal for distributed production environments, where parts can be printed locally and customized for end users, reducing lead times, inventory costs, and carbon footprints.

Impact of AI on the Selective Laser Sintering Market

Artificial Intelligence (AI) is becoming an increasingly influential force in the SLS market, driving optimization, automation, and quality assurance throughout the additive manufacturing lifecycle. AI algorithms are being used to improve design efficiency by automating part optimization, topology optimization, and generative design—resulting in structures that are lighter, stronger, and better suited to the SLS process.

In the printing phase, AI enables real-time monitoring and control of SLS machines. By analyzing data from sensors, cameras, and thermal imaging systems, AI can detect defects, predict failures, and dynamically adjust printing parameters to ensure consistent part quality. This significantly reduces material waste and enhances production reliability.

Predictive maintenance powered by AI is also enhancing machine uptime. By continuously monitoring machine behavior and usage data, AI models can forecast wear-and-tear or component failures, allowing for preemptive servicing that minimizes downtime.

Moreover, AI facilitates workflow automation and supply chain integration by managing scheduling, material usage, and inventory in smart manufacturing environments. In conjunction with cloud-based platforms, AI helps scale SLS production across multiple facilities, aligning output with demand forecasts and logistical constraints.

Ultimately, AI is making SLS systems smarter, more autonomous, and better suited to industrial-scale production—accelerating the transition from prototyping to full-scale digital manufacturing.

Selective Laser Sintering Market Scope

| Report Coverage | Details |

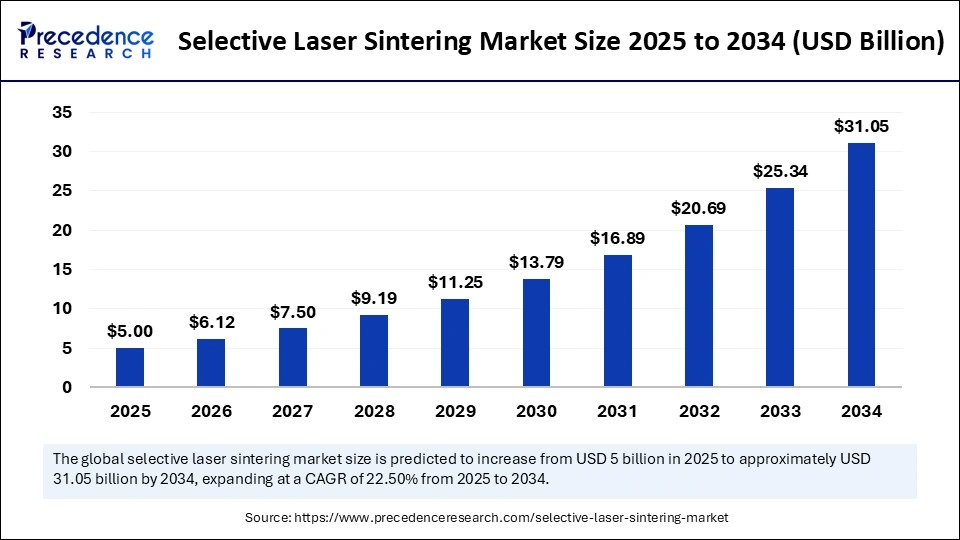

| Market Size by 2034 | USD 31.05 Billion |

| Market Size in 2025 | USD 5 Billion |

| Market Size in 2024 | USD 4.08 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 22.50% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Process Parameter, Material Type, Application, Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

Several powerful market drivers are accelerating the adoption of SLS technology. First among them is the demand for customized and low-volume production, particularly in sectors like healthcare (e.g., orthotics, prosthetics, dental aligners) and consumer goods (e.g., eyewear, fashion accessories). SLS enables economically viable customization without retooling, offering a distinct advantage over traditional manufacturing.

Cost efficiency over long-term use is another key driver. While the initial investment in SLS equipment may be high, the ability to consolidate parts, reduce waste, and eliminate tooling costs often results in lower total cost of ownership for many applications.

The push for digital transformation in manufacturing is also driving interest in SLS. As factories embrace Industry 4.0 principles, SLS integrates well with digital workflows, ERP systems, and cloud platforms, offering seamless control over design-to-production pipelines.

Sustainability goals are further encouraging SLS adoption. The technology supports environmentally friendly production by minimizing scrap, enabling lighter product designs, and allowing for recycling of unused powder material.

Additionally, greater accessibility and education are expanding the user base. As universities and technical institutions incorporate additive manufacturing into their curricula, a new generation of engineers and designers is emerging with hands-on SLS experience, creating long-term demand across industries.

Opportunities

The SLS market is ripe with growth opportunities across various dimensions. One major opportunity lies in the healthcare sector, particularly for patient-specific implants, surgical guides, and dental applications. The biocompatibility and design freedom offered by SLS allow for precise, patient-specific medical devices at scale.

Another major opportunity is the expansion into small- and medium-sized enterprises (SMEs), which are increasingly adopting compact, affordable SLS systems for in-house prototyping and short-run production. The democratization of SLS through desktop-scale models is breaking down entry barriers for small businesses and start-ups.

The development of new materials also represents a significant opportunity. Innovations in bio-based powders, high-temperature polymers, and conductive materials will open new applications in sectors like electronics, defense, and bioengineering.

Moreover, integration with digital supply chains and cloud platforms can position SLS as a core pillar of on-demand manufacturing services. This would allow global companies to produce parts closer to the point of use, reducing logistics costs and enhancing responsiveness.

There is also opportunity in software innovation, particularly for user-friendly design tools, simulation software, and AI-integrated print management systems that lower the skill threshold and streamline the SLS workflow.

Challenges

Despite its many advantages, the SLS market faces several challenges. Chief among them is the high capital cost of industrial-grade SLS systems, which can be prohibitive for smaller companies or those in price-sensitive sectors. Even as prices decline, cost remains a major hurdle for widespread adoption.

Material limitations and costs are another concern. While the range of usable powders is expanding, SLS-compatible materials remain more expensive than their injection molding counterparts. Additionally, the need for post-processing (e.g., cooling, de-powdering, finishing) adds time and labor costs.

Regulatory and certification hurdles can slow market penetration in sectors like aerospace and healthcare, where extensive validation is required for 3D-printed parts. SLS providers must invest in qualification processes and traceability systems to meet these stringent requirements.

Skill gaps also represent a barrier. Operating SLS equipment, optimizing designs, and maintaining quality standards require specialized knowledge, which may not be readily available in all manufacturing environments.

Lastly, powder management and recycling present logistical and environmental challenges. Maintaining powder consistency and quality over multiple reuse cycles is critical but technically demanding, and the handling of fine particulates raises safety and operational concerns.

Selective Laser Sintering Market Regional Outlook

North America is currently a global leader in the SLS market, driven by a strong innovation ecosystem, high adoption in aerospace and medical sectors, and robust government and private R&D funding. The U.S., in particular, is home to major additive manufacturing companies and has a mature infrastructure for industrial 3D printing.

Europe follows closely, with Germany, the UK, and France at the forefront. The region benefits from strong engineering talent, proactive sustainability policies, and a well-established base of automotive, aerospace, and industrial manufacturers investing in SLS technology.

Asia-Pacific is the fastest-growing region, fueled by rapid industrialization, smart manufacturing initiatives, and increasing investment in digital technologies. China, Japan, and South Korea are emerging as major hubs for additive manufacturing, with growing adoption in electronics, healthcare, and consumer products.

Latin America and the Middle East & Africa are nascent markets but show growing interest as infrastructure develops and awareness increases. Governments in these regions are beginning to recognize the potential of additive manufacturing for economic diversification and local production.

Selective Laser Sintering Market Companies

- GE Additive

- EOS

- HP

- Shining 3D

- Renishaw

- Materialise

- Trumpf

- Sciaky

- SLM Solutions

- Farsoon Technologies

- ExOne

- Arcam

- 3D Systems

- Voxeljet

- Prodways

Segments Covered in the Report

By Process Parameter

- Beam Profile

- Build Bed Temperature

- Hatch Spacing

- Laser Power

- Laser Scan Speed

- Layer Thickness

- Powder Flow Rate

- Scanner Type

By Material Type

- Biomaterials

- Ceramics

- Composites

- Metals

- Polymers

By Application

- Prototyping

- Tooling

- Rapid Manufacturing

By Industry

- Aerospace

- Defense

- Automotive

- Consumer Electronics

- Education & Research

- Medical

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Also Read: Communication Platform as a Service Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6099

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344