Security and Vulnerability Management Market Key Highlights

-

North America held the largest share of the global market at 38% in 2024.

-

Asia Pacific is anticipated to grow at the highest CAGR from 2025 to 2034.

-

By component, the software segment dominated the market with a 65% share in 2024.

-

The services segment is projected to grow at the highest CAGR during the forecast period.

-

In terms of type, the infrastructure protection segment captured the largest market share in 2024.

-

The cloud security segment is expanding at a significant CAGR from 2025 to 2034.

-

By target, the content management vulnerabilities segment led the market in 2024.

-

The API vulnerabilities segment is expected to grow significantly over the projected period.

-

Based on deployment, the cloud segment accounted for 55% of the market share in 2024.

-

The on-premises segment is forecasted to grow at the fastest CAGR through 2034.

-

By enterprise size, large enterprises dominated the market with a 72% share in 2024.

-

The SMEs segment is expected to witness notable growth from 2025 to 2034.

-

Among verticals, the defense/government segment held the leading market share in 2024.

-

The BFSI segment is projected to register the highest CAGR between 2025 and 2034.

Security and Vulnerability Management Overview

The Security and Vulnerability Management (SVM) market is rapidly becoming a cornerstone of modern cybersecurity frameworks as organizations grapple with the rising complexity and frequency of cyber threats. SVM refers to the processes, tools, and policies used to identify, classify, prioritize, and remediate security vulnerabilities across an organization’s IT infrastructure. It plays a critical role in minimizing risk exposure, ensuring regulatory compliance, and strengthening enterprise cyber resilience.

As digital transformation accelerates across industries, attack surfaces have expanded dramatically, encompassing cloud environments, mobile devices, IoT, and remote work endpoints. This evolution has made traditional reactive security approaches obsolete, giving rise to the growing demand for proactive and continuous vulnerability management solutions. In this context, the SVM market is experiencing robust growth, with enterprises increasingly investing in automated vulnerability scanning, patch management, threat intelligence integration, and risk-based prioritization tools. These solutions not only protect against known threats but also position organizations to adapt to emerging risks in a more agile manner.

Security and Vulnerability Management Growth Factors

Several key growth factors are propelling the Security and Vulnerability Management market forward. First and foremost is the escalating frequency and sophistication of cyberattacks. With threats ranging from ransomware and zero-day vulnerabilities to state-sponsored campaigns, organizations are under increasing pressure to continuously monitor and secure their digital environments.

Second, stringent regulatory compliance requirements such as GDPR, HIPAA, PCI-DSS, and CCPA demand that organizations demonstrate ongoing risk assessments, vulnerability scanning, and timely remediation actions. This has made SVM an essential element of governance and compliance frameworks across industries.

Third, the expansion of cloud computing, remote workforces, and hybrid IT architectures has created a more dynamic and complex threat landscape. These trends necessitate scalable, real-time vulnerability management tools that provide visibility across dispersed and heterogeneous environments.

Moreover, the growing awareness among executives and boards about cyber risk as a business risk is leading to increased cybersecurity budgets and strategic focus on proactive threat and vulnerability management. The convergence of SVM with broader cybersecurity frameworks such as Extended Detection and Response (XDR), Zero Trust, and Continuous Threat Exposure Management (CTEM) is also enhancing its relevance in enterprise security strategies.

Impact of AI on the SVM Security and Vulnerability Management

Artificial Intelligence (AI) is revolutionizing the Security and Vulnerability Management market by enabling faster, smarter, and more predictive defense mechanisms. One of the primary advantages of AI in this context is its ability to automate vulnerability discovery and risk assessment across large-scale, complex networks. AI algorithms can analyze massive volumes of network traffic, system logs, and configuration data to detect anomalies, misconfigurations, and vulnerabilities in real time.

AI-driven tools also facilitate risk-based vulnerability prioritization, helping security teams focus on the most critical threats based on exploitability, business impact, and threat intelligence feeds. This reduces alert fatigue and improves remediation efficiency by addressing high-impact vulnerabilities first.

Furthermore, AI enhances predictive threat modeling, allowing organizations to anticipate potential attack paths based on evolving threat actor behaviors and infrastructure weaknesses. Machine learning models can also adapt to new threats by continuously learning from global and local threat data, thereby improving detection accuracy and responsiveness.

AI is also critical in automated patch management, where it assists in identifying necessary updates, assessing patch compatibility risks, and scheduling deployments with minimal disruption to business operations. In essence, AI not only accelerates and strengthens vulnerability management processes but also reduces the manual burden on overworked security teams.

Market Drivers

Key drivers contributing to the growth of the Security and Vulnerability Management market include:

Rising cyberattack complexity and velocity, which require continuous and adaptive vulnerability monitoring solutions.

Increased adoption of cloud, mobile, and edge technologies, leading to greater attack surfaces and demand for scalable, cross-environment SVM solutions.

Evolving data privacy laws and industry-specific regulations, mandating regular vulnerability assessments and compliance documentation.

Growing business dependency on digital infrastructure, where any security lapse can result in significant financial and reputational losses.

Integration of SVM with IT asset management and threat intelligence platforms, providing a more holistic view of organizational risk posture.

Opportunities

The SVM market presents multiple opportunities for innovation and expansion. A major opportunity lies in the adoption of cloud-native vulnerability management platforms, designed specifically for multi-cloud and containerized environments. These platforms offer deep visibility into ephemeral and dynamic assets, making them ideal for DevOps-driven organizations.

Another opportunity exists in the SME segment, where demand is rising for affordable, easy-to-deploy SVM solutions that do not require extensive technical expertise. Vendors offering managed SVM services or SaaS-based models can gain significant traction in this market.

Emerging technologies, such as attack surface management (ASM), security posture automation, and AI-powered vulnerability intelligence, also offer scope for value-added offerings and competitive differentiation.

Furthermore, the increased interconnection of IT and operational technology (OT) networks in sectors like manufacturing, energy, and transportation creates demand for SVM solutions tailored to ICS/SCADA environments, where traditional IT security tools may fall short.

Challenges

Despite strong market momentum, the SVM industry faces several challenges. A prominent one is the high volume of vulnerabilities reported daily, making it difficult for security teams to keep up with detection, prioritization, and remediation in a timely manner. Without automated tools, this task can overwhelm even well-resourced security operations centers.

Integration complexities with existing security stacks, asset inventories, and patch management systems also pose barriers to seamless SVM adoption. Enterprises with legacy infrastructure may find it challenging to deploy or fully utilize modern SVM tools.

Shortage of skilled cybersecurity professionals is another significant hurdle. Even with advanced tools, organizations need qualified personnel to interpret findings, make strategic decisions, and manage remediation workflows.

False positives and lack of context in many traditional vulnerability scanners can erode trust in the tools and lead to inefficiencies. Hence, tools must evolve to provide richer, risk-based insights rather than simple vulnerability lists.

Market Scope

| Report Coverage | Details |

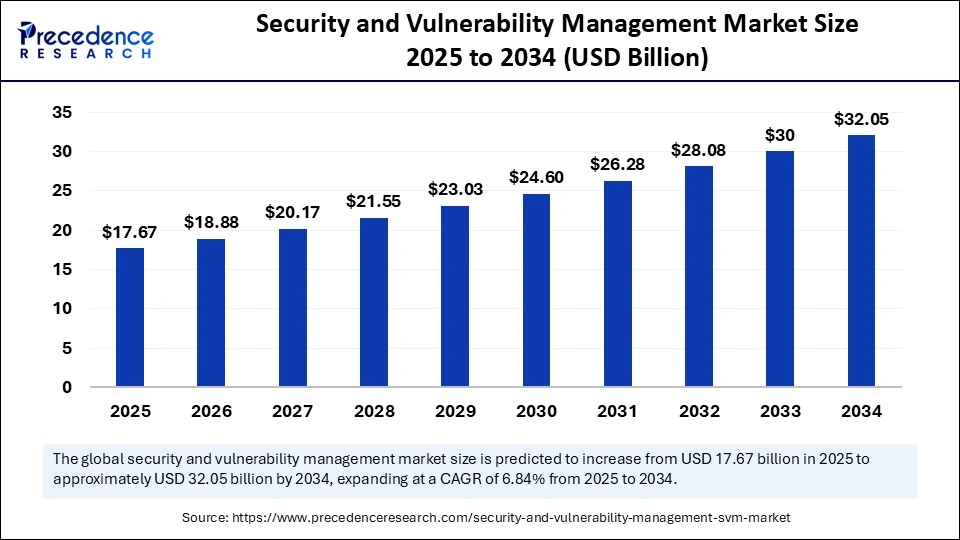

| Market Size by 2034 | USD 32.05 Billion |

| Market Size in 2025 | USD 17.67 Billion |

| Market Size in 2024 | USD 16.54 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.84% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Type, Target, Deployment, Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Outlook

North America remains the leading market for Security and Vulnerability Management, driven by its mature cybersecurity infrastructure, strong presence of key solution providers, and rigorous data protection regulations. U.S.-based enterprises, particularly in finance, healthcare, and technology, are among the earliest adopters of automated vulnerability management systems.

Europe follows closely, with countries such as Germany, the UK, and France showing robust demand, fueled by GDPR compliance, increased enterprise awareness, and public sector investments in cybersecurity.

Asia Pacific is anticipated to be the fastest-growing regional market over the forecast period. Rapid digitization, cloud adoption, and a growing incidence of cyberattacks in economies like India, China, Japan, and Australia are pushing both private and public sectors to enhance their vulnerability management capabilities.

Latin America, the Middle East, and Africa are emerging markets, gradually improving their cybersecurity postures through government initiatives, smart city projects, and enterprise IT modernization. However, budget constraints and a lack of local expertise may limit rapid adoption.

Security and Vulnerability Management Market Companies

- AT&T Intellectual Property.

- Cisco Systems, Inc.

- CrowdStrike

- Fortra, LLC

- IMB Corporation

- Microsoft

- Qualys, Inc.

- Rapid7

- RSI Security.

- Tenable, Inc.

Segments Covered in the Report

By Component

- Services

- Software

By Type

- Application Security

- Cloud Security

- Data Security

- Endpoint Security

- Infrastructure Protection

- Network Security

- Others

By Target

- API Vulnerabilities

- Content Management Vulnerabilities

- IoT Vulnerabilities

- Others

By Deployment

- Cloud

- On-premises

- By Enterprise Size

- Large Enterprises

- SMEs

By Vertical

- BFSI

- Defense/Government

- Energy

- Healthcare

- IT and Telecom

- Manufacturing

- Retail

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Read Also: Continuous Threat Exposure Management Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6260

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344