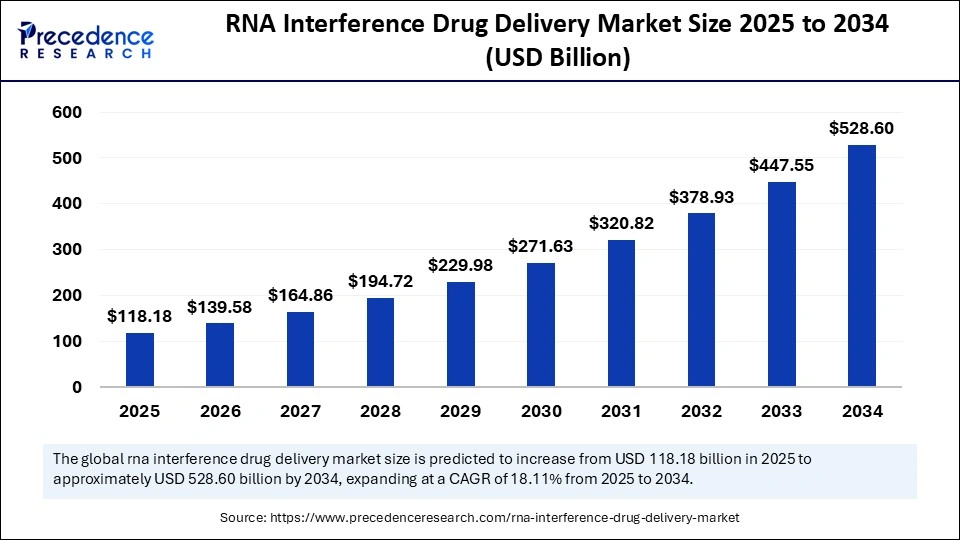

The global RNA interference (RNAi) drug delivery market, valued at USD 118.18 billion in 2025, is on a remarkable growth trajectory expected to reach approximately USD 528.60 billion by 2034, expanding at a compound annual growth rate (CAGR) of 18.11%.

This robust growth is driven by revolutionary advances in gene silencing technologies and delivery systems, enabling targeted treatments for genetic disorders, cancers, and viral infections. North America currently leads the market, while Asia Pacific emerges as the fastest-growing region, signaling a dynamic future for RNAi therapeutics.

RNA Interference Drug Delivery Market Key Points

-

The global market size is projected to soar from USD 139.58 billion in 2026 to USD 528.60 billion by 2034.

-

North America commands the largest regional share at 45%, with Asia Pacific poised to grow fastest at a 30% CAGR.

-

siRNA technology dominates with a 65% market share, underscoring its precision and clinical success.

-

Lipid nanoparticles (LNPs) hold 60% of the delivery system market, recognized as the gold standard for RNA delivery.

-

Intravenous administration leads with 55% share, preferred for reliable systemic delivery especially in oncology.

-

Cancer remains the largest target disease, representing nearly 40% of the market, followed by rapidly growing genetic disorders segments.

What Drives the RNA Interference Drug Delivery Market’s Exceptional Growth?

RNAi’s ability to silence previously untargetable genes presents a paradigm shift in treating complex diseases where traditional small molecules or antibodies fall short. This precision silencing heralds durable biological effects with potential disease modification, fueling investment and regulatory focus.

Innovations such as chemical conjugation with engineered nanoparticles, ligand targeting, and biodegradable backbones enable tissue-specific delivery and reduce systemic exposure, enhancing safety and efficacy.

How is AI Revolutionizing RNAi Drug Delivery?

AI plays a pivotal role in accelerating candidate selection and optimizing delivery mechanisms. Advanced algorithms analyze single-cell biodistribution data and immunogenicity profiles, refining therapeutic safety and efficacy predictions.

AI-driven drug design enhances oligonucleotide modifications for reduced immune activation and improved nuclease resistance, enabling lower dosages and less frequent administration. Moreover, AI streamlines manufacturing with microfluidic assembly innovations, reducing costs and variability to make RNAi therapies more accessible.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6979

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 118.18 Billion |

| Market Size in 2026 | USD 139.58 Billion |

| Market Size by 2034 | USD 528.60 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.11% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Delivery System, Route of Administration, Target Disease, Target Tissue, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

What Are the Key Opportunities and Emerging Trends in this Market?

Will expanding RNAi delivery beyond the liver unlock new therapeutic frontiers?

Enhanced delivery to CNS, lung, muscle, and tumor environments is a critical growth avenue, promising breakthroughs in neurology, respiratory diseases, and oncology.

Can subcutaneous delivery reshape patient experience?

It offers convenient, self-administration possibilities for chronic therapies, improving adherence and quality of life.

Is Asia Pacific’s biotech boom sustainable?

With government investment and maturing regulatory frameworks, the region is rapidly evolving from a manufacturing hub to an innovation center focused on affordable, localized RNAi solutions.

Segment Insights

Technology Segmentation: siRNA’s Market Leadership and shRNA’s Rapid Ascension

The RNA interference drug delivery market exhibits clear technological preferences, with siRNA commanding a dominant 65% market share due to its precision in post-transcriptional gene silencing and established therapeutic reliability. This dominance stems from siRNA’s ease of design, robust manufacturing pipelines, and successful regulatory approvals that have accelerated adoption across pharmaceutical portfolios. The technology’s potent gene knockdown efficiency with minimal off-target effects has made it the cornerstone of targeted therapeutics, particularly in oncology and rare disease applications where precision matters most.

Meanwhile, the shRNA segment is experiencing remarkable growth at a 23.60% CAGR, driven by its unique capability for sustainable gene silencing through stable genomic integration. This durability makes shRNA particularly attractive for chronic and hereditary diseases requiring long-term therapeutic intervention. Biotech innovators are increasingly exploring vector-based shRNA systems that offer prolonged efficacy with controlled expression levels, while advancements in non-viral shRNA vectors are addressing previous safety concerns and enhancing their therapeutic appeal.

Delivery System Dynamics: Lipid Nanoparticles Leading, Polymeric Systems Rising

Lipid nanoparticles (LNPs) maintain market leadership with a commanding 60% share, having achieved gold-standard status in nucleic acid therapeutics through their proven success in both mRNA and siRNA delivery. LNPs excel at encapsulating and protecting fragile RNA molecules while ensuring efficient cellular uptake and endosomal escape. Their flexibility in lipid composition enables precise tuning of biodistribution and tissue specificity, while their manufacturing scalability supports commercial viability across the growing RNA therapeutics landscape.

The polymeric nanoparticles segment is emerging as a strong competitor, growing at an impressive 20.70% CAGR due to their unparalleled versatility and tunable properties. These systems leverage superior surface chemistry customization and biodegradability to offer enhanced therapeutic windows through prolonged circulation times and controlled release kinetics. Innovations in stimuli-responsive polymers are enabling site-specific RNA release, while their superior stability compared to traditional lipid systems positions them as a crucial platform for next-generation RNA therapeutics.

Route of Administration: Intravenous Dominance with Subcutaneous Innovation

Intravenous administration maintains its preferred status with a 55% market share, reflecting its reliability and effectiveness in delivering RNA interference drugs. This route ensures rapid systemic distribution and controlled dosing, particularly crucial for acute and complex conditions in oncology and metabolic disorders. The direct bloodstream delivery maximizes bioavailability and therapeutic impact, while IV-compatible formulations integrate seamlessly into existing clinical infrastructure, earning pharmaceutical manufacturers’ trust through predictable pharmacokinetics and regulatory familiarity.

Subcutaneous delivery is gaining momentum as a patient-centric alternative, growing at approximately 17.80% CAGR as it addresses the increasing demand for convenient, self-administered therapies. This route enhances patient adherence and comfort, particularly valuable for chronic conditions requiring long-term treatment. Formulation advances have improved RNA molecule stability under physiological conditions, while integration of sustained-release technologies extends dosing intervals, embodying healthcare’s shift toward personalized and home-based treatment paradigms.

Target Disease Focus: Cancer Leadership and Genetic Disorders’ Rapid Growth

Cancer applications dominate the market with nearly 40% share, driven by RNAi technology’s precision in silencing oncogenes and modulating tumor microenvironments. This segment’s strength reflects pharmaceutical giants’ substantial R&D investments in siRNA-based oncology pipelines, where RNAi therapies offer novel mechanisms against previously undruggable cancer targets. The technology’s compatibility with immunotherapy and targeted delivery systems enhances clinical synergy, positioning RNA interference as both a powerful tool and gateway to next-generation precision oncology.

Genetic disorders represent the fastest-growing therapeutic frontier, expanding at a robust 23.40% CAGR fueled by genomic sequencing advancements and personalized medicine development. RNA interference offers unparalleled precision in silencing mutated genes at their transcriptional source, opening treatment possibilities for rare inherited conditions once deemed untreatable. Collaborations between genetic testing companies and biotech startups are catalyzing translational breakthroughs, epitomizing the convergence of diagnostics, therapeutics, and innovation in hereditary disease treatment.

Target Tissue Specialization: Liver Dominance and CNS Breakthrough

The liver segment commands 50% market share as the preferred target tissue, leveraging the organ’s natural propensity for nanoparticle uptake via the reticuloendothelial system. This dominance is reinforced by numerous FDA-approved RNAi drugs targeting hepatic disorders, established safety data that reduces developmental hurdles, and the liver’s robust vascularization ensuring efficient biodistribution. As metabolic and genetic liver diseases proliferate, hepatic targeting remains a cornerstone of the field’s therapeutic foundation.

Brain targeting is witnessing rapid exploration with a 17.60% CAGR, as innovative delivery technologies successfully transcend the blood-brain barrier. Novel carriers including exosomes, peptide shuttles, and polymeric nanogels are redefining CNS-targeted delivery possibilities, opening immense therapeutic promise for neurodegenerative diseases like Alzheimer’s and Parkinson’s. Collaborative efforts between neuroscientists and nanotechnologists are achieving unprecedented precision in neuronal gene silencing with minimal immunogenicity, marking a paradigm shift toward previously implausible neurological RNA therapeutics.

End-User Landscape: Pharmaceutical Leadership and Academic Innovation

Pharmaceutical companies maintain market leadership with approximately 50% share, driving commercialization and regulatory advancements through their substantial resources and manufacturing expertise. Their deep capital reserves and established infrastructure enable global clinical trials, accelerating time-to-market while strategic alliances with biotech startups foster innovation pipelines and reduce early-stage discovery risks. This dominance underscores the industry’s evolution from experimental science to therapeutic mainstream, with pharma’s integrated development capacity ensuring seamless bench-to-bedside transitions.

Academic institutions continue expanding at an estimated 20% CAGR, serving as the intellectual crucible of RNAi innovation. Universities and research centers pioneer novel delivery systems, chemical modifications, and therapeutic strategies, supported by government grants and translational collaborations that bridge discovery and development gaps. Many RNAi-based startups trace their origins to university spin-offs, highlighting academia’s role as an innovation incubator where open knowledge exchange accelerates collective progress in this rapidly evolving therapeutic field.

Regional Insights

North American Leadership and Asia Pacific’s Rapid Ascension

North America commands the largest regional share at 45%, benefiting from its concentration of biotech innovators, deep capital markets, and advanced GMP infrastructure for oligonucleotide and LNP production. The region’s dense clinical trial ecosystem, experienced regulatory consultants, and access to specialist CDMOs capable of bridging discovery to scale create virtuous innovation cycles. Major pharmaceutical and venture investors actively pursue platform acquisitions, while translational grant funding de-risks early innovation, maintaining North America’s position as the fulcrum of both scientific progress and commercialization strategy.

Asia Pacific emerges as the fastest-growing region with an impressive 30% CAGR, driven by expanding biotech ecosystems, increasing domestic capital, and strategic investments in oligonucleotide and LNP manufacturing capacity. Government and private sector prioritization of life sciences clusters enables rapid GMP facility scale-up and clinical trial network expansion. Lower manufacturing costs and growing CDMO sophistication make the region attractive for global supply diversification and cost-sensitive market entry, while local innovators focus on niche indications and affordable delivery solutions tailored to regional disease burdens, positioning Asia Pacific to evolve from manufacturing hub to clinical innovation center.

Top RNA Interference Drug Delivery Market Companies

- Alnylam Pharmaceuticals: is the global leader in RNA interference (RNAi) therapeutics, with four FDA-approved siRNA drugs: ONPATTRO®, GIVLAARI®, OXLUMO®, and AMVUTTRA®. The company’s proprietary GalNAc conjugate delivery platform enables targeted gene silencing for rare genetic, cardiometabolic, and hepatic diseases, positioning it at the forefront of RNA drug innovation.

- Ionis Pharmaceuticals: Ionis pioneered antisense oligonucleotide (ASO) therapy and developed landmark drugs, including SPINRAZA (for spinal muscular atrophy) and TEGSEDI. With over three decades of RNA expertise, Ionis continues advancing next-generation ASOs for neurological, cardiovascular, and rare disorders through its Ligand Conjugate Antisense (LICA) platform.

- Moderna, Inc.: Best known for its COVID-19 mRNA vaccine (mRNA-1273), Moderna is expanding into oncology, rare diseases, and personalized cancer vaccines. Its mRNA platform combines computational design, AI-driven optimization, and lipid nanoparticle (LNP) delivery systems, redefining RNA-based therapeutics at scale.

- Arrowhead Pharmaceuticals: Arrowhead develops RNA interference therapies using its Targeted RNAi Molecule (TRiM) platform, with a focus on liver, cardiometabolic, and pulmonary diseases. Its precision delivery approach enables the development of long-acting RNAi drugs, with key partnerships established with Takeda, Janssen, and Amgen.

- Arcturus Therapeutics: Arcturus specializes in self-replicating mRNA and lipid nanoparticle delivery technologies via its LUNAR® platform. The company’s pipeline includes mRNA vaccines, rare disease therapies, and its ARCT-810 candidate for urea cycle disorders, positioning it as a key player in next-gen mRNA therapeutics.

Other Companies in the RNA Interference Drug Delivery Industry

- Dicerna Pharmaceuticals (Acquired by Novo Nordisk)

- Silence Therapeutics

- Ionis Pharmaceuticals

- CureVac AG

- GSK plc

- Sanofi

Challenges and Cost Pressures

Despite promising advances, challenges persist. Delivering oligonucleotides efficiently to extra-hepatic tissues remains difficult, limiting broader application. Safety concerns such as immunogenicity, off-target effects, and the need for repeated dosing complicate clinical use and reimbursement. Manufacturing complexity, supply chain constraints, and long regulatory approval timelines further pressure costs and speed to market.

Case Study: Overcoming Delivery Barriers in Oncology

A recent clinical development utilizes biodegradable lipid nanoparticles to deliver siRNA specifically to tumor microenvironments, enabling precise oncogene silencing with minimal systemic exposure. This approach demonstrated significant tumor suppression in preclinical models and is now advancing to Phase II trials, exemplifying how innovative delivery systems can enhance RNAi therapeutic impact.

Read Also: Oncolytic Virus-Based Gene Therapy Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344