RF Test Equipment Market Key Points

-

Asia-Pacific led the market in 2024, generating the largest revenue share of 38%.

-

North America is anticipated to register the fastest CAGR between 2025 and 2034.

-

By equipment type, oscilloscopes accounted for the largest revenue share of 28% in 2024.

-

The spectrum analyzers segment is projected to grow at a CAGR of 9.83% from 2025 to 2034.

-

In terms of frequency range, the 1GHz–6GHz segment held the highest share of 31% in 2024.

-

The more than 20GHz segment is expected to expand at a notable CAGR of 10.1% during the forecast period.

-

By form factor, benchtop equipment contributed the largest revenue share of 48% in 2024.

-

The modular segment is anticipated to grow at a strong CAGR of 10% between 2025 and 2034.

-

Based on end-use, the telecommunications segment led the market with a 32% share in 2024.

-

The aerospace and defense segment is expected to grow steadily at a CAGR of 10% throughout the forecast period.

Overview of RF Test Equipment

RF (Radio Frequency) test equipment is used to design, test, and maintain devices that operate on radio frequencies, typically ranging from 3 kHz to 300 GHz. These tools are essential for evaluating the performance of components like antennas, transmitters, receivers, and wireless communication systems. Common RF test instruments include spectrum analyzers, signal generators, network analyzers, and oscilloscopes. They play a crucial role in ensuring compliance with standards and maintaining signal integrity across a wide range of industries.

How Is AI Enhancing the RF Test Equipment Market?

AI is revolutionizing the RF test equipment market by automating data analysis, detecting anomalies, and enabling predictive maintenance. These intelligent systems can quickly identify signal inconsistencies, diagnose performance issues, and recommend calibrations, thereby reducing downtime and improving testing accuracy. AI also helps streamline complex testing processes, making procedures more efficient and reliable—especially critical in high-frequency applications like millimeter-wave and terahertz testing.

Additionally, AI is integral to the evolution of software-defined and modular RF testing platforms. Advanced machine learning models embedded in testing systems support real-time signal classification and adaptive testing strategies, which are vital for industries such as 5G communications, aerospace, and the Internet of Things (IoT). With cloud integration and remote monitoring, AI-driven RF test equipment offers scalable, flexible, and highly responsive solutions that reduce human error and meet rapidly changing technological standards.

RF Test Equipment Market Growth Factors

-

Expansion of 5G and Advanced Wireless Networks

The global rollout of 5G and early developments in 6G, along with the growing use of IoT and machine-to-machine communication, are driving demand for high-frequency RF test equipment. -

Surge in Consumer Electronics

The increasing adoption of smartphones, wearables, and smart home devices requires rigorous RF testing to meet wireless communication standards and ensure optimal performance. -

Automotive Radar and V2X Development

As vehicles incorporate advanced radar systems and vehicle-to-everything (V2X) technologies, there is a rising need for precise RF testing to support safety and connectivity. -

Growth in Aerospace, Defense & Healthcare Applications

Sectors like defense, aviation, and medical devices depend heavily on RF systems for communications and diagnostics, fueling the need for high-performance test solutions. -

Shift Toward Modular & Automated Solutions

Industry 4.0 is promoting the adoption of modular, software-defined, and automated RF testing systems that are scalable, flexible, and cost-effective for manufacturers. -

Global Expansion in Telecom Infrastructure

Investment in telecom infrastructure, particularly in emerging markets and Asia-Pacific, is increasing the deployment of RF equipment for network development and maintenance.

Market Scope

| Report Coverage | Details |

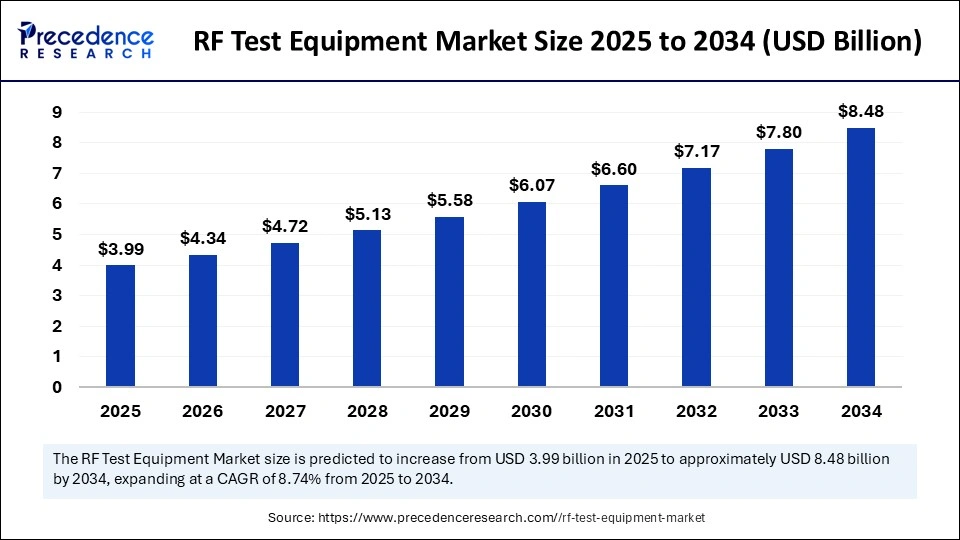

| Market Size by 2034 | USD 8.48 Billion |

| Market Size in 2025 | USD 3.99 Billion |

| Market Size in 2024 | USD 3.67 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.74% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Equipment Type, Frequency Range, Form Factor, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

The RF (Radio Frequency) Test Equipment market is gaining momentum due to the rapid growth of wireless technologies and the global proliferation of communication networks. One of the primary driving factors is the deployment and expansion of 5G infrastructure across the globe. RF test equipment plays a vital role in the design, development, and maintenance of 5G systems, ensuring network performance, signal integrity, and compliance with standards.

Additionally, the growing demand for consumer electronics, IoT devices, autonomous vehicles, and advanced aerospace and defense communication systems is further accelerating the need for precise and reliable RF testing solutions. Industries are increasingly relying on RF-enabled technologies for connectivity, prompting manufacturers to incorporate RF test solutions into their production lines for validation and quality assurance. Moreover, the evolution of Wi-Fi standards (such as Wi-Fi 6 and upcoming Wi-Fi 7) and increasing satellite communication applications are amplifying the demand for advanced RF testing tools.

Opportunities

The RF test equipment market presents significant growth opportunities with the emergence of next-generation technologies such as 6G, mmWave communications, and IoT expansion across industrial and smart city applications. With increasing investment in R&D for advanced wireless solutions, there is a need for more sophisticated and scalable test environments, opening avenues for innovation in modular and software-defined RF test systems.

The growing adoption of electronic warfare systems, radar technologies, and unmanned systems in defense sectors creates another high-value opportunity for RF testing vendors. Moreover, cloud-based testing platforms and remote testing capabilities are gaining traction, particularly for global companies managing multi-site development. Startups and smaller enterprises are also creating niche offerings in the RF test ecosystem, targeting cost-effective solutions for specific industries like medical devices, automotive electronics, and wearable technology. These trends are expected to create new markets and drive partnerships between equipment manufacturers, semiconductor firms, and research institutions.

Challenges

Despite the robust growth outlook, the RF test equipment market faces several notable challenges. The high cost of advanced RF test systems can be a major barrier for small and medium-sized enterprises (SMEs), particularly in emerging markets. The complexity of testing in higher frequency bands—such as millimeter wave (mmWave) used in 5G and 6G—requires specialized equipment and highly skilled professionals, which adds to operational costs and training burdens. Additionally, the market must deal with the rapidly evolving standards in wireless communication, which demand frequent upgrades and replacements of existing equipment.

This poses both a technical and financial challenge for testing labs and manufacturers. Another concern is the need for precision and accuracy in increasingly congested spectrum environments, where even minor errors in RF performance can lead to significant system failures or regulatory violations. Furthermore, integration with existing legacy systems, lack of standardized testing protocols for new technologies, and long development cycles for test setups continue to impede efficiency.

Regional Outlook

North America holds a dominant share of the RF test equipment market, driven by its leadership in technological innovation, presence of major equipment manufacturers, and significant investment in 5G, aerospace, and defense sectors. The United States, in particular, is at the forefront, with robust demand from industries such as telecommunications, automotive, and national security.

Europe follows closely, led by countries like Germany, the UK, and France, which are heavily invested in smart manufacturing and defense modernization. In the Asia-Pacific region, rapid industrialization and the surge in consumer electronics production have made it the fastest-growing market. Countries like China, Japan, South Korea, and India are investing aggressively in 5G rollouts, IoT ecosystems, and semiconductor development, all of which require comprehensive RF testing capabilities.

China is emerging as a key player in terms of both consumption and production of RF test equipment, while Japan and South Korea continue to innovate in high-frequency and miniaturized components. Meanwhile, Latin America, the Middle East, and Africa are gradually adopting RF test solutions, primarily driven by telecom expansion and regulatory compliance, though growth here is comparatively slower due to budget constraints and infrastructural challenges.

RF Test Equipment Market Companies

- Anritsu

- B&K Precision Corporation

- Chroma ATE

- Cobham Limited

- EXFO

- Fortive

- Giga-Tronics

- Goodwill Instruments

- Keysight Technologies

- National Instruments

- Rohde & Schwarz

- Teledyne Technologies

- Viavi Solutions

- Yokogawa Electric

Segments Covered in the Report

By Equipment Type

- Oscilloscopes

- Signal Generators

- Spectrum Analyzers

- Network Analyzers

- Power Meters

- Others

By Frequency Range

- Less than 1 GHz

- 1 GHz-6 GHz

- 7 GHz-20 GHz

- More than 20 GHz

By Form Factor

- Bench Top

- Portable

- Modular

- Rackmount

By End-use

- Telecommunications

- Aerospace & Defense

- Electronics Manufacturing

- Automotive

- Medical Devices

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Also Read: RFID Printers Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6202

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344