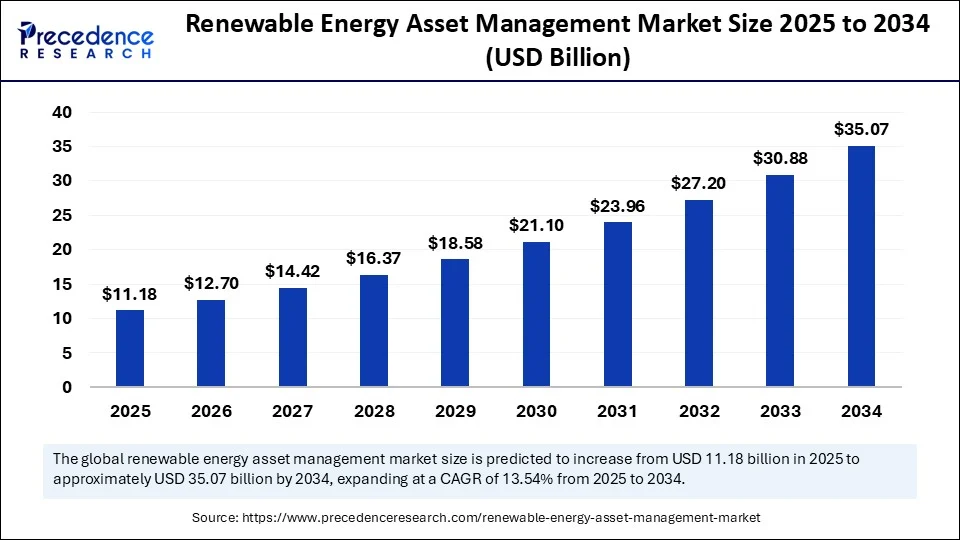

The global renewable energy asset management market is on a robust growth path, expected to escalate from USD 11.18 billion in 2025 to approximately USD 35.07 billion by 2034, registering a strong CAGR of 13.54% during the forecast period. This impressive growth is fueled by the accelerating deployment of renewable energy capacities worldwide, growing adoption of sophisticated digital asset management platforms, and escalating investments in sustainability initiatives aimed at optimizing operational efficiencies and maximizing asset life cycles.

Renewable Energy Asset Management Market Key Insights

-

The market size was USD 9.85 billion in 2024 and is projected to reach USD 11.18 billion by 2025.

-

Europe led the market in 2024 with a 30% revenue share, driven by advanced policy frameworks and extensive renewable portfolios.

-

Asia Pacific is the fastest-growing region due to expansive solar and wind capacity additions in countries like China, India, Japan, and Australia.

-

Independent Power Producers (IPPs) dominate end-user segments, holding about 71% revenue share in 2024.

-

Cloud-based SaaS models constitute approximately 45% of deployment models in 2024, facilitating centralized data aggregation and fleet-level analytics.

-

Solar power holds the major energy source market share, accounting for 30% in 2024, reflecting its dominant role in renewable capacity additions.

Role of Artificial Intelligence in Renewable Energy Asset Management

Artificial intelligence (AI) is transforming the renewable energy asset management landscape by empowering operators with real-time analytics to monitor asset health and grid conditions with superior precision. AI-driven solutions optimize turbine, solar panel, and storage system performance by enabling predictive maintenance and operational decision-making, thereby reducing downtime and enhancing returns. Companies integrating AI gain competitive advantages through intelligent data insights that contribute to a more resilient and efficient renewable energy infrastructure.

Moreover, AI facilitates automated performance benchmarking and failure prediction by leveraging sensor data and predictive algorithms, enabling asset managers to maximize output and comply with regulatory standards efficiently. This technological infusion is crucial for managing complex, distributed energy portfolios across regions, especially in leading markets such as Europe and Asia-Pacific.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6677

Renewable Energy Asset Management Market Growth Factors

Key factors propelling the renewable energy asset management market include the rapid expansion of renewable energy capacity globally, particularly in solar and wind sectors, along with aggressive government sustainability mandates and funding. The growing complexity of energy portfolios demands advanced digital asset management tools capable of integrating real-time monitoring, predictive maintenance, and performance analytics. Additionally, robust policy frameworks in regions like Europe and technological progress in AI-enhanced monitoring reinforce market expansion.

Renewable Energy Asset Management Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 35.07 Billion |

| Market Size in 2025 | USD 11.18 Billion |

| Market Size in 2024 | USD 9.85 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.54% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Energy Source, Functionality / Activity, Deployment Model, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Opportunities and Trends: How Will Rising Deployment of Renewable Energy Projects Shape the Market?

The increased deployment of renewable energy projects worldwide offers tremendous opportunities for market growth. Are companies prepared to utilize intelligent asset management platforms to optimize large-scale solar, wind, and hybrid power installations across multi-region portfolios? The surge in digital monitoring systems enables strategic asset performance tracking and compliance management, essential for maintaining profitability and operational sustainability. Furthermore, international commitments to decarbonization and sustainability are increasing financial investments in renewable assets, driving demand for intelligent, cloud-based management solutions.

Renewable Energy Asset Management Market Regional and Segmentation Insights

Europe, the largest market contributor in 2024, benefits from a sophisticated renewable portfolio and multi-faceted digital infrastructure supporting approximately 47.3% of the EU’s electricity from renewables. The Asia-Pacific region is the fastest-growing market, fueled by massive capacity additions exceeding 320 GW in 2024, driven by China, India, Japan, and Australia. North America, Latin America, and the Middle East & Africa also present evolving opportunities with emerging digital asset management adoption.

By energy source, solar power dominates with a 30% market share followed by wind and hybrid energy assets. Performance analytics represents the largest market segment in functionality/activities, accounting for 25%, while predictive maintenance is the fastest-growing segment, moving operators toward condition-based maintenance strategies. Deployment models are led by cloud-based SaaS solutions with a 45% share, key for scalable, centralized operations. Independent power producers are the primary end-users, holding 71% of the market due to their multi-location portfolio management needs.

Latest Breakthroughs and Leading Companies

Top companies leverage AI-enhanced monitoring, turbine life optimization, and cloud-based platforms to innovate asset lifecycle management. Key market players driving advancements include Siemens Gamesa, ABB, GE Renewable Energy, Schneider Electric, Enel Green Power, and Vestas Wind Systems, among others. These companies are developing integrated solutions that combine IoT sensors, predictive analytics, and digital twins for superior asset insights and operational agility.

Challenges and Cost Pressures

Significant upfront investments in advanced digital asset management systems pose a challenge, especially for small and mid-sized renewable project developers. The high costs of predictive analytics tools, IoT integration, and software platforms restrain rapid adoption. Additionally, the lack of standardized data protocols across renewable technologies impedes seamless system integration and efficiency.

Case Study Insight

A leading European independent power producer implemented a cloud-based renewable asset management platform incorporating AI predictive analytics, resulting in a 15% reduction in downtime and a 10% increase in overall operational efficiency within the first year. This success highlights how digital transformation supports asset longevity and profitability in the renewable sector.

Read Also: Wireless Temperature Sensors Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344