The primary benefits of recovery footwear include reducing muscle soreness, improving circulation, and providing lasting comfort during post-activity periods. These shoes are popular among athletes, fitness enthusiasts, and anyone needing relief from foot fatigue. The market for recovery footwear is growing steadily due to rising awareness about post-exercise recovery and advancements in materials such as memory foam, gel inserts, and antimicrobial fabrics. Additionally, the segment is expanding as brands blend recovery features with everyday casual styles to appeal to a broader audience.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/sample/6155

How is AI Transforming the Recovery Footwear Market?

AI is revolutionizing the recovery footwear market by enabling the development of smart shoes that offer personalized support and rehabilitation. Through AI-powered sensors and data analytics, recovery footwear can monitor a wearer’s gait, pressure points, and movement patterns in real time. This allows for customized adjustments and feedback to enhance comfort, reduce injury risk, and accelerate healing. Additionally, AI helps manufacturers design advanced materials and ergonomic structures based on extensive biomechanical data, improving overall product effectiveness.

What Future Opportunities Does AI Bring to Recovery Footwear?

AI opens new possibilities for integrating recovery footwear with digital health platforms, enabling continuous remote monitoring and personalized rehabilitation plans. By analyzing user data, AI can predict potential issues and recommend timely interventions, making recovery more proactive and efficient. Furthermore, AI-driven innovation supports the creation of adaptive footwear that can dynamically adjust to changing user needs, paving the way for smarter, more responsive recovery solutions that enhance user experience and clinical outcomes.

Market Scope

| Report Coverage |

Details |

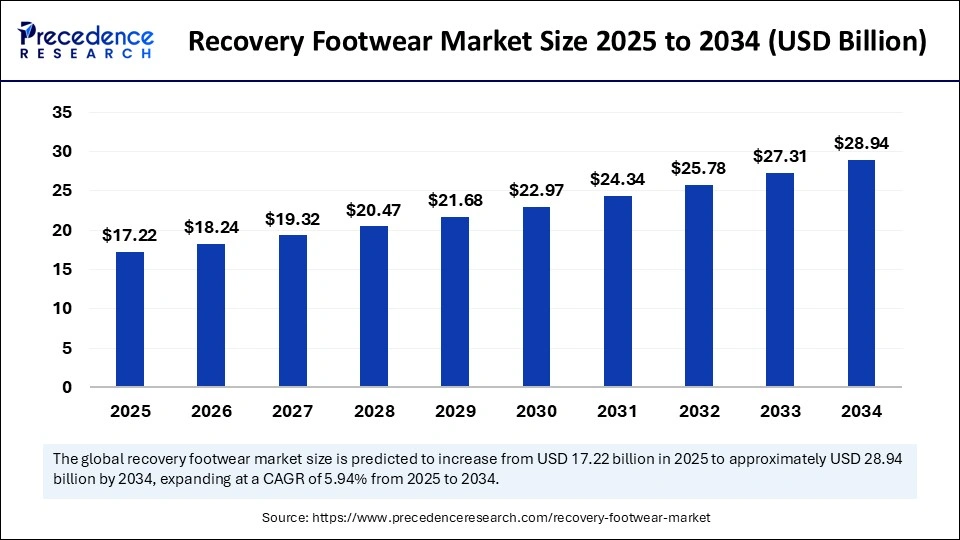

| Market Size by 2034 |

USD 28.94 Billion |

| Market Size in 2025 |

USD 17.22 Billion |

| Market Size in 2024 |

USD 28.94 Billion |

| Market Growth Rate from 2025 to 2034 |

CAGR of 5.94% |

| Dominating Region |

North America |

| Fastest Growing Region |

Asia Pacific |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Product Type, Consumer Orientation, Sales Channel, Application, and Region |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers:

The recovery footwear market is driven by the rising awareness of foot health and the growing emphasis on post-workout recovery among fitness enthusiasts and athletes. Increasing participation in sports and physical activities has resulted in higher incidences of foot fatigue, soreness, and plantar fasciitis, prompting a surge in demand for footwear that provides therapeutic support. Additionally, the aging global population, particularly in developed regions, is contributing to growth, as older adults seek comfortable footwear that alleviates joint and muscle strain.

The expansion of the wellness industry, coupled with endorsements from physiotherapists and sports professionals, is further reinforcing consumer trust in recovery footwear. Brands are also leveraging innovative materials such as EVA foam and memory foam to improve shock absorption, comfort, and ergonomic support, driving product adoption.

Market Opportunities:

The market presents significant opportunities in both product innovation and market expansion. There is increasing potential for companies to tap into the women’s segment, which is growing due to rising participation in fitness activities and demand for stylish yet functional footwear. Moreover, advancements in AI and wearable technology can be integrated into recovery footwear for tracking movement, foot pressure, and recovery progress, thereby attracting tech-savvy consumers. Sustainable and eco-friendly designs are also gaining traction, offering a niche but rapidly growing customer base seeking sustainable wellness products.

Expansion into emerging economies in Asia, Latin America, and the Middle East, where awareness about foot health is rising, offers another avenue for growth, especially with the rise of e-commerce and social media marketing strategies.

Market Challenges:

Despite strong growth drivers, the market faces several challenges. One of the major issues is consumer skepticism, particularly among price-sensitive buyers who may view recovery footwear as a luxury rather than a necessity. The relatively high price point compared to regular footwear can limit widespread adoption. Additionally, lack of standardization in terms of performance metrics makes it difficult for consumers to differentiate between genuinely therapeutic footwear and regular comfort shoes.

Another challenge lies in competition from established sportswear brands that may dominate shelf space and brand recognition, making it difficult for new or specialized recovery footwear brands to break through. Maintaining a balance between comfort, aesthetics, and affordability also poses a design and production challenge.

Regional Outlook:

North America currently dominates the recovery footwear market, holding the largest market share owing to a mature fitness industry, high consumer spending on health products, and widespread availability of branded footwear. Europe follows closely, with growing demand driven by health-conscious populations and increased interest in wellness-oriented lifestyle products. Asia Pacific, however, is expected to witness the fastest growth over the forecast period, led by expanding middle-class populations, urbanization, and increasing awareness about sports recovery and foot health.

Countries such as China, India, and Japan are experiencing rising demand, supported by growing online retail penetration and fitness trends. Latin America and the Middle East & Africa also show promise, though growth in these regions is more gradual due to economic constraints and limited consumer education on foot recovery solutions.

Recent Developments

- In April 2025, Nike revealed its first line of recovery items, including a compression boot and vest, in collaboration with Hyperice. Initially, only a chosen few Nike athletes were meant to get these, because approximately 100 athletes used them during the 2024 Olympics.

- In November 2024, Kane Footwear, which leads in active recovery shoes, introduced its second model, the Kane Revive AC, for people who need footwear that works in every climate. Based on the recovery features of the Kane Revive, the Revive AC, which stands for All Conditions, comes with a weatherproof design so athletes can recover well in any weather.

- In August 2024, OOFOS, the global leader in Active Recovery footwear, launched its latest innovation in recovery footwear – the OOmy Stride. With this technology, a new platform offers OOFOS users the familiar comfort they know from the brand and an enhancement to their step, from when their heels hit the ground through their toes, leaving.

- Adidas

- ANTA

- LiNing

- Mizuno

- Montrail

- Nike

- OOFOS

- PR Soles

- Qiandan

- Superfeet

- Under Armour

Segment covered in the report

By Product Type

- Flip-flop sandals

- Slides sandals

- Closed-toed shoes

- Others

By Consumer Orientation

By Sales Channel

- Convenience stores

- Multi-brand stores

- Exclusive stores

- Online retailers

- Others

By Application

- After-foot surgery

- After-workout

- Walking

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Also Read: Sewing Thread Market

Source: https://www.precedenceresearch.com/recovery-footwear-market