Rare Earth Minerals Market: Powering the Future of Clean Tech and Electronics

Rare earth minerals are the backbone of modern technology. From smartphones and wind turbines to electric vehicles and advanced defense systems, these elements are essential to building the infrastructure of tomorrow. As the world rapidly transitions toward green energy and digitalization, the demand for rare earth minerals is soaring.

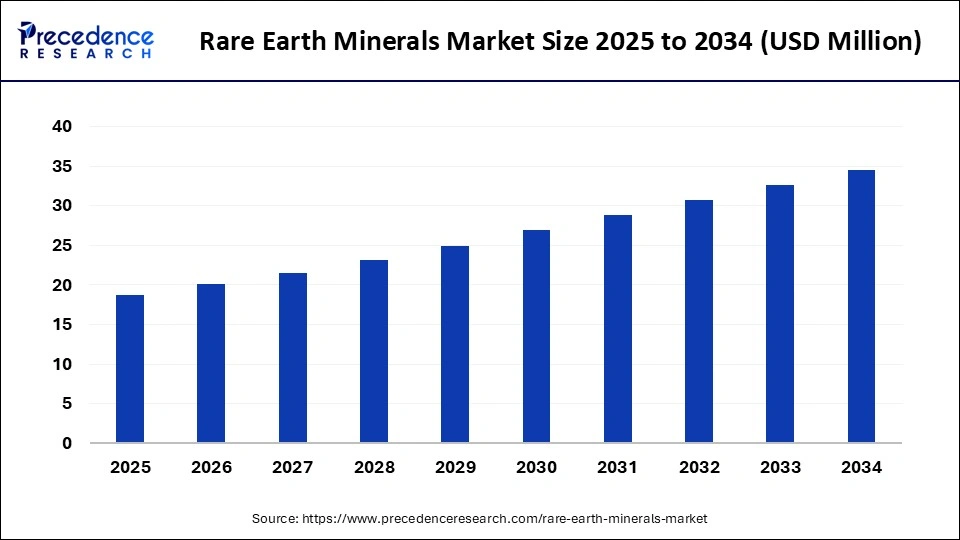

Market Overview and Growth Outlook

The global rare earth minerals market is poised for significant growth over the next decade This growth is driven by the expanding use of rare earths in electric vehicle motors, wind turbines, military technologies, and consumer electronics.

Rare earth elements (REEs) such as neodymium, praseodymium, dysprosium, and terbium are critical for the production of permanent magnets, which are central to many high-efficiency, low-emission technologies. With global efforts to reduce carbon emissions, these materials are gaining unprecedented strategic and economic importance.

Key Market Drivers

The push toward renewable energy and electrification is one of the most important drivers of the rare earth minerals market. Wind energy, in particular, relies heavily on high-performance permanent magnets made from rare earths to improve turbine efficiency and durability. Similarly, the rise in electric vehicle production has led to surging demand for neodymium and dysprosium-based magnets used in drivetrains.

Another key factor is the rising geopolitical interest in securing rare earth supply chains. Countries are investing in domestic mining and processing capabilities to reduce dependence on imports, particularly from dominant producers like China. Governments in the United States, Australia, Canada, and the European Union are promoting rare earth exploration through subsidies and strategic reserves.

Technological proliferation also plays a major role. Consumer electronics, medical imaging systems, and advanced optical devices all depend on rare earths for their miniaturized and high-efficiency components. The continual innovation in sectors like robotics, automation, and clean transportation further amplifies their necessity.

Technological Advancements

Technological advancements in mining, processing, and recycling are helping the rare earth industry overcome traditional challenges such as high extraction costs and environmental degradation. New hydrometallurgical and ion-exchange techniques are improving extraction yields and reducing chemical waste, enabling more sustainable practices.

Recycling technologies are also gaining traction. As electronic waste volumes rise globally, companies are developing methods to recover rare earths from discarded smartphones, hard drives, and batteries. Urban mining is emerging as a secondary resource stream that can supplement primary mining operations, particularly in regions with limited rare earth reserves.

In addition, technologies for rare earth separation are becoming more efficient. Ion-exchange membranes, solvent extraction enhancements, and AI-assisted process optimization are making it feasible to isolate specific rare earths with greater precision and at lower costs.

What is the Role of AI in the Rare Earth Minerals Market?

Artificial intelligence is becoming a valuable tool in multiple stages of the rare earth minerals supply chain. One of the most significant applications is in mineral exploration. AI-driven geospatial analysis and machine learning models can predict new rare earth deposits by analyzing satellite data, geological maps, and past drilling data, accelerating the discovery process and reducing exploration costs.

In mining operations, AI helps optimize extraction processes by monitoring equipment, predicting maintenance needs, and improving energy efficiency. Smart mining platforms powered by AI can analyze sensor data in real-time to adjust drilling strategies, minimize waste, and maximize output.

AI is also enhancing rare earth processing and recycling. Machine learning algorithms are used to control separation processes, ensuring optimal yield and purity while minimizing environmental impact. In recycling, AI-based image recognition and robotic sorting systems can identify and extract rare earth-rich components from complex waste streams, making urban mining more efficient and scalable.

Moreover, AI aids in supply chain transparency and risk management. Through predictive analytics and demand forecasting, companies can better manage inventory, assess market fluctuations, and reduce dependency on volatile sources. As the rare earth market becomes more strategic, AI will continue to provide the intelligence needed to build resilient, secure, and sustainable supply chains.

Market Challenges

Despite strong growth potential, the rare earth minerals market faces several key challenges. The first is supply chain concentration. China currently controls over 60% of global rare earth production and an even higher percentage of processing capacity. This dominance raises concerns about trade restrictions, geopolitical tensions, and supply disruptions.

Environmental concerns are another significant issue. Rare earth extraction is energy-intensive and often involves the use of hazardous chemicals that can contaminate local water and soil. Improper waste management has led to ecological damage in mining regions, prompting stricter regulations and the need for greener extraction technologies.

Price volatility also affects the market. Due to limited supply sources and fluctuating demand, prices of individual rare earth elements can spike dramatically, making it difficult for downstream industries to plan costs effectively.

Another challenge is the technological complexity of processing. Separating rare earth elements from their ores is a technically demanding and costly process. Many countries lack the infrastructure and expertise to perform this task domestically, leading to continued reliance on established players.

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Market Insights

Asia-Pacific currently dominates the global rare earth minerals market, largely due to China’s commanding position in mining and processing. The country has heavily invested in refining technology and has established a near-monopoly in rare earth exports. However, concerns over export controls and national security are prompting other countries to diversify their sources.

North America is rapidly investing in rare earth independence. The United States has launched multiple initiatives to restart domestic mining and build processing facilities. Public-private partnerships and federal funding are supporting exploration in states such as California, Wyoming, and Texas.

Australia is emerging as a critical supplier, with companies like Lynas Rare Earths expanding their production and refining capabilities. The country’s stable political environment and rich mineral reserves position it as a trusted supplier to Western economies.

Europe is focusing on building a circular economy around rare earths. The European Union’s Critical Raw Materials Act encourages member states to invest in rare earth recycling, sustainable mining, and supply chain cooperation. Countries like Germany and Sweden are exploring both primary mining and secondary recovery from industrial waste.

Latin America and Africa are also being explored for untapped rare earth deposits. Governments are working with international partners to develop infrastructure and regulatory frameworks that will allow them to enter the global market competitively.

Competitive Landscape

The rare earth minerals market features a mix of state-backed enterprises, private mining companies, and emerging recyclers. These players are competing on the basis of resource access, processing capacity, and technological innovation.

Key companies operating in the rare earth minerals market include:

- Lynas Rare Earths Ltd

- Arafura Resources Ltd

- Alkane Resource Ltd

- Avalon Rare Metals Inc

- Molycorp

- Lluka Resources Limited

- Great Western Minerals Group Ltd

- IREL Materials

- Ucore Rare Metals Inc

- MP Materials

- Rising Nonferrous Metals Co Ltd

- Solvay

- Texas Mineral Resources Corp.

Many of these companies are vertically integrating to control both mining and processing. Strategic partnerships, joint ventures, and government contracts are key strategies to secure long-term growth and supply chain control.

Future Outlook and Trends

The rare earth minerals market is expected to see robust expansion as clean energy and digital technologies continue to evolve. Future trends will focus on securing supply chains, increasing recycling rates, and innovating environmentally sustainable extraction methods.

Investments in alternative materials and magnet designs may reduce dependence on specific rare earths over time, but demand will remain high in the foreseeable future. Moreover, international cooperation on resource sharing, trade transparency, and technology transfer will shape the geopolitical landscape of the market.

As new players enter and technological frontiers expand, the rare earth industry is transitioning from a niche mining sector to a critical enabler of global innovation and sustainability.

Conclusion

The rare earth minerals market is entering a transformative era, driven by the global shift toward electrification, renewable energy, and high-performance technologies. While challenges related to supply chain concentration and environmental impact persist, technological advancements and the integration of AI are opening new opportunities for growth, efficiency, and resilience. As industries and governments around the world race to secure these strategic resources, rare earths are proving to be as vital to the 21st century as oil was to the last.

Also Read: Synthetic Aperture Radar Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6214

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344