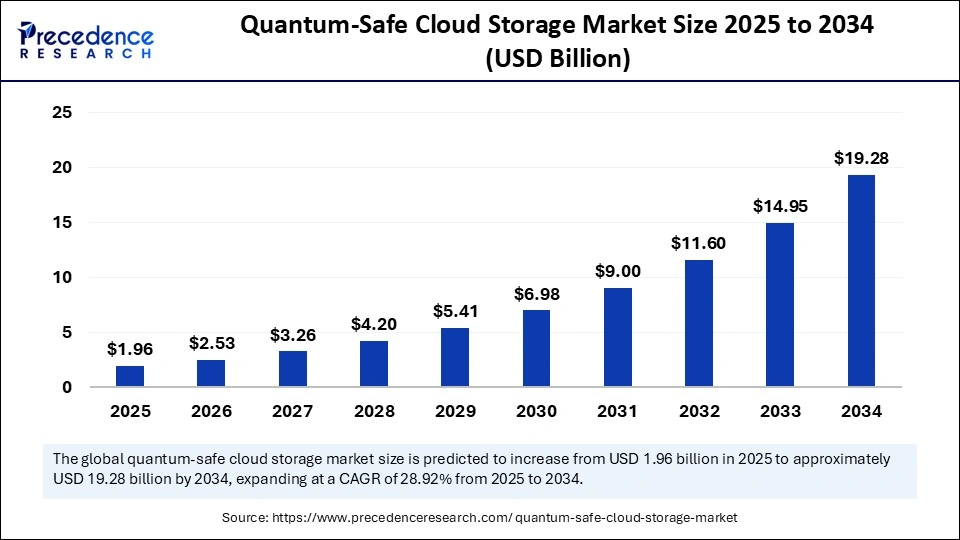

The global quantum-safe cloud storage market, valued at USD 1.52 billion in 2024, is projected to surge spectacularly to approximately USD 19.28 billion by 2034, expanding at a robust compound annual growth rate (CAGR) of 28.92% from 2025 to 2034. This striking growth is primarily fueled by escalating cyber threats, the urgent need for quantum-resistant data security solutions, and rapid advancements in quantum technology to fortify cloud infrastructures.

Quantum-Safe Cloud Storage Market Key Points

-

The market size is expected to leap from USD 1.96 billion in 2025 to USD 19.28 billion by 2034.

-

North America currently dominates the market with a 45% share, supported by strong regulatory backing and early technology adoption.

-

Asia Pacific emerges as the fastest-growing region, driven by expanding digital infrastructure and substantial government investments in quantum technology.

-

The post-quantum cryptography (PQC) segment accounts for 50% of the market share in 2024 due to its practical deployment advantages.

-

Public cloud deployment represents nearly 45% of the market, with hybrid cloud models projected to grow fastest.

-

The banking, financial services, and insurance (BFSI) sector dominates end-user segments with 40% share.

-

Key players include IBM, Microsoft Azure, Google Cloud, Quantinuum, SandboxAQ, QNu Labs, ID Quantique, Entrust, Thales, ResQuant, Intel, and Cloudflare.

How Will Artificial Intelligence Influence Quantum-Safe Cloud Storage?

Artificial Intelligence (AI) is set to revolutionize the landscape of quantum-safe cloud storage by enhancing threat detection and efficiency. AI leverages quantum-resistant cryptographic algorithms to proactively identify quantum threats through real-time data pattern analysis. This capability enables continuous monitoring and early scam detection, substantially strengthening cloud data defenses.

Moreover, AI-driven predictive analytics optimize resource allocation and forecast demand within cloud environments, improving cost efficiency and scalability of quantum-safe storage solutions. The fusion of AI with quantum encryption technology creates a resilient, adaptive security ecosystem for future-proof cloud infrastructures.

What Are the Primary Growth Drivers for the Quantum-Safe Cloud Storage Market?

The market growth is propelled by multiple factors, including:

-

Intensifying cyberattacks exploiting vulnerabilities of conventional encryption against quantum computing.

-

Regulatory mandates emphasizing data privacy and cybersecurity, especially in sensitive sectors like BFSI, healthcare, and government.

-

Expansion of cloud infrastructure with enterprises investing in next-generation, quantum-resistant security solutions.

-

Increasing adoption of quantum key distribution (QKD) services offering highly secure cryptographic key exchanges.

-

Rising enterprise demand for scalable, flexible cloud storage solutions resistant to quantum hacking.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6929

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 1.52 Billion |

| Market Size in 2025 | USD 1.96 Billion |

| Market Size by 2034 | USD 19.28 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 28.92% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Encryption Type, Deployment Model, Service Type, Compliance & Security Focus, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

What Key Opportunities and Trends Are Emerging in Quantum-Safe Cloud Storage?

-

How significant is the role of Quantum Key Distribution (QKD) in securing cloud storage?

QKD uses quantum mechanics to distribute cryptographic keys securely, rendering it nearly immune to both classical and quantum hacking attempts. This technology is rapidly gaining traction, particularly in finance, defense, and critical infrastructure, offering unprecedented security in data exchange. -

Why is hybrid cloud deployment gaining traction despite complex migration challenges?

Hybrid cloud enables enterprises to implement quantum-safe encryption flexibly without a full infrastructure overhaul, combining private and public cloud benefits with unified security frameworks and automated key orchestration, making it a preferred model for security-conscious organizations. -

What sectors are leading adoption, and which segments are poised for rapid growth?

BFSI leads current demand due to its sensitive and high-volume transactional data, while healthcare and life sciences are anticipated to experience the fastest growth, driven by stringent data protection regulations and the critical need to safeguard patient information.

Regional and Segmentation Analysis

North America dominates with nearly 45% market share, supported by substantial government investment, robust R&D ecosystems, and early adoption driven by stringent data privacy laws. The U.S. market alone is projected to grow from USD 0.53 billion in 2024 to USD 6.89 billion by 2034.

Asia Pacific is the fastest-growing region, leveraging expansive IT infrastructure developments and strong government programs in India, China, and Japan focused on quantum technology innovation.

Segmentation by encryption types shows post-quantum cryptography commanding half the market in 2024 due to scalability and immediate applicability. Meanwhile, quantum key distribution is anticipated to grow fastest, reflecting growing cybersecurity concerns.

Deployment models highlight the public cloud’s current dominance with 45% share, driven by scalability and broad enterprise access to quantum computing platforms. Hybrid cloud deployment is forecast to register the highest CAGR, balancing security with operational flexibility.

Service types are led by data storage services with 40%, addressing urgent needs for high-scalability, quantum-proof storage. Disaster Recovery as a Service (DRaaS) is the fastest-growing, offering budget-efficient solutions for business continuity.

In end-users, BFSI holds 40% share, with the healthcare and life sciences sector on course for rapid adoption due to strict regulatory requirements and the critical nature of patient data protection.

Latest Breakthroughs and Industry Leaders

Industry pioneers are advancing quantum-safe technologies at multiple innovation stages:

-

Quantum hardware production and QKD services: Quantinuum, SandboxAQ, QNu Labs, ID Quantique.

-

Quantum-safe hardware components manufacture: Entrust, Thales, ResQuant, Intel.

-

Software integration of PQC into cloud platforms: Google Cloud, IBM, Microsoft Azure, Cloudflare.

Challenges and Cost Pressures in Quantum Migration

Transitioning to quantum-safe cloud storage entails significant challenges, most notably the complexity and cost of migrating existing infrastructure to quantum-resistant cryptographic methods. Organizations face large-scale investments and operational overhauls. Additionally, universal standards for post-quantum cryptography are still evolving, adding uncertainty.

Case Study Snapshot: BFSI Sector Secures Future Transactions

A leading multinational bank adopted quantum-safe cloud storage solutions, integrating PQC and AI-based security monitoring. This proactive approach enabled the institution to safeguard cross-border payments against emerging quantum threats while ensuring compliance with global financial data regulations, significantly reducing breach risks.

Read Also: Mixed Signal IC Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344