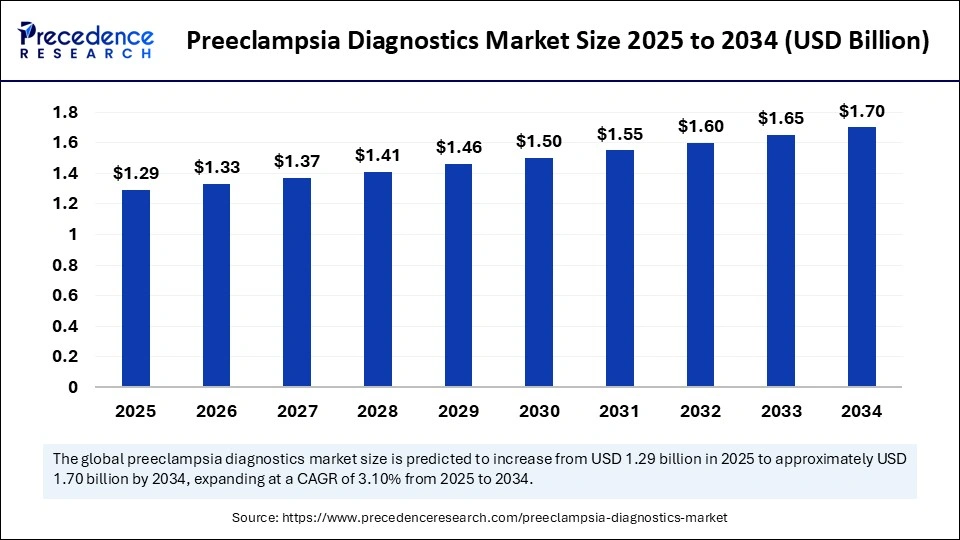

The global preeclampsia diagnostics market, valued at USD 1.29 billion in 2025, is forecasted to grow steadily to approximately USD 1.70 billion by 2034, registering a CAGR of 3.10%. Accelerated by advancements in diagnostic technologies, widespread prenatal screening, and heightened focus on maternal health, this market displays robust potential to improve pregnancy outcomes worldwide.

Preeclampsia Diagnostics Market Key Insights

-

The market was valued at USD 1.29 billion in 2025 and is set to reach USD 1.70 billion by 2034.

-

North America holds the dominant market share at approximately 43%, with the U.S. as a pivotal contributor.

-

Asia Pacific represents the fastest-growing market due to improved healthcare access and rising awareness.

-

Hospitals and maternity clinics account for nearly half the market’s end-use share.

-

Immunoassays led technology segments with about 45% market share in 2024.

-

Leading players include Thermo Fisher Scientific, F. Hoffmann La Roche Ltd., and PerkinElmer Inc.

-

AI technologies like predictive risk assessment are transforming early detection capabilities.

-

The U.S. PERA test by Mayo Clinic Laboratories exemplifies cutting-edge diagnostic innovation.

How Is the Market Fueled by Growth Drivers and Technological Advances?

The market expansion is primarily driven by the rising incidence of hypertensive disorders during pregnancy—preeclampsia affects 2%-8% of pregnancies globally, causing significant maternal and fetal morbidity and mortality.

Growing awareness campaigns and policy initiatives promote early screening as a critical intervention. Technological advancements such as point-of-care (POC) testing kits and biochemical marker assays further broaden diagnostic reach, especially in resource-limited settings.

What Role Does Artificial Intelligence Play in the Market?

Artificial Intelligence (AI) is poised to revolutionize preeclampsia diagnostics by enabling high-accuracy predictive risk assessments beyond traditional methods. Advanced algorithms analyze multifaceted patient data—including blood biomarkers, medical history, and placental imaging—to forecast risk at early stages. AI-driven models, validated by research institutions like the University of Oxford, facilitate quicker interventions by predicting preeclampsia before clinical symptoms appear.

Machine learning initiatives supported by national projects such as NIH’s Human Placenta Project enhance non-invasive diagnostic modalities, integrating molecular and imaging data. This evolving synergy transforms prenatal care into a personalized, data-driven process that optimizes outcomes and resource allocation.

Preeclampsia Diagnostics Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.29 Billion |

| Market Size in 2026 | USD 1.33 Billion |

| Market Size by 2034 | USD 1.70 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.10% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

What Opportunities and Trends Are Shaping the Market?

Which diagnostic technologies are gaining prominence?

Immunoassays hold the largest share due to their sensitivity in detecting critical biomarkers (e.g., PlGF and sFlt-1). Meanwhile, point-of-care devices and home-based monitoring platforms are rapidly gaining traction, enabled by mobile health integration and telemedicine expansion, allowing convenient, real-time maternal health monitoring.

How does regional growth vary?

While North America dominates due to advanced infrastructure and funding, Asia Pacific is the fastest-growing market, driven by expanding healthcare access in populous countries like India and China, and innovations such as Amazon India’s home testing services.

What challenges does the market face?

Development of novel biomarkers faces clinical validation hurdles across diverse populations. Cost pressures and variability in biomarker specificity impede widespread adoption. Regulatory harmonization is crucial to overcoming these barriers.

What Are the Key Segmentation Insights?

By Test Type: Biochemical marker assays dominate with ~40% share; point-of-care testing is growing fastest.

By Technology: Immunoassays lead (~45% share); biosensors and mobile-integrated devices grow rapidly.

By Setting: Laboratory-based testing commands ~50% share; home-based remote monitoring expands swiftly.

By Product: Diagnostic kits and reagents hold ~45% share; data analytics platforms forecast fastest growth.

By End-User: Hospitals and maternity clinics dominate (~50% share); obstetrics and gynecology practices grow fastest.

By Region: North America leads (~43%); Asia Pacific fastest expansion.

What Are Recent Breakthroughs and Company Roles?

Leading companies such as Thermo Fisher Scientific, F. Hoffmann La Roche Ltd., and PerkinElmer Inc. hold nearly 50% of the market, spearheading innovation in biomarker assay platforms and global lab networks. Established players including Siemens Healthineers and Abbott Laboratories contribute through diagnostic instruments and rapid testing platforms.

Notably, the January 2024 launch of the PERA test by Mayo Clinic Laboratories achieved 94% sensitivity in early preeclampsia detection, marking a significant milestone. Initiatives like the Foundation for the National Institutes of Health’s public-private partnerships accelerate tool development for early-onset preeclampsia risk identification.

Key Players Operating in the Preeclampsia Diagnostics Market and Their Offering

| Tier | Companies in Tier | Approx % Cumulative Share | Commentary |

| Tier I – Market Leaders (~45 55%) | Thermo Fisher Scientific; F. Hoffmann La Roche Ltd.; PerkinElmer Inc. | ~ 50% | These firms dominate via strong biomarker assay platforms (especially sFlt 1/PlGF), large global lab networks, regulatory approvals, and broad product portfolios. |

| Tier II – Established Players (~20 30%) | Siemens Healthineers; Abbott Laboratories; Bayer AG; QuidelOrtho Corporation | ~ 25% | These contribute significantly via diagnostics instruments, rapid/point of care platforms, complementary assays, and expanding reach into emerging markets. |

| Tier III – Emerging / Niche Players (~15 20%) | DRG Instruments GmbH; Diabetomics, Inc.; Metabolomic Diagnostics Ltd.; Sera Prognostics | ~ 15% | These smaller or more specialized companies often focus on risk score tools, early detection/prognostic assays, or regional deployment. |

Which Challenges and Cost Pressures Affect Market Growth?

The market confronts challenges around biomarker validation, regulatory approval complexities, and cost-effectiveness of novel diagnostics, especially in low-resource regions. High development costs and reimbursement uncertainties limit rapid uptake. Additionally, clinical variability requires standardized screening protocols to assure reliability and reproducibility.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/sample/6983

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com | +1 804 441 9344