Polyurea Coating Market Key Points

-

In 2024, North America held the leading position in the global polyurea coating market.

-

The Asia Pacific region is anticipated to register a notable CAGR throughout the forecast period.

-

Based on raw material, the aromatic segment accounted for a substantial market share in 2024.

-

The aliphatic raw material segment is projected to experience significant growth in the coming years.

-

By product type, the hybrid segment held the dominant share of the market in 2024.

-

The pure polyurea segment is expected to expand at the fastest pace over the projected period.

-

In terms of technology, the spraying segment captured a considerable portion of the market in 2024.

-

The pouring technology segment is forecasted to grow rapidly between 2025 and 2034.

-

Within applications, the building & construction sector led the market in 2024.

-

The transportation application segment is poised to grow at the highest rate during the forecast timeframe.

Polyurea Coating Market Overview

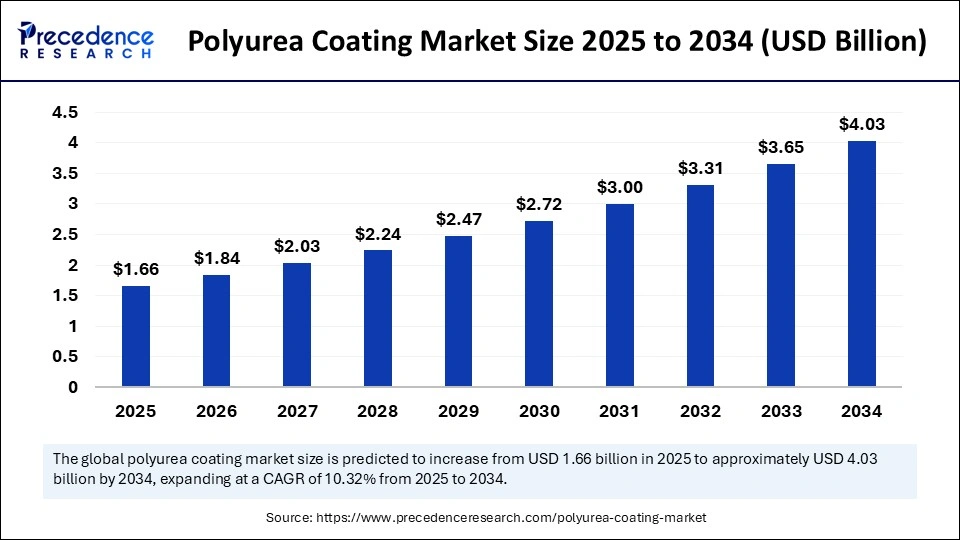

The polyurea coating market is witnessing substantial growth owing to its unique properties and versatile applications across a wide range of industries. Polyurea is an advanced elastomeric coating formed through the reaction of isocyanate with synthetic resin blends, known for its rapid curing time, excellent chemical resistance, superior mechanical strength, and high durability. These attributes make it ideal for use in protective coatings for infrastructure, automotive components, oil & gas pipelines, industrial floors, marine environments, and waterproofing systems.

Unlike traditional coatings such as epoxy or polyurethane, polyurea delivers remarkable performance even under extreme weather, abrasive conditions, and chemical exposure, making it a preferred choice for both new construction and maintenance projects. The increasing demand for advanced surface protection in industries like transportation, water treatment, defense, and construction is significantly boosting the adoption of polyurea coatings. As infrastructure aging, environmental regulations, and industrial safety standards tighten globally, the polyurea coating market continues to grow as a solution for long-lasting and eco-friendly protection.

Polyurea Coating Market Growth Factors

The growth of the polyurea coating market is propelled by a variety of structural and technological factors. One of the key growth drivers is the rising demand for high-performance coatings that provide long-term resistance to abrasion, moisture, UV rays, and corrosive chemicals. Industries such as oil & gas, marine, and civil infrastructure increasingly rely on polyurea to extend the life of assets exposed to harsh operating conditions.

Another strong factor is the global emphasis on infrastructure development and modernization. Governments and private players are heavily investing in roadways, bridges, water reservoirs, and commercial structures, all of which benefit from protective coatings to enhance longevity and reduce maintenance costs. Polyurea’s fast-curing nature and minimal downtime make it highly suitable for large-scale and time-sensitive projects.

Additionally, the increased awareness of environmental sustainability is playing a role in the market’s expansion. Polyurea coatings are solvent-free and have low VOC emissions, aligning with green building certifications and environmental regulations, particularly in developed economies. The growing popularity of eco-friendly and energy-efficient construction practices is further amplifying the demand for polyurea-based systems.

The market is also growing due to technological innovations in spray equipment and application techniques, which have made polyurea easier to apply and more consistent in finish. Improved accessibility to advanced spraying equipment has broadened the reach of polyurea coatings across smaller contractors and new geographies.

Impact of AI on the Polyurea Coating Market

Artificial Intelligence (AI) is progressively impacting the polyurea coating market by enhancing application accuracy, predictive maintenance, and quality assurance. In industrial coating processes, AI algorithms can be integrated into robotic spraying systems to ensure uniform application thickness, coverage optimization, and error reduction. These intelligent systems can adjust parameters in real-time based on surface geometry, ambient conditions, and curing rates—resulting in better efficiency and reduced material waste.

AI also plays a significant role in predictive maintenance and lifecycle monitoring. By analyzing data from sensors embedded in coated infrastructure or machinery, AI can predict coating degradation, corrosion risks, or material fatigue. This enables asset managers to plan maintenance before visible damage occurs, preventing downtime and reducing operational risks.

In research and development, AI aids in formulation optimization by simulating how different chemical compositions perform under various conditions. This accelerates the innovation cycle and leads to the development of more durable, environmentally friendly, and cost-effective polyurea products.

Additionally, AI-driven platforms are helping businesses make smarter decisions through supply chain optimization, demand forecasting, and project scheduling. By analyzing historical and real-time data, these platforms ensure that raw materials, labor, and equipment are utilized efficiently during large-scale coating projects.

Market Drivers

The primary market drivers include the increasing need for corrosion and abrasion-resistant coatings in industries such as oil & gas, water treatment, and marine transportation. These sectors often deal with harsh chemical exposure, saltwater corrosion, and mechanical wear, necessitating advanced coating solutions like polyurea to safeguard infrastructure and machinery.

The rise in industrial and commercial construction activities is another key driver. With expanding urbanization and industrialization, there is a growing requirement for durable and quick-to-apply waterproofing and flooring solutions, for which polyurea coatings are ideally suited.

Stringent environmental and worker safety regulations are pushing companies to shift away from solvent-based coatings to low-VOC and fast-curing alternatives. Polyurea meets these requirements while maintaining high performance, making it a regulatory-compliant solution in sensitive applications like food processing facilities and healthcare buildings.

Moreover, technological improvements in polyurea spray equipment have lowered the skill threshold for application, reduced operational costs, and improved finish consistency, all of which make polyurea a viable choice for a wider range of users.

Opportunities

There are significant growth opportunities in emerging economies where infrastructure development is accelerating. Countries in Asia-Pacific, Latin America, and parts of Africa are investing in urban infrastructure, transportation systems, and water management facilities, all of which require robust protective coatings.

Another promising opportunity lies in the renewable energy sector, particularly in wind turbine blade and base protection, solar panel installations, and hydroelectric facilities, where polyurea’s resistance to environmental stressors and UV radiation is highly beneficial.

There’s also a growing opportunity in defense and aerospace applications, where lightweight, impact-resistant coatings are essential. Polyurea can be used for blast mitigation, ballistic protection, and vehicle reinforcement, making it a valuable material for military-grade structures.

The rise in modular and prefabricated construction opens avenues for polyurea usage in factory-finished waterproofing and sealing processes. Additionally, the development of new polyurea formulations, such as hybrid and aromatic variants, will unlock custom applications and expand use in decorative and architectural sectors.

Challenges

Despite its advantages, the polyurea coating market faces several challenges. One key issue is the high cost of raw materials and specialized application equipment, which can deter adoption among small-scale contractors or cost-sensitive markets. While performance is superior, upfront costs can be a barrier in price-driven environments.

The complexity of application is another concern. Polyurea coating requires highly trained applicators and precise environmental conditions for optimal results. Improper application can lead to defects like blistering or poor adhesion, affecting product credibility and lifespan.

Limited awareness and market penetration in developing regions also restrict the market’s full potential. Many stakeholders continue to rely on traditional coating systems due to a lack of knowledge about polyurea’s benefits, or limited availability of trained professionals and materials.

Moreover, competition from established alternatives such as epoxy, polyurethane, and acrylic coatings poses a threat. These materials often have lower costs and greater familiarity among buyers, making market education and demonstration essential for polyurea manufacturers.

Regional Outlook

North America is a mature and leading market for polyurea coatings, driven by strong adoption in industrial, defense, and marine applications. The U.S. has a robust demand base due to aging infrastructure and stringent environmental regulations. Growth is also supported by advanced technological infrastructure and high construction standards.

Europe follows closely, with significant uptake in transportation, waterproofing, and architectural coatings. Countries like Germany, France, and the UK are emphasizing sustainable construction practices and durability, which align well with polyurea’s eco-friendly and long-lasting characteristics.

Asia-Pacific is the fastest-growing region due to booming construction, industrial development, and urban expansion in countries like China, India, Indonesia, and Vietnam. Government infrastructure initiatives and foreign investment in industrial parks are driving demand for high-performance coatings in this region.

Latin America and the Middle East & Africa are emerging markets with substantial growth potential. Infrastructure gaps, coupled with growing investment in energy, transportation, and water management, are creating opportunities for polyurea coating applications. However, market growth in these regions will depend on increased awareness, training, and support infrastructure.

Polyurea Coating Market Companies

- Pearl Polyurethane Systems LLC

- American Polymers Corp.(Polycoat Products)

- Teknos Group Oy

- PPG Industries, Inc.

- Rhino Linings Corporation

- BASF SE

- Huntsman Corporation

- Covestro AG

- Sika AG

- Sherwin-Williams Company

Segments Covered in the Report

By Raw Material

- Aromatic

- Aliphatic

By Product

- Pure

- Hybrid

By Technology

- Spraying

- Pouring

By Application

- Building & construction

- Transportation

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Also Read: Selective Laser Sintering Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6098

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344