Photonic Integrated Circuit Market: Size, Trends & Forecast

The exponential rise in global data consumption, AI processing, 5G connectivity, and cloud services has exposed the limitations of traditional electronic data processing systems. As industries continue to seek high-speed, low-power, and scalable solutions, Photonic Integrated Circuits (PICs) have emerged as a transformative force. PICs leverage light, rather than electricity, for data transmission and processing, offering unmatched bandwidth, speed, and energy efficiency. From hyperscale data centers to quantum computing and LiDAR applications, the Photonic Integrated Circuit market is poised for unprecedented growth, underpinned by rapid innovation and robust commercial adoption.

What Is a Photonic Integrated Circuit?

A Photonic Integrated Circuit is a microchip that integrates multiple photonic functions—such as lasers, modulators, detectors, and waveguides—onto a single platform. Unlike traditional electronic ICs, which use electrons to transmit signals, PICs use photons, enabling far faster and more energy-efficient communication. PICs can be fabricated using various materials, with the most common being indium phosphide (InP), silicon photonics, and silicon nitride. Each material has specific advantages. For example, silicon photonics enables low-cost mass production using standard CMOS processes, while InP-based PICs can integrate active components like lasers and modulators with high performance.

The benefits of PICs are multi-fold. Their ability to reduce latency and power consumption while handling massive data volumes makes them ideal for next-generation computing, telecom infrastructure, and sensing applications. In a world increasingly reliant on fast, data-rich environments, PICs are essential in building the future of communication technology.

Current Market Size and Growth Forecasts

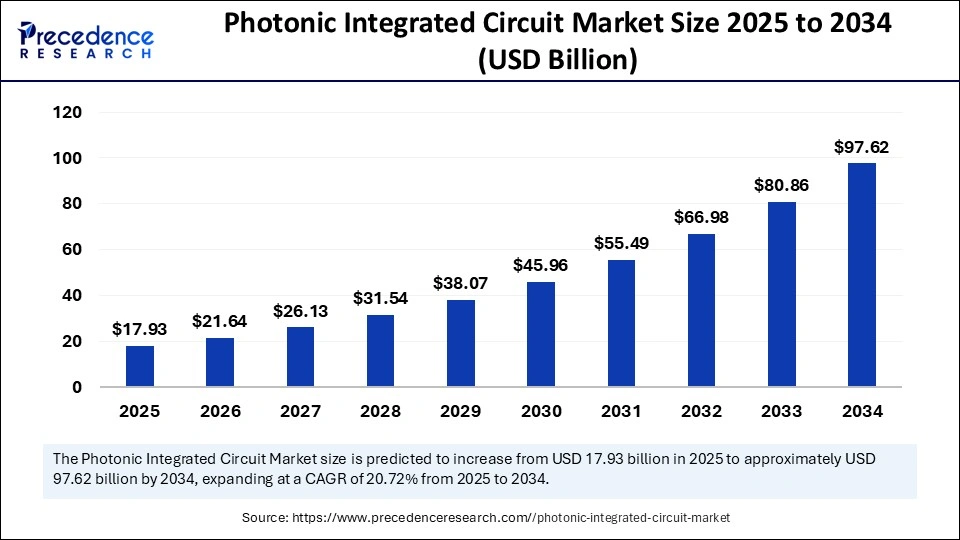

The global Photonic Integrated Circuit market is currently experiencing remarkable growth, driven by rising demand across telecommunications, data centers, and emerging technology sectors.

According to Precedence Research, the global photonic integrated circuit market size is estimated to hit around USD 97.62 billion by 2034 increasing from USD 14.85 billion in 2024, with a CAGR of 20.72%.

Drivers and Challenges Shaping the Market

The Photonic Integrated Circuit market is primarily driven by the massive surge in global data traffic and the demand for faster, more energy-efficient communication systems. Hyperscale data centers, in particular, are deploying PICs to enhance their optical interconnect capabilities, reducing latency and lowering energy usage. The rollout of 5G and its associated infrastructure needs are another powerful growth engine, especially in Asia-Pacific and North America. Additionally, PICs are playing an increasingly critical role in artificial intelligence systems, autonomous vehicle LiDAR systems, quantum computing, and healthcare diagnostics.

Despite these advantages, the market faces several challenges. Fabrication of PICs remains complex and capital-intensive. Achieving high yield and precision during manufacturing is difficult, particularly when integrating multiple material systems on a single chip. Standardization is another issue, as the industry lacks unified design and testing frameworks. Furthermore, the integration of photonics with existing electronic systems presents design and interoperability challenges, requiring a skilled workforce with expertise in both domains. These constraints may slow down the commercialization of PICs in some sectors.

Technology Platforms and Application Segments

Photonic Integrated Circuits are developed on several key material platforms. Indium phosphide (InP) currently leads the market due to its superior ability to integrate active optical functions, including lasers. However, silicon photonics is rapidly gaining ground, particularly in data center and telecommunications applications, thanks to its compatibility with standard semiconductor fabrication processes. Silicon nitride (SiN) is being increasingly used in sensing and metrology due to its low propagation loss and wide transparency window.

In terms of integration methods, hybrid integration—which involves combining separate chips or materials—is currently dominant due to its design flexibility and lower development risk. However, monolithic integration, where all components are built on a single substrate, is expected to experience faster growth as fabrication processes improve.

Application-wise, data communication and telecommunications remain the largest segments. PICs are used in high-speed optical transceivers, which are critical for reducing bottlenecks in cloud data centers and telecom networks. Automotive LiDAR systems use PICs for high-precision sensing in autonomous driving. In healthcare, PICs are being applied in lab-on-chip diagnostics and biosensors. Meanwhile, quantum photonics represents a futuristic frontier where PICs are used for manipulating quantum bits (qubits) using light.

Regional Market Insights

Regionally, North America holds the largest share of the Photonic Integrated Circuit market. The United States, in particular, has a strong presence of tech giants, government funding programs like DARPA and AIM Photonics, and a mature ecosystem of universities and research labs. This region accounts for nearly 38%–40% of the global market share.

Asia-Pacific, however, is the fastest-growing region, with countries like China, Japan, and South Korea making substantial investments in semiconductor and photonics research. The region benefits from strong manufacturing capabilities and rising demand for optical communication technologies in telecom and automotive sectors.

Europe is also emerging as a strong contender, driven by initiatives such as PhotonDelta in the Netherlands and public–private R&D partnerships across Germany, France, and the UK. The European Union has allocated significant funding for PIC development under its Horizon and IPCEI programs. Other regions like the Middle East and Latin America are seeing niche growth, especially in defense, oil & gas sensing, and emerging quantum technologies.

Competitive Landscape and Industry Leaders

The competitive landscape of the PIC market is evolving rapidly, with both established tech giants and innovative startups playing key roles. Large corporations such as Intel, Cisco (which acquired Acacia Communications), Lumentum, Broadcom, Infinera, and NeoPhotonics are leading the market with integrated silicon photonics solutions for high-speed data communication.

Emerging players like Ayar Labs, Lightmatter, ColorChip, and Rockley Photonics are pioneering new architectures, including photonic processors for AI and optical interconnects for high-performance computing. These startups often collaborate with hyperscalers and research consortia to bring cutting-edge solutions to market. Mergers, acquisitions, and strategic alliances are common, as larger players aim to consolidate their positions and expand into new verticals. For example, the merger between II-VI and Coherent created one of the largest vertically integrated optics players in the market.

Future Outlook and Emerging Trends

Looking ahead, the PIC market is expected to be revolutionized by co-packaged optics (CPO), where optics and electronics are integrated into a single package to dramatically reduce energy consumption and latency. This is particularly important for AI and machine learning applications, which require ultra-high-speed data transfer between processors.

Neuromorphic photonics is another area gaining traction. It aims to create brain-like computing systems using light instead of electricity, promising unprecedented speed and efficiency for complex AI workloads. Quantum photonics is also on the horizon, as researchers work toward developing room-temperature quantum computers using integrated photonic platforms.

Global foundries are racing to support these innovations by offering standardized design kits, multi-project wafer services, and volume production capabilities. As processes mature, costs will come down, and photonic chips will become more accessible for a wide range of commercial applications.

Conclusion

The Photonic Integrated Circuit market stands at the cusp of a technological revolution, with its ability to solve critical bandwidth, power, and size limitations in today’s data-driven world. With current valuations ranging between USD 13 and 18 billion and forecasts projecting the market to reach up to USD 90 billion within the next decade, the growth trajectory is both clear and compelling. As industries such as telecom, AI, healthcare, automotive, and quantum computing continue to evolve, the demand for PICs will only intensify.

While challenges around fabrication complexity, standardization, and integration remain, they are steadily being addressed through collaborative research, government support, and commercial investments. For companies and investors alike, entering this market now presents a strategic opportunity to be part of one of the most promising technology frontiers of the 21st century.

Also Read: Smart Card IC Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6206

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344