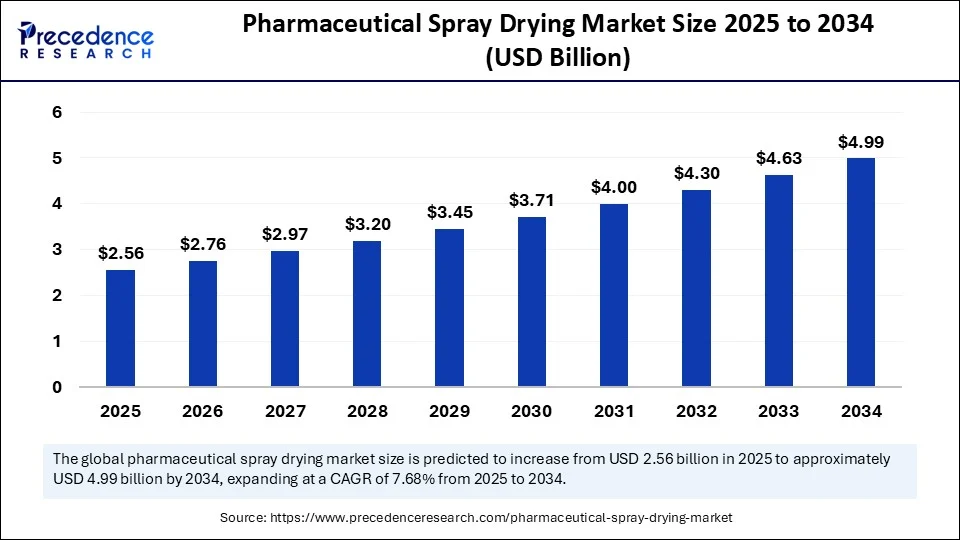

The global pharmaceutical spray drying market is set to more than double over the next decade, driven by rapid innovation and demand for advanced drug formulations. The market is projected to reach USD 4.99 billion by 2034, expanding at a robust CAGR of 7.68% from 2025 to 2034—with breakthroughs in AI and continued R&D investment shaping the industry’s future.

Fuelled by the pharmaceutical industry’s growing focus on high-quality, stable, and scalable drug formulation, the spray drying market is predicted to surge from USD 2.56 billion in 2025 to nearly USD 5 billion by 2034. Key drivers include the rise in chronic diseases, mounting need for poorly water-soluble drugs, and a wave of technological advancement, especially in the transformation of drying processes via artificial intelligence.

Pharmaceutical Spray Drying Market Key Insights

-

Global market value: USD 2.56 billion in 2025; forecast to hit USD 4.99 billion by 2034.

-

Top region: North America, holding 37.20% of the market share in 2024.

-

Fastest growth: Asia Pacific, expected CAGR of 10.20% (2025–2034).

-

Top player segment: Pharmaceutical companies, at 43.60% share in 2024.

-

Leading technology: Spray-dried formulations lead with 61.50% share; spray drying equipment segment growing at 9.30%.

-

Key application: Oral drug delivery dominates with a 39.40% share.

-

Strongest growth in drug type: Biologics & monoclonal antibodies set for fastest rise.

-

Nanoparticles segment: Fastest growth at 11.00% CAGR.

-

Dominant operation mode: Batch mode, at 58.10% in 2024.

Pharmaceutical Spray Drying Market Revenue Breakdown

| Region | 2024 Value (USD Million) | 2034 Projection (USD Million) | CAGR (2025–2034) |

|---|---|---|---|

| U.S. | 619.75 | 1,336.82 | 7.99% |

| Global | 2,380 | 4,990 | 7.68% |

| North America | 37.20% Market Share |

Advanced AI solutions in spray drying are revolutionizing workflows for pharmaceutical manufacturers. AI-driven systems accelerate drying processes, delivering superior scalability and productivity compared to traditional methods. These automated solutions support formulation consistency and rapid throughput, enabling the drying of tons of product in hours instead of days.

AI also enhances product quality and stability—optimizing the drying environment, predicting process outcomes, and supporting the manufacture of complex molecules. As machine learning models improve, manufacturers leverage AI to design nanoparticles, monitor reactions, and respond dynamically to production challenges, resulting in more innovative therapies.

Pharmaceutical Spray Drying Market Growth Factors

-

Growing prevalence of poorly water-soluble drugs requires advanced drying techniques for high bioavailability.

-

Rising incidence of chronic diseases boosts demand for innovative pharmaceuticals.

-

Technological advancements in spray drying equipment and process automation drive efficiency and uniform particle size control.

-

Stringent regulatory standards push companies toward reliable, compliant drying processes.

-

Investment in R&D leads to the development of next-generation therapies, challenging conventional manufacturing methods.

Where Are the Opportunities? What Are the Latest Trends?

Is Asia Pacific the Next Growth Engine?

Asia Pacific is anticipated to expand at the highest CAGR, driven by affordable, high-performance equipment and a surge in manufacturing hubs across China and India—a trend that is shifting the global balance of pharmaceutical production.

Will Nanoparticulate Drug Delivery Transform Therapy?

The rapid evolution of nanoparticle segments is opening new possibilities for targeting diseases from cancer to AIDS, with spray drying at the forefront of drug delivery innovation.

Are CDMOs Taking the Lead in Drug Development?

Contract Development and Manufacturing Organizations (CDMOs) are gaining prominence, offering expertise, regulatory support, and scalable production capacity for pharma innovators.

Pharmaceutical Spray Drying Market Regional and Segmentation Analysis

North America: Dominance Backed by R&D and Regulations

North America held a significant 37.20% market share in 2024 and is forecasted to retain a leading share of around 33% through 2034. The region’s dominance stems from substantial investments in pharmaceutical research and development, leading to continuous innovation in drug formulation. Coupled with stringent regulatory oversight that ensures high product quality and safety standards.

North America remains a pivotal market for pharmaceutical spray drying technologies. The U.S. alone had a market size of USD 619.75 million in 2024 and is expected to grow to USD 1,336.82 million by 2034, reflecting a CAGR of approximately 7.99%.

Asia Pacific: Fastest Growth Driven by Cost-Effective Manufacturing and AI

Asia Pacific is expected to witness the highest CAGR of 10.20% between 2025 and 2034, becoming a major growth engine. Key contributors include affordable manufacturing solutions catering to the expanding pharmaceutical production hubs in countries like China and India.

The adoption of AI-driven productivity enhancements complements this growth, allowing manufacturers to optimize spray drying processes and scale efficiently at lower costs—an attractive proposition amid rising global drug demand.

Europe, Latin America, Middle East & Africa: Emerging Clusters and Regulatory Progress

These regions are characterized by emerging innovation clusters and gradual regulatory harmonization efforts, contributing to expanding clinical research activities. This environment supports increasing pharmaceutical spray drying adoption as companies seek to leverage regional opportunities for drug development and manufacturing. Growth drivers here include collaborative research initiatives and evolving government policies encouraging innovation.

Pharmaceutical Spray Drying Market Key Segments Covered

Product Type

-

Spray-dried formulations dominated with a 61.50% market share in 2024. This segment benefits from spray drying’s ability to generate thermally stable, fine powders and improve drug bioavailability.

-

Spray drying equipment is the fastest-growing segment at a CAGR of 9.30% from 2025 to 2034, driven by demand for technological innovation and enhanced operational efficiency.

Drug Type

-

Small molecule drugs held the largest share at 52.70% in 2024, favored for their high oral availability and wide therapeutic use.

-

The biologics & monoclonal antibodies segment is poised for the highest growth, benefitting from advancements in protein-based drug formulations and therapeutic antibodies.

Formulation Type

-

The powder formulation segment accounted for 46.20% market share in 2024. Powder formulations created through spray drying ensure consistent solubility, stability, and controlled release characteristics essential for many pharmaceutical applications.

Application Type

-

Oral drug delivery dominated with a 39.40% share in 2024, mainly due to its non-invasive nature and patient compliance benefits.

-

The pulmonary drug delivery segment is expected to grow the fastest at a CAGR of 10.60%, driven by its rapid and targeted drug delivery advantages with minimal systemic side effects.

Operation Mode

-

Batch mode processing led the market with 58.10% share in 2024. Benefits include flexibility, lower upfront costs, and ease of data management.

-

The continuous mode segment is growing quickly at 9.70% CAGR, credited to increased process efficiency, reduced downtime, and better scalability.

Scale of Operation

-

The commercial/industrial scale segment held a leading 54.80% share. Large-scale manufacturing appeals to meeting global pharmaceutical demand.

-

The clinical/pilot scale segment is expanding at a CAGR of 9.20%, highlighting increased drug development and early phase clinical trials requiring smaller batch sizes.

End-User

-

Pharmaceutical companies commanded a 43.60% market share in 2024 and continue as major end-users due to their focus on internal drug development and manufacturing capabilities.

-

Contract Development and Manufacturing Organizations (CDMOs) are gaining share at 9.90% CAGR, valued for specialized expertise, cost savings, and accelerated time-to-market.

Technology

-

The two-fluid nozzle spray drying technology held the largest portion of market share at 33.90% in 2024. This technology atomizes liquid into finer particles using high-speed air streams, improving drying efficiency and particle uniformity.

-

Nano spray drying is the fastest-growing technological segment, growing at 11.40% CAGR. It enables generation of finer particle sizes than conventional dryers, boosting bioavailability and controlled release of drug compounds.

Pharmaceutical Spray Drying Market Breakthroughs and Leading Companies

Recent advancements include nano spray drying and controlled-release nanoparticulate technology, improving bioavailability and patient outcomes. Top players mentioned:

- Anhydro, Inc.

- Hosokawa Micron Ltd

- B. Bohle Maschinen + Verfahren GmbH

- Micron Power Systems

- JEL Drying Solutions (A/S)

- Armfield Ltd

- Buchi Labortechnik AG

- NiTech Solutions LLC

- Novatech International, Inc

- Innovative Drying Solutions, LLC.

- Yamato Scientific America, Inc.

- SPX FLOW, Inc.

- GEA Group

- Micro Powders, Inc.

Challenges and Cost Pressures

Despite dynamic growth, the industry faces strict regulatory barriers, cost pressure from process upgrades, and operational challenges in maintaining product quality and compliance. Small businesses struggle with regulatory complexity and capital intensity, while non-compliance can lead to market exclusion and financial penalties.

Case Study: Spray Drying for Nanoparticle Drug Delivery

A pharmaceutical company adopted nano spray drying to formulate a poorly soluble oncology drug. The solution improved the drug’s dissolution profile—ultimately increasing bioavailability by 30% and reducing time-to-market by 6 months, highlighting the power of spray drying innovation.

Read Also: Autologous Stem Cell and Non-Stem Cell Based Therapies Market

Get the Full Report

Take the next step ,download the sample report or schedule a meeting with our market specialists to explore the industry’s future:

[Download Sample Report ]

For more details or to request a tailored analysis, contact sales@precedenceresearch.com.