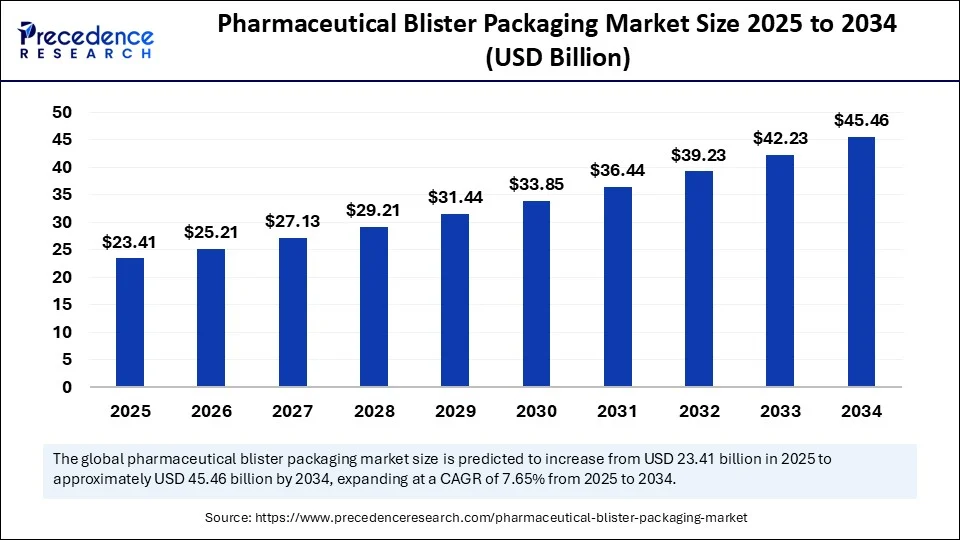

The global pharmaceutical blister packaging market, valued at USD 21.75 billion in 2024, is forecasted to surge to approximately USD 45.46 billion by 2034, exhibiting a robust CAGR of 7.65% during 2025-2034. This growth is propelled by rising e-pharmacies, demand for tamper-evident packaging, breakthroughs in cold form foil technology, and expanding generic drug manufacturing.

Pharmaceutical Blister Packaging Market Key Insights

-

The market size was USD 21.75 billion in 2024, expected to reach USD 23.41 billion in 2025 and further USD 45.46 billion by 2034.

-

North America dominated with a 32% market share in 2024; Asia Pacific is the fastest growing region with a CAGR of 8.90%.

-

The U.S. market alone was USD 4.87 billion in 2024, projected to hit USD 10.42 billion by 2034.

-

Thermoformed blister segment holds approximately 65% market share in 2024, while paper-based blisters are the fastest growing segment at 12.50% CAGR.

-

Plastic-based films dominated with 55% share, and multi-layer laminates are growing rapidly at 10.80% CAGR.

-

Solid oral dosage form packaging accounts for 72% of the market; transdermal patches segment is fastest growing among drug forms.

-

Anti-counterfeit packaging and environmentally sustainable packs are the highest CAGR segments growing at 11.30% and 13.40%, respectively.

-

The direct-to-pharma distribution channel leads with 70% share; online pharmacies exhibit a soaring growth at 14.10%.

-

Leading market players include Amcor, Bemis Company, Amcor PLC, Constantia Flexibles Group GmbH, Schott AG, and Sonoco Products Company.

How Artificial Intelligence Is Revolutionizing Pharmaceutical Blister Packaging

Artificial Intelligence (AI) is transforming blister packaging manufacturing by automating quality control inspections and ensuring superior consistency. AI-powered real-time monitoring detects micro-level defects invisible to the human eye, surpassing traditional labor-intensive quality checks. Additionally, AI expedites drug discovery by analyzing biomedical data to identify repurposable drugs, influencing packaging design through generation of innovative concepts and optimization of materials.

This incorporation of AI leads to enhanced product reliability, production efficiency, and accelerated innovation cycles, positioning the pharmaceutical blister packaging market for unprecedented technological advancement in the near future.

𝐆𝐞𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.precedenceresearch.com/sample/6703

What Drives the Market’s Strong Growth?

The growth is fuelled by the surge in e-pharmacy platforms and mounting demand for tamper-evident and child-resistant packaging, ensuring safety and compliance. Innovations like cold form foil technology significantly heighten protection against moisture, light, and oxygen, extending drug shelf life. The expansion of generic drug manufacturing scales demand for cost-effective and efficient packaging. Furthermore, rising chronic disease prevalence boosts medication consumption globally.

What Opportunities and Trends Are Emerging?

Could sustainable and smart packaging solutions redefine the pharmaceutical blister packaging landscape? Increasing environmental concerns drive the growth of eco-friendly paper-based blister packs and recyclable materials. Integration of IoT and digitalization enables smart packaging capabilities, offering real-time monitoring and improving supply chain transparency. Personalized medication packs and anti-counterfeit technologies represent further opportunities, addressing patient adherence and counterfeit drug challenges.

Pharmaceutical Blister Packaging Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 45.46 Billion |

| Market Size in 2025 | USD 23.41 Billion |

| Market Size in 2024 | USD 21.75 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.65% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Blister Type, Material Composition, Drug Form, Technology Used, Functionality, Packaging Format, Distribution Channel, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Pharmaceutical Blister Packaging Market Regional and Segmental Overview

North America maintains its dominance, backed by advanced healthcare infrastructure and strong regulatory standards. Asia Pacific leads in growth, driven by government support and rapid technological adoption. Europe, Latin America, and MEA present steady growth opportunities.

By blister type, thermoformed packaging is the predominant choice due to cost-efficiency and customization, while paper-based blister types are gaining popularity for sustainability. Plastic-based films dominate material composition, but multi-layer laminates are expanding for superior barrier properties. Solid oral dosage forms command the largest share in drug forms, though transdermal patches are rapidly gaining traction.

Packaging formats such as standard blister packs hold the largest market share, while blister wallets and cards are increasingly preferred for their protective attributes. Direct-to-pharma distribution leads, bolstered by the e-pharma boom, complemented by rapid expansion in online pharmacy channels.

Pharmaceutical Blister Packaging Market Companies

- Winpak

- WestRock

- VinylPlus

- Tjoapack

- Tekni-Plex

- Syensqo

- Sudpack

- Sonoco

- Romaco

- Rohrer

- Renolit

- Huhtamaki

- Honeywell

- Dow

- Constantia

- Carcano

- Caprihans

- Borealis

- Aptar

- Amcor

- ACG

What Challenges and Cost Pressures Exist?

Despite growth, challenges such as moisture ingress, packaging breakage due to substandard materials, and regulatory compliance costs persist. Balancing sustainability with cost-effectiveness remains critical as manufacturers invest heavily in R&D to develop robust yet eco-friendly packaging materials.

Case Study Highlight

A leading pharma manufacturer adopted AI-powered blister packaging inspection combined with cold-form foil technology, achieving a 40% reduction in production defects and extending drug shelf life by 25%, significantly improving patient safety and lowering operational costs.

Explore the Future with Precedence Research

To delve deeper into detailed market data, segmentation, and forecasts, download the comprehensive Pharmaceutical Blister Packaging Market report on Precedence Research. Schedule a meeting with our expert analysts to explore tailored insights and strategic opportunities.

This data-driven and forward-looking overview aims to equip industry stakeholders with actionable intelligence, facilitating informed decisions in a rapidly evolving pharmaceutical packaging ecosystem.

Read Also: Pharmaceutical Blister Packaging Market Companies

For inquiries or to request discounts, bulk purchases, or customization, contact sales@precedenceresearch.com.