North America leads, Asia Pacific emerges as fastest growth engine – driven by AI, genomics, and rising consumer wellness demand

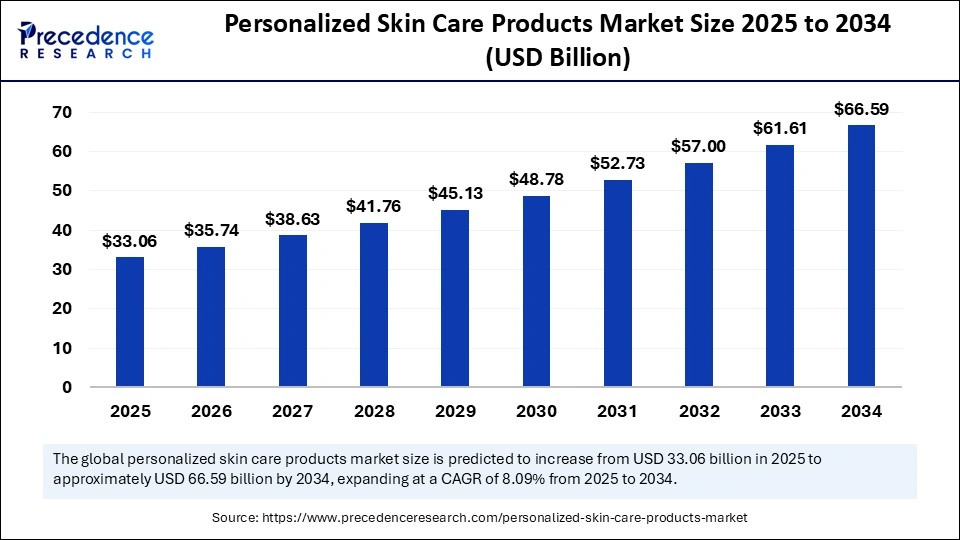

The personalized skin care products market achieved a valuation of USD 30.59 billion in 2024 and is projected to surge from USD 33.06 billion in 2025 to USD 66.59 billion by 2034, expanding at a CAGR of 8.09%.

This growth is powered by increasing consumer demand for tailored solutions addressing unique skin types and concerns, supported by advancements in AI analytics, genetic profiling, and biotechnology. Factors such as rising awareness of skin health, demand for natural and clean beauty, and the ubiquity of e-commerce platforms are reshaping industry dynamics.

Market Highlights

-

The market reached USD 30.59 billion in 2024.

-

Forecasted to grow to USD 33.06 billion in 2025 and USD 66.59 billion by 2034.

-

CAGR for 2025-2034 stands at 8.09%.

-

North America holds the largest share (42%), driven by advanced tech infrastructure and high consumer spending.

-

Asia Pacific is the fastest-growing region, evolving through digital adoption and cultural beauty focus.

-

U.S. market alone is set to hit USD 21.93 billion by 2034.

-

Moisturizers and creams dominate the product segment (35% market share) while serums and oils experience fastest segmental growth.

-

AI and machine learning technologies comprise the largest technology segment (40%), followed by rapid adoption in genetic testing.

-

Women account for 60% of the consumer base, but men are the fastest-growing demographic due to changing norms.

Revenue Breakdown Table

| Year | Global Market Value (USD Billion) | U.S. Market Value (USD Billion) |

|---|---|---|

| 2024 | 30.59 | 9.89 |

| 2025 | 33.06 | 10.69 |

| 2034 | 66.59 | 21.93 |

Artificial intelligence and machine learning tools are revolutionizing the personalized skin care products market. AI platforms enable brands to capture and process vast amounts of consumer skin data, including facial scans, lifestyle inputs, and biometric information, generating highly nuanced and adaptive product recommendations. Smartphone apps now offer dermatologist-level diagnostics, while AR tools simulate treatment outcomes, bridging the gap between technology and personal biology.

Moreover, predictive customization ensures products evolve alongside users’ changing needs. The accessibility of AI-powered skin analysis democratizes the space, making expert care routine for millions. As genetic testing becomes more integrated, consumers can access solutions at the cellular level, laying the groundwork for bespoke preventative treatments; this shift blurs traditional boundaries between cosmetics and healthcare.

What’s Driving Market Growth in Personalized Skin Care?

Several factors underpin the rise of personalized skin care:

-

Heightened consumer awareness of skin health and efficacy of tailored products.

-

Increasing adoption of direct-to-consumer models and e-commerce, widening market access.

-

Major advances in biotechnology and digital diagnostics, boosting ingredient innovation and precise formulation.

-

Rising interest in preventative wellness through skincare, not merely cosmetic enhancement.

The Price of Exclusivity: What Challenges Face the Market?

Moving towards individualization comes with its own set of cost and operational challenges:

-

Bespoke products generally command premium pricing, limiting accessibility for lower-income groups.

-

Complex diagnostic platforms and genetic testing require substantial investment—technology costs are difficult to scale down.

-

Consumer privacy concerns around biometric and genetic data remain, requiring robust safeguards and transparent practices.

-

The risk of overpromising benefits can erode consumer trust in younger brands, making credibility a key differentiator.

Opportunities & Trends:

Is Skincare Becoming Healthcare?

Brands are integrating preventive solutions for conditions like eczema, rosacea, and early aging, entering the health and wellness continuum. Corporate wellness partnerships, dermatology ties, and app-based diagnostics are expanding access, defining a new era where “skin care” means holistic self-care.

Are E-commerce Channels Reshaping Beauty Consumption?

Online platforms now account for 35% of market share, supported by virtual consultations, digital try-ons, and subscription boxes. These platforms nurture niche brands, enabling worldwide consumer access, while adaptive subscription models deepen brand relationships via iterative feedback and personalization.

Is Men’s Skin Care Really Surging?

Men’s personalized skin care is the sector’s fastest-growing demographic.

Men increasingly seek tailored regimens for concerns like oil control, sensitivity, and post-shaving care, supported by gender-neutral branding and targeted digital campaigns. This shift is expanding market boundaries and accelerating experimentation.

Regional and Segment Analysis

-

North America: Dominates with 42% market share due to high tech adoption, strong consumer demand, and collaborative innovation between cosmetic companies and dermatologists. The U.S. is a trendsetter, with diverse demographic preferences and fast expansion in e-commerce.

-

Asia Pacific: Fastest-growing region, propelled by digital diagnostics, rising incomes, and cross-cultural product innovation (notably China, South Korea, India). South Korea leads with rapid product cycles and digital-cultural blending.

Segment Highlights:

-

Moisturizers & creams hold the largest product share (35%): daily use and versatile customization.

-

Serums & oils: fastest-growing, targeting concentrated skin issues.

-

AI-driven diagnostics: 40% share in technology segment, making personalized consultations mainstream.

-

Genetic testing/genomics: fastest-growing tech, driving bespoke solutions at the DNA level.

-

Anti-aging: 38% share, driven by consumer desire for youth-preserving formulations.

-

Acne & blemishes: fastest-growing segment, fueled by e-commerce and targeted solutions for younger consumers.

-

E-commerce/online: 35% market share, transforming retail and consumer-brand relationships.

-

Direct-to-consumer subscriptions: fastest-growing channel, fostering routine and loyalty.

-

Women: 60% share, leading demand for personalized solutions; men’s segment is surging in growth.

Top Personalized Skin Care Products Market Companies

- L’Oréal S.A. – Global beauty giant offering makeup, skincare, haircare, and dermatologic brands across all market tiers.

- Estée Lauder Companies Inc. – U.S. premium cosmetics and skincare firm with brands like Estée Lauder, MAC, Clinique, and La Mer.

- Procter & Gamble Co. – Consumer goods conglomerate owning skincare and personal care brands such as Olay, SK-II (via license), and others.

- Unilever PLC – Multinational with a broad personal care portfolio (Dove, Lux, Axe) and growing interest in beauty & skincare.

- Johnson & Johnson – Healthcare and consumer products leader with skincare brands like Neutrogena, Clean & Clear, and dermatology products.

- Shiseido Company, Limited – Japanese prestige beauty company with emphasis on skincare, cosmetics, and Asian beauty innovations.

- Beiersdorf AG – German company best known for NIVEA, Eucerin, La Prairie, focusing on skin care, personal care, and premium dermatology.

- Amorepacific Corporation – South Korean beauty powerhouse with brands like Sulwhasoo, Innisfree, Laneige, leading in K-beauty.

- Coty Inc. – Global beauty company focused on fragrances, color cosmetics, and skincare brands.

- Avon Products Inc. – Direct sales pioneer in cosmetics and skincare, with a strong presence in emerging markets.

- Perfect Corp. – Technology company offering augmented reality (AR) and AI tools for virtual try-on and beauty personalization.

- Curology – Teledermatology & skincare startup offering customized prescription and over-the-counter skincare regimens.

- Proven Skincare – AI-driven skincare brand that customizes products based on user data and skin profiles.

- Function of Beauty – Direct-to-consumer beauty brand making customizable hair, skin, and body care products.

- SkinCeuticals – Skincare brand under L’Oréal that specializes in advanced, science-backed dermatologic products.

- Dermalogica – Professional skincare brand known for salon/therapist-distributed formulas and clean formulations.

- Clinique (Estée Lauder) – Dermatologist-developed cosmetics and skincare brand, known for allergy-tested, fragrance-free formulas.

- La Roche-Posay (L’Oréal) – Dermatologist-recommended French skincare brand focused on sensitive skin, SPF, and therapeutic formulas.

- Neutrogena (Johnson & Johnson) – Widely distributed, pharmaceutical-grade skincare and cosmetics brand accessible in mass markets.

- Clarins Group – French luxury skincare and cosmetics company emphasizing plant-based ingredients and spa heritage.

Challenges & Cost Pressures

-

Premium pricing and technology costs restrict access for some consumer groups.

-

Data security and privacy concerns require diligence and transparency.

-

Maintaining efficacy and credibility while scaling up remains a hurdle for fast-growing brands.

Case Study: Procter & Gamble (P&G) – Olay Skin Advisor 2.0

Headquarters: Cincinnati, Ohio, USA

Offering: AI-powered mobile skincare analysis and customized product recommendations

Detailed Case Study:

In 2025, P&G launched Olay Skin Advisor 2.0, an upgraded version of its digital skincare consultant using deep neural networks and computer vision. The platform analyzed over 4 million selfies and user profiles to recommend personalized skincare regimens based on age, skin tone, and lifestyle habits. Integrated with AR try-on and e-commerce, it bridged digital experience with in-store purchases.

Outcome:

Olay’s personalized range saw a 50% boost in online conversions, and customer satisfaction scores increased by 35%. The solution also reduced product return rates by 22%.

Protectional:

All user images were anonymized and processed through P&G’s secure data framework, compliant with U.S. and EU privacy standards, protecting user biometrics and purchase behavior data.

Impact of the Market:

P&G’s innovation pushed the beauty industry toward data-driven consumer insights, influencing retailers to adopt AI personalization for product bundling and recommendations.

Financial After Implementation:

P&G’s skincare division recorded $400 million in incremental sales, marking its strongest digital quarter in over a decade.

Read Also: 3D Protein Structures Analysis Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344