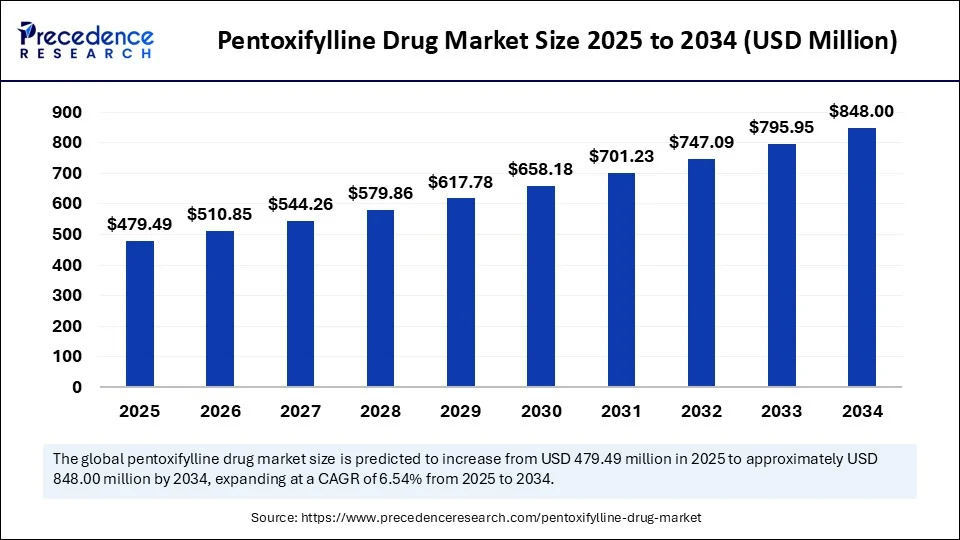

The global pentoxifylline drug market is on a strong upward trajectory, expected to grow from USD 479.49 million in 2025 to approximately USD 848.00 million by 2034.

This growth is fueled by the increasing prevalence of peripheral artery diseases (PAD) and chronic blood circulation disorders worldwide, alongside pentoxifylline’s proven clinical efficacy in improving blood flow and managing vascular conditions. The expanding use of pentoxifylline in treating diabetic neuropathy and microcirculatory complications further propels this momentum.

What Are the Quick Insights for the Pentoxifylline Drug Market?

-

The market was valued at USD 450.06 million in 2024 and is forecasted to expand at a 6.54% CAGR through 2034.

-

North America stood as the dominant region in 2024, led by the U.S. market with a valuation of USD 110.26 million.

-

Asia Pacific is the fastest-growing region due to demographic shifts and rising disease prevalence.

-

Tablets remain the leading dosage form segment, while injections are the fastest-growing due to novel drug delivery advances.

-

Key global players active in this space include Sanofi, Apotex, CSPC Ouyi Pharmaceutical, Sun Pharma, Teva, and Zydus Cadila.

-

The U.S. pentoxifylline market aims to reach USD 212.23 million by 2034, growing at a CAGR of 6.77%.

-

Digital clinical trials such as the upcoming RECLAIM study in Canada highlight the evolving therapeutic scope of pentoxifylline.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6619

What Is Driving Pentoxifylline Market Growth?

The principal growth driver is the soaring incidence of peripheral arterial disease among an aging global population. Pentoxifylline’s ability to increase red blood cell flexibility, reduce blood viscosity, and improve tissue oxygenation underpins its clinical value in managing symptoms like intermittent claudication. Furthermore, increasing diabetic cases worldwide and attention on microvascular complications are expanding its use in diabetic neuropathy and potentially diabetic kidney disease.

How Is Artificial Intelligence Shaping the Pentoxifylline Market?

AI is playing a transformative role in accelerating drug research and optimizing pentoxifylline therapies. By analyzing extensive clinical and molecular data, AI algorithms predict drug efficacy, toxicity, and pharmacokinetics more efficiently, minimizing the need for exhaustive laboratory testing. AI also identifies new molecular targets and therapeutic applications, potentially leading to novel formulations or expanded uses beyond vascular disorders. This intelligent data-driven approach could significantly boost R&D productivity and patient outcomes in the pentoxifylline market.

What Market Opportunities and Trends Are Emerging?

-

Could pentoxifylline’s anti-inflammatory and anti-fibrotic effects unlock new treatment options for diabetic kidney disease or nonalcoholic steatohepatitis?

-

Will innovations in sustained-release and nano-encapsulation propel injectable pentoxifylline as a preferred choice in acute vascular conditions?

-

How will online pharmacy growth impact accessibility and affordability in emerging markets?

Pentoxifylline Drug Market Regional and Segment Landscape

-

North America remains the largest market due to advanced healthcare infrastructure, high PAD prevalence, and pharmaceutical innovation hubs.

-

Asia Pacific exhibits the fastest expansion, driven by a rapidly aging population, escalating PAD cases, healthcare improvements, and emerging manufacturing hubs in India and South Korea.

-

Europe, Latin America, and Middle East & Africa markets are growing steadily, supported by increasing disease awareness and healthcare modernization efforts.

By dosage form, tablets dominate due to ease of use and patient adherence, whereas injections are gaining attention for broader clinical applications and improved bioavailability. Oral administration leads by convenience and compliance, while IV/injectables see rapid growth in acute care. Among indications, peripheral vascular disease holds the largest share, followed by rapidly growing diabetic neuropathy segments.

Distribution channels reflect hospital pharmacies’ dominance driven by chronic disease programs, with online pharmacies emerging as the fastest-growing segment thanks to convenience and cost advantages.

Latest Breakthroughs and Key Players

Clinical trials like the RECLAIM study on Long COVID in Canada highlight pentoxifylline’s expanding research footprint. Companies spearheading innovations include Sanofi, Apotex, CSPC Ouyi Pharmaceutical, Sun Pharmaceutical, Teva, Zydus Cadila, Sandoz, Mylan, Pfizer, and ANI Pharmaceuticals. These leaders focus on enhancing formulations, exploring new indications, and improving global drug access.

Challenges and Cost Pressures

The rise of generic alternatives and alternative therapies exerts pricing pressures, limiting profitability for branded products. Side effect profiles and stringent regulatory landscapes challenge new formulation approvals. Nonetheless, ongoing research into novel indications and formulations offers avenues to mitigate these constraints.

Case Study: RECLAIM Trial in Canada

The upcoming adaptive clinical trial involving 800-1,000 participants will assess pentoxifylline’s efficacy in alleviating Long COVID symptoms. This study underscores the drug’s evolving role from vascular therapy to addressing complex post-viral syndromes, potentially opening new market segments and patient populations.

Read Also: Diabetes Nutrition Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344