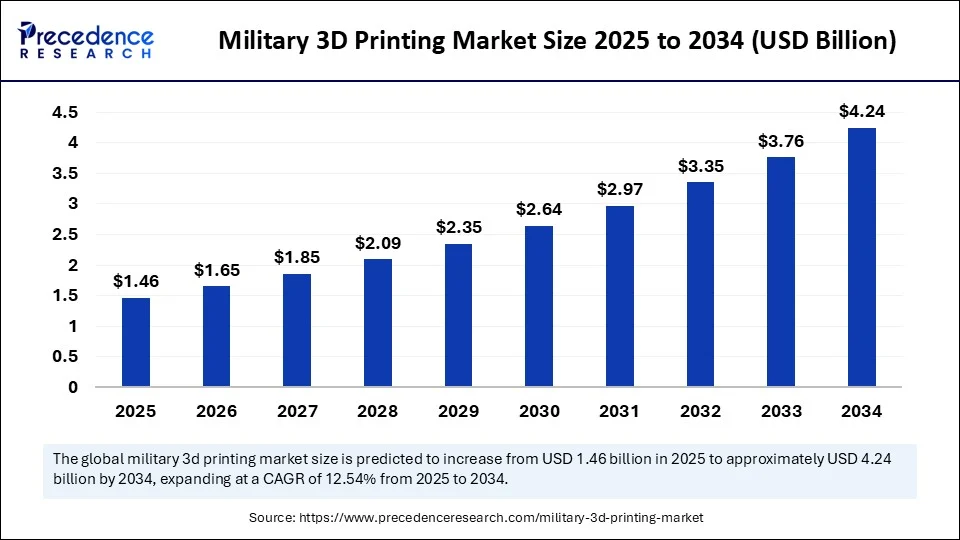

The military 3D printing market is projected to grow from USD 1.30 billion in 2024, through USD 1.46 billion in 2025, and skyrocket to USD 4.24 billion by 2034, fueled by global defense upgrading initiatives, rising geopolitical tensions, and the increasing adoption of fast, decentralized manufacturing across military command structures.

Turbocharged Growth in Modern Defense

Accelerating at a CAGR of 12.54% between 2025 and 2034, the defense sector is leveraging 3D printing to manufacture mission-critical parts, prototypes, and customized equipment for battlefield and base environments. Key drivers include rapid prototyping, supply chain resilience, and new material innovations.

Military 3D Printing Market Quick Insights

- The military 3D printing market was valued at USD 1.30 billion in 2024 and is forecast to surpass USD 4.24 billion by 2034.

-

North America holds the largest market share, buoyed by advanced defense infrastructure and R&D investment, while Asia-Pacific is expected to be the fastest-growing region due to increasing defense budgets and tech adoption.

-

The U.S. market alone will expand from USD 327.60 million in 2024 to USD 1,091.06 million by 2034.

-

Fused Deposition Modeling (FDM) remains the most widely adopted technology, offering quick, cost-effective, and material-efficient manufacturing.

-

Metals & alloys dominate material segments for their strength, while ceramics & composites are on a rapid growth course for specialized uses.

-

The Army is the lead end user, and the Air Force is the fastest adopter due to high-performance aerospace component needs.

-

Direct procurement is the dominant distribution model, as militaries prefer tight control over confidential manufacturing processes.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6694

Military 3D Printing Market Revenue Table: Global and U.S. Market Breakdown

| Year | Global Market Value (USD Billion) | U.S. Market Value (USD Million) |

|---|---|---|

| 2024 | 1.30 | 327.60 |

| 2025 | 1.46 | 367.92 |

| 2034 | 4.24 | 1,091.06 |

Artificial Intelligence is revolutionizing military 3D printing by enabling smarter design, predictive maintenance, and manufacturing optimization. AI algorithms simulate battlefield conditions to refine, test, and strengthen prototypes before physical production, securing equipment durability and mission success. Additionally, machine learning models streamline supply chain planning and quality control, detecting flaws and reducing waste for reliable, high-speed delivery. This convergence supports autonomous manufacturing units, capable of functioning independently in conflict zones and remote setups.

Market Growth Factors: Powering the Shift

Defense modernization programs, rapid R&D, and demand for on-site, decentralized manufacturing are the backbone of market growth. Advanced polymer and metal printing technologies enable the production of vital equipment at the point of need, minimizing logistics, downtime, and operational vulnerability.

Are Military Logistics Ready for Transformation?

Can on-demand manufacturing reshape military logistics and enable real-time response in critical missions? The push is on to streamline supply chains and gain operational independence, with 3D printing offering a dramatic reduction in inventory and transport risks. Defense forces now fabricate spare parts and mission tools directly at bases—slashing turnaround time and boosting battlefield resilience.

Military 3D Printing Market Regional and Segmentation Analysis

North America

North America leads the military 3D printing market, largely due to its advanced infrastructure and extensive research and development (R&D) capabilities. The region benefits from strong defense budgets and investment in cutting-edge additive manufacturing technologies. The U.S., in particular, has a robust ecosystem of defense contractors, technology developers, and academic institutions working collectively to accelerate deployment of 3D printing in military applications. Additionally, tight integration of supply chains and government support foster innovation and rapid adoption of advanced manufacturing techniques across Army, Air Force, and Navy sectors.

Asia-Pacific

Asia-Pacific is the fastest-growing market for military 3D printing, propelled by rising defense budgets in countries like China, India, South Korea, and Japan. These nations are keenly focusing on enhancing defense self-sufficiency and technological innovation, which includes adopting 3D printing for rapid prototyping, spare parts manufacturing, and medical applications on the battlefield. Government policies supporting modernization and indigenous manufacturing also drive growth in this region. The increased collaboration between defense agencies and private sector startups further fuels innovation and market expansion.

Segmentation Overview

By Technology

-

Fused Deposition Modeling (FDM): FDM holds the largest market share in 2024 due to its cost-effectiveness and suitability for rapid prototyping. This technology extrudes thermoplastic material layer by layer, making it ideal for producing quick, relatively low-cost parts and components for tactical needs. Its widespread use is attributed to ease of use, relatively low investment cost, and availability of a wide range of materials.

-

Direct Metal Laser Sintering/Selective Laser Melting (DML/SLM): DML/SLM technologies are the fastest-growing segment. These powder bed fusion methods allow manufacturing of high-strength, complex metal parts with exceptional precision. They are critical in producing aerospace components, armored vehicle parts, and other high-performance military equipment requiring superior mechanical properties and durability.

By Material

-

Metals & Alloys: This segment dominates due to the critical requirement for durable and heat-resistant components in military hardware. Metals such as titanium, aluminum, and specialized alloys are commonly used to manufacture structural components, weapons, and vehicle parts that must withstand extreme conditions including heat, pressure, and mechanical stress.

-

Ceramics & Composites: Experiencing rapid growth, ceramics and composites are increasingly used for applications needing lightweight and heat-resistant materials. These materials are especially important for protective armor and high-performance aerospace components. Their ability to reduce weight while maintaining strength is vital for operational efficiency and fuel savings in aircraft and armored vehicles.

By Application

-

Functional Parts Manufacture: This is the leading application area, with militaries leveraging 3D printing to produce functional parts on demand (e.g., spare parts, tools) to maintain operational continuity. On-site production reduces logistics costs and downtime by minimizing the need to transport bulky or sensitive parts from factories, enabling customization tailored to specific mission requirements.

-

Medical & Bioprinting: The fastest-growing segment supports battlefield medical care, including the production of customized implants and prosthetics. Advanced biomaterials allow for printing medical supplies and tissues on-site, improving trauma management and accelerating recovery for injured personnel.

By End User

-

Army: The largest consumer of military 3D printing technology, given the broad operational scope requiring various parts from weapons to vehicles and logistical tools. The Army’s vast and diverse needs underpin its significant use of additive manufacturing to enhance field readiness and flexibility.

-

Air Force: The fastest-growing end user, driven by the demand for lightweight and fuel-efficient aerospace components. Rapid prototyping is also critical in the Air Force, allowing quick iteration of designs and manufacturing of parts for aircraft, drones, and other aerial vehicles.

By Distribution Model

-

Direct Procurement: The preferred procurement method among militaries to retain control and confidentiality over manufacturing processes and intellectual property. Direct procurement ensures that sensitive parts and blueprints remain secure, facilitating onsite or in-house production tailored to specific operational needs.

-

Additive Manufacturing Service Providers: This model is expanding rapidly as it allows defense agencies to access specialized expertise, advanced technologies, and capabilities without the need for heavy upfront investment in equipment and skilled labor. Service providers also enable scalability and flexibility in meeting fluctuating production demands.

Military 3D Printing Market Companies

- 3D Systems Corporation

- Stratasys Ltd.

- EOS GmbH

- ExOne (Desktop Metal)

- GE Additive

- SLM Solutions Group AG

- Renishaw plc

- Materialise NV

- HP Inc.

Why Are Security, Cost, and Standards Still Roadblocks?

The sector faces persistent challenges around cybersecurity, quality standardization, and high deployment costs. Digital blueprint vulnerability, lack of uniform component standards, and skilled workforce requirements slow market expansion. Geopolitical restrictions and supply chain risks remain critical concerns, mandating greater investment in secure, certified additive manufacturing processes.

Case Study: Deploying Mobile 3D Printing Units in Combat Zones

For example, U.S. military field bases have successfully employed mobile 3D printing units to fabricate essential vehicle spares and medical tools, enhancing operational efficiency and lowering supply-chain dependency—even in high-risk environments.

Read Also: Underwater LiDAR Market

Want a Deeper Dive? Request Sample/Meeting

Discover how military 3D printing is redefining defense manufacturing standards. Download a free sample report or schedule a meeting with our market specialists at Precedence Research to explore the full report and customized advisory. Contact: sales@precedenceresearch.com