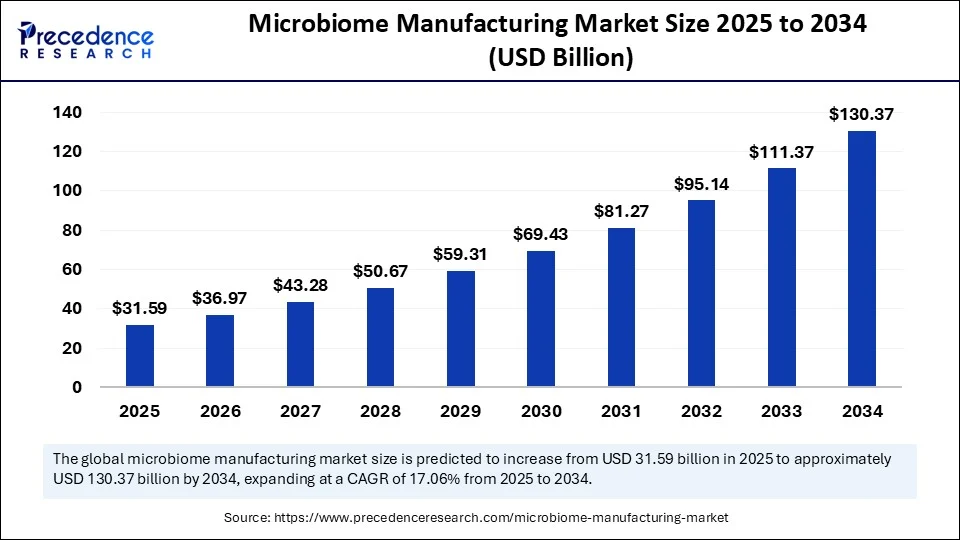

The global microbiome manufacturing market, valued at USD 26.98 billion in 2024, is poised for exponential growth, expected to reach approximately USD 130.37 billion by 2034. Fueled by a robust CAGR of 17.06% from 2025 to 2034, the market’s ascent is propelled by mounting investments in microbiome research, breakthroughs in live microbial therapeutics, and expansion of GMP-compliant manufacturing capabilities.

What’s Powering the Microbiome Manufacturing Market Growth?

The market’s rapid expansion is being driven by the increasing prevalence of chronic and lifestyle diseases such as gastrointestinal disorders, autoimmune conditions, metabolic syndromes, and obesity. These health challenges have accelerated the adoption of microbiome-based therapies targeting underlying microbial imbalances rather than just symptoms. Coupled with enhanced regulatory approvals of live microbial therapeutics and advanced bioprocessing technologies, microbiome manufacturing is emerging as a key pillar of future healthcare innovation.

Microbiome Manufacturing Market Key Insights

-

The global market size stood at USD 26.98 billion in 2024 and is forecasted to surge to USD 130.37 billion by 2034, reflecting a CAGR of 17.06%.

-

North America dominated the market in 2024, driven by pioneering biotech firms, academic-industry collaborations, and supportive regulatory frameworks.

-

The Asia-Pacific region is the fastest-growing market segment, bolstered by increased R&D investments, government support, and emerging microbiome consortia.

-

The U.S. microbiome manufacturing market alone is projected to escalate from USD 7.55 billion in 2024 to USD 37.22 billion by 2034.

-

Probiotics led product segments with roughly 40% market share in 2024, providing stable, shelf-stable health solutions.

-

Fermentation technology accounted for 50% of manufacturing process revenue, with anaerobic fermenters dominating platforms (45% share).

-

Pharmaceutical and biotechnology companies were the largest end-users, while contract development and manufacturing organizations (CDMOs) are the fastest-growing segment.

-

Leading players reinforcing the market include Lonza, among others driving microbial biologics and drug-product services expansions.

Microbiome Manufacturing Market Revenue Breakdown (USD Billion)

| Year | Market Size (Global) | U.S. Market Size |

|---|---|---|

| 2024 | 26.98 | 7.55 |

| 2025 | 31.59 | 8.85 |

| 2034 | 130.37 | 37.22 |

How is AI Revolutionizing Microbiome Manufacturing?

Artificial Intelligence plays a transformative role in microbiome manufacturing by optimizing entire production value chains. AI-driven platforms enable researchers to decode complex microbial communities and pinpoint therapeutically promising strains.

Real-time fermentation controls driven by AI adjust nutrient feeds and environmental parameters to maximize yield and consistency while minimizing waste. This powerful integration enhances product reliability and scalability, accelerating market growth and helping companies meet rising demand more cost-effectively.

Moreover, AI solutions are instrumental in streamlining quality control and regulatory compliance by enabling predictive analytics for batch consistency and process optimization. This positions microbiome manufacturers to overcome traditional production challenges and deliver advanced microbial therapeutics with improved precision.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/sample/6708

What Key Factors are Driving Market Expansion?

Rising investments in large-scale microbiome R&D initiatives, regulatory approvals such as the U.S. FDA’s landmark Vowst and Rebyota microbial therapeutic authorizations, and expanding GMP manufacturing infrastructures are fundamental growth drivers.

In North America, strong funding from organizations like NIH and strategic industry-academic partnerships expedite clinical-to-commercial pipelines. Asia-Pacific’s fast growth reflects enhanced regulatory transparency and collaborative microbiome consortia, notably initiatives in India fostering clinical trials and training specialized bioprocess teams.

The surge in chronic disease prevalence worldwide, including obesity and inflammatory bowel diseases, further fuels demand for microbiome-based interventions. Advances in bioprocessing technology and the growing requirement for precision medicine also contribute significantly to the market’s momentum.

What Emerging Opportunities and Trends Could Shape the Market?

-

How will microbiome-based therapies expand beyond gastrointestinal disorders into broader chronic disease applications?

-

Can innovations in fermentation and microfluidic culturing enhance the scalability and customization of live biotherapeutics?

-

What impact will increasing CDMO collaborations have on reducing production complexities and costs?

-

Will AI-driven biomanufacturing platforms become a standard in microbial therapeutic production globally?

Regional and Segmentation Highlights

In 2024, North America led with the highest market share due to its advanced clinical pipelines, regulatory support, and concentration of biotechs and research institutes, such as Harvard Medical School and UC San Diego.

Asia-Pacific is rapidly expanding, driven by government-backed initiatives, multinational sponsor alliances, and regulatory clarity. Europe, Latin America, and the Middle East & Africa also contribute steadily with growing R&D investments.

Segment-wise, probiotics maintain dominance in product types with strong consumer adoption, while live biotherapeutics demonstrate the fastest growth trajectory fueled by clinical advancements and regulatory acceptance.

Fermentation remains the core manufacturing process, but formulation and packaging technologies are rising quickly to address stability and delivery challenges.

Pharmaceutical & biotech companies are the largest end-users, with CDMOs gaining momentum by facilitating outsourced complex manufacturing.

Notable Industry Breakthroughs and Players

The adoption of anaerobic fermentation systems and real-time environmental monitoring reflects the industry’s move towards higher precision and compliance. Strategic partnerships among tech firms, pharmaceutical giants, and biotech startups continue to accelerate innovation pipelines and commercial rollouts.

Microbiome Manufacturing Market Companies

- 4D Pharma

- ActoBio Therapeutics

- AOBiome

- Axcella Health

- BioGaia

- BiomX

- Enterome

- Exeliom Biosciences

- Ferring Pharmaceuticals

- Finch Therapeutics

- MaaT Pharma

- Microbiotica

- NuBiyota

- Prokarium

- Rebiotix (a Ferring Company)

- Second Genome

- Seres Therapeutics

- Synlogic

- Vedanta Biosciences

- Evelo Biosciences

Market Challenges and Cost Pressures

Despite growth prospects, microbiome manufacturing faces challenges such as high process complexity due to stringent growth conditions for diverse microbial strains. Batch-to-batch variation risks can lead to product rejections, increasing operational costs and pressuring profit margins. Scaling advanced fermentation systems while maintaining product consistency remains a hurdle. Additionally, high capital expenditures for GMP-compliant facilities and regulatory hurdles challenge new entrants.

Case Study: Accelerating Microbiome Manufacturing Scale-Up

In 2024, a leading CDMO partnered with biotech innovators to implement AI-controlled anaerobic fermentation and advanced formulation processes, reducing batch lead times by 25% and increasing yield consistency by 30%. This pilot project showcased how integrating AI and digital biomanufacturing platforms can overcome traditional microbial cultivation challenges and fast-track product commercialization.

Read Also: U.S. Digital Health in Neurology Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344