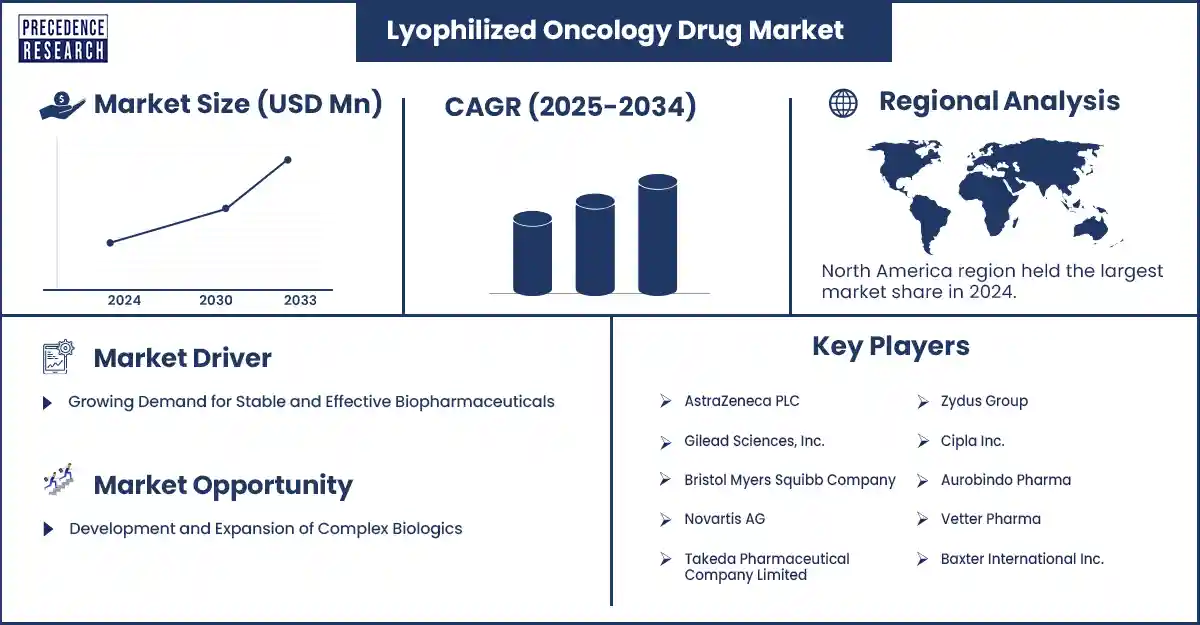

The global lyophilized oncology drug market is poised for substantial growth, fueled by rising cancer incidence and increasing adoption of biologic therapies that require enhanced stability and extended shelf life. Forecasted to grow steadily at a notable compound annual growth rate (CAGR) from 2025 to 2034, lyophilized formulations are becoming essential for preserving the potency of temperature-sensitive cancer therapeutics. Innovations in freeze-drying technology and supportive cold-chain logistics are further catalyzing the market expansion, making these drugs more accessible globally.

Lyophilized Oncology Drug Market Key Insights

-

The lyophilized oncology drug market held a significant valuation in 2024, reflecting growing demand for stable cancer biologics.

-

North America dominates the market with approximately 42% share, underpinned by advanced healthcare infrastructure and regulatory support.

-

Asia Pacific is the fastest-growing region, led by increasing cancer burden and enhanced healthcare investments.

-

Biologics account for about 42% market share due to their sensitivity and therapeutic superiority.

-

Powders for injection are the most popular formulation type, representing around 55% share of the market.

-

Intravenous administration holds about 65% of the market share, favored for rapid and effective drug delivery.

-

Major companies span tiers from top global players to niche regional innovators, driving product development and distribution.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/sample/6982

Lyophilized Oncology Drug Market Segmentation

The lyophilized oncology drug market segments by drug type, formulation, therapeutic application, route of administration, end user, and region reveal diverse dynamics:

| Segment | Leading Share | Growth Insight |

|---|---|---|

| Drug Type | Biologics (42%) | Fastest growth in peptide-based therapies |

| Formulation | Powders for injection (55%) | Fastest CAGR in oral reconstitution powders |

| Therapeutic Application | Solid Tumors (60%) | The hematologic cancers segment is the fastest-growing |

| Route of Administration | Intravenous (IV) (65%) | Subcutaneous (SC) fastest growth |

| End User | Hospital & Cancer Treatment Centers (50%) | Specialty pharmacies are growing quickly |

| Region | North America (42%) | Asia-Pacific fastest growing |

Artificial intelligence (AI) is revolutionizing the lyophilized oncology drug landscape by accelerating drug discovery and optimizing manufacturing techniques. During the development phase, AI algorithms analyze vast biological datasets to identify novel cancer targets and potential drug candidates, enabling the rapid repurposing and formulation of therapies.

In manufacturing, AI-driven predictive models refine freeze-drying cycles to enhance drug stability, reduce production time, and improve consistency. This integration results in higher-quality formulations, faster time-to-market, and a streamlined supply chain, which are crucial for maintaining the potency of sensitive oncology biologics.

Lyophilized Oncology Drug Market Growth Factors

The market growth is primarily propelled by:

-

Rising cancer incidence worldwide, increasing demand for effective therapies.

-

Advancements in biologic drug development require improved preservation.

-

Enhanced lyophilization techniques and cold-chain logistics supporting global distribution.

-

Regulatory approvals favoring novel lyophilized formulations that extend drug shelf life.

-

Increasing use of combination and personalized medicine approaches in oncology.

Opportunities and Trends: What Drives Future Market Potential?

What makes lyophilized biologics the dominant segment?

Biologic drugs are inherently unstable in liquid form and require lyophilization to maintain potency and safety during storage and transit. Their high specificity to cancer cells results in superior therapeutic outcomes, making lyophilized biologics indispensable in modern oncology.

Why is Asia Pacific the fastest-growing market?

The Asia Pacific region benefits from a high cancer burden, improving healthcare infrastructure, supportive governmental policies, and cost-effective manufacturing, fostering a favorable environment for lyophilized oncology drug growth.

How are new drug delivery systems impacting the market?

Innovations like prefilled syringes and reconstitution devices are enhancing patient convenience and drug safety, driving greater adoption of lyophilized drugs across healthcare settings.

Lyophilized Oncology Drug Market Regional and Segment Analysis

North America leads due to robust healthcare infrastructure, regulatory facilitation like the FDA’s Project Orbis, and high R&D investments. The U.S. is a major contributor with cutting-edge cancer biologics and nanomedicine research. Asia Pacific is rapidly growing, driven by governmental support and a large patient pool, with India emerging as a notable player due to its manufacturing strength and expanding pharmaceutical sector.

Segment-wise, biologics dominate, followed by peptide-based therapies growing fastest due to their efficacy and specificity. Powders for injections are the mainstay formulations, though oral reconstitution powders are gaining traction for patient convenience. Intravenous administration remains dominant, but subcutaneous routes are rapidly expanding, offering ease and cost benefits. Hospitals lead end users, with specialty pharmacies growing due to the complexity of handling advanced oncology drugs.

Top Companies in the Lyophilized Oncology Drug Market and Their Offerings

Tier I – Major Players

These companies dominate the lyophilized oncology drug market with extensive product portfolios, strong global distribution, and significant R&D investment. Collectively, they hold nearly half of the total market revenue.

- Pfizer Inc.: Pfizer leverages its extensive oncology pipeline and advanced lyophilization technologies to deliver stable, effective cancer therapeutics, ensuring improved shelf life and ease of distribution globally.

- Merck & Co., Inc.: Merck’s robust focus on innovative cancer drugs, combined with its expertise in lyophilized formulations, supports the production of high-potency oncology drugs that maintain efficacy and patient safety.

- F. Hoffmann-La Roche Ltd.: Roche utilizes its cutting-edge R&D capabilities and strong global manufacturing network to produce lyophilized oncology drugs, emphasizing biologics and targeted therapies for various cancer types.

- Sanofi S.A.: Sanofi’s contribution stems from its diverse oncology portfolio and commitment to advanced drug delivery systems, including lyophilization, which enhances the stability and usability of injectable cancer treatments.

- Johnson & Johnson Services, Inc.: Johnson & Johnson integrates comprehensive pharmaceutical manufacturing expertise with lyophilization processes to support scalable production of oncology drugs, focusing on innovation and patient-centric formulations.

Tier II – Mid-Level Contributors

These firms maintain a solid market presence with focused oncology pipelines and growing lyophilized drug portfolios, contributing about a third of the overall market revenue.

- AstraZeneca PLC

- Gilead Sciences, Inc.

- Bristol Myers Squibb Company

- Novartis AG

- Takeda Pharmaceutical Company Limited

Tier III – Niche and Regional Players

Smaller companies or those with regional reach that specialize in niche products or contract manufacturing, collectively accounting for roughly 15–20% of the market share.

- Zydus Group

- Cipla Inc.

- Aurobindo Pharma

- Vetter Pharma

- Baxter International Inc.

Challenges and Cost Pressures

Despite promising growth, the market faces hurdles such as high costs and complexity in manufacturing, requiring specialized equipment and infrastructure. Maintaining drug stability during freeze-drying involves adding cryoprotectants, demanding skilled handling. These challenges necessitate substantial upfront investments, potentially limiting entry for smaller players.

Case Study

A recent application of lyophilized oncology drugs involves antibody-drug conjugates (ADCs), which are highly sensitive biological molecules that benefit extensively from freeze-drying. Lyophilized ADCs have demonstrated enhanced stability and extended shelf life, enabling effective targeted cancer therapies with reduced side effects. This case underscores lyophilization’s critical role in improving therapeutic efficacy and logistic feasibility in oncology.

Read Also: Cell Encapsulation Technology Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com | +1 804 441 9344