Livestock Animal Rehabilitation Services Market Size and Growth Outlook

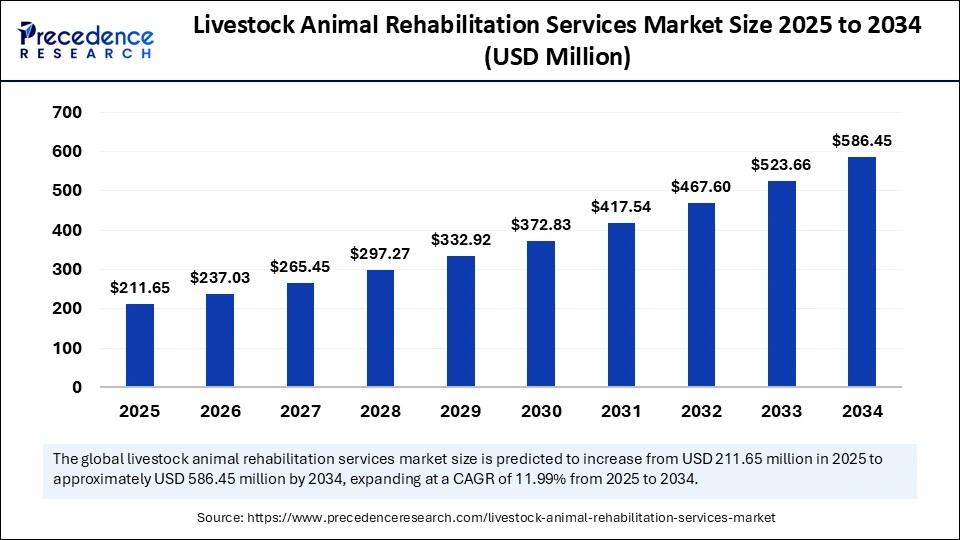

The Livestock Animal Rehabilitation Services Market is poised for significant growth, with its global valuation projected to increase from USD 211.65 million in 2025 to USD 586.45 million by 2034, registering a strong CAGR of 11.99% over the forecast period. In 2024, the market stood at USD 188.99 million, reflecting the increasing attention towards animal welfare, particularly in commercial and sustainable farming practices.

This rising demand is underpinned by a growing awareness among farmers and livestock owners about the benefits of rehabilitation in enhancing animal productivity and quality of life. Moreover, advancements in veterinary diagnostics and treatment modalities are enabling more targeted and efficient rehabilitation services, making them more appealing to veterinary professionals and animal caregivers alike.

Livestock Animal Rehabilitation Services Market Key Takeaways

-

North America dominated the global market with the largest market share of 31% in 2024.

-

Asia Pacific is projected to grow at the fastest CAGR during the forecast period.

-

By animal type, the cattle segment contributed the biggest market share of 45% in 2024.

-

The poultry segment is expected to expand at a significant CAGR of 12.55% during the forecast period.

-

By therapy type, the therapeutic exercises segment captured the largest market share of 23% in 2024.

-

The hydrotherapy segment is projected to grow at the fastest CAGR of 1.63% in the coming years.

-

By indication, the post-surgery segment held a significant market share of 32% in 2024.

-

The acute & chronic diseases segment is expected to grow at the fastest CAGR in the upcoming years.

-

By end use, the veterinary rehab centers and hospitals segment generated the major market share of 44% in 2024.

Role of Artificial Intelligence in Livestock Rehabilitation

Artificial Intelligence (AI) plays a transformative role in the livestock rehabilitation services sector. It is being leveraged to monitor the health and behavior of livestock in real time, allowing for early detection of musculoskeletal disorders, stress indicators, or injuries. AI-driven platforms can predict health issues before clinical symptoms arise, enabling preventive interventions and reducing treatment time.

In addition, AI facilitates precision rehabilitation by tailoring exercise plans and therapies to each animal’s unique condition and recovery pace. In 2024, European researchers developed an AI-based model capable of interpreting pig vocalizations to assess emotional states, which is helping farmers to understand animal welfare at a deeper, more scientific level. This integration of AI not only improves outcomes but also enhances efficiency in farm management, reinforcing its importance in modern livestock rehabilitation.

Country-Level Insight: United States

The U.S. livestock animal rehabilitation services market was valued at USD 43.94 million in 2024 and is forecasted to reach approximately USD 139.47 million by 2034, growing at a CAGR of 12.24%. The country remains a leader due to its highly developed veterinary infrastructure, widespread awareness about animal welfare, and strong government backing.

Programs such as the USDA’s Veterinary Services Grant Program (VSGP) are instrumental in strengthening rural veterinary capacity, directly supporting rehabilitation services. Additionally, the high level of collaboration between public and private veterinary institutions, coupled with ongoing investments in research and education, is fostering a robust environment for market expansion.

Regional Outlook: North America

North America continues to dominate the global market, primarily due to its concentration of certified veterinary rehabilitation professionals, advanced therapeutic technologies, and comprehensive animal welfare standards. The region benefits from substantial government incentives and public initiatives aimed at improving the quality of life for farm animals. In 2024, the USDA announced funding of $3.8 million to support rural veterinary practices, highlighting its commitment to animal health.

Alongside institutional efforts, private organizations and sanctuaries are increasingly investing in rehabilitative care, especially for injured, neglected, or retired livestock. The growing consumer demand for ethically sourced animal products is further compelling producers to adopt humane farming practices, including rehabilitation services.

Regional Outlook: Asia Pacific

Asia Pacific is expected to witness the fastest growth during the forecast period due to the region’s expanding livestock population and growing awareness about animal welfare. Countries like India and China are witnessing a surge in livestock-based agricultural activity, resulting in increased incidences of musculoskeletal and chronic conditions among animals.

Governments across the region are launching educational campaigns and programs aimed at improving veterinary outreach in rural and underserved areas. Additionally, rising disposable incomes and increasing demand for high-quality animal-derived products are encouraging farmers to invest in animal health. Technological adoption is also improving across veterinary institutions, and this trend is expected to propel the adoption of advanced rehabilitation services in the coming years.

Regional Outlook: Europe

In Europe, the market is being driven by a strong regulatory emphasis on animal welfare, sustainable agriculture, and advanced veterinary research. The European Union is actively supporting collaborative research projects aimed at developing innovative livestock rehabilitation techniques. In 2024, the EU pledged over €600 million towards agroecology and animal welfare partnerships, reflecting its long-term commitment to ethical livestock care.

There is a particularly sharp increase in the rehabilitation of poultry, which often suffers from mobility issues and injuries due to intensive farming. The use of modern rehab therapies like hydrotherapy and electrotherapy is becoming increasingly common in European veterinary centers.

Country-Level Insight: United Kingdom and Germany

Within Europe, countries like the United Kingdom and Germany are making significant strides. The UK benefits from a high degree of professional veterinary expertise and infrastructure. There is an increasing demand for rehabilitation services due to mobility-related conditions and surgical recoveries among livestock. The government’s proactive stance on animal welfare, combined with rising consumer awareness, is helping expand the adoption of such services.

In Germany, the use of technological advancements such as hydrotherapy pools and AI-based monitoring tools is becoming standard in livestock rehab clinics. The country also boasts strong academic and institutional backing, making it a fertile ground for innovations in animal rehabilitation.

Overview of Livestock Rehabilitation Services

Livestock animal rehabilitation services cover a wide range of treatments aimed at improving mobility, health, and quality of life for farm animals. These services are particularly beneficial for animals recovering from surgeries, injuries, chronic illnesses, or developmental abnormalities.

Common therapies include therapeutic exercises, hydrotherapy, acupuncture, electrotherapy, hot and cold treatments, and manual therapy. The goal of these services is not just recovery but also to enhance the animal’s physical capacity, thereby improving overall productivity and reducing the risk of further injuries or complications.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/sample/6172

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 586.45 Million |

| Market Size in 2025 | USD 211.65 Million |

| Market Size in 2024 | USD 188.99 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.99% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Animal Type, Threrapy, Indication, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Livestock Animal Rehabilitation Services Market Dynamics

Market Growth Drivers

Several factors are fueling the market’s growth. The increasing global livestock population, particularly in developing countries, is creating greater demand for health management services. As farm animals are more frequently subjected to injuries and chronic illnesses, rehabilitation is becoming essential for their care. Awareness is growing among farmers about the long-term benefits of rehabilitation in enhancing productivity and animal well-being.

Veterinary infrastructure is also improving, especially in rural and emerging regions, allowing more animals to receive these services. Moreover, technological advancements such as remote monitoring, laser therapy, and stem cell treatments are making rehabilitation more effective and accessible.

Market Challenges and Opportunities

However, the market does face certain challenges. High costs associated with specialized rehabilitation services and equipment may limit access, especially for small-scale farmers in low-income regions. Additionally, there is a shortage of trained professionals with expertise in livestock rehabilitation, which could hamper growth in some markets.

Despite these restraints, opportunities abound—particularly in the form of government-backed welfare programs and innovations in AI-driven and remote rehabilitation tools. One notable example is the launch of the Vantara animal rescue and rehabilitation center in India in 2025, a large-scale initiative aimed at offering high-tech care to neglected and injured animals.

Segmentation by Animal Type

In terms of animal type, cattle dominated the market in 2024, accounting for 45% of the market share. This is primarily due to their widespread use in dairy and meat industries and their susceptibility to mobility-related issues such as lameness.

Rehabilitation services are particularly critical in ensuring continued productivity in these animals. Poultry, on the other hand, is expected to grow at the highest CAGR of 12.55%. This growth is fueled by increasing occurrences of deformities and leg issues in commercial poultry operations, which significantly impact overall flock health and production.

Segmentation by Therapy Type and Indication

Therapeutic exercises held the largest share among therapy types in 2024 due to their versatility and ability to address a wide range of mobility and injury-related issues. These exercises improve flexibility, strength, and coordination, leading to faster recovery. Hydrotherapy, while still a smaller segment, is projected to grow at the fastest rate. The low-impact nature of hydrotherapy makes it ideal for post-surgical and arthritic animals, and its growing availability in veterinary settings is expected to support its expansion.

Post-surgery indications accounted for the largest share of the market in 2024, with many livestock animals requiring rehabilitation to regain full function after operations. However, the acute and chronic diseases segment is expected to grow at the fastest rate, driven by rising cases of arthritis, lameness, and metabolic disorders in aging livestock populations. These conditions require long-term, consistent therapy plans to maintain animal health and functionality.

End User Analysis

Veterinary rehabilitation centers and hospitals were the largest end users in 2024, owing to their access to skilled professionals and advanced treatment infrastructure. These centers offer a wide range of therapies and are well-equipped to handle complex rehab cases. Rescue and shelter homes, although smaller in comparison, are rapidly adopting rehabilitation practices as part of their broader welfare mission, especially for abused or abandoned animals needing long-term care.

Recent Developments

Recent developments in the market underscore the momentum of innovation and policy support. In February 2025, Elanco launched Pradalex, a new respiratory therapy targeted at cattle and swine, which complements rehab treatments for respiratory complications. In January 2025, ICAR hosted a large-scale animal health camp in India, demonstrating a growing emphasis on preventive and rehabilitative care. Similarly, the USDA committed $17.6 million in September 2024 to fund farm animal health research. These developments illustrate the growing institutional support for livestock rehabilitation, a trend that is likely to sustain the market’s upward trajectory.

Role of Listed Companies in the Livestock Animal

Rehabilitation Services Market

| Company | Key Role in Market | Market Impact |

|---|---|---|

| Greenside Veterinary Practice | Regenerative medicine, advanced rehab, evidence-based therapies | Industry leader, promotes innovation and data-driven care |

| Chaseview Farm Animal Service | Farm animal rehab, post-surgical care | Expands access in rural/agricultural communities |

| St Boniface Veterinary Centre | Specialized livestock rehab, mobility improvement | Supports welfare and productivity |

| Deepwood Veterinary Clinic | Physical therapy, post-op care | Reduces recovery times, improves outcomes |

| Desert Forest Animal Hospital | Physical therapy, chronic/acute condition care | Enhances regional access to advanced rehab |

| REC Vet Physio | Veterinary physiotherapy, mobility restoration | Integrates physiotherapy into livestock care |

| Animal Health & Rehab Center | Injury recovery, chronic disease management | Drives rehab adoption, improves farm efficiency |

| Pedernales Veterinary Center | Post-surgical recovery, physical therapy | Delivers specialized solutions for livestock producers |

| Ladson Veterinary Hospital | Advanced therapies, comprehensive care | Promotes rehab adoption, improves animal health |

| Tabernacle Animal Hospital | Physical therapy, post-op care | Expands advanced rehab access for livestock owners |

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344