How Is AI Elevating Japan’s Video Streaming Experience?

AI is reshaping Japan’s video streaming market by delivering smarter, more personalized user experiences. Platforms are integrating cognitive AI to extract emotional metadata, automatically generate binge markers, and create attention-grabbing thumbnails—all designed to enhance content discovery, engagement, and viewer retention. These AI-driven enhancements enable streaming services to tailor recommendations and streamline content presentation, which is essential in Japan’s competitive and rapidly evolving on-demand streaming industry.

Beyond personalization, AI supports optimized video delivery and real-time analytics in Japan’s cloud-centric streaming infrastructure. AI-powered tools help monitor performance, reduce latency, and adapt to changing network conditions, ensuring seamless playback of 4K, HDR, and live content. This integration of AI with cloud scalability allows platforms to handle peak traffic efficiently, maintain high viewer satisfaction, and respond swiftly to evolving user preferences and content consumption patterns.

Japan Video Streaming Market Growth Factors

-

High-Speed Broadband & 5G Expansion

Japan’s advanced internet infrastructure, including widespread fiber-optic and 5G networks, supports smooth HD and 4K streaming, driving user satisfaction and broader adoption.

-

Strong Demand for Local Content & Anime

Japanese viewers have a strong preference for domestic content, particularly anime. Additionally, growing global demand for anime is encouraging greater investment in Japanese productions and exclusive titles.

-

Multiple Platform Competition & Localization

Both international (like Netflix and Amazon Prime Video) and local platforms (such as U‑Next, TVer, and Abema) are competing intensely, leading to more localized content and user-centric features.

-

Shift Toward Subscription Models (SVOD)

The decline of traditional pay-TV and the rise of high-speed internet have led to a significant increase in subscription-based video-on-demand services across households.

-

Value-Added Features & Convenience

Features like offline viewing, personalized recommendations, live streaming, and freemium models with ad-supported tiers are enhancing the streaming experience and encouraging user retention.

-

COVID-19 Acceleration & Changing Habits

The pandemic accelerated the shift to home entertainment, with many users continuing to prefer on-demand streaming even after lockdowns, solidifying long-term market growth.

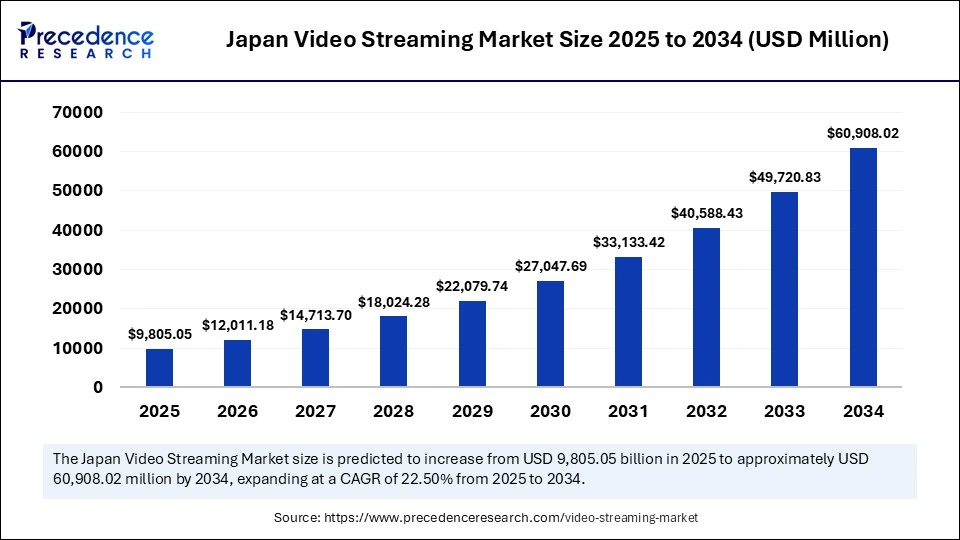

Market Scope

| Report Coverage |

Details |

| Market Size by 2034 |

USD 60,908.02 Million |

| Market Size in 2025 |

USD 9,805.05 Million |

| Market Size in 2024 |

USD 8,004.12 Million |

| Market Growth Rate from 2025 to 2034 |

CAGR of 22.50% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Authentication, Component, Deployment, Application, and Region |

Market Dynamics

Market Drivers

The Japan video streaming market is being propelled by strong consumer demand for on-demand and personalized content experiences. One of the primary drivers is the rapid penetration of high-speed internet and widespread adoption of smart devices, including smartphones, tablets, and smart TVs, which have made video streaming more accessible across demographics. The rise of OTT (Over-the-Top) platforms such as Netflix, Amazon Prime Video, Hulu Japan, and local services like U-NEXT and AbemaTV has transformed content consumption habits, shifting preference away from traditional cable TV.

Japan’s strong infrastructure in 5G deployment also enhances streaming quality, supporting high-definition (HD) and ultra-high-definition (UHD) content. Moreover, the increasing popularity of anime, J-dramas, and variety shows, both domestically and internationally, is driving content production and subscription-based video streaming growth. The COVID-19 pandemic further accelerated digital content consumption, solidifying streaming platforms as a mainstream entertainment medium.

Opportunities

Japan’s video streaming market presents significant opportunities in areas such as localized and original content creation, niche streaming services, and integration with emerging technologies like artificial intelligence and virtual reality. Local platforms have the advantage of curating culturally relevant and language-specific content that resonates more effectively with Japanese audiences. Additionally, the demand for anime globally has opened avenues for Japanese companies to export original IP and co-produce with international studios.

Live streaming, especially in entertainment, e-sports, and influencer-driven commerce, is gaining traction, creating a hybrid of content consumption and interactive engagement. Furthermore, as Japan has a highly tech-savvy and mobile-oriented population, there are opportunities for innovation in mobile-first video formats, gamified content, and AI-powered recommendation engines. Businesses can also explore ad-supported models (AVOD) for younger users or cost-conscious consumers, alongside premium subscription tiers (SVOD) for exclusive content.

Challenges

Despite its growth, the Japan video streaming market faces a number of challenges. Intense competition between global OTT giants and local platforms creates pricing pressures and necessitates heavy investment in original content to retain subscribers. Content licensing remains a complex and expensive affair, especially when negotiating distribution rights for international content or co-productions. Language and cultural preferences also pose barriers for foreign entrants who must adapt their user interfaces and content libraries to local tastes.

Another challenge is the aging population of Japan, where a sizable portion of potential users are less digitally inclined, requiring more inclusive digital strategies to engage older demographics. Additionally, concerns around digital piracy and the need to safeguard intellectual property add to the regulatory and technical burdens for streaming providers. Lastly, maintaining high-quality streaming in rural or less connected regions may be difficult despite Japan’s overall advanced telecom infrastructure.

Regional Outlook

Urban regions such as Tokyo, Osaka, and Nagoya dominate the video streaming landscape in Japan due to their high population density, superior broadband infrastructure, and high concentration of tech-savvy consumers. These cities host a majority of media companies, production studios, and consumers with higher disposable incomes, leading to higher subscription rates for premium content.

Rural areas, on the other hand, show slower adoption due to comparatively lower internet speeds, digital literacy, and entertainment alternatives. However, the government’s continued investment in nationwide digital infrastructure and the expansion of 5G networks could bridge this divide in the coming years. In the broader Asia-Pacific context, Japan remains a pivotal market, both as a content originator—especially for anime—and as a trendsetter in premium content production and user engagement.

Going forward, the regional growth trajectory is expected to be strong, provided platforms continue to localize offerings, innovate with technology, and align with shifting consumer behaviors.

Japan Video Streaming Market Companies

Segments Covered in the Report

By Streaming Type

- Live Video Streaming

- Non-Linear Video Streaming

By Component (USD)

- Software

- Content Delivery Services

By Solutions

- Internet Protocol TV

- Over-the-Top (OTT)

- Cable TV

- Pay-TV

By Platform

- Gaming Consoles

- Laptops & Desktops

- Smartphones & Tablets

- Smart TV

By Service

- Consulting

- Managed Services

- Training & Support

By Revenue Model

- Advertising

- Rental

- Subscription

By Deployment Type

By End User

Also Read: Secure Web Gateway Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6201

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344