Japan Streaming Market Expansion

In an increasingly saturated global streaming landscape, one market has emerged as a new battleground for dominance — Japan. In April 2025, two major developments confirmed that this high-value, tech-savvy region is now front and center in the growth playbook of international streaming giants. Both Apple TV+ and Paramount+ announced aggressive new expansion initiatives in Japan, marking a significant escalation in the country’s competitive streaming wars.

From add-on subscriptions via Prime Video to strategic partnerships with domestic telecom giants like NTT Docomo, these moves are more than mere distribution deals — they reflect a deeper, more targeted strategy to capture Japanese audiences. With Japan’s growing appetite for digital content, strong broadband infrastructure, and affinity for global media, it’s no surprise that platforms are racing to localize their offerings and stake their claims.

Apple TV+ Joins Prime Video Channels in Japan and the Netherlands

In April 2025, Apple made a pivotal move by launching Apple TV+ as an add-on subscription via Amazon Prime Video in both Japan and the Netherlands. This marks a significant shift in Apple’s distribution strategy, opening its premium content library to millions of Amazon Prime users who may not have previously engaged with Apple’s streaming platform.

Seamless Integration for the Viewer

Through this partnership, Prime Video users in Japan and the Netherlands can now access Apple TV+ Originals within the Prime Video interface, eliminating the need to toggle between apps or manage multiple billing platforms. For Japanese customers, the deal includes an introductory promotional price of JPY 200 (€1.25) per month for the first three months, significantly lowering the barrier to entry.

Kelly Day, Vice President of International at Prime Video, emphasized the goal of “bringing Prime Video customers an even greater selection of TV shows and films, all in one app experience.” Keisuke Oishi, Country Manager of Prime Video Japan, reinforced this sentiment, saying the move strengthens Prime Video’s position as a “leading entertainment destination” in Japan.

Apple’s Growing Appetite for International Viewership

This isn’t Apple’s first foray into strategic bundling. However, integrating Apple TV+ into Prime Video’s massive ecosystem represents a savvy approach to audience acquisition, especially in markets where Amazon has a dominant user base. With Japanese consumers showing increasing interest in international drama, action, and thriller genres — all of which are Apple TV+ strong points — this move could yield significant user growth.

Paramount+ Expands in Japan with NTT Docomo’s Lemino

In a near-parallel development, Paramount+ also bolstered its Japanese footprint in April 2025 by announcing a major distribution deal with Lemino, a streaming service operated by NTT Docomo, Japan’s largest telecom provider. Under this agreement, Japanese users can subscribe to Paramount+ directly via the Lemino Channel for JPY 770 ($5.40) per month.

A Broader Ecosystem Play

This is not Paramount+’s first attempt to penetrate the Japanese market. It follows earlier partnerships with J:COM, WOWOW Inc., and Prime Video Channels. However, the Lemino partnership gives Paramount+ direct access to Docomo’s massive customer base, providing a clear channel to scale rapidly without needing to build a large brand presence from scratch.

Additionally, Paramount+ has entered the in-flight entertainment space through a content licensing deal with Japan Airlines, extending its content visibility even further. This multi-layered strategy allows the brand to reach users not just in homes, but also in hotels, flights, and through telecom bundles.

Japan streaming market expansion- Why Japan, and Why Now?

Japan represents a massive untapped opportunity for Western streaming platforms. While local giants like U-NEXT, AbemaTV, and Rakuten Viki dominate certain content niches, global players have been slower to achieve scale — often due to cultural preferences, content localization challenges, and platform fragmentation.

But with younger Japanese audiences increasingly embracing global series, especially in genres like crime, sci-fi, and docu-series, the tide is shifting.

The Bigger Picture: What These Moves Mean for the Global Streaming Landscape

The entry and expansion strategies of Apple TV+ and Paramount+ in Japan reflect larger trends shaping the global OTT (Over-the-Top) video market in 2025. As traditional subscriber growth slows in North America and parts of Europe, platforms are doubling down on high-potential international markets. Japan, with its strong broadband penetration, cultural openness to international content, and high disposable income, is ripe for strategic expansion.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6201

Platform Aggregation Is the Future

Both companies are leaning into distribution via established aggregators — whether that’s Prime Video Channels or telecom-backed platforms like Lemino. This approach provides:

-

Lower customer acquisition costs

-

Stronger user retention

-

Seamless user experience

It also reflects a key evolution in user behavior: consumers prefer centralized access points to manage their media consumption, rather than juggling multiple standalone apps.

Content Is Still King

Despite platform consolidation, the underlying value driver remains content. Apple TV+ brings critically acclaimed Originals like Ted Lasso, Severance, and Foundation, while Paramount+ boasts a massive library including Star Trek, Yellowstone, and a growing catalog of international co-productions.

Localizing these offerings — through subtitles, dubbing, and cultural partnerships — will be key to long-term success in Japan.

Challenges Ahead: It’s Not All Smooth Sailing

Despite the excitement, there are hurdles both Apple and Paramount must overcome to fully capture the Japanese market:

-

Content localization and cultural alignment are still major challenges for Western streamers.

-

Strong local competition from U-NEXT, dTV, and Netflix Japan continues to dominate domestic rankings.

-

Platform fatigue could lead to consumer resistance as more players flood the market.

Furthermore, pricing sensitivity remains a factor. While Apple’s promotional rate of JPY 200 may spark initial subscriptions, long-term retention will depend on consistent perceived value.

What’s Next for the Japanese Streaming Market?

If these latest partnerships are any indication, Japan is entering a golden age of streaming choice and innovation. The competitive environment is becoming more dynamic, and consumers stand to benefit from:

-

More diverse international content

-

Simplified access via aggregators

-

Competitive pricing and promotions

Looking ahead, we can expect further consolidation, new content partnerships (including anime co-productions), and perhaps even more cross-platform bundling — such as pairing streaming services with mobile data plans or smart TVs.

Final Thoughts

The simultaneous expansion of Apple TV+ and Paramount+ in Japan is more than a coincidence — it’s a clear sign of the country’s emergence as a key global growth engine for the streaming industry. Their respective distribution strategies, pricing models, and partnership ecosystems offer valuable case studies for any media company looking to break into Asia.

For Japanese viewers, it means unprecedented access to global content through local platforms, and for the rest of the world, it reaffirms that Japan’s media landscape is becoming more open, competitive, and exciting than ever before.

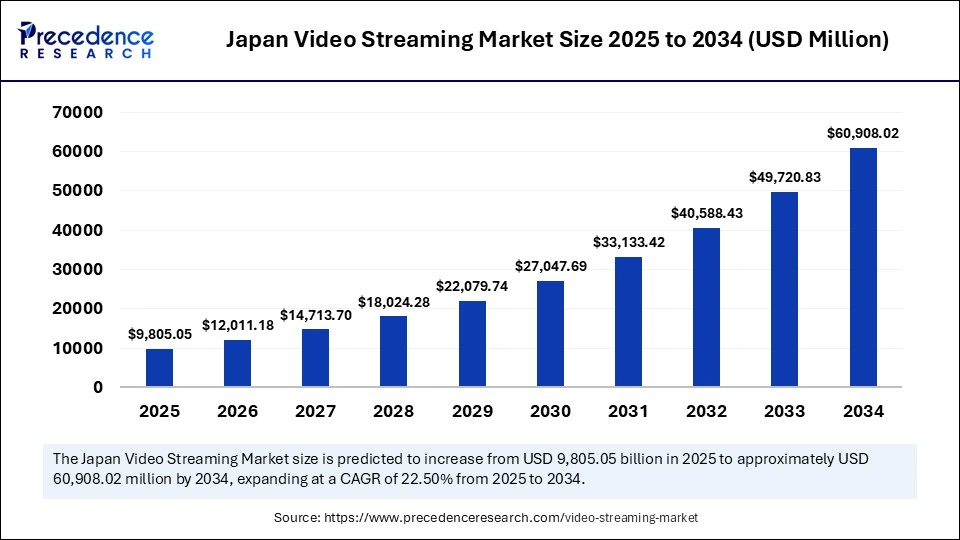

Also Read: Japan Video Streaming Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344