Investigational New Drug CDMO Market Key Points

-

North America dominated the global market with the largest revenue share of 44% in 2024.

-

Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

-

By product, the small molecules segment captured the biggest revenue share of 89% in 2024.

-

The large molecules segment is projected to expand at the fastest CAGR over the projected period.

-

By service, the contract development segment held the highest market share in 2024.

-

The contract manufacturing segment is expected to grow at a notable CAGR during the forecast period.

-

By end-user, the pharmaceutical companies segment accounted for the biggest market share in 2024.

-

The biotech companies segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

How is the Investigational New Drug (IND) CDMO Market Evolving Amid Rising R&D Outsourcing?

The global Investigational New Drug (IND) CDMO market is experiencing significant growth, projected to expand from approximately USD 4.45 billion in 2024 to over USD 7.49 billion by 2029–2030, at a CAGR of around 6.5% to 6.9%. This momentum is fueled by increasing pharmaceutical and biotechnology R&D investments, alongside the need to reduce development costs and speed up IND submissions. Contract development services—such as formulation, bioanalysis, toxicity studies, and process scaling—are seeing high demand as companies increasingly outsource these tasks to leverage the expertise and infrastructure of specialized CDMOs.

North America leads the IND CDMO market with about 43% share in 2023, supported by its well-established pharma ecosystem and robust regulatory framework. However, the Asia-Pacific region—especially India and China—is witnessing the fastest growth, driven by expanding local drug development efforts, cost-effective manufacturing, and evolving regulatory landscapes. Small molecules continue to dominate the market with around 88% share, though biologics and large molecules are gaining prominence, reflecting a shift in drug development pipelines toward more complex therapies.

Growth Factors of the Investigational New Drug (IND) CDMO Market

Rising R&D Outsourcing and Strategic Partnerships

Pharmaceutical and biotech companies are increasingly outsourcing development and manufacturing services to CDMOs to reduce operational costs and accelerate time-to-market for investigational drugs. This trend is particularly strong among small and mid-sized firms that lack the infrastructure for early-phase drug development. CDMOs are enhancing their offerings with formulation development, analytical testing, and early-stage manufacturing services to support IND filings. Strategic collaborations, capacity expansions, and integrated service models are further boosting the appeal of CDMOs to drug sponsors seeking efficiency and regulatory readiness.

Technological Innovation and Regional Expansion

Innovations in automation, AI-driven data analysis, continuous manufacturing, and biologics development are improving the capabilities and efficiency of CDMOs. These technological advancements enable faster and more precise development of both small- and large-molecule drugs. At the same time, increasing regulatory demands are driving the need for high-quality, compliant CDMO services. Regionally, North America continues to lead due to its strong R&D ecosystem and regulatory infrastructure, while Asia-Pacific is emerging as the fastest-growing market, supported by lower production costs, favorable government policies, and expanding biotech industries in countries like China and India.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/sample/6169

Market scope

| Report Coverage | Details |

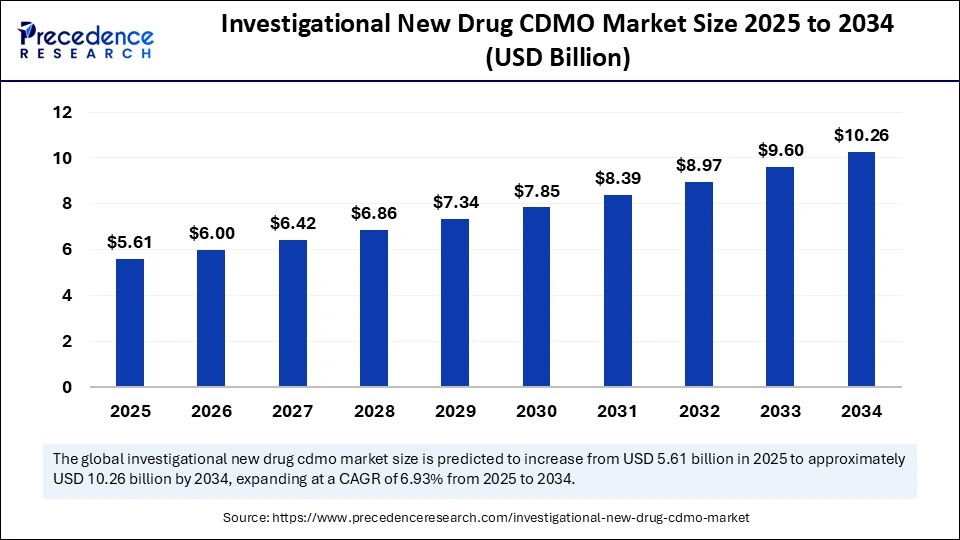

| Market Size by 2034 | USD 10.26 Billion |

| Market Size in 2025 | USD 5.61 Billion |

| Market Size in 2024 | USD 5.25 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.93% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Service, End Use and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

The Investigational New Drug (IND) CDMO market is being strongly driven by the rising demand for outsourcing drug development activities due to increasing complexity, cost, and regulatory pressures in the pharmaceutical and biotechnology sectors. As pharmaceutical companies seek to expedite early-stage drug development and reduce time-to-market, Contract Development and Manufacturing Organizations (CDMOs) offer specialized expertise, infrastructure, and scalability. The growing number of clinical trials and innovative drug candidates—especially in areas such as oncology, rare diseases, and biologics—is fueling the need for efficient IND-enabling services. Moreover, the shift toward personalized medicine and complex molecule development, including cell and gene therapies, is increasing reliance on CDMOs with advanced technical capabilities and regulatory knowledge. Stringent global regulations around IND submissions also make CDMOs attractive partners for ensuring compliance and efficient dossier preparation.

Opportunities

Significant opportunities in the IND CDMO market lie in the rapid growth of biotechnology startups and small to mid-sized pharma companies that often lack in-house resources and turn to CDMOs for end-to-end support. Expansion of CDMO capabilities into integrated services—from preclinical development and IND-enabling studies to clinical manufacturing—presents a strategic opportunity to capture long-term client partnerships. The rise of biologics, biosimilars, and advanced therapies like mRNA-based drugs and gene therapies is creating new market segments for specialized IND support services. Digital transformation, including the use of AI and data analytics in drug development, is also opening up avenues for CDMOs to enhance process efficiency and regulatory intelligence. Furthermore, emerging markets offer strong growth potential due to increasing clinical trial activity, favorable government support, and the globalization of pharmaceutical R&D.

Challenges

Despite strong market prospects, the IND CDMO sector faces several critical challenges. High capital investment and technological barriers can limit the ability of smaller CDMOs to expand service offerings or enter new therapeutic areas. The complexity of IND-enabling studies for novel drug modalities requires specialized expertise in toxicology, pharmacokinetics, CMC (chemistry, manufacturing, and controls), and regulatory affairs, which can be resource-intensive. Competition among CDMOs is intensifying, making differentiation through innovation and service quality a necessity. Regulatory variability across regions and evolving standards can create hurdles in ensuring global compliance for IND submissions. Additionally, managing timelines, costs, and intellectual property rights in collaborative settings continues to be a concern for both CDMOs and their clients.

Regxional Outlook

North America dominates the IND CDMO market due to its robust pharmaceutical and biotech ecosystem, high clinical trial volume, and strong regulatory infrastructure led by the U.S. Food and Drug Administration (FDA). The United States remains a major hub for IND submissions and contract development services, driven by a high concentration of biotech firms and early-stage drug developers. Europe is also a significant player, supported by growing investment in innovative drug development, strong academic-industry collaborations, and well-established regulatory frameworks like those from the EMA. The Asia-Pacific region is witnessing rapid expansion, particularly in countries such as China, India, South Korea, and Japan, where cost advantages, growing expertise, and government support for biotech innovation are making it a preferred destination for IND-enabling activities. Latin America and the Middle East & Africa are gradually emerging as potential markets, although limited infrastructure and regulatory complexities may slow their pace of development compared to more established regions.

Investigational New Drug CDMO Market Companies

- Catalent, Inc.

- Lonza

- Recipharm AB

- Siegfried Holding AG

- Patheon Inc.

- Covance

- IQVIA Holdings Inc.

- Cambrex Corporation

- Charles River Laboratories International, Inc.

- Syneous Health

Segments Covered in the Report

By Product

- Small Molecules

- Large Molecules

By Service

- Contract Development

- Small Molecule

- Bioanalysis and DMPK Studies

- Toxicology Testing

- Pathology and Safety Pharmacology Studies

- Drug Substance Synthetic Route Development

- Drug Substance Process Development

- Form Selection Crystallization Process Development

- Scale-up of Drug Substance

- Pre Formulation

- Preclinical Formulation Selection

- First In Man Formulation/ Process Development

- Analytical Method Development / Validation

- Release Testing of Drug Substance and Drug Product

- Work Up Purification Steps

- Telescoping & Process Refining

- Initial Optimization

- Formal Stability of Drug Substance and Drug Product

- Large Molecule

- Cell Line Development

- Process Development

- Upstream

- Microbial

- Mammalian

- Downstream

- MABs

- Recombinant Proteins

- Others

- Upstream

- Small Molecule

- Contract Manufacturing

- Small Molecule

- Oral Solids

- Liquid and Semi-solids

- Injectables

- Others

- Large Molecule

- MABs

- Recombinant Proteins

- Others

- Small Molecule

By End-use

- Pharmaceutical Companies

- Biotech Companies

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Also Read: Skin Substitute Market

Source: https://www.precedenceresearch.com/investigational-new-drug-cdmo-market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344