India Actuator Market Key Takeaways

- By industry vertical, the automotive segment accounted for the largest market share of 23% in 2024.

- The aerospace segment is projected to grow at the fastest CAGR of 10.23% from 2025 to 2034.

- By type, the rotary actuator segment dominated the market with a 70% share in 2024.

- The linear actuator segment is expected to register a significant CAGR of 10.40% in the upcoming years.

- By actuation, the hydraulic actuators segment held the largest market share of 36.54% in 2024.

- The electric actuators segment is forecasted to grow at the highest CAGR of 10.10% during the forecast period.

Market Overview and Growth Outlook

The India actuator market comprises electric, hydraulic, pneumatic, and electro-mechanical actuators used across various industries such as automotive, aerospace, manufacturing, infrastructure, and robotics. The growing adoption of automation, Industry 4.0, electric vehicles, and smart city initiatives is significantly driving market growth. Additionally, indigenous defense and space programs are accelerating the demand for high-precision actuators in India.

Role of AI in the India Actuator Market

AI is transforming actuator performance by enabling predictive maintenance, self-optimization, and real-time monitoring. In sectors such as robotics, defense, and manufacturing, AI algorithms analyze sensor data to control actuator movements more efficiently, minimize energy usage, and reduce system failures. This results in greater uptime, improved product quality, and more adaptive actuator-based systems in complex applications.

Market Growth Factors

India’s push toward industrial digitization, government initiatives like “Make in India,” and the rise of electric vehicles are some of the major growth accelerators. Expanding automation in manufacturing and the rising need for motion control in infrastructure and aerospace segments are creating vast opportunities for actuator deployment. Additionally, the increasing emphasis on renewable energy and defense modernization is fueling long-term market demand.

Market Scope

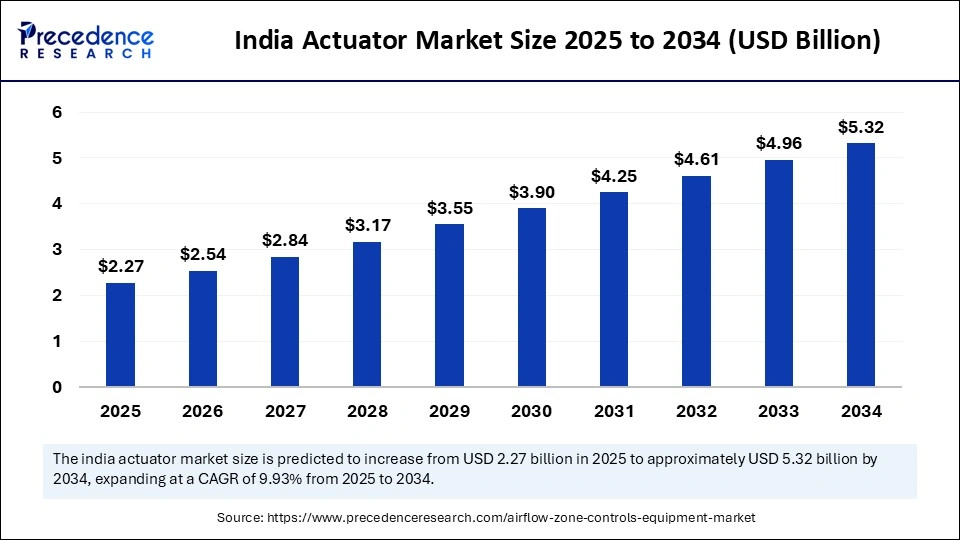

| Report Coverage | Details |

| Market Size by 2034 | USD 5.32 Billion |

| Market Size in 2025 | USD 2.27 Billion |

| Market Size in 2024 | USD 2.03 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.93% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Industry Vertical, Type, and Actuation |

Market Drivers

Key drivers include the rapid expansion of EV production requiring throttle, braking, and HVAC actuators. The growing implementation of automated systems in manufacturing and logistics is boosting demand for precision motion control. Furthermore, infrastructure developments in transportation and smart cities are contributing to increased deployment of hydraulic and pneumatic actuators. Defense sector requirements for tactical motion control and missile positioning systems also present strong demand potential.

Market Opportunities

The adoption of AI-enabled and IoT-integrated actuator systems opens new avenues for predictive control and diagnostics. The aerospace industry offers promising growth opportunities with indigenous missions and satellite deployment. Additionally, India’s emergence as a global manufacturing and export hub creates room for locally produced actuators to be integrated into global supply chains. The push toward renewable energy and sustainable infrastructure is also increasing demand for robust actuator systems in power and water treatment plants.

Market Challenges

Challenges include high initial investment in smart actuator technology and the requirement for skilled labor to operate advanced systems. Local manufacturers face strong competition from established global players, both in pricing and technological innovation. Additionally, maintaining product standards across diverse applications and managing supply chain disruptions for key raw materials are persistent industry concerns.

Regional Outlook

Northern and Western India are dominant in automotive, automation, and general industrial actuator demand due to hubs in Pune, NCR, and Gujarat.

Southern India, particularly Karnataka and Telangana, is a growing center for aerospace, electronics, and precision manufacturing.

Eastern India is seeing increasing demand from railways, mining, and construction sectors.

Export potential is increasing as India integrates further into global aerospace and manufacturing supply chains.

India Actuator Market Companies

- Hitachi, Ltd.

- Hella KGaA Hueck & Co

- Firgelli Automations

- Denso Corporation

- Delphi Automotive PLC

- CVEL Automotive Electronics

- CTS Corporation

- Continental AG

- Buehler Motor Inc.

- APC International, Ltd.

Future Outlook and Trends

The India actuator market is poised for strong growth, with a projected value of over USD 2.6 billion by 2033. The transition to electric actuators in EVs, automation, and smart manufacturing will be the dominant trend. AI and IoT integration will enable real-time monitoring and remote operations. The development of sustainable infrastructure, electrification of public transport, and growth of private aerospace ventures will further propel the market.

Segments Covered in the Report

By Industry Vertical

- Automotive

- Door Hardware and Access Control

- Aerospace

- Defense

- Manufacturing

- Robotics

- Others

By Type

- Linear Actuator

- Rotary Actuator

By Actuation

- Pneumatic Actuators

- Hydraulic Actuators

- Electric Actuators

- Others

Read Also: Airflow and Zone Control Equipment Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6238

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344