Hydraulic Fracturing Dual Engine Systems Market to Hit USD 872.62 Million by 2034, Fueled by Push for Cleaner and More Efficient Oil & Gas Operations

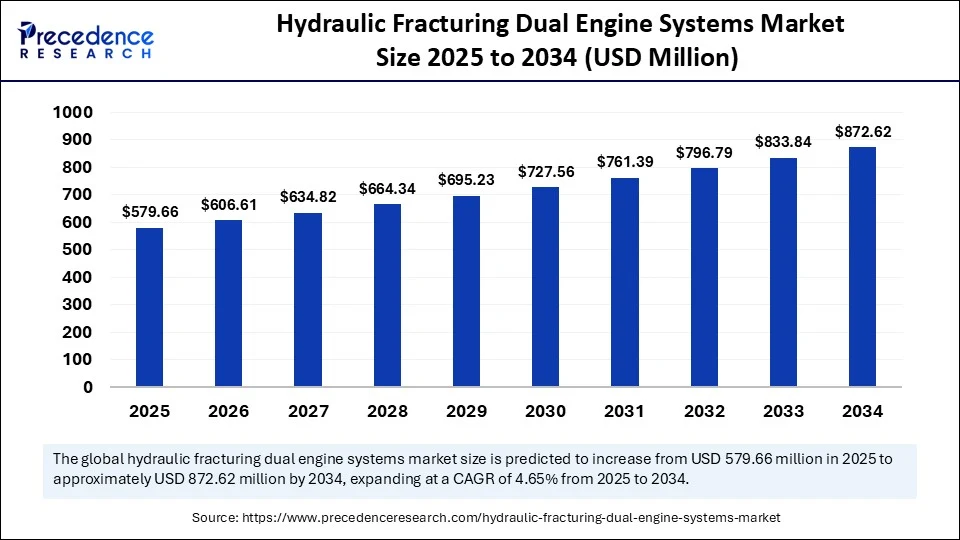

According to a newly released report by Precedence Research, the global hydraulic fracturing dual engine systems market was valued at USD 553.9 million in 2024 and is expected to reach USD 872.62 million by 2034, expanding at a compound annual growth rate (CAGR) of 4.65% from 2025 to 2034. The demand for efficient and cleaner fracturing operations, amid increasing environmental scrutiny, is fueling the rapid adoption of dual-engine systems globally.

Dual-engine systems, which operate on both diesel and natural gas, are gaining momentum as a cost-effective and lower-emission solution in hydraulic fracturing. These systems offer a practical balance between performance and sustainability, particularly as oilfield operators look for ESG-compliant equipment without compromising hydraulic horsepower (HHP) capacity.

-

North America led the global market in 2024, accounting for the largest share of 38.1%, while Asia Pacific is expected to register the fastest growth over the forecast period.

-

Based on well type, the horizontal segment dominated the market in 2024 with a commanding share of 82.3% and is projected to grow at the fastest pace.

-

By unlocking mechanism, the hybrid/dual fuel systems segment held the largest share in 2024, whereas the autonomous/algorithm-led control systems segment is poised to witness the highest CAGR moving forward.

-

In terms of application, the shale gas segment captured the highest revenue share in 2024, while the tight oil & shale gas integration segment is emerging as the fastest-growing.

-

Regarding technology, manual/traditional systems accounted for the majority share in 2024; however, the autonomous systems segment is forecast to expand at the fastest rate through 2034.

Read Also: Automated Mining Equipment Market

Hydraulic Fracturing Dual Engine Systems Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 872.62 Million |

| Market Size in 2025 | USD 579.66 Million |

| Market Size in 2024 | USD 553.9 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.65% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Well Type, Unlocking Mechanism, Application, Technology and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Hydraulic Fracturing Dual Engine Systems Market Dynamics:

What’s Driving the Growth of Hydraulic Fracturing Dual Engine Systems?

Market Drivers

The rising pressure to reduce carbon emissions in upstream oil and gas operations is a primary driver accelerating the adoption of dual-fuel hydraulic fracturing engines. These systems offer a flexible alternative to traditional diesel-only engines, running on a mix of natural gas and diesel to reduce fuel costs and harmful emissions.

Additionally, growing shale gas exploration and production activities, particularly in North America, is bolstering demand. Governments and environmental agencies are also tightening regulations around flaring and carbon intensity, further pushing operators toward dual-fuel and lower-emission solutions.

The demand for fuel savings and operational efficiency is another significant growth factor. Operators using dual-fuel engines report fuel cost reductions of 20%–40% by utilizing field gas or compressed natural gas (CNG), contributing to a favorable return on investment (ROI).

Challenges

Despite the clear advantages, dual-engine systems come with high initial capital expenditure, often acting as a barrier for small and mid-sized operators. These systems require supporting infrastructure such as gas compressors, blending units, and monitoring tools, which can raise the overall project cost.

Moreover, the lack of a uniform regulatory framework across regions and limited access to field gas infrastructure in some developing economies hinder large-scale adoption. Technological complexity, maintenance training, and fuel supply consistency are additional concerns facing stakeholders.

Opportunities

Growing interest in hybrid fracturing systems—that combine electric and dual-fuel engines—presents a lucrative opportunity for equipment manufacturers. Integration of AI and IoT for real-time monitoring of fuel efficiency, emissions, and predictive maintenance further adds value, making these systems more attractive to modern operators.

Emerging markets in Asia-Pacific and Latin America, where unconventional exploration is on the rise, are also expected to offer new growth avenues, especially as energy security and emissions mitigation remain national priorities.

Hydraulic Fracturing Dual Engine Systems Market Regional Insights

-

North America remains the frontrunner with over 38% of the global market share in 2024, led by active shale plays in the U.S. and Canada. States like Texas and Pennsylvania are adopting these systems rapidly due to stricter emissions mandates and abundant natural gas.

-

Asia-Pacific is projected to grow at the fastest CAGR, driven by energy reforms in China, Australia, and India. Government-backed investments in unconventional oil and gas are likely to stimulate demand for dual-engine systems.

-

Middle East & Africa is showing a steady uptick as national oil companies invest in cleaner technologies and leverage local natural gas resources for upstream activities.

Latest Developments from Key Players

-

Caterpillar has launched advanced dual-fuel modules with enhanced load management and fuel-blending algorithms.

-

GE Power Conversion is partnering with frac fleet integrators to deliver high-efficiency electric-gas hybrid units.

-

Cummins Inc. recently rolled out its next-gen “FracMax DF” engine series optimized for rugged shale terrains and reduced methane slip.

Real-World Use Case

A mid-sized operator in the Bakken Shale transitioned 70% of its hydraulic fracturing fleet to dual-fuel engines and achieved a 28% reduction in CO₂ emissions and 32% savings in fuel costs within the first operational year. Downtime was also reduced by 18% through improved fuel logistics and supply chain planning.

Get Your Sample Report or Book a Consultation

Ready to explore growth strategies or compare regional opportunities?

🔗 Click here to request the sample report

📞 Schedule a meeting with our analysts: +1 650-460-3308

Contact Information:

📧 Email: sales@precedenceresearch.com

🌐 Website: www.precedenceresearch.com

📞 Phone: +1 650-460-3308

🏢 Address: 77 King Street West, Suite 3000, Toronto, ON M5K 1G8, Canada