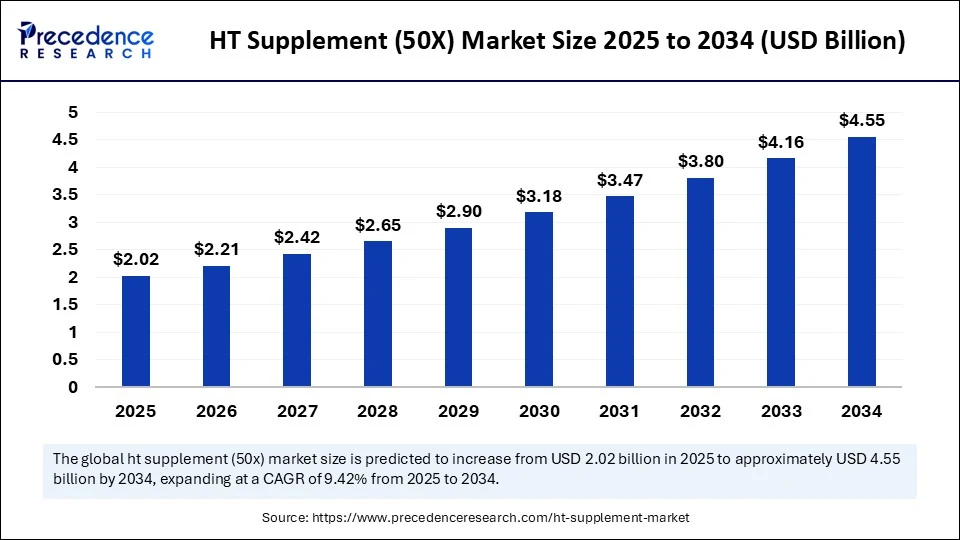

The global HT supplement (50X) market valued at $1.85 billion in 2024, is set to soar to $4.55 billion by 2034. A robust CAGR of 9.42% from 2025 to 2034 is driven by relentless biotech innovation, the rise of precision health, and a worldwide shift toward preventive wellness. Stakeholders are betting big as advances in cell culture, protein expression, and digital health combine to create a golden age for high-potency nutrition.

Quick Insights: State of the HT Supplement (50X) Market

-

In 2024, the global market size was $1.85 billion, projected to reach $4.55 billion by 2034.

-

North America led the market in 2024, powered by a mature supplement industry and advanced consumer infrastructure.

-

Asia Pacific is the fastest-growing region, fueled by rising incomes, middle-class expansion, and digital adoption.

-

The U.S. market alone accounted for $534.28 million in 2024, projected to reach $1.34 billion by 2034.

-

Ginseng extract (herbal extract 50X) is the top product, prized for energy and vitality.

-

Capsules dominate by formulation, thanks to ease of dosage and stability.

-

Immune support drives application growth—post-pandemic awareness is high.

-

Online retail is the top distribution channel, but direct selling is on the rise.

-

Key market segments: Product Type, Formulation, Application, End User, Distribution Channel, and Region.

| Insights | 2024 Value | 2034 Forecast | CAGR 2025-2034 | Leading Region | Fastest Growing Region |

|---|---|---|---|---|---|

| Market Valuation | $1.85 billion | $4.55 billion | 9.42% | North America | Asia Pacific |

| U.S. Market Value | $534.28 million | $1.34 billion | 9.63% |

Artificial Intelligence is accelerating every stage of the HT supplement (50X) market life cycle. From optimizing ingredient sourcing and automating quality checks to personalizing product recommendations, AI-powered solutions are making supplement development faster, safer, and more targeted. Enhanced data analytics further enable predictive testing, allowing companies to streamline product efficacy studies and safety monitoring at scale.

Meanwhile, the integration of IoT and IIoT tools means stakeholders can track production batches, monitor logistics in real time, and deploy robotics for inventory efficiency. The result: smarter supply chains, rapid new product launches, and a surge of innovation that keeps companies ahead of both compliance curves and consumer demands.

What’s Driving the HT Supplement (50X) Market Skyward?

-

Booming biotechnology research: Increased R&D funding and advances in life sciences are feeding demand for high-efficacy supplements.

-

Personalized health focus: Swelling interest in tailored wellness, especially in immune and cognitive support categories.

-

Digital commerce dominance: E-commerce and direct-to-consumer channels are breaking down access barriers for specialty supplements.

-

Growing wellness culture: Heightened preventive care awareness post-pandemic and among ageing populations.

Could E-Commerce and Direct-to-Consumer Channels Be the Game-Changer?

The rise of digital shopping is not just a convenience—it’s a strategic growth lifeline. Subscription models, user reviews, and tailored product education through DTC and e-commerce mean that brands can connect directly with health-conscious consumers. This evolution could spark the next growth wave by empowering greater transparency and personalization in the ever-expanding specialty supplement landscape.

Are Undisclosed Ingredients Undermining Trust?

Despite the rosy growth outlook, the market faces real reputational hurdles. Mislabeled or adulterated products remain a persistent risk, with studies finding high rates of labeling errors or unreported substances. Regulatory vigilance—and industry transparency—are essential to safeguard consumer trust and mainstream acceptance.

Can the Herbal Health Trend Catapult the Market to the Next Level?

A global wave for natural, plant-based wellness is driving experimentation and innovation. HT supplement (50X) products, delivering potent concentrations, are riding on the popularity of herbal and minimally processed formulas. With over 74% of U.S. adults taking dietary supplements—and Asia Pacific’s rising interest in functional blends—the opportunity for botanicals and “clean label” ingredients is immense.

Regional and Segment Analysis

Regional Leaders:

-

North America: Dominates with mature distribution, high per-capita spend, regulatory clarity, and strong contract manufacturing.

-

Asia Pacific: Fastest growth, driven by rising urban incomes, e-commerce penetration, and strong traditional supplement culture.

-

China: Leads Asia’s charge, benefiting from local sourcing, dynamic social commerce, and rapid product testing environments.

Segmentation Highlights:

-

Product Type: Ginseng extract sub-segment leads for its proven benefits; vitamin/mineral blends are rapidly expanding.

-

Formulation: Capsules dominate for reliability; gummies, chewables surge among youth/elderly.

-

Application: Immune support is top; cognitive health forecasted for fastest segment growth.

-

End User: Adults take the largest share; elderly market growing fastest due to preventive health adoption.

-

Distribution Channel: Online retail is king for convenience; direct selling rising with personalized consultations.

Industry Breakthroughs & Notable Companies

Latest Advances:

-

IoT/IIoT integration enables real-time monitoring and logistics optimization.

-

Automation and robotics driving faster, more cost-efficient supply chains.

-

Digitally-native brands leveraging big data for targeted R&D and consumer engagement.

HT Supplement (50X) Market Key Companies

- Herbalife Nutrition

- Amway (Nutrilite)

- GNC Holdings, Inc.

- NOW Foods

- Nature’s Bounty

- NutraScience Labs

- Swanson Health Products

- Himalaya Herbal Healthcare

- USANA Health Sciences

- Solgar, Inc.

- Nature’s Way

- Yakult Honsha Co., Ltd.

- Garden of Life

Life Extension - Pharmavite LLC (Nature Made)

- BioTechUSA

- ON (Optimum Nutrition)

- Nutrex Hawaii

- Jarrow Formulas

- Herbaland

Risk Factors: What’s Holding Growth Back?

-

Regulatory complexities around ingredient approval and labeling.

-

Ongoing consumer trust issues with unlabeled or counterfeit supplements.

-

Cost pressures from supply chain disruptions and premium ingredient sourcing.

-

Marketing challenges around educating new consumers on “50X” potency benefits.

Case Study:

A leading North American brand scaled rapidly by integrating AI-based inventory and predictive analytics, reducing out-of-stock events by 40%. Leveraging direct-to-consumer kits online, they captured loyalty in the competitive immune support segment, exemplifying tech-driven market leadership.

Read Also: Artificial Organs and Bionic Implants Market

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344