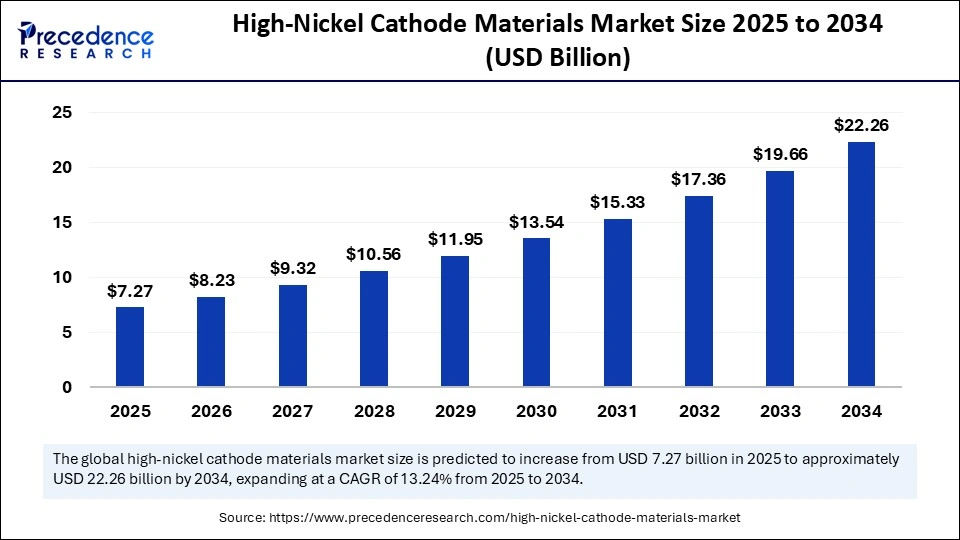

The global high-nickel cathode materials market, valued at USD 7.27 billion in 2025, is projected to expand to approximately USD 22.26 billion by 2034, registering a robust CAGR of 13.24% between 2025 and 2034. This surge is primarily driven by the escalating demand for high-performance, energy-dense batteries essential for electric vehicles (EVs) and energy storage applications.

High-Nickel Cathode Materials Market Key Insights

-

The global market size is USD 7.27 billion in 2025 and forecasted to grow to USD 22.26 billion by 2034.

-

Asia Pacific leads the market with the largest share, accounting for 38% of total revenue.

-

North America is identified as the fastest-growing regional market, supported by major battery production facilities like Tesla’s Gigafactory.

-

The automotive segment dominates end-user demand, holding roughly 50% market share due to increased EV adoption.

-

Direct sales to original equipment manufacturers (OEMs) constitute about 55% of sales, emphasizing secure supply chain strategies.

-

Leading industry players include BASF SE, Umicore SA, Sumitomo Metal Mining Co., POSCO, Johnson Matthey, and Tanaka Chemical Corporation.

What Role Does AI Play in the High-Nickel Cathode Materials Market?

Artificial Intelligence is increasingly integrated into materials research and production in this market. AI-driven predictive models accelerate the development of novel high-nickel cathode compositions, optimizing energy density, cycle stability, and thermal safety. Advanced AI analytics also enhance quality control during manufacturing, improving consistency and reducing defects.

Moreover, AI technologies enable smart supply chain management, forecasting raw material demand and pricing fluctuations. This intelligence mitigates risks associated with the volatile supply of nickel and cobalt, aiding manufacturers in cost management and timely delivery of cathode materials.

What Factors Are Driving Market Growth?

The high-nickel cathode materials market’s impressive growth stems from multifaceted drivers:

-

Electric Vehicle Boom: The global shift to electric mobility pushes demand for batteries with higher energy density and longer driving ranges, favoring high-nickel cathodes for their superior performance.

-

Government Incentives: Policies promoting clean energy and EV adoption provide significant tailwinds to battery materials markets worldwide.

-

Advancement in Battery Manufacturing: Increasing investments in gigafactories and battery production infrastructures bolster market expansion.

-

Consumer Electronics Growth: Rapid proliferation of AI-powered devices and 5G technology propels demand for durable, high-capacity batteries using these advanced materials.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6980

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.27 Billion |

| Market Size in 2026 | USD 8.23 Billion |

| Market Size by 2034 | USD 22.26 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.24% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, End-User Demographics, Distribution Channel, Nature, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

What Opportunities and Trends Are Emerging in the Market?

How is regional collaboration influencing the high-nickel cathode materials market?

International partnerships, especially in the Asia Pacific region between countries like Australia and India, strengthen the critical mineral supply chain and foster technological exchange, enhancing market resilience and growth potential.

What trends are reshaping battery technology using high-nickel cathode materials?

Innovations focus on increasing nickel content to above 90% to maximize energy density, alongside efforts to reduce cobalt dependency to lower costs and environmental impact, meeting the high-performance demands in EVs and energy storage.

How are end-use segments evolving?

While automotive remains dominant, consumer electronics and renewable energy storage systems are emerging as fast-growing sectors fueled by demand for compact, long-lasting batteries.

Segmentation Analysis

Product Type Insights

The NCM811 segment dominated the high-nickel cathode materials market with a 45% share in 2024. Its popularity stems from its proven reliability, cost-effectiveness, and high energy density, making it ideal for electric vehicle batteries. The well-balanced nickel, cobalt, and manganese composition allows manufacturers to achieve longer battery life and improved driving range, which supports widespread EV adoption.

Looking ahead, the NCM811 segment is expected to be the fastest-growing product type during the forecast period. Its superior energy density and extended cycle life make it particularly suited for high-end electric cars and other high-performance applications. Continued R&D efforts focusing on reducing cobalt content and enhancing safety are accelerating its adoption across the automotive and energy storage sectors.

Application Insights

In 2024, the electric vehicle (EV) segment led the high-nickel cathode materials market, holding approximately 60% market share. This dominance is driven by the increasing demand for long-range EVs equipped with high-energy-density batteries. Automakers are shifting toward nickel-rich cathode chemistries like NCM811 and NCA to improve efficiency and reduce cobalt usage. Supportive government policies and rapid improvements in battery technology have further reinforced this trend.

Besides EVs, the energy storage systems (ESS) segment is predicted to be the fastest-growing application. The rising need for effective grid-scale storage and increasing integration of renewable energy sources are driving this growth. High-nickel cathode materials offer superior durability and energy density, making them ideal for smart grid technologies and renewable energy storage solutions. For example, in August 2025, Trina Storage launched its Elementa 2 Pro platform, a turnkey grid-scale energy storage platform in North America, highlighting this expanding market.

End-User Insights

The automotive manufacturers segment was the largest end-user of high-nickel cathode materials in 2024, capturing around 50% of the market. This is largely due to the adoption of high-nickel batteries, which improve EV range and help reduce battery costs. Major original equipment manufacturers (OEMs) like Tesla and Hyundai have driven this trend through strategic partnerships with material suppliers and expansions in EV production.

The consumer electronics segment is expected to be the fastest-growing end-user market. Growth in portable devices, wearables, and smartphones all demanding compact, durable batteries is contributing to rising demand. The proliferation of 5G connectivity and AI-powered devices also accelerates the need for high-performance, thermal-stable batteries in this segment.

Distribution Insights

Direct sales to OEMs dominated the high-nickel cathode materials market in 2024, accounting for approximately 55% of total sales. This direct sales model ensures consistency in production quality, cost control, and supply security. Battery manufacturers and OEMs have signed long-term supply contracts to manage the high demand effectively and maintain steady material flow.

Battery manufacturers themselves are forecasted to be the fastest-growing distribution segment. The expansion of gigafactories and the growing number of independent battery producers sourcing materials directly are driving this trend. Manufacturers benefit from vertical integration, which supports faster decision-making and adaptability to market needs.

Nature Insights

The conventional high-nickel cathode materials segment held a dominant position in 2024 with a 70% market share. Its widespread adoption is attributed to well-established, reliable, and cost-effective formulations such as NCM622 and NCM811. These conventional chemistries benefit from mature manufacturing processes and integrated supply chains, facilitating large-scale production for automotive applications.

The advanced high-nickel segment with reduced cobalt content is expected to grow the fastest during the forecast period. This growth is fueled by R&D aimed at developing safer, longer-lasting, and more sustainable cobalt-free cathode chemistries. These innovative materials align with the market’s increasing focus on cost reduction and environmental compliance.

Regional Insights

The Asia Pacific region dominated the high-nickel cathode materials market in 2024, holding about 50% of the share. This dominance is driven by substantial investments in battery gigafactories and electric vehicle manufacturing. Robust government incentives, increasing R&D capabilities, and technological advancements have firmly established the region as a global leader.

India’s market is expanding rapidly due to growing EV adoption and government initiatives like the FAME scheme, which support domestic battery production. Investments in gigafactories further enhance India’s role in the regional battery ecosystem.

North America is expected to be the fastest-growing region over the forecast period. The market growth is propelled by significant investments in EV infrastructure, government clean energy incentives, and new gigafactory projects. Canada’s local battery manufacturing, raw material availability, recycling initiatives, and EV incentives contribute strongly to regional expansion.

Top Companies in the High-Nickel Cathode Materials Market

- LG Energy Solution: LG Energy Solution is a global leader in advanced battery technologies, actively developing high-nickel NCM and NCMA cathode chemistries to enhance energy density and longevity in EV batteries. The company’s focus on sustainable raw material sourcing and closed-loop recycling supports its transition to next-generation lithium-ion and solid-state battery systems.

- Contemporary Amperex Technology Co. Limited (CATL): CATL leads the global EV battery market with large-scale production of NCM and NCA high-nickel cathode materials for electric vehicles and energy storage systems. Its R&D focuses on improving thermal stability and cost efficiency, with proprietary technologies enabling batteries exceeding 500 Wh/kg for high-performance EVs.

- Samsung SDI: Samsung SDI develops high-nickel cathode materials such as NCA and NCMA for long-range electric vehicles and premium energy storage systems. The company emphasizes performance optimization and fast-charging capability through advanced cathode coating and particle design technologies.

- SK Innovation: SK Innovation produces high-nickel NCM cathode materials (up to 90% nickel) to achieve higher energy densities and extended battery life. It is expanding production across the U.S. and Europe to supply major automakers, leveraging its proprietary Z-fold and thermal management designs for EV batteries.

- Panasonic Energy: Panasonic is a pioneer in high-nickel NCA cathode chemistry, used extensively in Tesla’s EV batteries for superior energy density and durability. The company continues R&D in next-gen high-nickel and cobalt-free cathodes to enhance sustainability and cost competitiveness.

- BYD Company Ltd.: BYD manufactures both LFP and high-nickel NCM batteries, targeting balanced performance and energy density for its EV lineup. The company’s vertical integration strategy enables control over cathode material sourcing, production, and recycling for maximum efficiency.

- BASF SE: BASF develops advanced high-nickel cathode materials, including NCM 811 and NCMA, with a focus on enhanced thermal stability and reduced cobalt dependency. Its European production network supports the EV supply chain for OEMs through sustainable and scalable cathode material manufacturing.

- Umicore: Umicore is a major supplier of high-nickel NMC cathode materials, with a focus on sustainable battery chemistry and closed-loop recycling. Its upcoming European cathode production sites will strengthen regional EV battery independence and reduce carbon footprint.

- POSCO Chemical: POSCO Chemical manufactures high-nickel NCM and NCMA cathodes through integrated raw material sourcing and advanced synthesis technology. The company is rapidly expanding its global supply to automakers and battery producers, leveraging its strong ties with LGES and GM.

- China Northern Rare Earth Group High-Tech Co.: A key supplier of high-purity rare earths and nickel-based materials supporting cathode production for lithium-ion batteries. The company plays a strategic role in China’s domestic high-nickel cathode supply chain, aiding large-scale EV battery manufacturing.

Key Challenges and Cost Pressures:

Despite promising growth, challenges such as high production and processing costs, volatility in raw material (nickel and cobalt) supply, and thermal stability issues remain pressing. Reducing cobalt content without compromising battery performance is a critical concern, along with managing price fluctuations amid global supply constraints.

Case Study: Tesla’s Strategic Supply Chain Integration

Tesla’s approach to battery manufacturing underscores the impact of direct OEM engagement in the high-nickel cathode materials market. Through long-term strategic agreements with cathode suppliers and significant investments in gigafactories, Tesla ensures a stable supply of advanced cathode materials, enabling the production of EV batteries with enhanced energy density and range while controlling costs effectively.

Segments Covered in the Report

By Product Type

- NCM (Nickel Cobalt Manganese)

- NCM811: 8 parts nickel, 1 part cobalt, 1 part manganese

- NCM622: 6 parts nickel, 2 parts cobalt, 2 parts manganese

- NCM523: 5 parts nickel, 2 parts cobalt, 3 parts manganese

- NCA (Nickel Cobalt Aluminum)

- Other Variants: Including NCMA (Nickel Cobalt Manganese Aluminum)

By Application

- Electric Vehicles (EVs)

- Energy Storage Systems (ESS)

- Consumer Electronics

- Power Tools

- Aerospace & Defense

By End-User Demographics

- Automotive Manufacturers

- Electronics Companies

- Energy Providers

- Industrial Users

By Distribution Channel

- Direct Sales to OEMs

- Battery Manufacturers

- Third-Party Distributors

By Nature

- Conventional High-Nickel

- Advanced High-Nickel with Reduced Cobalt Content

By Region

- Asia-Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

Read Also: Cloud Security Posture Management Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344