Rising EV Adoption and Battery Innovation Fuel Explosive Growth

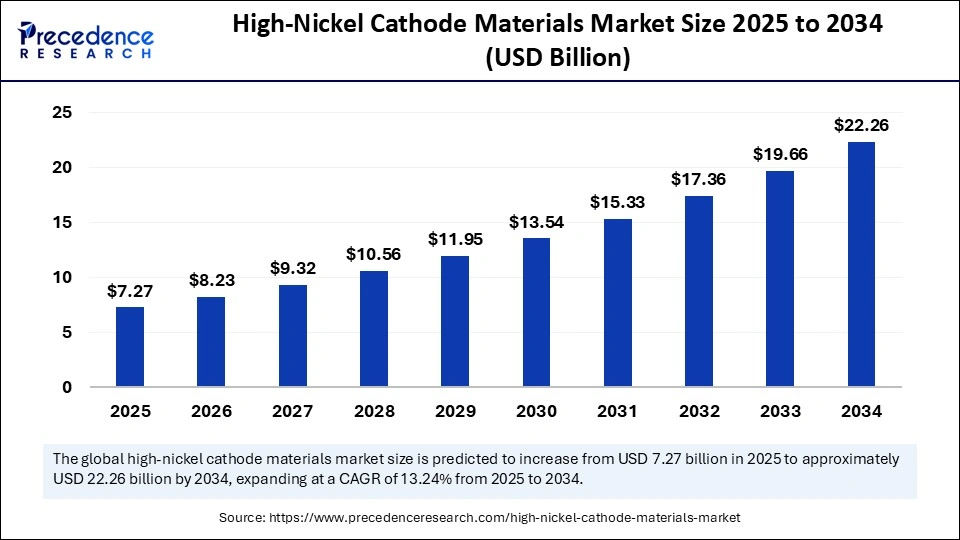

The global high-nickel cathode materials market is projected to reach USD 22.26 billion by 2034, expanding from USD 7.27 billion in 2025 at a robust CAGR of 13.24% from 2025 to 2034.

The growth is propelled by an accelerating demand for high-performance electric vehicles (EVs) requiring batteries that deliver superior energy density, extended driving range, and durability. Government incentives for clean energy adoption and remarkable innovations in cathode chemistry further bolster this trajectory .

High-Nickel Cathode Materials Market Key Insights

-

The market accounted for USD 7.27 billion in 2025 and is forecast to touch USD 22.26 billion by 2034.

-

Asia-Pacific leads the global share with over 50% in 2024, driven by gigafactory investments.

-

North America emerges as the fastest-growing region, backed by EV infrastructure expansion and domestic battery manufacturing.

-

NCM811 dominates the product landscape with a 45% share due to its balance of energy density and cost efficiency.

-

Key players: Umicore, Panasonic, LG Chem, Sumitomo, and Tesla.

-

EV applications accounted for over 60% of total revenue in 2024.

-

Automotive manufacturers continue to be the prime end users, holding approximately 50% share.

How AI Is Refining the Future of Cathode Materials

The integration of AI in battery chemistry is transforming high-nickel cathode innovation. AI-driven predictive models are enabling manufacturers to optimize nickel-cobalt-manganese ratios, reducing development time and enhancing thermal stability. Machine learning algorithms are also being applied to assess cycle performance and predict degradation patterns to help create safer, longer-lasting batteries.

AI-enabled simulations are now streamlining cathode material discovery—helping laboratories run thousands of virtual tests simultaneously. This reduces dependence on expensive trial-and-error physical experiments. Consequently, companies adopting AI in R&D are achieving higher efficiency, precision, and sustainability across their supply chains.

What Factors Are Driving Market Growth?

The industry is gaining traction due to three major factors:

-

Rising EV Adoption: Automakers’ push for higher nickel content enables more compact yet powerful battery packs.

-

Government Support: Carbon neutrality goals and strict EV policies stimulate new investments in domestic battery manufacturing.

-

Improving Energy Density: New chemistries such as NCM811 and NCA enhance vehicle range and performance, meeting consumer expectations.

Where Are the Key Opportunities Emerging?

Grid Storage The Next Big Catalyst?

The growing demand for renewable energy integration is increasing the need for grid-scale energy storage systems (ESS). High-nickel cathode materials are crucial to achieving stable and durable storage for these large-scale renewable infrastructures.

Can Reduced Cobalt Formulations Revolutionize Manufacturing?

Advanced high-nickel alloys with lower cobalt content are becoming the preferred choice among manufacturers aiming for sustainability and lower costs without sacrificing performance.

Will Consumer Electronics Fuel the Next Wave?

The proliferation of 5G-enabled smart devices, wearables, and laptops is generating new demand for compact, durable, and energy-dense batteries—directly supporting growth in the high-nickel materials market.

High-Nickel Cathode Materials Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.27 Billion |

| Market Size in 2026 | USD 8.23 Billion |

| Market Size by 2034 | USD 22.26 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.24% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

Regional Highlights

Asia-Pacific dominated the global market with approximately 50% share in 2024, valued at USD 3.64 billion in 2025 and projected to surpass USD 11.24 billion by 2034 at a CAGR of 13.35%. China, Japan, South Korea, and India continue to lead due to investments in gigafactories and EV adoption programs such as India’s FAME initiative.

North America is projected to be the fastest-growing, spearheaded by the United States and Canada. Incentives under clean energy programs and gigafactory expansions contribute to regional momentum. Europe, particularly Germany, is seeing accelerated uptake of advanced chemistries for its fast-maturing EV market.

Segmentation Overview

| Segment | 2024 Status | Outlook to 2034 |

|---|---|---|

| Product Type | NCM811 leads with 45% share | NCA projected fastest-growing |

| Application | EVs dominate at 60% share | Energy storage systems expected to accelerate |

| End User | Automotive manufacturers – 50% share | Consumer electronics fastest-expanding |

| Distribution Channel | OEM direct sales – 55% share | Battery producers gaining share |

| Nature | Conventional high-nickel – 70% share | Advanced reduced-cobalt chemistries expanding rapidly |

- LG Energy Solution: LG Energy Solution is a global leader in advanced battery technologies, actively developing high-nickel NCM and NCMA cathode chemistries to enhance energy density and longevity in EV batteries. The company’s focus on sustainable raw material sourcing and closed-loop recycling supports its transition to next-generation lithium-ion and solid-state battery systems.

- Contemporary Amperex Technology Co. Limited (CATL): CATL leads the global EV battery market with large-scale production of NCM and NCA high-nickel cathode materials for electric vehicles and energy storage systems. Its R&D focuses on improving thermal stability and cost efficiency, with proprietary technologies enabling batteries exceeding 500 Wh/kg for high-performance EVs.

- Samsung SDI: Samsung SDI develops high-nickel cathode materials such as NCA and NCMA for long-range electric vehicles and premium energy storage systems. The company emphasizes performance optimization and fast-charging capability through advanced cathode coating and particle design technologies.

- SK Innovation: SK Innovation produces high-nickel NCM cathode materials (up to 90% nickel) to achieve higher energy densities and extended battery life. It is expanding production across the U.S. and Europe to supply major automakers, leveraging its proprietary Z-fold and thermal management designs for EV batteries.

- Panasonic Energy: Panasonic is a pioneer in high-nickel NCA cathode chemistry, used extensively in Tesla’s EV batteries for superior energy density and durability. The company continues R&D in next-gen high-nickel and cobalt-free cathodes to enhance sustainability and cost competitiveness.

- BYD Company Ltd.: BYD manufactures both LFP and high-nickel NCM batteries, targeting balanced performance and energy density for its EV lineup. The company’s vertical integration strategy enables control over cathode material sourcing, production, and recycling for maximum efficiency.

- BASF SE: BASF develops advanced high-nickel cathode materials, including NCM 811 and NCMA, with a focus on enhanced thermal stability and reduced cobalt dependency. Its European production network supports the EV supply chain for OEMs through sustainable and scalable cathode material manufacturing.

- Umicore: Umicore is a major supplier of high-nickel NMC cathode materials, with a focus on sustainable battery chemistry and closed-loop recycling. Its upcoming European cathode production sites will strengthen regional EV battery independence and reduce carbon footprint.

- POSCO Chemical: POSCO Chemical manufactures high-nickel NCM and NCMA cathodes through integrated raw material sourcing and advanced synthesis technology. The company is rapidly expanding its global supply to automakers and battery producers, leveraging its strong ties with LGES and GM.

- China Northern Rare Earth Group High-Tech Co.: A key supplier of high-purity rare earths and nickel-based materials supporting cathode production for lithium-ion batteries. The company plays a strategic role in China’s domestic high-nickel cathode supply chain, aiding large-scale EV battery manufacturing.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6980

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344