GPU as a Service Market Key Takeaways

-

North America led the GPU as a Service market in 2024, accounting for over 34% of the total market share.

-

The Asia Pacific region is expected to witness the fastest CAGR of 25.5% during the forecast period.

-

Based on component, the solutions segment held the largest market share at 56% in 2024.

-

The services segment is projected to grow at the highest rate between 2025 and 2034.

-

By pricing model, subscription-based plans captured the biggest market share in 2024.

-

The pay-per-use pricing model is expected to expand at the fastest CAGR during the projected timeframe.

-

In terms of organization size, large enterprises led the global market in 2024.

-

The small and medium enterprises (SMEs) segment is anticipated to grow rapidly over the coming years.

-

Based on vertical, the gaming segment dominated the market in 2024.

-

The IT and telecom segment is projected to record the fastest growth during the assessment period.

Market Overview

The GPU as a Service (GPUaaS) market is emerging as a cornerstone of modern computing infrastructure, enabling scalable, on-demand access to powerful Graphics Processing Units (GPUs) through cloud platforms. This model allows organizations to harness high-performance computing (HPC) power without owning or managing expensive hardware. GPUaaS supports a range of compute-intensive applications including deep learning, artificial intelligence (AI), big data analytics, 3D rendering, video processing, medical imaging, and high-end gaming. With the rising demand for accelerated workloads and real-time data processing, the market is seeing rapid adoption across sectors such as healthcare, automotive, finance, academia, and media & entertainment.

Cloud service providers—like Amazon Web Services (AWS), Microsoft Azure, Google Cloud, and Oracle Cloud—are continuously expanding their GPU offerings, while specialized platforms such as Lambda Labs and CoreWeave are gaining traction by offering tailored GPU services for AI and ML workloads. The GPUaaS model is particularly appealing to startups, researchers, and enterprises needing temporary, flexible, or burst computing capabilities. The market is also benefiting from the convergence of trends such as cloud-native development, remote work, and the democratization of AI technologies, positioning GPUaaS as an essential enabler in the era of digital transformation.

GPU as a Service Market Growth Factors

Several major forces are propelling the growth of the GPU as a Service market. Chief among them is the exponential growth in artificial intelligence and machine learning workloads. Training complex neural networks requires immense computational power, and GPUs—designed for parallel processing—are vastly more efficient than traditional CPUs for these tasks. GPUaaS eliminates the need for upfront capital investment in specialized hardware, offering businesses a pay-as-you-go model that scales with demand.

Another key growth driver is the increased adoption of 3D rendering and virtual simulation in sectors like architecture, automotive, and gaming. GPUaaS provides the necessary graphical horsepower to deliver high-quality visualization and rendering in real-time, reducing project timelines and enhancing design workflows.

The rapid expansion of big data and real-time analytics is also contributing to the surge in GPUaaS demand. GPUs significantly accelerate the processing of large datasets, making them ideal for financial modeling, genomic sequencing, fraud detection, and real-time customer insights.

Furthermore, remote collaboration and virtual desktop infrastructure (VDI) are benefiting from GPUaaS, especially in creative and engineering domains. Professionals can now work on graphically intensive applications from any location, using cloud-hosted GPU instances to ensure performance and security.

The increasing availability of multi-cloud and hybrid cloud environments is also supporting market expansion by allowing enterprises to optimize cost, performance, and compliance across different workloads and geographies.

Impact of AI on the GPU as a Service Market

Artificial Intelligence (AI) is not only a key driver but also a transformative force within the GPUaaS market itself. On one hand, AI workloads—especially deep learning—are a primary use case for GPU services. Training large-scale models like GPT, BERT, or convolutional neural networks (CNNs) for image recognition or language processing demands immense computational capacity, which GPUaaS can deliver flexibly and affordably.

On the other hand, AI is enhancing the management, provisioning, and optimization of GPU resources. Cloud platforms are integrating AI into their orchestration tools to predict workload requirements, optimize load balancing, reduce idle times, and improve energy efficiency. For example, AI-driven auto-scaling features help allocate GPU instances based on real-time demand, ensuring cost-effectiveness and performance continuity.

AI is also being used to monitor system health and performance, enabling predictive maintenance and reducing downtime. Additionally, AI-powered developer tools help users choose the right GPU configurations for their workloads and streamline model deployment across cloud environments.

Moreover, AI is driving innovation in edge computing, where GPUaaS is being extended to edge locations to support real-time decision-making in applications like autonomous vehicles, smart surveillance, and industrial automation. These developments are pushing GPUaaS beyond traditional data center deployments into more distributed and intelligent compute networks.

Market Scope

| Report Coverage | Details |

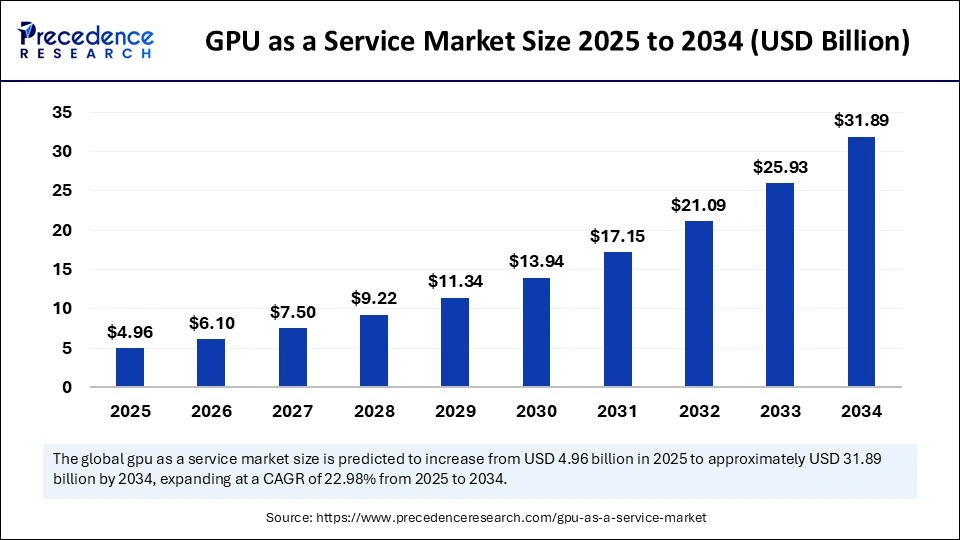

| Market Size by 2034 | USD 31.89 Billion |

| Market Size in 2025 | USD 4.96 Billion |

| Market Size in 2024 | USD 4.03 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 22.98% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Pricing Model, Organization Size, Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

Key drivers fueling the GPUaaS market include:

Rising demand for accelerated computing across AI, ML, and data science domains. The necessity for powerful hardware that can be accessed flexibly is fundamental for organizations driving AI innovation.

Cost efficiency and scalability of the GPUaaS model. Businesses can avoid the heavy capital expenditure of purchasing GPUs by renting cloud-based resources on an hourly or per-second basis.

Growth in content creation and rendering workflows, particularly in media, entertainment, and architecture, where real-time rendering, video editing, and visual effects require GPU-accelerated systems.

Proliferation of AR/VR applications, which require high-performance GPU power for real-time 3D rendering, especially in education, gaming, and virtual training environments.

Cloud-native software development and containerization. Modern applications are designed to run on elastic cloud infrastructure, and GPUaaS integrates seamlessly with Kubernetes, Docker, and other cloud-native tools.

Expanding use of blockchain and cryptocurrency mining, where GPUs are essential for hash calculations and transaction validations.

Opportunities

The GPUaaS market is brimming with growth opportunities. One of the largest lies in democratizing access to high-performance AI computing for small and medium enterprises (SMEs), startups, and research institutions. By eliminating the entry barrier posed by hardware costs, GPUaaS enables smaller players to compete in cutting-edge innovation.

There is a major opportunity in industry-specific cloud platforms offering GPUaaS tailored for sectors such as healthcare (for medical imaging and diagnostics), automotive (for autonomous driving simulations), and finance (for real-time trading algorithms).

Another opportunity is the integration of GPUaaS with low-code and no-code AI development platforms, which would allow non-experts to deploy and run AI models without needing in-depth knowledge of infrastructure or programming.

Edge GPUaaS is also an emerging opportunity. As IoT and edge computing expand, delivering GPU-accelerated services at the edge—such as for real-time video analytics or smart manufacturing—can unlock new use cases and revenue models.

Lastly, as regulatory and privacy concerns grow, there is opportunity in providing GPUaaS solutions with enhanced data security, compliance, and on-premise capabilities, appealing to sectors like government, defense, and regulated healthcare environments.

Challenges

Despite its strong outlook, the GPUaaS market faces several challenges. High operational costs for GPU infrastructure, including energy consumption and cooling requirements, can limit profitability and scalability for providers.

Vendor lock-in and interoperability issues are a concern for enterprises adopting GPUaaS across multiple cloud platforms. Proprietary configurations, pricing complexity, and limited cross-cloud support can create operational friction and dependence on specific providers.

Latency and bandwidth limitations, especially for remote rendering and edge workloads, can hinder performance in real-time applications. Without robust network infrastructure, user experience can suffer.

Security and data governance remain critical issues, particularly when sensitive data is processed in the cloud. Ensuring compliance with GDPR, HIPAA, or other standards is essential for enterprise adoption.

Another challenge is the shortage of skilled professionals who can effectively utilize GPU resources for AI and data science workloads. While cloud platforms aim to simplify access, there remains a steep learning curve for optimizing GPU-based workloads efficiently.

Lastly, rapid evolution in GPU hardware can render existing infrastructure obsolete quickly. This pressures service providers to constantly upgrade and optimize hardware to remain competitive.

Regional Outlook

North America dominates the GPUaaS market, led by the U.S., where cloud adoption is highest, and key players such as NVIDIA, AWS, Microsoft, and Google are headquartered. The region benefits from advanced AI research, a strong tech ecosystem, and robust investments in cloud infrastructure.

Europe is seeing growing adoption, especially in countries like Germany, France, and the UK. Enterprises are leveraging GPUaaS for automotive R&D, fintech applications, and academic research. However, stricter data protection laws mean European cloud deployments often prioritize privacy and compliance.

Asia-Pacific is the fastest-growing market, driven by rapid digitization, smart city projects, and innovation in AI and robotics. China, India, South Korea, and Japan are investing heavily in GPU-powered cloud and edge infrastructure to support sectors such as manufacturing, healthcare, and e-commerce.

Latin America and the Middle East & Africa are emerging markets with growing potential. Increasing investment in digital transformation, coupled with the rise of local cloud data centers, is making GPUaaS more accessible to startups, educators, and public institutions in these regions.

GPU As A Service Market Companies

- Qualcomm Technologies, Inc.

- Oracle

- NVIDIA Corporation

- Microsoft

- Intel Corporation

- IBM Corporation

- HCL Technologies Limited

- Fujitsu

- Arm Limited

- Amazon Web Services, Inc.

Segments Covered in the Report

By Component

- Services

- Solution

By Pricing Model

- Subscription-based plans

- Pay-per-use

By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Vertical

- Automotive

- BFSI

- Gaming

- Healthcare

- IT & telecom

- Media and Entertainment

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Read Also: Online Books Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6094

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344