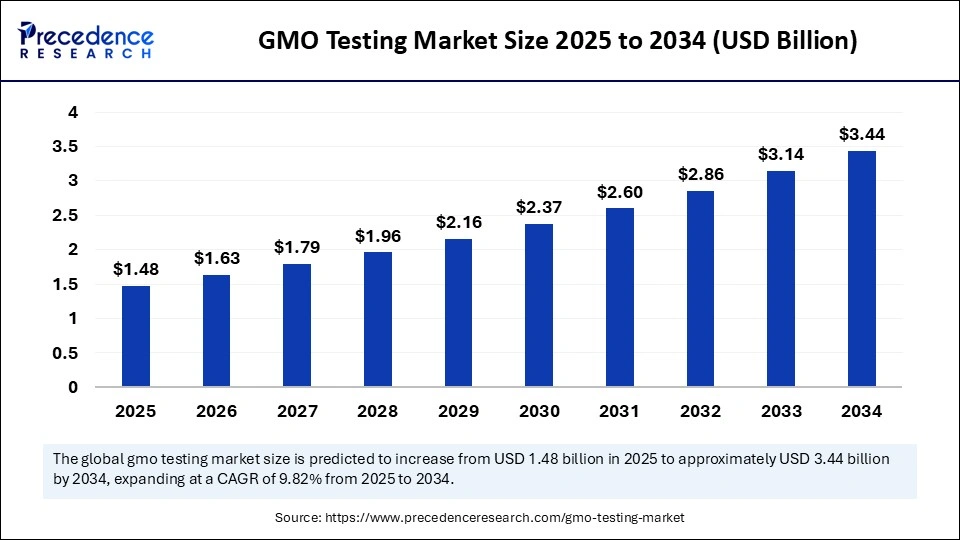

According to Precedence Research, the global GMO testing market will reach USD 3.44 billion by 2034, climbing from USD 1.48 billion in 2025, driven by rapid adoption in food safety and compliance across key regions worldwide. The GMO testing market is expected to surge at a CAGR of 9.82% from 2025 to 2034, fuelled by rising global regulations, consumer demand for transparency, and breakthroughs in detection technologies. Leading players, including Eurofins Scientific, SGS, and Thermo Fisher Scientific, continue to reshape industry standards, ensuring that food, seed, and ingredient supply chains remain secure and compliant.

Market Outlook & Key Drivers

Accelerating regulatory mandates for GMO labelling, especially in North America, Europe, and Asia Pacific, are compelling food and agribusinesses to invest in advanced GMO testing protocols. From polymerase chain reaction (PCR) to next-generation sequencing (NGS), technology adoption is transforming accuracy, speed, and scalability. Record-high GMO crop acreage, especially in the U.S. and Brazil, underscores the urgency for efficient detection systems and traceability solutions.

GMO Testing Market Key Insights

-

Global market size: USD 1.48 billion (2025), projected to reach USD 3.44 billion by 2034.

-

Compound Annual Growth Rate: 9.82% (2025–2034).

-

Dominant region: North America (largest market share in 2024).

-

Fastest-growing region: Asia Pacific.

-

Top segment: Testing services (50% market share, 2024).

-

Leading technology: Real-time PCR (qPCR) held 45% share in 2024.

-

Market leaders: Eurofins Scientific, SGS, Thermo Fisher Scientific, QIAGEN N.V., Nestle S.A., PepsiCo Inc., Danone S.A..

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6949

Revenue Breakdown (2024–2034)

| Year | Market Size (USD Billion) | CAGR |

|---|---|---|

| 2024 | 1.35 | |

| 2025 | 1.48 | 9.82% (2025–2034) |

| 2034 | 3.44 | |

| Asia Pacific (2034) | 1.15 | 9.97% |

AI-driven analytical platforms now enable rapid interpretation of complex genetic data, dramatically reducing turnaround time and human error. Machine learning algorithms, deployed by Eurofins Scientific and Thermo Fisher Scientific among others, boost accuracy, reliability, and cost-efficiency in GMO detection workflows. On-site testing equipment powered by AI is revolutionizing agricultural supply chains, offering real-time results that replace conventional lab procedures and ensure compliance.

Artificial intelligence (AI) not only streamlines laboratory operations but also empowers global traceability efforts—processing massive genomic datasets and identifying unauthorised GMO modifications with unprecedented precision. This is particularly critical in cross-border trade, where AI-enabled platforms minimise the risk of regulatory breaches and product recalls.

Market Growth Factors: What’s Driving Adoption?

-

Rising adoption of GM crops in farming for yield, resistance, and quality.

-

Increasing regulatory scrutiny across major export markets—the U.S., Brazil, China, India, and the EU.

-

Surge in consumer demand for non-GMO food labelling and certified supply chains.

-

Technological advancements in detection: real-time PCR, digital PCR, and targeted NGS.

Opportunity and Trends

How Is the Global Adoption of GM Crops Affecting Testing Demand?

The push for higher-yield, pest-resistant crops is driving expansion in GM acreage, notably in North America and Latin America. This trend, combined with stringent government standards, increases demand for testing solutions that guarantee food safety and transparent labelling.

What Role Does Regulatory Variability Play in Market Challenges?

Inconsistent global regulations often complicate standardisation. Non-uniform GMO monitoring and labelling requirements make cross-border certification complex, pushing players to invest in region-specific solutions—especially in Asia Pacific, Latin America, and the EU.

How Are Technological Breakthroughs Changing the Industry?

Portable field-testing devices and next-generation sequencing are accelerating sample turnaround times—from days to hours. Event-specific qPCR and digital PCR platforms are now staple technologies, enabling laboratories to handle higher sample volumes with increased specificity.

Regional & Segment Analysis

-

North America continues to lead global revenue with over 90% GMO crop acreage and the highest regulatory compliance standards.

-

Asia Pacific: Poised for fastest growth, fueled by expanding biotech regulations in China, India, and Japan.

-

Europe: Stringent traceability laws and consumer preferences for non-GMO products boost high-tech testing.

Segment leaders:

-

Test Type: Event-specific (qPCR) tests—40% share.

-

Technology: Real-time qPCR (largest revenue), digital PCR expected to grow fastest.

-

Sample: Processed foods & ingredients dominate, seeds & planting materials fastest-growing.

-

End User: Food & beverage manufacturers lead, seed companies/breeders fastest-growing.

Latest Breakthroughs & Companies

-

Eurofins Scientific: Launched high-throughput GMO screening platform with 99+% accuracy.

-

SGS: Expanded laboratory capacity for rapid detection compliance.

-

QIAGEN N.V.: Advanced targeted NGS systems.

-

Thermo Fisher Scientific: Leveraged AI for enhanced genetic analysis.

-

Nestle S.A., PepsiCo Inc., Danone S.A.: Rolled out global testing initiatives to meet stricter safety standards.

Challenges and Cost Pressures

-

Regulatory fragmentation between regions increases cost and complexity.

-

High investment required for advanced lab equipment—NGS, dPCR, automated sample handling.

-

Third-party testing labs dominate but face cost pressure from in-house solutions and rapid test kits.

-

Supply chain management is impacted by zero-tolerance policies on unapproved GMOs.

Case Study

In 2024, Eurofins Scientific partnered with a leading Asia-Pacific food company to deploy automated GMO screening. Their new platform cut sample turnaround by 30%, achieving regulatory compliance with both domestic and export buyers. This case exemplifies the market’s shift toward speed, reliability, and global interoperability in food testing services.

Read Also: Microbiome Therapeutics Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344