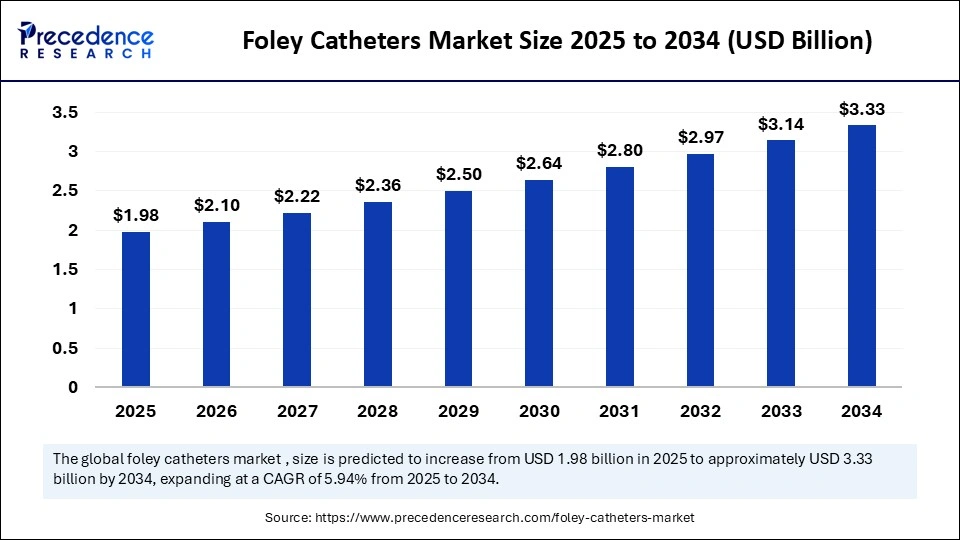

The global Foley catheters market size was valued at USD 1.87 billion in 2024 and is projected to grow to approximately USD 3.33 billion by 2034, exhibiting a robust compound annual growth rate (CAGR) of 5.94% from 2025 to 2034.

This growth is propelled by increasing prevalence of urological disorders, an expanding geriatric population, and rising demand for long-term urinary catheterization in hospitals and home care settings.

Foley Catheters Market Key Points

-

The Foley catheters market was worth USD 1.87 billion in 2024 and is forecasted to reach USD 3.33 billion by 2034.

-

North America dominates the market, holding the largest revenue share in 2024, while Asia Pacific is the fastest-growing region.

-

Leading companies in the market include Becton Dickinson, Cardinal Health, and B. Braun.

-

The latex Foley catheters segment led the market due to comfort, elasticity, and affordability, especially in developing regions.

-

Single-use sterile Foley catheters are preferred, accounting for the highest market revenue on safety and infection control grounds.

-

The short-term use segment dominates with extensive application in surgeries and acute care settings, while long-term use grows fastest due to aging and chronic health conditions.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6922

Market Revenue Overview (USD Billion)

| Year | Market Size |

|---|---|

| 2024 | 1.87 |

| 2025 | 1.98 |

| 2034 | 3.33 |

Artificial intelligence (AI) is making transformative impacts on the Foley catheters market by powering smart catheter systems. These devices can monitor urine flow, detect infections early, and alert healthcare providers in real-time to abnormal conditions. By integrating AI, the devices help minimize catheter-associated infections and improve clinical decision-making.

Predictive analytics enabled by AI also identify high-risk patients before complications arise. Additionally, combining AI with telemedicine extends Foley catheter applications into home care, offering remote patient monitoring for optimized treatment pathways.

Growth Drivers of the Foley Catheters Market

The Foley catheters market’s expansion is supported by escalating cases of urinary tract infections, benign prostatic hyperplasia, and bladder obstructions, often necessitating long-term catheter use. Technological advancements, such as antimicrobial coatings and hydrophilic surfaces, enhance patient safety and comfort, driving adoption.

The growing elderly demographic, increasing surgical interventions, and greater awareness of urinary health also fuel demand. Furthermore, improvements in healthcare infrastructure worldwide, especially in emerging economies, facilitate broader access and advanced care delivery, catalyzing market growth.

What Opportunities and Trends are Shaping the Foley Catheters Market?

How is home care impacting the Foley catheters market?

The rise of home-based healthcare and remote patient monitoring introduces vast opportunities for Foley catheter manufacturers. Home care demands devices that are user-friendly, safe, and efficient for non-clinical use, resulting in targeted product designs for comfort and ease of application. Telehealth infrastructure supports these advances, making long-term urinary management more feasible outside hospitals.

What innovations are improving patient safety?

Antimicrobial-coated and hydrophilic Foley catheters are gaining traction as they reduce infection risks and friction-related discomfort. Smart catheters with AI integration add value by offering real-time monitoring and predictive health analytics.

Which regions show the most promising growth?

Asia Pacific is poised to register the highest CAGR thanks to increasing urological disorders, enhanced medical infrastructure, and government initiatives promoting elderly care and chronic disease management.

Segmentation and Regional Analysis

By Material, latex Foley catheters remain dominant for their elasticity, comfort, and lower cost, especially in emerging markets. Silicone and antimicrobial types are growing due to safety concerns.

Size-wise, male/standard adult catheters lead market revenue due to the high prevalence of urological diseases in men, while female and pediatric sizes exhibit rapid growth from increasing awareness and diagnosis.

In product sterility, single-use sterile catheters account for the largest share, favored by hospitals to reduce infection risks, whereas reusable catheters grow as cost-effective, sustainable alternatives.

Regarding application, short-term catheter use leads with widespread surgical and acute care use, but long-term catheter use is growing fastest, especially in aging populations with chronic conditions.

Hospital and clinic settings generate the highest revenue share, driven by the volume of procedures requiring catheterization and stringent infection control standards. Home care and long-term care facilities are the fastest-growing end-user segments due to demographic trends and telemedicine adoption.

Regionally, North America dominates with mature healthcare infrastructure, strong regulatory support, and a large concentration of leading manufacturers. The Asia Pacific market is expanding rapidly with emerging healthcare investments and increased disease prevalence.

Top Companies in the Foley Catheters Market & Their Offerings

- B. Braun Melsungen AG: B. Braun is a manufacturer of Foley catheters in different types of silicone and latex, both suitable for hospitals and homes. Their products are based on patient safety, easy insertion, and the reduction of the chances of infections.

- Hollister Incorporated: Hollister also offers Foley catheters, which are comfortable and long-term use, and also has antimicrobial-coated catheters. The company focuses on home care solutions and easy designs for the patients and caregivers.

- Coloplast A/S: Coloplast creates new Foley catheters, including intermittent and indwelling catheters, which contain properties to minimize infection and enhance drainage. The company has its subsidiaries, such as Symmetry Medical, which increase its distribution around the globe and the availability of its products.

- Teleflex Incorporated: Teleflex has numerous urological devices, including the safety and comfort options with advanced Foley catheters. Their products are also commonly used in hospitals, surgical facilities, and home care units to manage urinary incontinence securely.

Tier I – Major Players

These are the dominant companies in the Foley catheter market. Each of them holds a significant share individually, and together, they account for approximately 40–50% of the total market revenue.

- Becton, Dickinson & Company (BD)

- Cardinal Health

- B. Braun SE

- Teleflex Inc.

Tier II – Mid-Level Contributors

These companies have a strong market presence but are not as dominant as Tier I players. Collectively, they contribute around 30–35% of the market.

- Coloplast A/S

- Medline Industries, LP

- ConvaTec Group plc

- Cook Medical

- Hollister Inc.

Tier III – Niche and Regional Players

These are smaller or regionally-focused companies with limited global reach. Individually, their contributions are modest, but together they hold around 15–20% of the market.

- Bactiguard AB

- ANGIPLAST Private Limited

- Sterimed Group

- Other local manufacturers and emerging companies

Challenges and Cost Pressures

Despite growth, catheter-associated urinary tract infections (CAUTIs) and patient discomfort remain challenges. The painful catheterization process and risks of infections cause hesitancy among some patients and healthcare providers. Furthermore, cost pressures in healthcare systems, especially in developing nations, limit adoption of high-end catheter technologies. Manufacturers must balance affordability with innovation to address these challenges.

Case Study: Smart Foley Catheter Adoption in Home Care

A pioneering hospital in the U.S. integrated AI-powered smart Foley catheters in its home health program for elderly patients with chronic urinary retention. With real-time urine flow monitoring and infection alerts, the program reduced hospital readmissions by 20% and improved patient satisfaction scores significantly, demonstrating the impact of technology-driven solutions in enhancing treatment outcomes and reducing healthcare costs.

Read Also: Microbiome Therapeutics Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344