Financial App Market Key Insights

-

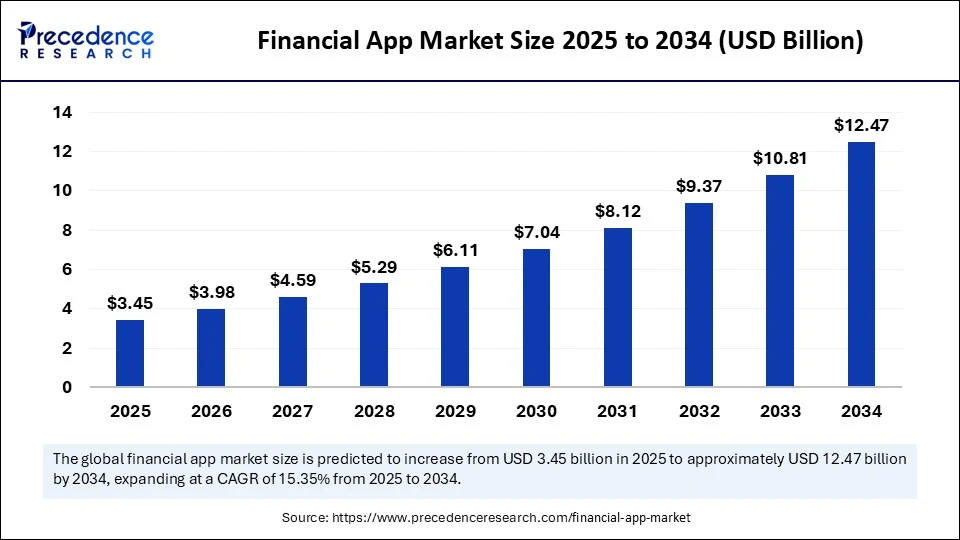

The global financial app market was valued at USD 2.99 billion in 2024 and is projected to reach USD 12.47 billion by 2034, growing at a CAGR of 15.35% from 2025 to 2034.

-

North America held the largest share of the market in 2024, while the Asia Pacific region is anticipated to register the fastest growth during the forecast period.

-

Based on software, the risk and compliance segment accounted for the highest market share in 2024.

-

The BI and analytics segment is expected to witness the most rapid growth in the coming years.

-

In terms of application, the investments segment led the market with the largest share in 2024.

-

The cost tracking and saving segment is forecasted to grow at the highest CAGR during the forecast period.

Financial App Market Growth Factors

Several long-term trends are supporting the growth of the financial app market. The proliferation of affordable smartphones has made digital financial services accessible to a broader demographic. Increased public awareness of personal finance and financial inclusion initiatives by governments are encouraging the use of financial apps. Moreover, regulatory support for open banking and digital innovation is making it easier for both startups and traditional financial institutions to offer app-based services. The COVID-19 pandemic also played a significant role in accelerating the shift toward digital financial interactions.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6312

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 12.47 Billion |

| Market Size in 2025 | USD 3.45 Billion |

| Market Size in 2024 | USD 2.99 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.35% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Software, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Financial App Market Drivers

Three major forces are driving the market: the ongoing shift toward a cashless economy, advancements in technology, and improved mobile infrastructure. As digital payment methods become more prevalent, financial apps are increasingly used for everyday transactions. Innovations like AI, machine learning, blockchain, and biometric authentication are enhancing app functionality, personalization, and security. In addition, the widespread availability of fast mobile internet (4G/5G) is enabling smoother, high-frequency app usage, especially in developing markets.

Opportunities

There are major opportunities for growth across several areas. The convergence of financial services into all-in-one “super apps” that offer payments, loans, savings, investments, and insurance is creating stickier platforms with multiple revenue streams. AI and predictive analytics are allowing apps to deliver highly personalized financial advice and product recommendations at scale. Moreover, underbanked regions such as Latin America, Africa, and South and Southeast Asia represent untapped markets with significant potential for digital-only financial solutions.

Challenges

Despite strong growth, the financial app market faces critical challenges. Cybersecurity and data privacy remain top concerns, as financial apps are high-value targets for hackers. Breaches can result in not only financial losses but also regulatory penalties and damaged reputations. Additionally, digital literacy gaps and mistrust of digital financial platforms — especially among older and rural populations — hinder adoption. The market is also highly competitive, with traditional banks, fintech startups, and tech giants all vying for market share, leading to increased customer acquisition costs. Furthermore, navigating diverse regulatory environments across different regions poses a challenge for global scalability.

Financial App Market Regional Outlook

-

North America leads the market due to its mature financial systems, strong fintech ecosystem, and supportive regulatory environment.

-

Asia-Pacific is the fastest-growing region, driven by rapid smartphone adoption, real-time payment systems, and digital innovation in countries like China and India.

-

Europe is experiencing steady growth due to unified regulations and strong data protection standards, although compliance requirements are more stringent.

-

Latin America is witnessing strong momentum due to high demand for financial inclusion and favorable fintech regulations.

-

Middle East & Africa show promising growth, particularly in countries with established mobile money ecosystems that are now transitioning toward full-service financial apps.

Financial App Market Companies

- PayPal Holdings

- Square Inc. (Block)

- Revolut Ltd.

- Robinhood Markets Inc.

- Monzo

- N26

- Google Pay

- Apple Pay

- Alipay

- WeChat Pay

- Venmo

- Cash App

- Plaid

- Stripe

Segments Covered in the Report

By Software

- Audit

- Risk & Compliance

- BI & Analytics Application

- Business Transaction Processing

By Application

- Cost Tracking Saving

- Investing

- Tracking Debts

- Taxes

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Also Read: Security and Vulnerability Management Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344