Fermented Foods Market Key Insights

-

North America dominated the fermented foods market with the largest share in 2024.

-

Asia Pacific is expected to grow at the fastest rate from 2025 to 2034.

-

Fermented dairy products held a significant share of the market by food type in 2024.

-

Fermented confectionery and bakery products are projected to grow at the fastest rate during 2025 to 2034.

-

Organic acids dominated the market by ingredient type in 2024.

-

Industrial enzymes are expected to witness the fastest growth from 2025 to 2034.

-

Anaerobic fermentation led the market by fermentation process in 2024.

-

Batch fermentation is projected to grow at the highest CAGR between 2025 and 2034.

-

Supermarkets and hypermarkets accounted for the largest share by distribution channel in 2024.

-

Online stores are expected to grow at the fastest rate in the coming years from 2025 to 2034.

Market Overview

The global fermented foods market is witnessing robust expansion, propelled by increasing consumer awareness of the health benefits associated with fermented products. Fermented foods, rich in probiotics and bioactive compounds, are known to enhance gut health, boost immunity, and improve nutrient absorption. This health-conscious shift is complemented by a growing demand for natural, clean-label, and minimally processed foods. Furthermore, the rise of plant-based diets has spurred innovation in plant-derived fermented products, catering to vegan and vegetarian consumers. The market’s growth is also supported by advancements in fermentation technologies, enabling the development of new products and improving production efficiency.

Growth Factors

-

Health and Wellness Trends: An increasing focus on preventive healthcare has led consumers to seek foods that offer health benefits beyond basic nutrition. Fermented foods, known for their probiotic content, align well with this trend.

-

Clean-Label Demand: Consumers are gravitating towards products with natural ingredients and transparent labeling. Fermented foods, often free from artificial additives, meet this demand.

-

Technological Advancements: Innovations in fermentation processes, including the use of specific microbial strains and controlled fermentation environments, have enhanced product quality and consistency.

-

Cultural and Culinary Appeal: Traditional fermented foods hold cultural significance in many regions, contributing to their sustained popularity and consumption.

AI Impact on Fermented Foods Market

-

Process Optimization: AI algorithms analyze fermentation conditions in real-time, allowing for precise control over variables such as temperature, pH, and microbial activity, leading to improved product consistency and reduced waste.

-

Product Innovation: AI aids in formulating new fermented products by predicting consumer preferences and identifying optimal ingredient combinations.

-

Quality Assurance: Machine learning models detect anomalies in fermentation batches, ensuring product safety and quality.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/6146

Market Scope

| Report Coverage | Details |

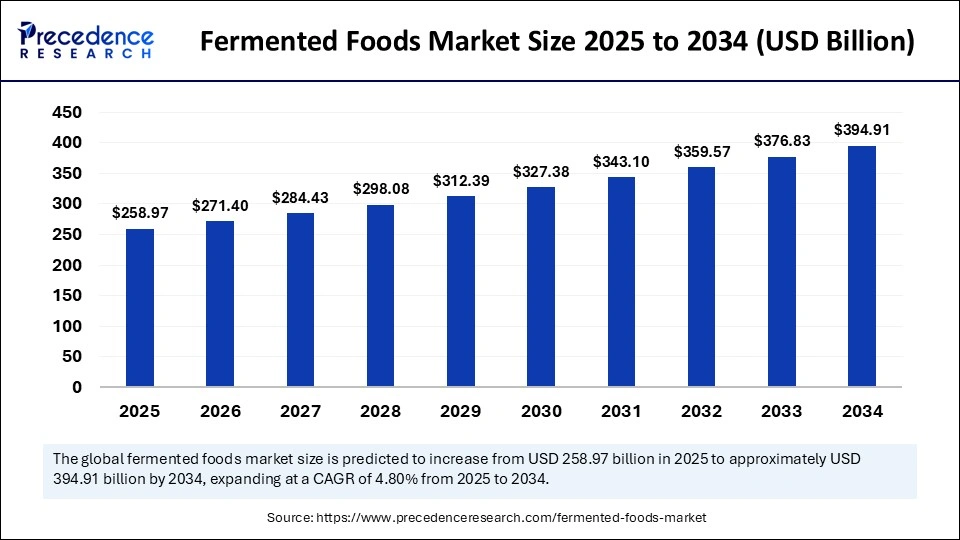

| Market Size by 2034 | USD 394.91 Billion |

| Market Size in 2025 | USD 258.97 Billion |

| Market Size in 2024 | USD 247.11 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.80% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Food Type, Ingredient Type, Fermentation Process, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Drivers

-

Rising Health Consciousness: A growing awareness of the link between diet and health is driving demand for functional foods, including fermented products.

-

Plant-Based Diets: The shift towards plant-based eating habits has led to increased consumption of plant-derived fermented foods, such as tempeh and dairy-free yogurts.

-

Convenience and Accessibility: The proliferation of online retail channels has made fermented foods more accessible to consumers, expanding their reach.

-

Culinary Exploration: An interest in global cuisines has introduced consumers to a variety of traditional fermented foods, broadening market appeal.

Opportunities

-

Product Diversification: There is potential to develop new fermented products that cater to specific dietary needs, such as gluten-free or low-sodium options.

-

Emerging Markets: Regions with growing middle-class populations and increasing health awareness present opportunities for market expansion.

-

Sustainable Practices: Implementing eco-friendly fermentation processes can appeal to environmentally conscious consumers and reduce production costs.

-

Collaborations and Partnerships: Collaborating with research institutions can drive innovation and enhance product offerings.

Challenges

-

Regulatory Compliance: Navigating the complex regulatory landscape for fermented foods, which varies by region, can be challenging for manufacturers.

-

Consumer Education: Lack of awareness about the benefits and varieties of fermented foods may hinder market growth.

-

Production Costs: High costs associated with fermentation processes and quality control measures can impact profitability.

-

Shelf Life and Distribution: Ensuring the stability and shelf life of fermented products during distribution requires careful management.

Regional Outlook

-

North America: The market is driven by a health-conscious population and a strong demand for natural and functional foods. The U.S. and Canada are leading markets, with steady growth.

-

Europe: A rich tradition of fermented foods, combined with a growing interest in organic and plant-based diets, supports market growth. The region focuses on product innovation and maintains steady growth.

-

Asia Pacific: Traditional consumption of fermented foods in countries like Japan, South Korea, and China, along with rising disposable incomes, is propelling market expansion. The region is projected to witness the fastest growth.

Fermented Foods Market Companies

- Ajinomoto Co., Inc.

- Angel Yeast Co., Ltd.

- Archer Daniels Midland Company

- Cargill Incorporated.

- Chr. Hansen Holding A/S

- Conagra Brands Inc

- Danone, Dohler GmbH

- General Mills Inc.

- Kerry Group plc

- KeVita Inc (PepsiCo Inc.)

- Koninklijke DSM N.V.

- Lallemand Inc.

- Mars Incorporated

- Meiji Holdings Co. Ltd.

- Mondelez International

- Nestlé S.A.

- Royal Friesl

- Campina N.V.

Latest Announcements

- On 16 May 2025, Nutri Ferment launched the Functional Fermented Beverage Line. The CEO of Nutri Ferment stated, “Our new beverage line blends tradition with innovation, offering consumers functional benefits through carefully crafted fermentation processes.”

- On 19 April 2025, GreenFerment launched the Eco-Friendly Fermented Snack Range. The CEO of GreenFerment stated, “Our new snack range is designed to meet consumer demands for delicious, healthy, and eco-conscious fermented foods that support both wellness and the planet.”

Segments Covered in the Report

By Food Type

- Fermented Dairy Products

- Fermented Beverages

- Fermented Confectionery & Bakery Products

- Fermented Vegetables

- Others

By Ingredient Type

- Amino Acids

- Organic Acids

- Vitamins

- Industrial Enzymes

- Others

By Fermentation Process

- Batch Fermentation

- Continuous Fermentation

- Aerobic Fermentation

- Anaerobic Fermentation

By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Also Read: Satellite-based 5G Network Market

Source: https://www.precedenceresearch.com/fermented-foods-market