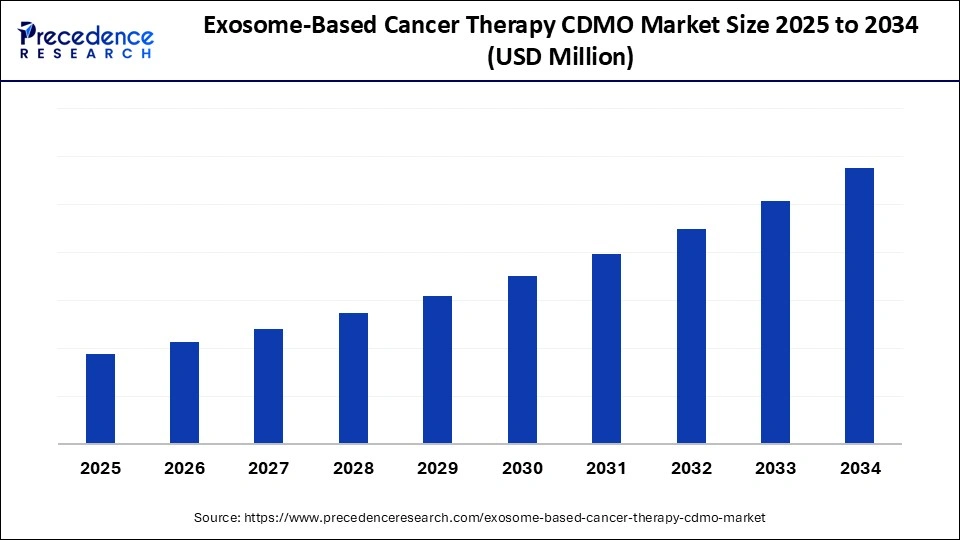

The global exosome-based cancer therapy contract development and manufacturing organization (CDMO) market is witnessing rapid growth, propelled by advancements in exosome technology, rising cancer prevalence, and increasing demand for personalized therapies. Expected to grow at a robust CAGR from 2025 to 2034, this market is transforming cancer treatment landscapes with precise drug delivery and innovative therapeutic solutions.

Key drivers include technological advances in exosome isolation and engineering, substantial investments in healthcare infrastructure, and a surge in oncology-focused clinical trials.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6978

Quick Insights:

- North America dominates the market due to strong biotechnology innovation and high healthcare spending.

-

Asia Pacific is the fastest-growing region, supported by rising R&D investments and government healthcare funding.

-

Engineered/modified exosomes lead the market by type, offering targeted drug and gene delivery.

-

Upstream processing accounts for the largest share of service types, optimizing exosome production.

-

Solid tumors represent the largest therapeutic application segment, driven by lung, breast, and colorectal cancers.

-

Leading players include Aegle Therapeutics, Capricor Therapeutics, StemXO Therapeutics, Codiak BioSciences, and others.

AI’s Transformative Role

Artificial intelligence is revolutionizing exosome-based cancer therapy by enhancing complex molecular data analysis from exosomes, such as proteins, lipids, and nucleic acids. AI-driven identification of novel biomarkers accelerates the discovery of more effective and personalized treatment targets.

Furthermore, AI optimizes immunomodulatory strategies, boosting the precision of exosome-based immunotherapies by studying immune response modulation. These technologies hold promise for tailoring therapies to individual patient profiles, increasing therapeutic effectiveness and safety.

Factors Fueling Market Growth

The primary growth factors include the surge in cancer prevalence globally and the urgent need for personalized treatment options. Technological breakthroughs in exosome isolation, purification, and therapeutic cargo engineering have enhanced treatment specificity and safety.

Expansion of clinical trials, increased funding from biopharmaceutical companies, and strategic collaborations with CDMOs underpin market momentum. Regulatory support in key regions further facilitates market expansion through streamlined approvals and quality standards.

What New Opportunities and Trends Are Shaping This Market?

How is personalized medicine influencing exosome-based cancer therapy?

Personalized medicine is driving demand for therapies that deliver drugs directly to cancer cells using engineered exosomes, allowing treatment tailored to individual patient profiles with enhanced efficacy and minimal side effects.

What technological advances are propelling innovation in exosome therapeutics?

Innovations in 2D and 3D cell culture, cargo loading with nucleic acids and proteins, and advanced engineering techniques are pushing therapeutic frontiers, improving drug delivery systems and therapeutic outcomes.

How significant are emerging markets like Asia Pacific for future growth?

Asia Pacific is rapidly growing due to rising healthcare infrastructure investment, favorable reimbursement policies, and increasing regulatory approvals, creating a fertile ground for market expansion and innovation.

Segmental Insights

Exosome Type/Source

The engineered/modified exosomes segment led the exosome-based cancer therapy CDMO market in 2024. This segment includes drug-loaded and surface-modified exosomes that have been systematically engineered for targeted drug and gene delivery. These modifications enhance treatment specificity, efficacy, and safety in cancer therapy. Meanwhile, the autologous exosomes segment, derived from a patient’s own tumor or immune cells, is expected to see remarkable growth due to their role in promoting tissue repair and reducing inflammation.

Service Type Insights

The upstream processing segment dominated the market in 2024 with a 33.60% share. This segment focuses on producing high-quality, clinical-grade exosomes using 2D and 3D/bioreactor cell cultures, optimizing culture conditions to maximize exosome quantity and quality. The cargo loading and engineering segment is also projected to grow notably, involving the loading of nucleic acids (siRNA, mRNA, miRNA) and proteins to enhance drug delivery, often employing extracellular vesicles to transport therapeutic agents directly to tumor cells.

Therapeutic Insights

The solid tumors segment held the largest market share in 2024, driven by the increasing burden of lung, breast, and colorectal cancers globally. Exosomes serve as natural nanocarriers that deliver drugs directly to cancer cells with high biocompatibility and low immunogenicity. On the other hand, the hematologic cancers segment is expected to grow strongly due to rising cases of leukemia, lymphoma, and multiple myeloma, supported by growing biopharmaceutical investments, clinical trials, and academic-industry partnerships.

End User Insights

Biopharmaceutical companies dominated the exosome-based cancer therapy CDMO market in 2024. These companies utilize exosomes for personalized cancer treatments in collaboration with CDMOs, focusing on advanced loading and targeting technologies. Strategic partnerships with CDMOs and academic institutions are key growth drivers. Biotechnology startups are also anticipated to expand rapidly with increasing venture capital funding and collaborative efforts to develop innovative cancer therapies.

Regional Insights

North America led the market in 2024 due to its strong biotechnology sector, increased healthcare spending, robust R&D investments, and numerous clinical trials focusing on cancer and other diseases. The U.S. plays a major role with leading companies such as Aegle Therapeutics, Capricor Therapeutics, and StemXO Therapeutics. Conversely, the Asia Pacific region is expected to grow the fastest, driven by expanding healthcare infrastructure, government funding, favorable reimbursement policies, and rising regulatory approvals. Rapid advancements in exosome isolation and purification technologies in this region are broad

Top Key Players in the Exosome-Based Cancer Therapy CDMO Market & Their Offerings

- Lonza Group: A global leader in biologics manufacturing offering scalable, GMP-compliant exosome production, purification, and analytical support. Lonza’s strong regulatory expertise and advanced bioprocessing facilities make it a preferred CDMO partner for exosome therapeutics.

- WuXi AppTec: Provides integrated end-to-end services for exosome-based biologics, from discovery and preclinical development to GMP manufacturing. Known for its “follow-the-molecule” model and rapid project turnaround.

- Catalent: Expanding into exosome-based modalities through its cell and gene therapy divisions, offering process development, formulation, and aseptic fill-finish capabilities. Catalent leverages its expertise in advanced biologics and drug delivery.

- Fujifilm Diosynth Biotechnologies: Offers biologics and cell therapy CDMO services with growing capabilities for exosome purification, analytics, and formulation development. Strong expertise in viral vectors and protein expression platforms.

- Samsung Biologics: One of the largest biologics CDMOs globally, investing in advanced modalities including exosomes. Its large-scale biomanufacturing infrastructure ensures reliability and compliance with global regulatory standards.

- Curia: Provides customized bioprocessing solutions for novel modalities, including exosome-based biologics. Known for flexible capacity, tailored development services, and strong analytical capabilities.

- Codiak BioSciences: A pioneer in exosome therapeutics with its proprietary engEx™ platform, developing exosome-based drug delivery systems and partnering with CDMOs for clinical-scale production.

- Evox Therapeutics: Focused on engineering exosomes for targeted drug delivery and therapeutic applications. Partners with major CDMOs to expand GMP manufacturing capacity for oncology and rare disease programs.

- Thermo Fisher Scientific / Patheon Biologics: Offers integrated bioprocessing systems, raw materials, and CDMO services supporting exosome research and production. Combines equipment supply with manufacturing expertise for biologics and exosomes.

- KBI Biopharma: Provides biopharmaceutical process development, analytical testing, and small- to mid-scale GMP manufacturing services applicable to exosome production.

- BioVectra (Canada): Specializes in biologics, small molecule, and mRNA manufacturing, supporting exosome-based drug production through its bioprocess development capabilities.

- Rentschler Biopharma: Offers expertise in cell culture manufacturing and downstream purification—key elements in scalable exosome therapy production. Recognized for quality and regulatory excellence.

- AGC Biologics: A global CDMO providing cell culture, protein, and viral vector manufacturing, expanding into exosome therapeutics as part of its advanced therapies portfolio.

- GenScript Biologics offers biologics development and manufacturing, along with gene vector and payload services, adaptable for exosome-based therapies.

- Evotec: Focuses on integrated discovery and early-stage development partnerships, supporting preclinical exosome therapeutic programs and translational oncology research.

- CMC Biologics: Specializes in biologics and cell therapy manufacturing, providing expertise in process development and analytical characterization for exosome products.

- Cytovance Biologics (USA): Offers custom biologics process development and GMP manufacturing, with growing applications in exosome-based biotherapeutic development.

- Jubilant Biosys: Provides early-stage discovery, process development, and analytical support, enabling foundational R&D for exosome therapeutic programs.

- Boehringer Ingelheim BioXcellence: BI’s biologics manufacturing arm provides comprehensive CDMO services for complex biologics, including emerging platforms such as exosomes.

- Oxford Biomedica: A leader in viral vector manufacturing, expanding into exosome bioprocessing, leveraging its cell and gene therapy production expertise and GMP infrastructure.

Challenges and Cost Pressures:

Despite promising growth, the market faces challenges such as high manufacturing costs, complex regulatory requirements, and ensuring consistent exosome product quality and purity. Establishing standardized large-scale production methodologies remains a key hurdle. Moreover, navigating regulatory landscapes across regions requires significant expertise and investment.

Case Study Highlight:

A leading biopharmaceutical company partnered with a CDMO to optimize the upstream processing of engineered exosomes for targeted lung cancer therapy. This collaboration reduced production costs by 20%, shortened time-to-market by six months, and improved therapeutic efficacy, showcasing the critical role CDMOs play in accelerating cancer treatment development.

Read Also: Cell and Gene Therapy Quality Control and Analytics Market

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344