Embedded Non Volatile Memory Market Size and Growth

Embedded Non-Volatile Memory Market Key Points

-

Asia Pacific dominated the market with the largest share of 49% in 2024.

-

North America is projected to grow at the fastest CAGR in the upcoming years.

-

By product, the eFlash segment accounted for the largest share of 41% in 2024.

-

The eE2PROM segment, by product, is expected to register the highest CAGR of 12.05% during the forecast period.

-

By wafer size, the >100 mm segment led the market in 2024.

-

The <100 mm wafer size segment is projected to grow at the fastest CAGR in the coming years.

-

By application, the BFSI segment captured the largest market share in 2024.

-

The telecommunication segment, by application, is expected to grow at the fastest CAGR during the projection period.

Embedded Non Volatile Memory Market Overview

The embedded non-volatile memory (eNVM) market is witnessing steady growth as demand rises across multiple sectors including consumer electronics, automotive, industrial, and IoT devices. Embedded non-volatile memory refers to memory that is integrated directly into a semiconductor chip and retains data even when the power is turned off.

Unlike standalone memory components, eNVM is embedded within system-on-chips (SoCs), microcontrollers, and ASICs, making it a critical element for efficient and compact electronic system designs. Its ability to offer low-power operation, fast read access, and data retention without external power makes it essential in applications such as firmware storage, boot code, and secure data storage. As of 2024, the market is valued significantly, with increasing traction in advanced nodes and applications requiring reliable, energy-efficient, and scalable memory architectures. The ongoing evolution of semiconductor fabrication technologies and the rise of edge computing and artificial intelligence have further propelled the importance of eNVM in modern electronic devices.

Embedded Non Volatile Memory Market Growth Factors

Several core factors are fueling the growth of the embedded non-volatile memory market. The first is the increasing miniaturization and integration of electronic devices, which is creating a demand for compact, high-density memory solutions integrated within chips. Additionally, the exponential growth of the Internet of Things (IoT) ecosystem has led to a surge in demand for embedded memory in smart devices, wearables, and connected home appliances. eNVM plays a key role in enabling secure booting, configuration data storage, and over-the-air firmware updates in these devices.

Furthermore, the shift toward autonomous and semi-autonomous vehicles is pushing the automotive sector to adopt more sophisticated embedded systems, where eNVM is used for storing critical data in electronic control units (ECUs). Also, advancements in process technologies, such as FinFET and FD-SOI, are making it feasible to integrate eNVM in smaller process nodes, thereby expanding its application base and driving market growth.

Impact of AI on the Embedded Non Volatile Memory Market

Artificial intelligence (AI) is playing a transformative role in shaping the future of the embedded non-volatile memory market. As AI becomes increasingly integrated into edge computing, autonomous vehicles, smart robotics, and IoT ecosystems, the need for fast, efficient, and reliable on-chip memory has become critical. AI workloads often demand real-time data processing and decision-making capabilities, which rely heavily on embedded memory for rapid access and low-latency storage. Embedded non-volatile memory technologies such as MRAM and ReRAM are particularly well-suited for AI applications due to their high endurance, fast write speeds, and low power consumption.

Moreover, AI is also being leveraged to optimize the design, testing, and reliability assessment of embedded memory architectures. Machine learning algorithms are helping semiconductor engineers identify design flaws, enhance yield, and predict failure rates in memory cells, thereby improving product quality and reducing time-to-market. As AI-driven applications proliferate across sectors—from healthcare diagnostics to smart manufacturing—the demand for AI-ready hardware platforms with high-performance eNVM will continue to grow. This synergy between AI and embedded memory technologies is not only accelerating innovation but also expanding the use cases and commercial value of eNVM across diverse markets.

Market Scope

| Report Coverage | Details |

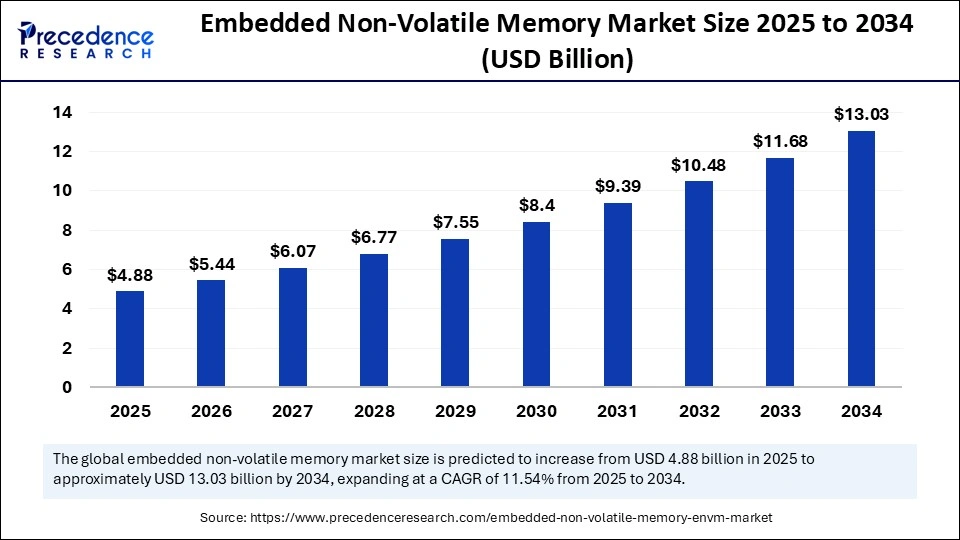

| Market Size by 2034 | USD 13.03 Billion |

| Market Size in 2025 | USD 4.88 Billion |

| Market Size in 2024 | USD 4.37 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.54% |

| Dominating Region | Aisa Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Wafer Size, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

The market is strongly driven by the increasing demand for high-performance and energy-efficient memory in mobile devices and microcontrollers. One of the major drivers is the growing adoption of microcontrollers (MCUs) across industries, particularly in automotive electronics, where MCUs integrated with eNVM are used for safety-critical and mission-critical applications. Another key driver is the widespread implementation of smart technologies in industrial automation, smart meters, medical devices, and security systems, all of which require robust, tamper-resistant embedded memory.

Additionally, the trend toward system-level integration in consumer electronics is accelerating the replacement of external flash memory with on-chip eNVM, which enhances performance while reducing the bill of materials and power consumption. The increasing focus on cybersecurity and secure data storage is also pushing the adoption of secure eNVM technologies like embedded flash and MRAM.

Opportunities

The embedded non-volatile memory market presents several promising opportunities, particularly with the expansion of 5G networks, AI-enabled edge devices, and wearable medical technologies. One of the most notable opportunities lies in the development of next-generation non-volatile memory technologies such as embedded MRAM (eMRAM) and embedded ReRAM (eReRAM), which offer faster write speeds, better endurance, and lower power consumption than traditional embedded flash. These emerging technologies are finding growing acceptance in advanced SoCs for AI, machine learning, and real-time data processing at the edge.

Moreover, as semiconductor companies move toward advanced nodes such as 28nm and below, the scalability and compatibility of modern eNVM solutions will open new doors for deployment in high-performance applications. Additionally, government-backed initiatives to promote semiconductor manufacturing and reduce dependency on imports in regions like Asia-Pacific and North America are expected to boost local production of memory-integrated chips, generating further market momentum.

Challenges

Despite its potential, the eNVM market faces a range of technical and economic challenges. One of the key challenges is the complexity and cost associated with integrating non-volatile memory into advanced process nodes. Traditional embedded flash memory begins to lose scalability and cost-effectiveness below the 28nm node, necessitating the transition to newer memory types such as MRAM and ReRAM, which are still in early adoption phases and may require significant redesigns in manufacturing workflows.

Additionally, ensuring data retention and endurance under extreme temperature and voltage conditions—especially in automotive and industrial applications—remains a critical challenge. Intellectual property (IP) licensing and standardization hurdles may also slow down innovation and implementation for smaller players in the industry. Furthermore, concerns related to memory reliability, latency, and compatibility with existing logic technologies may hinder widespread adoption if not addressed effectively.

Embedded Non Volatile Memory Market Regional Outlook

Regionally, Asia Pacific dominates the embedded non-volatile memory market and is expected to maintain its lead through 2034, driven by the massive presence of semiconductor manufacturing hubs in countries like China, Taiwan, South Korea, and Japan. The region benefits from a strong electronics ecosystem, favorable government initiatives to boost semiconductor production, and the rising consumption of smartphones, automotive electronics, and IoT devices.

North America holds a significant share of the market due to its early adoption of advanced semiconductor technologies, high R&D investments, and the strong presence of key players like Intel, GlobalFoundries, and Micron. The region is also at the forefront of developing AI and edge computing solutions, which heavily rely on embedded memory. Europe is growing steadily, especially with increasing demand in automotive and industrial automation sectors, while Latin America and the Middle East & Africa are still in early growth phases but show potential with the rise of digital transformation and smart infrastructure development. Overall, global momentum in digitalization and electronics innovation continues to shape a robust growth trajectory for the embedded non-volatile memory market.

Embedded Non-Volatile Memory Market Companies

- Samsung Electronics Co. Ltd

- Micron Technology, Inc.

- Rohm Co. Ltd

- Toshiba Electronic Devices & Storage Corporation

- Western Digital Technologies, Inc.

- Honeywell International Inc.

- Crossbar Inc.

- Fujitsu Ltd.

- Japan Semiconductor Corporation

- HDD Manufacturers

Segments Covered in the Report

By Product

- eFlash

- eE2PROM

- FRAM

- Others

By Wafer Size

- <100 mm

- >100 mm

By Application

- BFSI

- Consumer Electronics

- Government

- Telecommunications

- Information Technology

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Read Also: Credit Risk Assessment Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6243

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344