Electronic Grade Nitric Acid Market Key Points

- Asia Pacific led the electronic grade nitric acid market in 2024, accounting for the largest share of 40%.

- North America is projected to witness the fastest CAGR in the market from 2025 to 2034.

- By product type, the EL grade segment dominated the market with a 51% share in 2024.

- The VL grade segment is anticipated to grow at the highest CAGR of 5.94% during the forecast period.

- By application, the semiconductor segment held the largest market share of 57% in 2024.

- The solar energy segment is expected to register a significant CAGR of 5.95% between 2025 and 2034.

What is Electronic Grade Nitric Acid?

Electronic Grade Nitric Acid (EGNA) is a highly purified form of nitric acid used primarily in the electronics and semiconductor industries. It features extremely low levels of metal and particle contaminants, making it ideal for applications requiring ultra-clean conditions, such as etching, cleaning silicon wafers, and oxidation processes in semiconductor fabrication. Its purity levels are classified into various grades like EL (Electronic Low) and VL (Very Low), each suited for different precision requirements.

Why is it Important in Modern Technology?

Electronic grade nitric acid plays a vital role in maintaining the reliability and efficiency of microelectronics and photovoltaic devices. As the demand for high-performance semiconductors and solar cells grows, the need for high-purity chemical reagents like EGNA is also increasing. Its ability to provide consistent and contamination-free processing helps manufacturers meet stringent quality and yield standards in the production of chips, displays, and advanced electronic components.

Market Overview and Growth Outlook

Electronic grade nitric acid is a high-purity formulation of nitric acid used primarily in the electronics industry, especially in semiconductor manufacturing. It is essential for cleaning silicon wafers, removing organic and inorganic residues, and preparing surfaces for photolithography and other critical processes. The rising demand for advanced microelectronics, along with rapid development in AI chips, 5G infrastructure, and solar photovoltaics, is driving the demand for this ultra-pure chemical compound.

The market is witnessing increasing consumption due to miniaturization trends and higher precision in chip designs. Manufacturers are moving toward smaller technology nodes, which require enhanced purity in cleaning and etching chemicals. As a result, EL and VL grade nitric acid are gaining traction, with new fab projects in Asia, North America, and Europe driving volume and innovation.

Role of AI in the Electronic Grade Nitric Acid Market

Artificial intelligence is becoming a transformative force in the electronic grade nitric acid industry. AI is used for real-time monitoring of purification processes, ensuring consistent high-purity standards during production. Predictive analytics enable chemical manufacturers to optimize supply and anticipate demand from semiconductor fabrication plants more accurately.

Additionally, AI-integrated quality assurance systems help detect anomalies in acid formulation, reducing wastage and ensuring adherence to ultra-purity requirements. In the future, smart sensors and AI-driven feedback loops may play a vital role in on-site quality checks, traceability, and safety compliance—particularly important in fabs that demand zero-defect chemicals.

Market Growth Factors

Key growth drivers for the electronic grade nitric acid market include the explosive demand for semiconductors and solar cells. These industries collectively represent more than 85% of the total consumption of this grade of nitric acid. Technological advances in chip manufacturing, such as the shift to extreme ultraviolet lithography (EUV), further increase the need for reliable and consistent wafer cleaning agents.

Increased government investments and subsidy programs promoting domestic chip production across countries like the U.S., China, India, and South Korea are accelerating demand for high-purity chemicals. At the same time, cleaner production technologies are being adopted to comply with stringent environmental regulations, further boosting interest in highly controlled manufacturing processes involving electronic grade nitric acid.

Market Scope

| Report Coverage | Details |

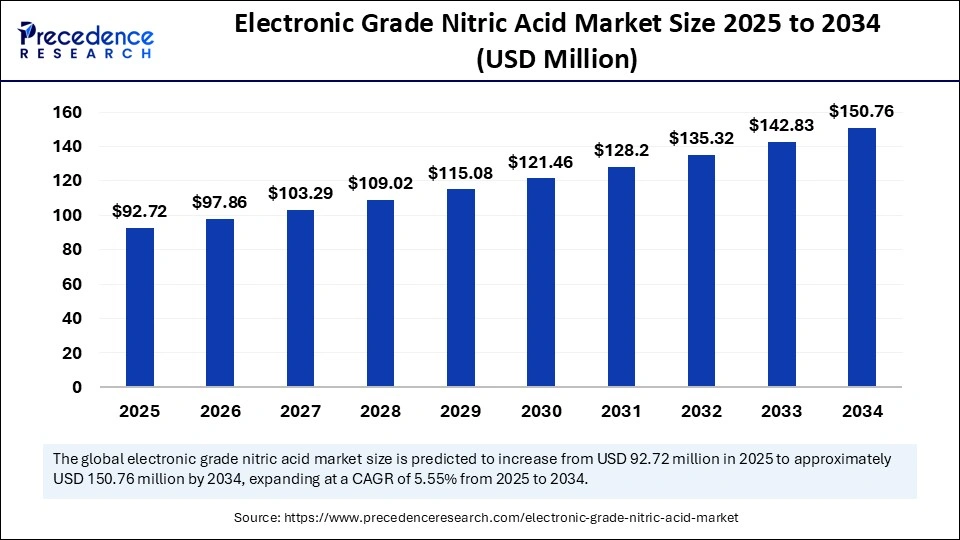

| Market Size by 2034 | USD 150.76 Million |

| Market Size in 2025 | USD 92.72 Million |

| Market Size in 2024 | USD 87.84 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.55% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Drivers

The primary drivers of the market include increased investment in semiconductor fabrication, rising demand for high-purity materials in photovoltaics, and expansion of display panel manufacturing. The industry is also benefiting from growing interest in sustainable and waste-minimizing fabrication processes, where consistent chemical purity enhances yield and reduces reprocessing costs.

Market Opportunities

Emerging markets such as Vietnam, India, and parts of the Middle East present significant untapped potential for electronic grade nitric acid producers. As these regions ramp up local chip production and solar capacity, demand for high-purity chemicals will follow. Innovations in acid recovery and closed-loop systems could provide cost and environmental advantages to suppliers.

The growing application of remote sensing, electric vehicles, and AI technologies also opens indirect demand channels for nitric acid used in the production of advanced chips and sensors.

Market Challenges

Despite its high potential, the market faces notable challenges. These include the high cost of production facilities capable of maintaining ultra-purity standards, complex regulatory requirements for handling and transportation, and raw material supply chain vulnerabilities. Price volatility of feedstocks and geopolitical factors may disrupt production or increase costs.

Moreover, there is a significant need for skilled labor and specialized infrastructure, which could slow the pace of new plant development in developing countries.

Regional Outlook

Asia Pacific remains the dominant region due to the presence of leading semiconductor and solar panel manufacturers in China, South Korea, Japan, and Taiwan.

North America is expanding rapidly, driven by substantial U.S. investments into domestic chip fabs and clean energy technologies.

Europe is focusing on establishing strategic autonomy in chip production and is increasingly investing in fabs and related chemicals.

Latin America and the Middle East & Africa are at nascent stages but could become regional hubs for solar technologies, further enhancing the regional demand.

Competitive Landscape

The competitive landscape includes a mix of multinational corporations and regional players focused on niche applications. Leading players in this market include:

- Mitsubishi Chemical Corporation

- Everest Kanto Cylinder

- BASF SE

- Columbus Chemicals

- UBE Corporation

- T. N. C. Industrial

- KMG Electronic Chemicals

- EuroChem

- Asia Union Electronic Chemicals

- Juhua Group

- Everest Kanto Cylinder

- KMG Electronic Chemicals

- Suzhou Crystal Clear Chemical Co., Ltd.

- thyssenkrupp Uhde

These companies compete based on chemical purity, production scalability, customer customization, and adherence to sustainability and safety regulations.

Future Outlook and Trends

The electronic grade nitric acid market is expected to maintain steady growth as new chip fabs come online and countries invest in energy transitions. Key trends include:

-

Increasing use of VL grade for high-performance chips

-

AI and automation in quality control and production

-

Environmental sustainability through closed-loop systems

-

Strategic regional expansions to reduce dependency on specific supply chains

Technological convergence and the rise of digital infrastructure will continue to fuel demand for advanced semiconductors and, consequently, for highly purified process chemicals such as electronic grade nitric acid.

Segments Covered in the Report

By Product Type

- EL Grade

- VL Grade

- UL Grade

- SL Grade

By Application

- Semiconductor

- Solar Energy

- LCD Panel

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Read Also: Waterproofing Admixtures Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6234

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344