Distributed Temperature Sensing Market: Trends, Technologies, and Future Prospects

The demand for intelligent monitoring systems across industries such as oil & gas, power, mining, and infrastructure has given rise to advanced sensor technologies that provide real-time data and operational insights. Among these, distributed temperature sensing (DTS) systems have emerged as a game-changing innovation. Utilizing fiber-optic technology, DTS systems offer continuous, real-time temperature profiling along the entire length of a fiber cable—unlike traditional point sensors. This capability makes them essential for detecting leaks, monitoring equipment health, and preventing potential failures in critical assets.

As digital transformation accelerates across sectors, the DTS market is experiencing exponential growth. Increased adoption in energy, utilities, and environmental monitoring, coupled with the rising need for automation and safety, positions this market for sustained expansion.

What is Distributed Temperature Sensing?

Distributed temperature sensing refers to a sensing technology that uses optical fibers to measure temperature continuously and in real time along the entire length of the fiber. DTS systems are based on the principle of Raman scattering, a phenomenon where light is scattered by temperature variations within the fiber core. The backscattered light carries temperature information, which is interpreted by a DTS interrogator unit.

Unlike conventional sensors that can measure temperature at discrete points, DTS can measure temperature across kilometers of fiber—offering unparalleled spatial resolution and accuracy. The technology is highly durable, immune to electromagnetic interference, and suited for use in extreme environments like oil wells, high-voltage substations, or mining tunnels.

DTS is commonly deployed in three forms: single-ended, double-ended, and looped configurations, depending on the desired accuracy and system redundancy. The versatility, safety, and real-time monitoring features make DTS a critical tool in predictive maintenance and risk management strategies.

Distributed Temperature Sensing Market Size and Growth Outlook

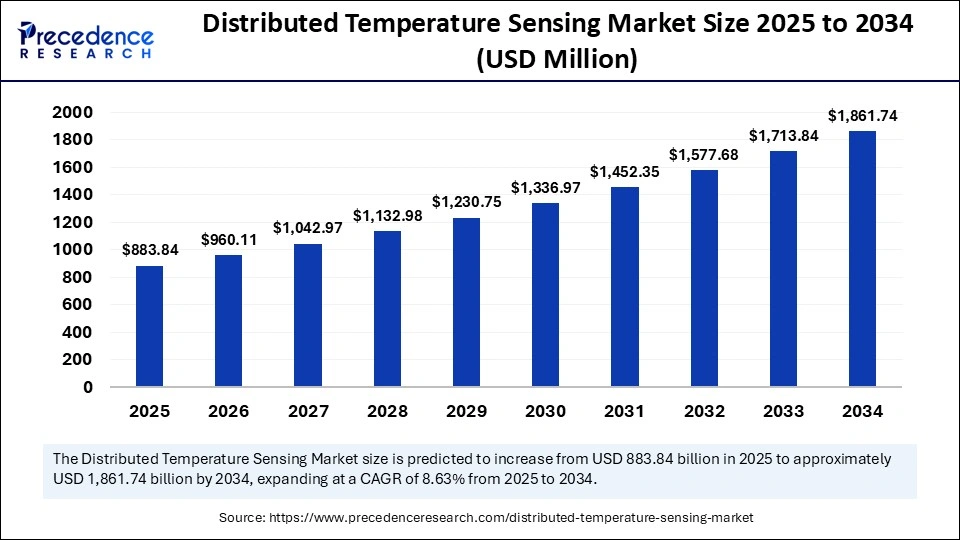

The global distributed temperature sensing market size is estimated to cross around USD 1861.74 million by 2034 from USD 813.62 million in 2024, with a CAGR of 8.63%.

The surge in market value is driven by the increasing demand for real-time temperature monitoring in hazardous environments, growing awareness about asset safety and environmental protection, and technological advancements in fiber optics and data analytics. The oil & gas industry remains the largest consumer of DTS systems, but other sectors such as power & utilities, civil engineering, and environmental monitoring are rapidly increasing their adoption.

As smart infrastructure initiatives and Industry 4.0 standards proliferate, DTS systems will play a vital role in digitizing field operations and improving system efficiency across verticals.

Distributed Temperature Sensing Market Key Points

-

North America held the largest revenue share of 34% in the distributed fiber optic sensor market in 2024.

-

Asia-Pacific is projected to register the fastest CAGR of 12.2% between 2025 and 2034.

-

By operating principle, the optical frequency domain reflectometry (OFDR) segment accounted for the highest revenue share of 79% in 2024.

-

By operating principle, the optical time domain reflectometry (OTDR) segment is anticipated to grow at a notable CAGR of 10.3% from 2025 to 2034.

-

By fiber type, the single-mode fiber segment led the market with the largest share in 2024.

-

By fiber type, the multi-mode fiber segment is expected to experience the highest growth rate in the coming years.

-

By application, the oil and gas segment was the leading contributor to market revenue in 2024.

-

By application, the process and pipeline monitoring segment is forecasted to expand at a significant CAGR over the projection period.

Distributed Temperature Sensing Market Drivers and Challenges

Several factors are driving the growth of the DTS market. One of the primary drivers is the need for enhanced safety and risk mitigation in high-risk industries. In oil & gas, DTS is used to monitor pipelines for hot spots or leaks, helping operators prevent blowouts or ruptures. Similarly, in power cable monitoring, DTS ensures the cables are operating within safe thermal limits, preventing potential outages or fires.

Another growth factor is the adoption of smart grid technologies. Utility companies are deploying DTS systems to monitor underground power cables and transformers, enabling predictive maintenance and real-time fault detection. In mining, DTS systems help track temperature changes to ensure worker safety and structural integrity. Furthermore, government regulations and environmental standards are encouraging industries to adopt monitoring systems that can detect anomalies early, thereby reducing emissions, accidents, and downtime.

Despite these advantages, the DTS market faces several challenges. The initial installation costs of DTS systems are high, which may deter small- and medium-sized enterprises. The complexity of deployment, especially in retrofitting existing infrastructure, and the need for skilled technicians to interpret the data can slow down adoption. Additionally, data management and integration into existing SCADA or IoT systems require tailored software solutions, which adds to overall project costs.

Technology Platforms and Applications

The distributed temperature sensing market is segmented based on technology type, fiber type, operating principle, and applications. The two main operating principles are optical time domain reflectometry (OTDR) and optical frequency domain reflectometry (OFDR). OTDR is the most widely adopted due to its scalability and ability to operate in harsh environments.

DTS systems are usually deployed using single-mode or multi-mode fibers, depending on the required range and resolution. Single-mode fibers are ideal for long-distance applications, whereas multi-mode fibers are preferred for shorter, high-resolution sensing needs.

In terms of applications, the oil & gas sector is the largest and most mature market for DTS. The technology is widely used in downhole well monitoring, pipeline leak detection, and reservoir management. In the power & utilities sector, DTS is used for monitoring underground cables, transformers, and switchgear. Civil engineering projects use DTS in tunnels, bridges, and dams to monitor thermal stress, while environmental monitoring applications include detecting forest fires, landslides, and temperature profiles in rivers or glaciers.

With the advent of smart cities and intelligent infrastructure, DTS is gaining traction in structural health monitoring, providing early warning signs of wear, overheating, or stress accumulation.

Regional Market Insights

North America holds a leading position in the global DTS market, driven by extensive oil & gas infrastructure, well-established power utilities, and strong investments in R&D. The United States, in particular, has a mature market supported by safety regulations and a growing emphasis on renewable energy monitoring.

Europe follows closely, with countries such as Germany, the UK, and Norway integrating DTS into offshore drilling, renewable energy plants, and transportation systems. Stringent environmental laws and increased focus on sustainable development are also pushing the adoption of smart monitoring technologies.

The Asia-Pacific region is the fastest-growing market for DTS systems. Nations like China and India are investing heavily in smart grids, oil & gas exploration, and mining operations. Urbanization, industrial expansion, and infrastructure development programs are creating new opportunities for DTS technology in the region.

Middle East & Africa is another promising market, particularly in pipeline monitoring, oil field services, and utility grid modernization. Latin America is also seeing slow but steady adoption in energy and environmental monitoring.

Distributed Temperature Sensing Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1861.74 Million |

| Market Size in 2025 | USD 883.84 Million |

| Market Size in 2024 | USD 813.62 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.63% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Operating Principle, Fiber Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Key Players and Competitive Landscape

The DTS market is characterized by the presence of several global and regional players. Leading companies include Schlumberger Limited, Halliburton, Yokogawa Electric Corporation, NKT Photonics, Silixa Ltd, AP Sensing, Sensornet, Bandweaver Technologies, and LIOS Technology GmbH.

These companies offer a range of DTS products tailored for various industries and often compete on factors such as system range, resolution, installation flexibility, and software analytics. Many players are also focusing on strategic partnerships, mergers, and collaborations with IoT and AI startups to enhance their DTS solutions with intelligent data processing and predictive maintenance capabilities.

The market is witnessing innovation in terms of compact DTS interrogators, cloud-connected sensing platforms, and AI-driven data analytics, which are broadening the appeal and usability of DTS systems across mid- to large-scale enterprises.

Future Trends and Emerging Opportunities

The future of the distributed temperature sensing market lies in its convergence with digital technologies like AI, IoT, and cloud computing. By integrating DTS data into centralized dashboards, companies can obtain actionable insights in real time, enabling proactive maintenance and risk prevention.

Another trend is the shift toward wireless and portable DTS systems. These compact systems can be easily deployed in remote locations or temporary installations, making them suitable for disaster response and military operations. In renewable energy, DTS will play a key role in monitoring thermal loads in solar farms, wind turbines, and energy storage systems.

Smart city infrastructure offers yet another growth avenue. Cities can embed fiber optic cables with DTS into bridges, tunnels, and buildings to enable real-time structural health monitoring. As climate change increases the risk of wildfires and extreme weather, DTS will also be used for environmental and climate sensing, offering early warning capabilities in vulnerable ecosystems.

With increasing awareness, lowering hardware costs, and improved data processing tools, the barriers to entry for DTS systems are expected to decline, ushering in a new era of temperature intelligence across industries.

Conclusion

The distributed temperature sensing market is at a pivotal point, where the convergence of optical sensing technology and digital intelligence is unlocking new capabilities across industries. With proven benefits in real-time monitoring, safety assurance, and operational efficiency, DTS systems are becoming indispensable in sectors such as energy, infrastructure, and environmental management.

The market is projected to witness robust growth in the coming years, fueled by regulatory compliance, industrial digitization, and emerging smart applications. While challenges such as installation complexity and high initial costs remain, technological innovation and increased industry awareness are steadily addressing these barriers.

For businesses aiming to enhance safety, reduce downtime, and embrace data-driven operations, investing in distributed temperature sensing technologies is no longer a luxury—but a strategic necessity.

Also Read: Photonic Integrated Circuit Market

Also Read: Smart Card IC Market

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6207

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344