Cyclic Olefin Polymer Market Key Points

-

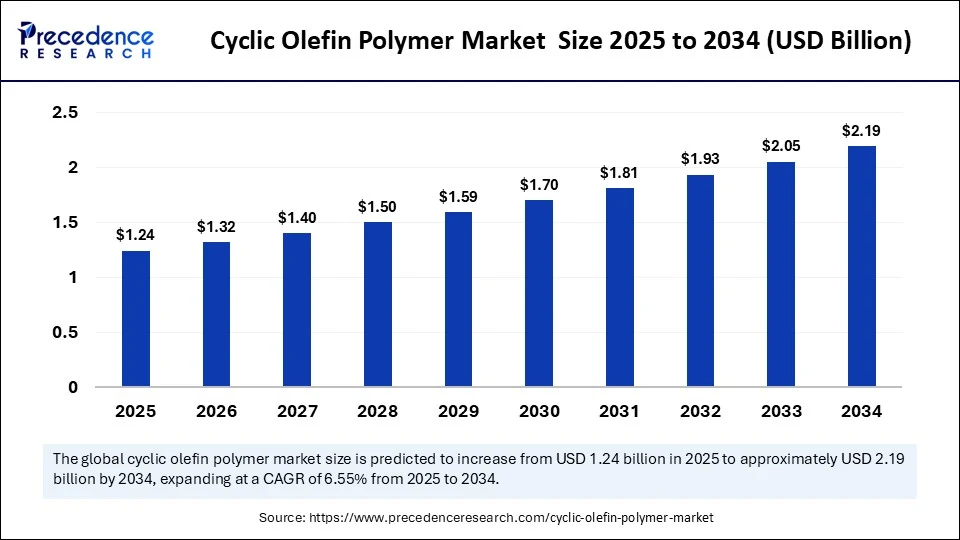

The global cyclic olefin polymer market was valued at USD 1.16 billion in 2024 in terms of revenue.

-

It is projected to reach approximately USD 2.19 billion by 2034, growing at a CAGR of 6.55% from 2025 to 2034.

-

North America emerged as the leading regional market in 2024, accounting for the largest share of 52.5%.

-

The Asia Pacific region is anticipated to register a strong CAGR during the forecast period.

-

Based on type, cyclic olefin copolymers dominated the market in 2024 with a 68.3% share.

-

The cyclic olefin polymer segment is expected to expand at a considerable CAGR between 2025 and 2034.

-

In terms of application, the pharmaceutical and medical sector led the market in 2024, contributing 61.4% of the total share.

-

Among end-users, the healthcare and life sciences segment accounted for the highest share of 64.7% in 2024.

-

The electronics and semiconductor industry is projected to experience substantial growth throughout the forecast period.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6335

Cyclic Olefin Polymer Market Growth Factors

Several structural tailwinds underpin market expansion. First, the accelerating shift toward biologics, pre‑filled syringes, and point‑of‑care diagnostics in healthcare has created a pressing need for containers that are inert, transparent, break‑resistant, and easily molded—characteristics that give COP/COC a clear edge over glass. Second, the miniaturization of optical and electronic devices demands polymers with exceptionally low birefringence and high dimensional precision, enabling thinner light guides, wafer carriers, and camera lenses.

Third, sustainability goals are pushing brand owners to replace multilayer barrier structures and heavy glass with lightweight, recyclable, single‑material solutions—an area where COC’s moisture barrier and hot‑fill capabilities are opening new packaging avenues. Finally, growing investment in high‐throughput, additive‑manufacturing‑grade COP resins for microfluidics and 3‑D printed labware is unlocking entirely new application clusters across life‑science research and personalized medicine.

Role of AI in the Cyclic Olefin Polymer Market

Artificial intelligence is rapidly becoming a catalyst for performance leaps across the COP/COC value chain. Machine‑learning algorithms now analyze polymerization kinetics and monomer ratios in real time, automatically adjusting reactor conditions to achieve tighter molecular‑weight distribution and customizable glass‑transition temperatures. In film and injection molding, AI‑driven vision systems detect surface defects and birefringence variations at sub‑micron resolution, ensuring medical‑grade consistency while cutting scrap rates.

On the demand side, predictive analytics ingest prescription trends, diagnostic test volumes, and semiconductor order books to optimize production scheduling and inventory allocation, helping suppliers mitigate the long lead times typical of specialty polymer markets. These capabilities shorten development cycles, trim operating costs, and accelerate regulatory qualification for new grades tailored to emerging drug or electronics platforms.

Cyclic Olefin Polymer Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.19 Billion |

| Market Size in 2025 | USD 1.24 Billion |

| Market Size in 2024 | USD 1.16 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.55% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Key Market Drivers

Regulatory and commercial imperatives converge to propel COP/COC uptake. Stricter extractables‑and‑leachables guidelines from agencies such as the FDA and EMA favor inert polymer primary packaging over glass or polycarbonate. Surgeons and clinicians increasingly specify COP-based syringes and cartridges because they virtually eliminate protein adsorption and delamination risks, safeguarding high‑value biologics. In electronics, ever‑shrinking feature sizes amplify the need for ultra‑clean, low‑outgassing carrier materials that can withstand reflow temperatures without warping.

Meanwhile, consumer electronics and automotive LiDAR units rely on glare‑free optical films and lenses, where COC’s low color shift and superior replication fidelity translate into sharper imaging and longer service life. Together, these regulatory requirements and performance advantages drive steady, high‑margin demand across multiple verticals.

Opportunities

A host of opportunities invite fresh investment. The rise of home‑based diagnostics and microfluidic “lab‑on‑a‑chip” platforms calls for low‑cost, mass‑moldable COP substrates that tolerate aggressive solvents and high‑energy detection wavelengths—an opening for contract molders and film extruders to carve out new revenue streams. Large‑area, ultra‑thin COC films are finding use as moisture barriers in OLED and micro‑LED displays, presenting a greenfield arena for polymer film converters.

Recent progress in 3‑D printable cyclic olefin resins introduces possibilities in personalized implants and intricate surgical tools. Finally, as global vaccine distribution expands, cyclic olefin vials and cyclic‑olefin‑lined stoppers offer superior break resistance and cold‑chain stability, suggesting robust growth for packaging innovators that can scale capacity quickly.

Challenges

Despite its promise, the market faces non‑trivial hurdles. Feedstock availability for specialty metallocene catalysts remains concentrated, making supply chains vulnerable to price spikes. COP and COC resins carry a cost premium over commodity plastics, limiting penetration into price‑sensitive segments unless converters can capture added value through weight reduction or performance differentiation. Molding these polymers requires tight temperature control to prevent residual stress and haze, demanding capital investment in upgraded tooling and process monitoring.

End‑of‑life recycling streams are still evolving, with limited post‑consumer collection for cyclic olefin materials; regulatory pressure for circularity could intensify and require collaborative recycling initiatives. Lastly, the transition from glass to polymer in injectable drug packaging must clear conservative validation cycles, extending time‑to‑adoption for certain blockbuster biologics.

Cyclic Olefin Polymer Market Regional Outlook

North America dominates with more than half the global share, thanks to its extensive biologics pipeline, advanced diagnostic manufacturing, and stringent pharmaceutical packaging standards that tilt heavily toward cyclic olefin solutions. Europe follows closely, sustained by a strong medical‑device cluster and progressive sustainability mandates that favor lightweight, lower‑carbon materials.

Asia‑Pacific is the clear growth engine: China and South Korea are scaling OLED and semiconductor fabs that consume high‑clarity COC films, while Japan continues to innovate in precision optics and niche medical disposables. Latin America and the Middle East & Africa remain smaller but increasingly attractive export destinations as healthcare infrastructure modernizes and demand rises for high‑barrier packaging to support temperature‑sensitive pharmaceuticals.

Cyclic Olefin Polymer Market Segmental Insights

From a type perspective, cyclic olefin copolymers secure roughly two‑thirds of revenue, prized for their excellent moisture barrier and dimensional stability, particularly in pharmaceutical syringes and optical films. Pure cyclic olefin polymers, though currently smaller, are growing faster on the back of their higher heat resistance and extremely low birefringence—attributes that are winning business in lithography optics and next‑generation microfluidic chips.

By application, pharmaceutical and medical uses account for well over half of global sales; pre‑filled syringes, diagnostic consumables, and drug‑delivery inhalers dominate this segment, while electronics and optics are the most dynamic, registering double‑digit gains driven by wafer‑level packaging and high‑resolution display backplanes.

In terms of end users, healthcare and life‑science companies consume almost two‑thirds of output, but the electronics and semiconductor sector is closing the gap quickly as the industry migrates to lower‑contamination carrier materials.

Cyclic Olefin Polymer Market Key Companies

- Zeon Corporation

- TOPAS Advanced Polymers (Daicel Group)

- Mitsui Chemicals, Inc.

- JSR Corporation

- Polyplastics Co., Ltd.

- Sumitomo Chemical

- SABIC

- BASF SE

- Dow Inc. (involved in olefin-based specialty polymers)

- Eastman Chemical Company

Read Also: Fusion Energy Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344