Cybersecurity Services Market Overview: Trends and Forecast 2025 to 2034

Defining the Cybersecurity Services Landscape

Cybersecurity services encompass a broad range of offerings designed to protect information systems from unauthorized access, data breaches, and other cyber incidents. These services include managed security services (MSS), security consulting, threat intelligence, incident response, penetration testing, and compliance auditing.

The market covers both proactive measures, such as vulnerability assessment and security architecture design, and reactive responses like forensic investigations and breach containment. Cybersecurity services are increasingly being delivered in scalable, on-demand formats such as Security-as-a-Service (SECaaS), enabling organizations to access sophisticated solutions without heavy upfront investments in infrastructure or personnel.

Cybersecurity Services Market Key Insights

-

North America dominated the global market with the largest market share of 40% in 2024.

-

Asia Pacific is projected to expand at the fastest CAGR during the forecast period.

-

By service, the professional services segment captured the biggest market share in 2024.

-

The managed services segment is expected to grow at the highest CAGR in the coming years.

-

By industry vertical, the defense and government segment contributed the highest market share in 2024.

-

The healthcare segment is anticipated to register the fastest CAGR in the upcoming period.

Strategic Relevance in a Digitally-Driven Economy

As digital transformation accelerates across industries, cybersecurity has evolved from an IT concern to a critical business enabler. The proliferation of connected devices, remote work setups, and cloud-hosted applications has expanded the attack surface for malicious actors, compelling organizations to rethink their security strategies.

Governments around the world are also playing a vital role, tightening regulatory frameworks and mandating robust cybersecurity practices through legislation like the GDPR in Europe, HIPAA in the U.S., and India’s CERT-IN directives. This heightened regulatory scrutiny is creating a favorable environment for cybersecurity service providers, who are seen as trusted partners in navigating compliance and risk management.

Market Dynamics and Growth Forecast

Between 2025 and 2034, the cybersecurity services market is expected to experience exponential growth driven by both demand-side and supply-side dynamics. The increasing sophistication of cyberattacks, including ransomware-as-a-service, phishing campaigns, and AI-powered threats, is prompting businesses to invest in advanced detection and response capabilities. Simultaneously, the global shortage of skilled cybersecurity professionals is encouraging outsourcing to specialized service providers.

The shift towards digital business models, the rise of Industry 4.0, and the deployment of 5G infrastructure are further amplifying security concerns, creating long-term demand for comprehensive cybersecurity solutions delivered via managed services and professional consulting.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/sample/6175

Market Scope

| Report Coverage | Details |

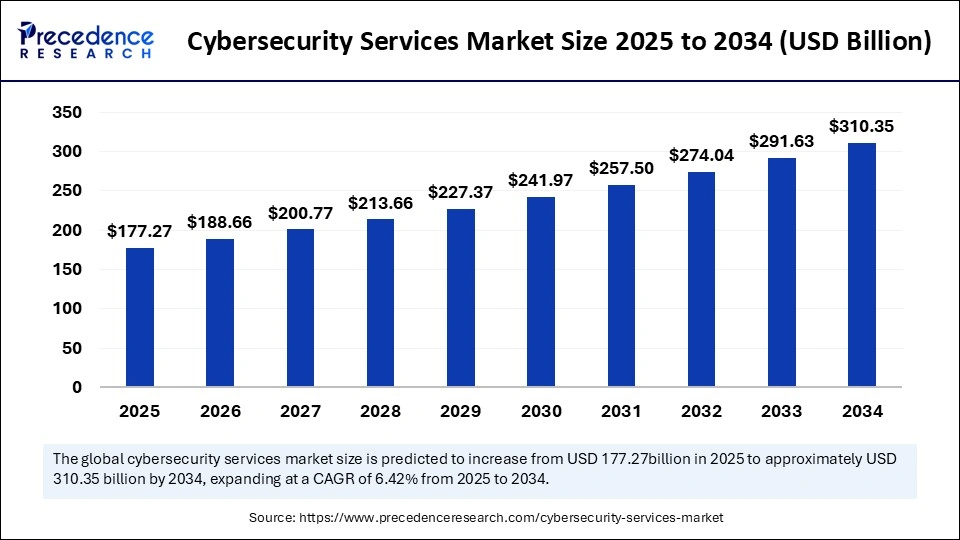

| Market Size by 2034 | USD 310.35 Billion |

| Market Size in 2025 | USD 177.27 Billion |

| Market Size in 2024 | USD 166.58 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.42% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Growth Drivers

Several key factors are propelling the cybersecurity services market forward. Firstly, the alarming rise in cybercrime is pushing companies to adopt a defense-in-depth strategy, leveraging external expertise for continuous monitoring and incident response. Secondly, the hybrid work culture and widespread use of personal devices for business tasks are increasing vulnerabilities, leading to a surge in demand for endpoint protection and identity management services.

Thirdly, the expansion of cloud environments necessitates specialized skills and tools to secure dynamic, scalable infrastructure. Finally, increasing regulatory pressure across industries is driving the need for compliance assessments, risk audits, and data protection services—further strengthening market growth.

Challenges Facing the Market

Despite strong growth prospects, the cybersecurity services market faces several challenges. The most prominent is the global shortage of trained cybersecurity professionals, which limits service scalability and drives up labor costs. Moreover, the complex and fragmented nature of the cybersecurity ecosystem, with numerous tools and platforms from various vendors, often creates integration and interoperability issues.

High costs associated with premium cybersecurity services can also be a barrier for small and medium enterprises (SMEs), which remain underprotected. Additionally, data sovereignty laws and cross-border compliance requirements complicate service delivery for multinational organizations, requiring service providers to develop region-specific strategies and solutions.

Opportunities for Expansion and Innovation

The cybersecurity services market holds considerable opportunities for innovation and expansion, especially in emerging areas such as Zero Trust Architecture (ZTA), AI-driven threat detection, and extended detection and response (XDR). As organizations move away from perimeter-based security models, ZTA frameworks are gaining traction, offering vendors a chance to develop consulting and implementation services.

Artificial Intelligence and Machine Learning are revolutionizing threat intelligence by enabling behavior-based analysis and predictive defense mechanisms. The rise of subscription-based Security-as-a-Service models is making enterprise-grade security accessible to mid-market companies. Moreover, the convergence of cybersecurity and cyber insurance is opening new avenues for bundled offerings that combine risk assessment with financial protection.

Market Segmentation Insights

Cybersecurity services can be segmented based on service type, enterprise size, deployment mode, and end-use industry. Managed Security Services (MSS) dominate the market due to the rising need for 24/7 threat monitoring and response. Professional services, including consulting and assessment, remain essential for enterprises navigating compliance and regulatory requirements. Incident response services are witnessing the fastest growth, as organizations seek rapid containment and recovery solutions.

Large enterprises continue to represent the largest market share, but SMEs are emerging as a high-growth segment driven by increasing digitalization. Deployment-wise, while on-premise solutions still hold relevance in data-sensitive sectors, cloud-based security services are gaining popularity due to their scalability and cost-effectiveness.

Regional Outlook

North America leads the global cybersecurity services market, thanks to its advanced digital infrastructure, high incidence of cyberattacks, and stringent regulatory landscape. The United States, in particular, is home to major cybersecurity vendors and government-led initiatives that drive innovation. Europe follows closely, with GDPR and the upcoming NIS2 directive significantly influencing demand for compliance-related services.

Countries like Germany and the United Kingdom are strengthening national cybersecurity capabilities. Meanwhile, the Asia Pacific region is expected to witness the fastest CAGR due to its rapid digital transformation, growing internet penetration, and increased awareness of cyber threats. Governments in countries like India, China, and Japan are boosting investment in national cybersecurity frameworks, creating a fertile ground for service providers.

Technology and Innovation Trends

Technological innovation is reshaping the cybersecurity services landscape. AI and machine learning are increasingly being used to enhance threat detection, automate response protocols, and analyze vast amounts of security data in real time. Extended Detection and Response (XDR) platforms are emerging as a next-generation solution that integrates endpoint, network, and cloud security into a unified system. Blockchain technology is being explored for applications in secure identity management and transaction validation.

Quantum computing, while still in its early stages, is prompting research into quantum-resistant encryption techniques, which could redefine data protection in the future. These innovations are not only improving the efficacy of cybersecurity solutions but also expanding the value proposition of service providers.

Competitive Landscape

The cybersecurity services market is highly competitive, with a mix of global consulting firms, specialized cybersecurity companies, and emerging startups. Leading players include IBM Security, Accenture, Cisco Systems, Palo Alto Networks, Deloitte, CrowdStrike, Check Point Software Technologies, Booz Allen Hamilton, FireEye, and Fortinet.

These companies are investing in AI-powered security platforms, expanding their global service delivery capabilities, and forming strategic alliances to strengthen their market position. Mergers and acquisitions are also common, as firms seek to broaden their expertise and regional presence. The market is characterized by innovation, with vendors constantly enhancing their service offerings to meet evolving threat landscapes and client expectations.

Recent Developments in the Market

The cybersecurity services landscape is dynamic, with frequent strategic moves by key players. In March 2025, Cisco unveiled an AI-enhanced Extended Detection and Response (XDR) platform designed for hybrid cloud environments. In February 2025, Accenture acquired a South Korean cybersecurity firm to bolster its presence in the Asia Pacific region.

Meanwhile, in January 2025, CrowdStrike launched a managed identity protection service that leverages behavioral analytics to detect lateral movement in enterprise networks. These developments reflect the industry’s shift toward integrated, intelligent, and globally scalable security solutions.

Future Outlook and Strategic Recommendations

Looking ahead, the cybersecurity services market is expected to remain a cornerstone of enterprise risk management. Service providers should focus on delivering modular, outcome-based solutions that address specific pain points such as identity protection, cloud security, and threat intelligence. Investment in talent development and AI-driven automation will be critical to scale services efficiently.

Collaborations between insurers and cybersecurity vendors offer an untapped opportunity to develop integrated risk mitigation packages. Governments, on their part, must support public-private partnerships and invest in national cybersecurity strategies to build resilient digital ecosystems. As digital dependence grows, cybersecurity services will not only protect assets but also drive trust, innovation, and sustainable business growth.

Roles of Companies in the Cybersecurity Services Market

Accenture

Accenture is a major global provider of cybersecurity consulting and managed security services. It delivers end-to-end solutions such as risk assessment, security strategy, cyber defense, and incident response for large enterprises and governments. Accenture is well known for integrating cybersecurity into digital transformation and cloud migration projects.

AT&T INC.

AT&T offers managed cybersecurity services, including threat detection, network security, and incident response. Leveraging its telecommunications infrastructure, AT&T provides security solutions for enterprise networks, IoT, and mobile environments, combining connectivity with robust security.

Atos SE

Atos provides a broad range of cybersecurity services, including managed security services, digital identity, data protection, and advanced threat analytics. It is a key player in the European market, serving critical infrastructure, the public sector, and large enterprises.

Capgemini

Capgemini delivers cybersecurity consulting, managed security services, and security integration as part of its IT and digital transformation offerings. It helps organizations secure cloud environments, comply with regulations, and build resilient IT infrastructures.

Cisco Systems, Inc.

Cisco is a global leader in network security, offering solutions for network detection and response, cloud security, and zero-trust architectures. Cisco provides a comprehensive suite of security products integrated with its networking portfolio, making it a preferred choice for organizations seeking seamless security integration.

CrowdStrike Holdings, Inc.

CrowdStrike specializes in endpoint security, extended detection and response, managed detection and response, vulnerability management, and cloud security posture management. Its cloud-native Falcon platform is highly regarded for threat detection and incident response.

Deloitte Global

Deloitte is a leading provider of cybersecurity advisory, risk management, and managed security services. It helps organizations develop security strategies, manage compliance, and respond to cyber incidents, with a strong presence in regulated industries such as finance and healthcare.

DXC Technology Company

DXC Technology offers managed security services, cyber risk management, and security operations center solutions. It supports enterprises in securing digital transformation initiatives and maintaining regulatory compliance.

IBM

IBM is a top-tier cybersecurity vendor, providing a wide range of services including security information and event management, threat intelligence, cloud security, identity management, and incident response. IBM is known for its advanced research, AI-driven solutions, and global reach.

Rapid7

Rapid7 is a leading provider of vulnerability management, penetration testing, and security analytics solutions. Its Insight platform helps organizations detect, assess, and respond to security threats across cloud and on-premises environments.

Also Read: Automotive Drivetrain Market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344